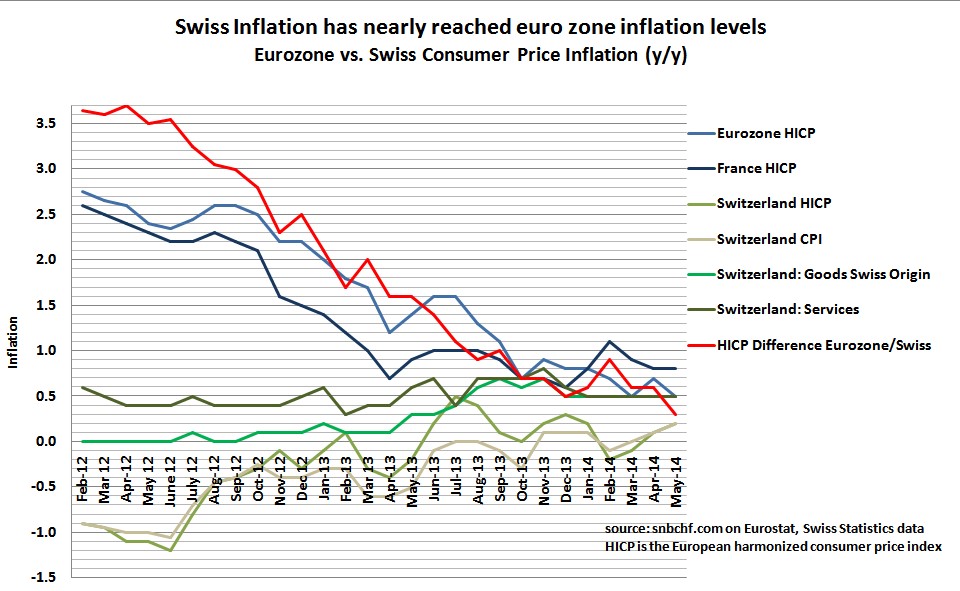

According to Swiss Statistics the inflation rate has risen to 0.2% y/y – as for both the Swiss CPI standard and the European HICP standard.

Given that the euro zone HICP is now at 0.5%, this implies that Swiss inflation is only 0.3% behind the one in the euro zone. Still in February 2012, the difference was 3.7%.

Prices of goods have fallen by -0.1% y/y, while services are up 0.5%. Swiss goods are rising in price by 0.5% y/y, foreign goods have fallen by 0.5%. The reason for cheaper imported goods can be found in long-lasting contracts that incorporate the new FX rate only slowly. Wages are currently rising by 0.7% per year.

Rising rents exercise smaller pressure on inflation than previously, the yearly price increase for rents has fallen from 1.4% to 1%. Given that home prices were up 6% per year from 2008 to 2012 and by 4.3% in 2013, there is still strong upwards potential for rents, but rent control measures demand lower rents for existing contracts when interest rates are falling.

Food prices in Switzerland increased by 1.1% YoY, while they are falling in France by 0.9%.

The most interesting fact for us was that German inflation has fallen to 0.6% y/y, despite 1.9% salary hikes; real wages are hence up 1.3%. The strong German competition and desire for cheaper prices seems to exercise competitive downwards pressure on prices in Southern Europe. For years already, many Germans continue to avoid more expensive goods and buy elsewhere instead. If rising wages and smaller sales prices and consequently smaller margins justify the record levels of the DAX, is for us a question.

Read also:

Switzerland’s Slow Way to Inflation

Tags: Eurozone Consumer Price Index,inflation,Switzerland,Switzerland Consumer Price Index

2 comments

Stefan Wiesendanger

2014-06-17 at 10:09 (UTC 2) Link to this comment

Interesting point about rents: The law coupling rents to the interest rate in Switzerland is actually counter-productive from a monetary point of view. If the SNB hikes interest rates to counter inflation, rents go up which exerts upward pressure on inflation. In a world with a more or less stable evolution of the interest rate and real-estate prices, the interest rate reflects cost for mortgage-financed property. That is the logic behind the coupling of rents to the interest rate. Rents therefore reflect the cost evolution that someone with a fully mortgaged home would have.

George Dorgan

2014-06-17 at 20:42 (UTC 2) Link to this comment

Thanks for this nice idea. Will incorporate it in a post.