page 4

reference to the real estate market where higher house prices imply higher mortgage volumes to finance the same stock of housing.

The rationality of this explanation has to be relativized, however. This is certainly the case if we think of credit financing long run projects such as real estate. Here the average interest rate over the life-time of the credit must be relevant for investment decisions. An exceptional, prolonged period of low rates might imply a decrease in the lifetime average rate, a form of “window of opportunity”. However, the very fact that interest rates must – eventually – rise again implies that credit expansion based on low interest rates cannot be viewed as a shift to a permanent higher credit level. At higher interest rates, credit demand will decline once again. To the extent that the credit expansion was driven by miscalculations on credit affordability, this may even lead to a crisis.

3.4. Behavioral biases

The latter remark leads to a fourth potential explanation, that is, credit expansion driven by behavioral biases. As highlighted by Hyman Minsky1, the credit cycle appears to be driven by “waves of optimistic and pessimistic sentiment”2. In an upswing, expectations about future developments may turn erratically exuberant. Observing a long period of price increases, investors tend to believe that new circumstances justify the perpetuation of the upward trend and act on this belief. Overconfident lenders and borrowers are increasingly ready to take higher risks. Ever increasing prices become a necessary condition to enable borrowers to service their debts. Then the tide turns. A few investors fail to meet their obligations, confidence crumbles, asset prices stop increasing or begin to fall and optimism turns into a wave of pessimism. Clearly, credit expansion driven by such erratic beliefs is a cyclical phenomenon and no viable explanation for a sustainable increase in the credit-to-GDP ratio.

As we have seen, there are various potential explanations for an increase in the credit-toGDP ratio, some suggesting a permanent, structural increase in this ratio, others hinting at a temporary, cyclical upswing. Which of those explanations can plausibly contribute to explain the remarkable development of credit-to-GDP ratio in Switzerland highlighted before?

4. A plausible explanation for the current Swiss developments

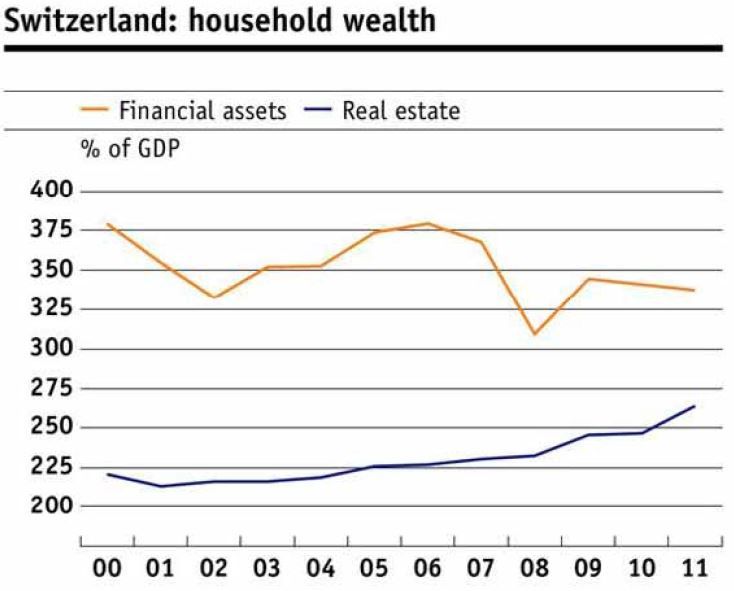

As already hinted at, the review of possible structural drivers of an increase in credit volumes does not seem to provide solid support for arguing in favor of a recent permanent shift in the case of Switzerland. Switzerland has a highly developed financial system. Economic stability, a high wealth level – Swiss households’ stock of financial assets amounted to about 3.5 times GDP in 2011 (Figure 6) – a high savings rate and structurally low interest rates are probable reasons for high credit volumes, possibly even a high credit-to-GDP ratio, in international comparison.

Figure 6: Swiss case: structural factors may rationalize high levels of credit to GDP, e.g. high househod wealth in Switzerland - Click to enlarge

It is not clear, however, how one could argue that significant changes in these structural factors are currently at work.3

By contrast, many of the cyclical drivers that we have discussed appear highly plausible in the current circumstances.

Specifically, the prolonged current period of ultra-low interest rates feeding into and being reinforced by rising real estate prices, combined with the potential for some of the abovementioned behavioral biases, have a higher explanatory power. These developments bear clear risks for financial stability. Let me go into more detail.

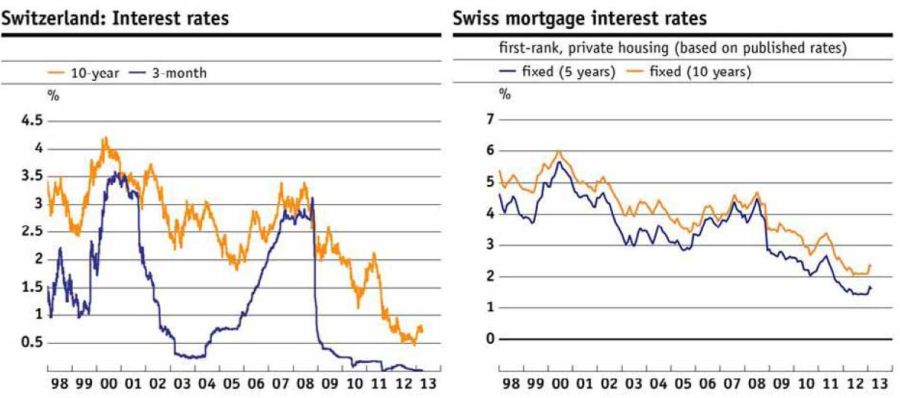

We are currently experiencing a prolonged period of low interest rates (Figure 7a).

This holds globally as well as in Switzerland; it is one of the key consequences of the financial crisis of

- Minsky, H.P. (1982) [↩]

- Keynes, J.M. (1936) [↩]

- For instance, wealth of Swiss households relative to GDP, measured in terms of financial assets, shows no clear trend over the last decade (Figure 6) [↩]