(post written originally in March 2013, last update in May 2015)

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account (now called “financial account”) of the Swiss balance of payments will not cover the persistent Swiss current account surpluses. Only strong outflows in the capital account may lead to a carry trade that may make SNB interventions obsolete.

We judge that the balance of payments model is the only useful ex-ante estimation and ex-post FX rate valuation.

Other ex-ante FX estimations like the Real Effective Exchange Rate for the Swiss franc need to be rejected.

This page contains the original post from 2013 and the updates with more recent data.

UPDATE after end of peg, January 2015

As we expected, the Swiss balance of payments of Q3/2014 did not exhibit any export of capital any more. The risk-averse behaviour of investors and the success of Swiss companies are key here. Swiss investors prefer to invest in Swiss stocks – denominated in CHF – to get a global exposure.

Swiss do not risk to buy stocks and bonds in foreign currency, they are far more risk-averse than Americans or British, in particular towards currency risks.

Foreign investors like Russian oligarchs continued to buy Swiss francs to hedge against their weak economy. They know that Swiss investors are risk-averse, so they know that CHF must appreciate.When Draghi announced ECB’s Quantitative Easing, massive inflows in CHF started. Exporting this capital was finally impossible for the SNB and would have led either to a SNB default or to inflation in the long-term. Both cases would have implied higher risks to financial stability, the second mandate of the SNB.

—————————————————————————————————————————————————————————————————

UPDATE September 3, 2013:

The strong Swiss GDP growth of 2.5% y/y confirms our opinion that foreign investments do not deliver the right risk-reward combination for Swiss investors.

———————————————————————————————————————————————————————————————

Carry Trade: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

In our overview post “What determines FX rates?” we indicated that the financial position of the concerned country and the availability of funds are one the five key indicators for foreign exchange rates.

We split the financial position into the following components:

- Net Worth or Wealth

- Net International Investment Position, Net Foreign Assets and Net Foreign Debt

Switzerland has a very strong financial position at least since WWI and managed to improve this position with high savings. After the Swiss real estate crisis of the 1990s, however, the Swiss started to save even more. Swiss current account surplus strengthened heavily, one reason was that savings rates declined in other nations.

These lower savings lead naturally to higher GDP growth abroad. The Swiss followed the yield and capital left the country.

As we have learned in the balance of payments section, outflows in the capital account must neutralise the current account surpluses; otherwise the local currency must appreciate and/or reserve assets at the central bank must increase.

Based on this data we ask the question’ “will outflows in the Swiss capital account be able to neutralise the persistent Swiss current account surpluses?” This post is highly related and potentially a follow-up to Thomas Jordan’s important speech “Strong franc and high current account surplus – a contradiction?” .

Confronted with “global imbalances”, Thomas Jordan claimed that Switzerland has high savings; therefore it is normal to possess high current account surpluses. The Swiss invested their savings in foreign assets and helped out with investments in favor of countries that do not save enough or are not sufficiently rich (ibid p.13).

Net International Investment Position (NIIP)

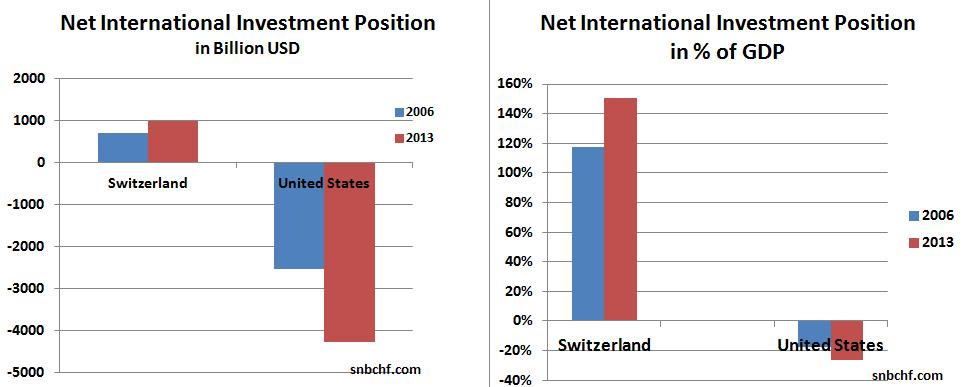

The difference between foreign assets – assets held abroad by locals – and foreign liabilities – local assets held by foreigners – is called the net international investment position (NIIP). Similarly, net worth, the NIIP, is dependent on the development of markets, in particular for countries like Switzerland that exhibit a strongly positive NIIP.

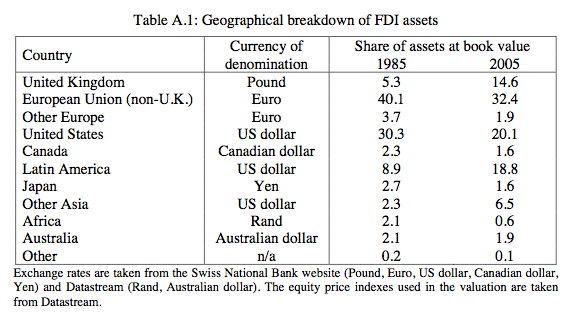

In the last decade the Swiss NIIP, was continuously on the rise. It increased significantly between 2002 and 2007, when the cheap franc allowed for a strong current account surplus and improvements in the values of foreign direct investments (FDI) in emerging markets – albeit less in the United States (see next section). Swiss multi-nationals left the profits of the international subsidiaries in foreign currency.

In 2008 foreign assets saw a big trough, while foreign liabilities did not decrease that much. From 2009 on, the NIIP rose again because Switzerland profited from the recovery of the world economy. The NIIP of the United States, however, is getting more and more negative.

Rising Swiss NIIPIn the last decade the Swiss NIIP, was continuously on the rise. It increased significantly between 2002 and 2007, when the cheap franc allowed for a strong current account surplus and improvements in the values of foreign direct investments (FDI) in emerging markets – albeit less in the United States (see next section). Swiss multi-nationals left the profits of the international subsidiaries in foreign currency. In 2008 foreign assets saw a big trough, while foreign liabilities did not decrease that much. From 2009 on, the NIIP rose again because Switzerland profited from the recovery of the world economy. The NIIP of the United States, however, is getting more and more negative. |

|

Are Swiss investors able to achieve higher foreign yields than the yield on Swiss investments?

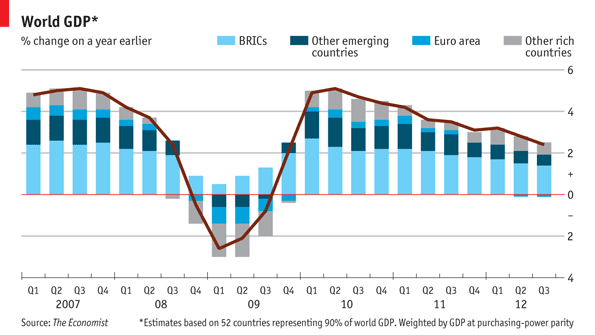

The first thing we need to remember are global growth expectations: while until 2007 the franc was used as a funding currency for investments in foreign assets a big difference of 3 – 4% GDP growth between Swiss and the global economy persisted. However, the expected Swiss growth rate of around 1% in 2012 and 2013 (source UBS) is only a bit lower than global growth of 2.5%. Investments in Swiss real estate have achieved 5% per year since 2008. |

The essential question is: |

Rising Prices for Swiss real estate investments

Especially for Swiss foreign portfolio investments, the question arises if these foreign investments are justified in a risk-return perspective, given that higher foreign growth will be obtained in emerging and less developed countries with substantial political risks and downside risks in the case of a recession. |

Versus Slowing Global GDP Growth

|

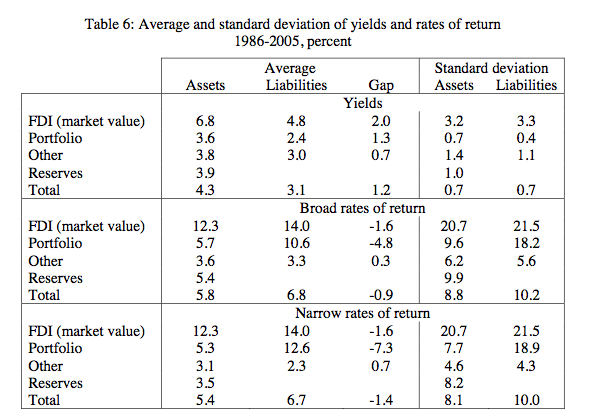

Low return of Swiss Foreign AssetsA paper by the New York Fed – Nicolas Stoffels Cédric Tille: Federal Reserve Bank of New York, Staff Reports, Staff Report no. 283 April 2007, access here – questioned in 2007 why the return and value of Swiss foreign assets were so low. This implies that the strong improvement of the Swiss NIIP since 2002 was based mostly on the current account surpluses, but far less on a higher value of foreign assets. |

The Valuation Effect on Swiss Foreign Assets until 2007

The New York Fed writes:

Four facts emerge from both figures.

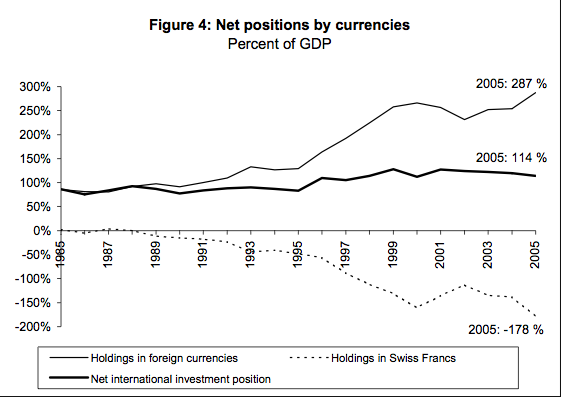

- First, net capital flows have always been positive since 1986, reflecting chronic Swiss current account surpluses.

- Fluctuations in asset prices matter, although their impact on the net position is somewhat muted when FDI is assessed at market value. Until 2000 the asset prices component shows net losses for Switzerland, as rising prices added to the value of foreign investors’ claims on Switzerland, particularly in terms of equity holdings. The pattern was reversed in 2000–2002, where falling equity prices led to losses for foreign investors that were only partially offset by losses on assets, leading to an improvement of the Swiss net investment position. The pickup of Swiss equity prices in 2005 led to a sizable valuation loss for Switzerland as the value of its liabilities rose.

- Exchange rate movements have a substantial valuation effect. This is associated with the movements of the Swiss franc against the US dollar, reflecting the strong exposure of Switzerland to the US currency. The weakening of the dollar in the late 1980s and, more recently, in 2001–2004 led to valuation losses. Those were partly offset in 2005 as the dollar strengthened. While movements in the exchange rate primarily affect the value of assets, they also have a sizable impact on liabilities, as a substantial share of other liabilities is denominated in foreign currencies.

- Exchange rate and asset price movements only account for part of the gap between financial flows and the change in the net investment position, leaving a sizable role for other valuation effects. This is especially the case since 2000, with large and persistent valuation losses that we cannot attribute to exchange rate and asset prices. While the other valuation effects are considerable in net terms, they are much smaller in terms of gross assets and liabilities as can be seen from the bottom panel.

The conclusion was as follows:

The Swiss international position has been characterized by a growing leverage in the last ten years, both in terms of gross assets and liabilities and in terms of exposure to foreign currencies. As a result the net investment position of Switzerland is now substantially more exposed to fluctuations in the value of assets and liabilities. This is strikingly illustrated by the disconnect between a steady net investment position since 1999 and large current account surpluses.

We first document the increase in leverage and the international exposure of Switzerland, and then estimate the impact of exchange rate and asset price movements on the Swiss external position, including on a measure of FDI at market value. We find that both led to sizable capital losses in the 2000’s, especially exchange rate fluctuations. Nevertheless, they only offer a partial account of the recent disconnect. Our analysis points to sizeable increases in equity liabilities in the early 2000’s that cannot be attributed to movements in asset prices. Improving our understanding of the disconnect will likely require finer estimates in terms of the sectoral composition of the various assets and liabilities.

The presence of valuation effects substantially affects the pattern of returns on external assets and liabilities. While Switzerland earns higher dividend and interest yields on its assets that it pays on its liabilities, the picture is reversed once valuation changes are included in the computation of overall returns.

(source NY Fed)

Yield of Swiss Foreign Investments 1990-2005 (source NY Fed)

The study proves that Swiss investors had issues in achieving sufficiently high yields with their foreign investments even until 2007. Given this bad experience, the low growth in the euro zone and the rising Swiss asset prices, it is strongly questionable if Swiss investors will take the risk again to move funds abroad.

Summary

Due to the low or non existent differences in yield between Swiss foreign assets and foreign liabilities, the outflows in the capital account of the Swiss balance of payments might not cover the persistent current account surpluses over the longer term. Given strong increases in Swiss asset prices, outflows that represent “risk-on capital movements” could be limited.

Apart from some “risk-off” funds that return from Switzerland to their origin, it can be expected that Swiss currency reserves will not become significantly smaller. That SNB currency reserves have remained nearly stable despite significant reduction of tail risks, shows that even some foreign “risk-off investors” like funds in Switzerland.

Once Swiss inflation becomes stronger, the SNB will need to retreat from the minimum exchange rate of the EUR/CHF and sell foreign currency reserves with the potential amplification of this movement by FX markets.

See more for