Be aware that the SNB has not intervened since the second half of January, even if some people on Twitter claim that it has.

Any change in reserves come mostly from the “natural” variation in FX rates, the rise of the dollar until the end of February lead to 17 bln. more currency reserves

UPDATE April 3

The IMF suggests that the SNB should restart interventions, so-called “Foreign currency QE”. At the “Geldpolitischer Apero“, the evening event on monetary policy, board member Fritz Zurbruegg, said that they listen to the IMF but they do not necessarily do what the IMF suggests. The SNB understands their own solvability issues better than the IMF. The IMF recently started to finance insolvable countries like Greece or Ukraine and is ready to take big losses.

Since early March, EUR/CHF has strongly depreciated, given that internal demand increased thanks to deflation. This helps to overcome lower exports, and can raise GDP, in particular real GDP.

Update after monetary policy meeting in March:

The latest sight deposits show that the SNB lets the franc free float. EUR/CHF of 1.10 was not reached.

At the monetary policy meeting in March 2015, I asked Thomas Jordan if the SNB will realize profits on their cheap USD purchases of 2011 (0.78 vs 0.96 today). He answered that they simply cannot do it because they are bound by the sight deposits on the other side of the balance sheet. Moreover, Jordan excluded the use of options: “The SNB does simple monetary policy and not things like Greece with Goldman Sachs”.

Update January 25th.

Effectively the SNB has intervened between 1.00 and 1.05 in January, this means that the central bank is ready to risk its own solvability, because once again they intervene far above Friedman’s intervention level. But

———————————————————————————————————————————————————————————————————

Originally written on January 15, update with newest data

In his first response to the Swiss financial tsunami on January 15, George Dorgan suggested that the EUR/CHF of 1.10 will not be reached any time soon. He explains where the SNB should intervene and if they sell euros and dollars.

Currency movements and fair valuation

Please read the initial post on the financial tsunami, “the three reasons and the trigger” first.

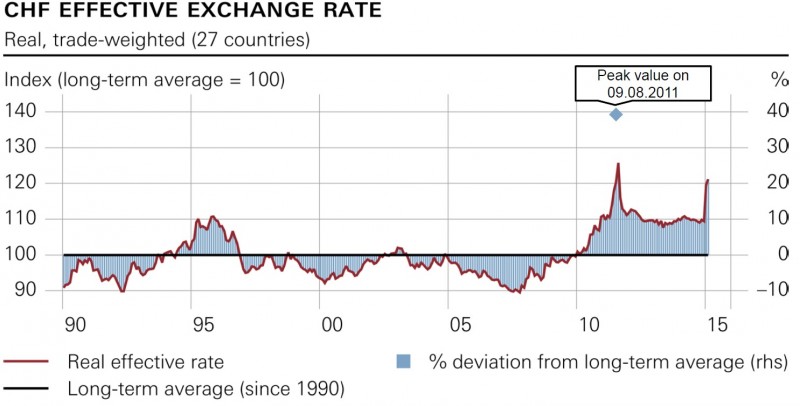

On the first day, the EUR/CHF quickly dived to 0.82 and finally stabilized around 1.01. The dollar is now moving around 0.88 CHF, this dollar value is still over 11% higher than the 2011 dollar lows – 0.7855 CHF in August 2011.

In real terms, the dollar has appreciated by more than 30% since the 2011 lows (iin 2011 dollar at 0.78 plus lower Swiss inflation). Swiss blue-chips, in particular pharmaceuticals and the chemical industry, make 25% of their revenue in the US. US-dollar pegged countries like China are not counted yet.

According to February 2015 IMF data, the CHF real effective exchange rate was 21% overvalued – compared to a 1999 basis.

However one must consider that 1999 was part of a period when USD was strong and CHF undervalued because the Swiss economy struggled with a housing bust and with a lack of qualified labor. Thanks to qualified immigration this issue has been cleared since 1999, here demonstrated by the central bank itself.

source SNB, Geldpolitischer Apero

Strong immigration of qualified labor with the Swiss-European bilateral agreements helped to increase Swiss competitiveness, visible in massive current account surpluses. Off-shoring has increased profits of Swiss companies, those stocks are denominated in CHF and further improve the Swiss balance of payments and hence CHF.

This clearly indicates that today the Swiss franc is not too much overvalued, it is overvalued versus the EUR, but rather undervalued against USD.

Where will SNB sell euros and dollar?

After the end of the peg, the EUR/CHF of 1.00 was easily broken upwards. The EUR quickly moved to 1.05. This makes it clear that the SNB is not selling euros at parity. The Swiss finance minister suggested that they are happy with 1.10; moreover, Jordan and, the member of the board of directors, Lengwiler sounded quite confident in their NZZ interviews (Jordan here and Lengwiler here).

Baltensperger, the grey eminence behind the SNB thinking, was the most optimistic. Once again he emphasized the strength of the US economy. We agreed with him only partially: profit margins of US companies are very good but US households might not spend enough because they do not have the cash that companies possess.

Jordan’s optimism rather suggests that the SNB sells euros at 1.10, namely where the finance minister sees the “manageable” value – and not lower as we thought at first sight.

Technicals, however, are able to identify where the point is where the SNB sells. ….. and where they buy against excessive CHF overvaluation.

Will the SNB intervene?

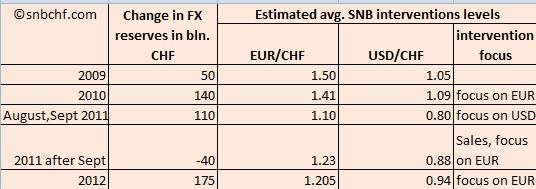

The following table gives on overview of historic SNB interventions. In December 2014 and January 2015, the bank added another 50 billion.

We will need to examine if the SNB will intervene in the future. The logical answer for us is No, unless the euro moves under 0.90 CHF, where the new bottom for intervention for Friedman would be (ignoring the very short-term bottom of 0.82 CHF). This is currently not the case. Be also aware that the SNB set the minimum rate 20% above the bottom of 2011, which was an error, also criticized by one voice at the Peterson institute, an economic think-tank close to the US government.

Will 1.10 ever be reached again?

I think yes, but only briefly in the next ten years. Here, one of my first essays “Will EUR/CHF ever rise over 1.22 again?“, on my old site, during the early stage, summarized my ideas and explained why EUR/CHF would not rise much over 1.20.

Effectively it touched 1.26 in Spring 2013. Read also my post on Zerohedge “SNB Buys CHF and Sell Euros. Welcome to the euro peg” , where I first explained that the SNB bought CHF and drove the EUR/CHF down to 1.20. The 1.26 was caused by big optimism on the US economy.

References

Royal Bank of New Zealand: Where to implement interventions against overvalued currencies? (incl. M. Friedman rule)

See more for

3 comments

Romanio

2015-01-15 at 17:20 (UTC 2) Link to this comment

Lol what I day, woke up late midday just to see what already happened few hours ago lol. I was shorting UCHF from hourly top of last night, got my ~100pips profit and about 1:5RR, but from what… from the move of ~3000pips??!!! I feel so sad and disappointed thinking how much more could I get instead of those silly, pathetic 100pips ;((. Sometimes I just want to kill myself.

I expected second bottom on ECHF though not as big, I was thinking for it go maybe to ~1.1 before strong reversal but whatever. Anyway, great job Mr. Dorgan, it was always a pleasure to read your insights. Now that we are where we are on ECHF, I guess we finally painted that(much needed) leg, longs have been cleared and CHF is overvalued, idiots(read hedge funds) gotten rid of, its time IMHO for biggest LONG trend on ECHF to some 1.4+. I say its time to dump CHF in favor of EUR(and soon also LONG in EUR/USD).

kleingut

2015-01-15 at 18:12 (UTC 2) Link to this comment

I will make a ‘crazy’ prediction: Once the markets have realized that Switzerland’s export sector will nose-dive with a CHF below 1:1, leading to unemployment; that Swiss real estate is dramatically overvalued in terms of other currencies; that they have a high opportunity cost when keeping their money in CHF (negative rates); etc. etc. Once that happens, a run INTO the CHF could very quickly convert into a run OUT OF the CHF. A CHF in the range 1,20-1,30 is not totally out of imagination for me.

GeorgeDorgan

2015-01-16 at 07:18 (UTC 2) Link to this comment

I included more details how far CHF is “overvalued” and some answers to your question. Bear in mind that the SMI weathered the 2011 abyss very well despite the risk of a global recession.