Found 1,867 search results for keyword: label

Swiss hail ‘cordial’ talks with Biden

Swiss President Guy Parmelin has underlined the importance of bilateral relations after a “cordial” meeting with US President Joe Biden. Parmelin also called Wednesday’s US-Russia meeting a “sign of hope”. Biden arrived in Geneva on Tuesday afternoon, ahead of the summit with Russia's Vladimir Putin.

Read More »

Read More »

SWISS airline job cuts less severe than expected

Swiss International Air Lines will make fewer pandemic-related job cuts than feared following consultations with staff and trade unions. On Tuesday, SWISS said the number of intended layoffs has been reduced to 550 from the 780 announced last month. Of the 550 affected jobs, 58 employees have accepted a downgrade from their current positions so that they will remain with the company.

Read More »

Read More »

Pesticide-free farming: can the vision seduce Swiss voters?

Voters decide Sunday on two separate initiatives aiming to ban or reduce the use of synthetic pesticides in the country. Polls suggest the proposals are on the back foot. Is Switzerland about to become an organic farming pioneer?

Read More »

Read More »

Bitcoin Upgraded from Vacuous Child to Rebellious Adult

As a naughty young child bitcoin was viewed as too vacuous and devoid of prospects to warrant serious attention. At the grand old age of 22, the cryptocurrency is poised to be given a seat at the high table by the Bank for International Settlements (BIS).

Read More »

Read More »

Switzerland-EU: a Complicated Relationship that puts Swiss Research at Risk

They break up, they get back together, and then they break up again. The rift between Bern and Brussels over the framework agreement is causing frustration among Swiss researchers who depend on EU funding for their work. Universities, companies and start-ups fear that science and research will become "collateral damage" of a negotiation gone wrong.

Read More »

Read More »

Child Labour rises for first time in two decades

The world has witnessed the first rise in child labour in 20 years and the coronavirus crisis threatens to push millions more minors into the same fate, the United Nations said on Thursday. Swiss multinationals from food giant Nestlé to mining titans Glencore and Trafigura have struggled to eradicate child labour from their supply chains and the communities where they work.

Read More »

Read More »

Why Monetary “Stimulus” Won’t Prevent an Economic Bust

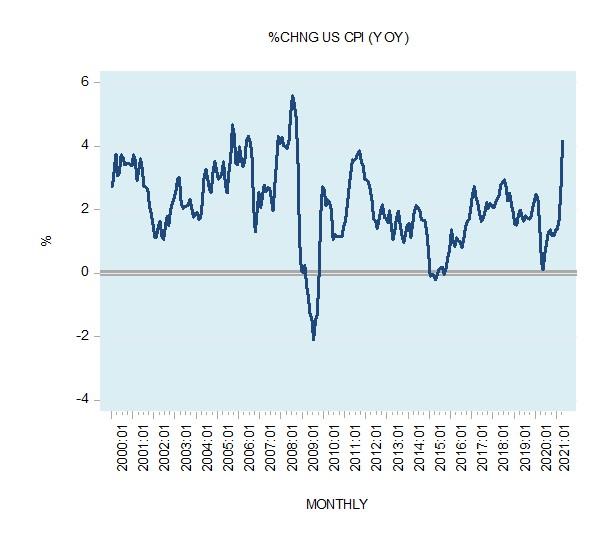

The increase in the growth rate of the Consumer Price Index (CPI) has fueled concerns that if the rising trend were to continue the Fed is likely to tighten its interest rate stance. Observe that the yearly growth rate in the CPI climbed to 4.2 percent in April from 2.6 percent in March and 0.3 percent in April 2020.

Read More »

Read More »

Podcast mit Maximilian-Benedikt Köhn: Notfallspritze für den Gesundheitssektor

Der Healthcare Sektor steht seit Beginn der Corona-Pandemie im besonderen Fokus. Entgegen den Erwartungen entwickelte sich der MSCI Healthcare-Aktienindex in Euro in den ersten vier Monaten dieses Jahres um über fünf Prozent schlechter als der breite weltweite Aktienmarkt. Innerhalb der Gesundheitsbranche war die Wertentwicklung – ähnlich wie schon im vergangenen Jahr – äußerst unterschiedlich. Welche nachhaltigen Effekte sind zu erwarten und...

Read More »

Read More »

DJE – Marktausblick Juni 2021 mit Stefan Breintner und Markus Koch: Kurspotenzial und Inflation

Hohe Gewinnerwartungen der Unternehmen lassen für die kommenden Monate weiteres Kurspotenzial für die Aktienmärkte vermuten. Eine erhöhte Inflation begleitet die gut laufende Konjunktur, ohne jedoch weitere Schocks auszulösen. Da sich der übertriebene Optimismus wieder abgekühlt hat, ist eine abrupte Enttäuschung der Investoren unwahrscheinlich.

Erfahren Sie mehr im VIDEO-INTERVIEW mit Stefan Breintner, Leiter Research bei DJE, und dem Wallstreet...

Read More »

Read More »

Global minimum tax deal bad for Switzerland, say experts

The decision by the leading industrial nations (G7) to support a global minimum tax of 15% for large corporations is not good news for Switzerland, according to Swiss economists. Certain cantons in particular would come under pressure.

Read More »

Read More »

Electricity watchdog sounds warning on Swiss energy security

The Federal Electricity Commission (ElCom) has again voiced concern about Switzerland’s ability to secure sufficient power supplies in the coming years. While there is no immediate danger of shortfalls in the Alpine state, the electricity watchdog said on Thursday that more should be done to ensure domestic energy security in the mid to long term.

Read More »

Read More »

A Libertarian Approach to Disputed Land Titles

The recent spate of bombing violence in Israel's West Bank, East Jerusalem, and Gaza demonstrates the enduring attachment both Israelis and Palestinians have to physical land in the country. Both sides make claims—legal, moral, and political—to land within Israel, from the southernmost tip of Gaza to the northernmost tip of the Golan Heights.

Read More »

Read More »

Cobalt must be included in Swiss responsible business legislation

Business and human rights experts argue that Switzerland should seize the opportunity to require responsible sourcing of cobalt, an in-demand mineral whose risks to human rights are often overlooked. The government is holding consultations on a new law to hold companies accountable for the adverse impact of their operations on people after the Responsible Business Initiative failed at the ballot box last year.

Read More »

Read More »

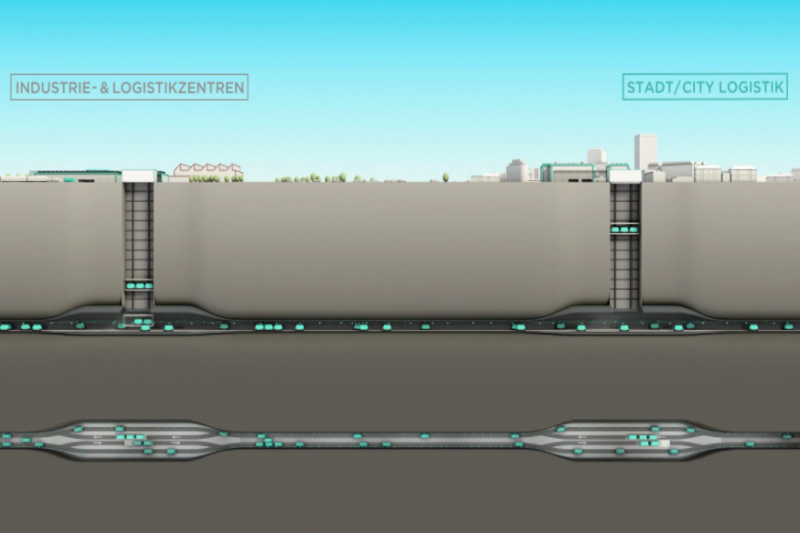

Futuristic underground cargo project moves a step closer to reality

Goods that are normally trucked on busy Swiss roads are a step closer to travelling underground on driverless vehicles after an ambitious cargo project got a first legislative go-ahead. The Cargo sous terrain (CST) project sounds like science fiction: a 500-kilometre network of tunnels to transport freight between Switzerland’s busiest cities.

Read More »

Read More »

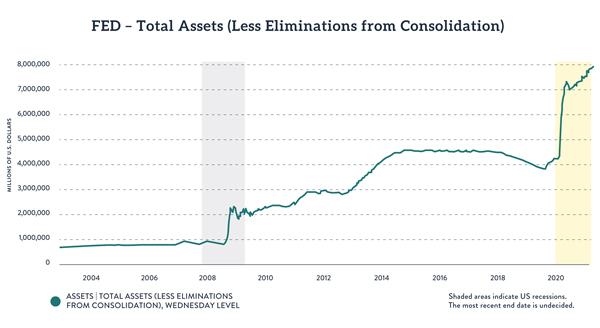

The Fed’s Policies since the 2020 Coronavirus Panic

In chapter 7 we summarized some of the major changes in how central banks have operated since the 2008 financial crisis. In the present chapter, we detail some of the even more recent changes in Federal Reserve operations since the onset of the coronavirus panic in March 2020.

Read More »

Read More »

Swiss Aviation Sector Aims to go Carbon Neutral by 2050

The Swiss aviation sector, which includes Swiss International Air Lines and Zurich Airport, has pledged to slash CO2 emissions and make flying net zero by 2050.

Read More »

Read More »

Dr. Ulrich Kaffarnik im Gespräch mit Wall Street Experte Markus Koch

„Es klingt komisch, aber wir bewegen uns Richtung Normalität“

Nach einem starken ersten Quartal entwickelt sich der Markt aktuell etwas verhaltener. Das hat zum einen saisonale Gründe – aber nach der starken Rallye der vergangenen 15 Monate ist die Luft nach oben naturgemäß deutlich dünner. Auch die Sorge vor einer stark zunehmenden Inflation beschäftigt professionelle wie Privatanleger. Wie lange kann die FED noch ihre Anleihenkäufe...

Read More »

Read More »

How Swiss Asset Managers Opened their Doors to Lex Greensill

In late 2014, David Solo lent A$12.2 million (CHF8.5 million) to a little-known supply-chain finance group with eye-catching claims. Greensill Capital, which was trying to muscle in on a corner of finance dominated for decades by banks, vowed to make “finance fairer” and declared that it would be “democratising capital”.

Read More »

Read More »

DJE-plusNews Mai 2021

In dem monatlich stattfindendem DJE-plusNews reflektiert Mario Künzel, Leiter Vertrieb Retail Business, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden Wochen.

#News #Aktien #Fonds #Investment #Märkte

Seit über vier Jahrzehnten setzt die DJE Kapital AG Maßstäbe in der Vermögensverwaltung und in Fonds.

Die DJE Kapital AG (DJE) ist seit 45 Jahren als unabhängige Vermögensverwaltung am...

Read More »

Read More »

Dishonest Partial Unemployment Claims Alarm Swiss Auditors

The Swiss Federal Audit Office says it is worried by a surge in fraud cases linked to the short-time working system, a key pillar of the country’s economic response to Covid-19. The office’s director Michel Huissoud told public radio SRF on Monday he was “shocked by the number of complaints, mistakes, and abuses” recorded to date.

Read More »

Read More »