UPDATE February 2014:

Everybody is blaming the winter for recent weakness. But not many economist aware that most Americans did not profit on rising confidence. Yes, companies are sitting on a lot of cash, but private households do not.

Just the uppper 10% continued spending in 2013 thanks to higher stock valuations. With cheap gas prices, the American producers Ford and GM were leading and selling to their fuel-extensive cars. Despite all the hype about shale oil and U.S. energy indepence, crude oil prices have risen clearly above 100$, natural gas is at 5.50$.

UPDATE November 2013:

Consumer confidence from the University of Michigan

The current state of consumer sentiment is consistent with an economic growth rate slightly above 2%, largely stimulated by wealth gains not improvements in jobs and wages.

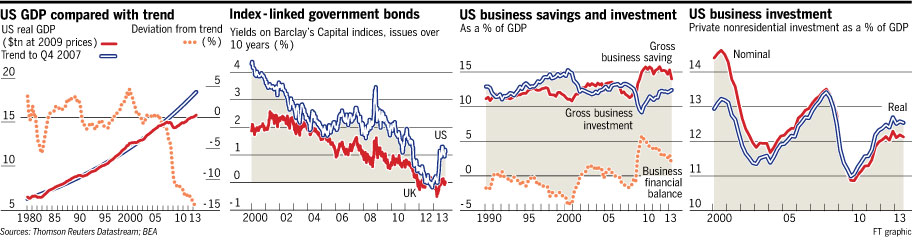

Finally companies invest the cash they were sitting on for years, gross business investment is picking up:

Despite record-high stocks, far lower gasoline prices than in July and Non-Farm Payrolls of over 200K, consumer spending does not pick up. The Savings Rate has risen from 4.5% to 4.7%. Companies are sitting on lots on inventories, the 3.6% increase in GDP was driven by inventories, while consumption rose by only 1.4%.

All these are typical symptoms of a “false recovery”.

See more for

2 pings

How Long Will the U.S. Recovery Last? A Reminde...

2013-05-18 at 20:22 (UTC 2) Link to this comment

[…] Whoever is betting on a quick and long lasting U.S. recovery after the deep financial crisis should look on Japan in 1998/1999. After the Asian financial crisis, the Japanese yen recovered from 147 yen per dollar to 115 in just 4 months. […]

Artikel über Finanzen, Investments und Forex / Devisenhandel | Pipsologie

2013-05-18 at 23:21 (UTC 2) Link to this comment

[…] Vergleichen. Man vergleicht 2013 mit 1995, 1997, 1999 und sogar den 50er Jahren. Hier ein Vergleich zum momentanen amerikanischen Aufschwung und der kurzen japanischen …. […]