Swiss Balance of Payments Q4/2013 and year 2013

Finally the long-awaited moment for the SNB has arrived. The gap between outflows and inflows in direct investment and portfolio investments is able to counter the heavy Swiss current account surplus. This was the moment we are expecting when we asked “Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?” But in the same article we ask if this is sustainable.

But as for bank lending, in Q4 the outflow of funds reversed, Swiss banks received lending/repayment inflows of 12 bln. CHF. It seemed that with the stronger franc they burned their fingers. Lending to foreigners in a foreign currency brings too many risks on their Basel III capital requirements.

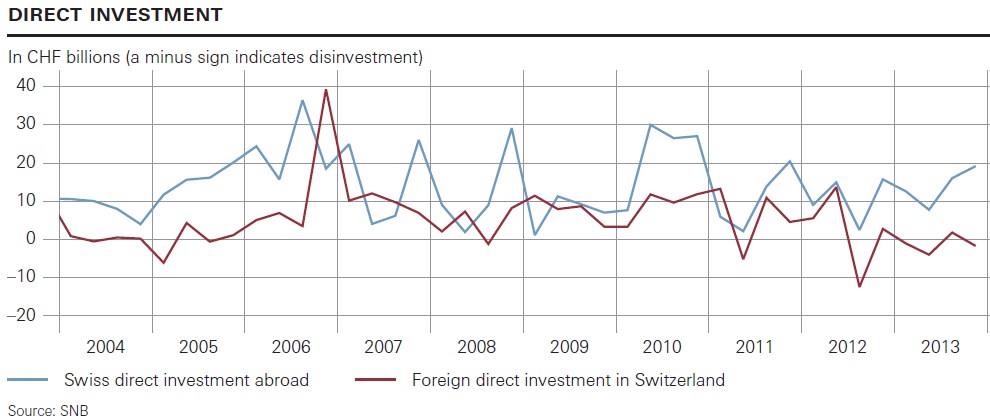

Direct investments

Until Q2/2011 foreign investors invested quite strongly in Switzerland; with the euro crisis unfolding in Q3/2011, these flows suddenly stopped. Foreign direct investment in Switzerland have rather fallen since summer 2011.

Total investments – as described in the GDP figures – did not fall; the Swiss have enough funding themselves.

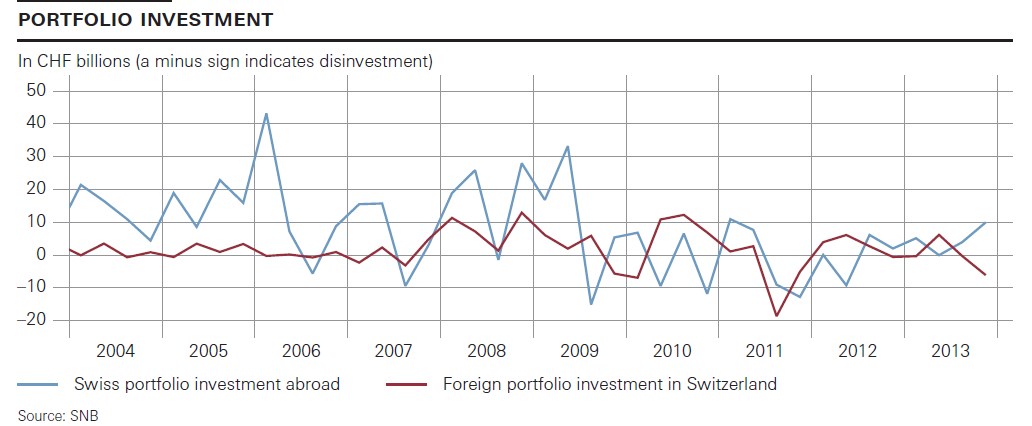

Portfolio Investments

Between 2010 and summer 2012, foreigners bought more Swiss assets than Swiss foreign assets (in most periods the red line is higher than the blue one).

We already explained that the biggest part of these purchases were Swiss stocks, e.g. profitable multinationals and not – as many might think – safe Swiss bonds.

In 2013, domestic investors purchased a net CHF 19 billion in securities issued by foreign borrowers. Investments in equity securities – predominantly collective investment schemes – amounted to CHF 15 billion. Investments in debt securities came to CHF 4 billion on balance, with purchases of bonds amounting to CHF 10 billion and sales of money market instruments totalling CHF 6 billion. Purchases were made particularly in US dollar securities, while euro securities were sold on balance.In net terms, foreign investors sold CHF 1 billion in securities issued by domestic borrowers. They sold debt securities for CHF 4 billion, while buying equity securities for CHF 3 billion. Equity securities exhibited a reverse trend: On balance, shares were purchased (CHF 9 billion), whereas collective investment schemes were sold (CHF 6 billion). (source BoP Q4 and 2013 press release)

Thanks to deflation and cheaper purchase prices, Swiss companies continue to be profitable, visible purchase of Swiss equities. Due to higher salaries, the profitability has severely fallen for Emerging Markets, but also for companies in Australia and Norway. Smaller investments and rising wages and costs reduced margins. This weak profitability might be a reason why Swiss banks slowed their lending to foreign, in particular to Emerging Markets.

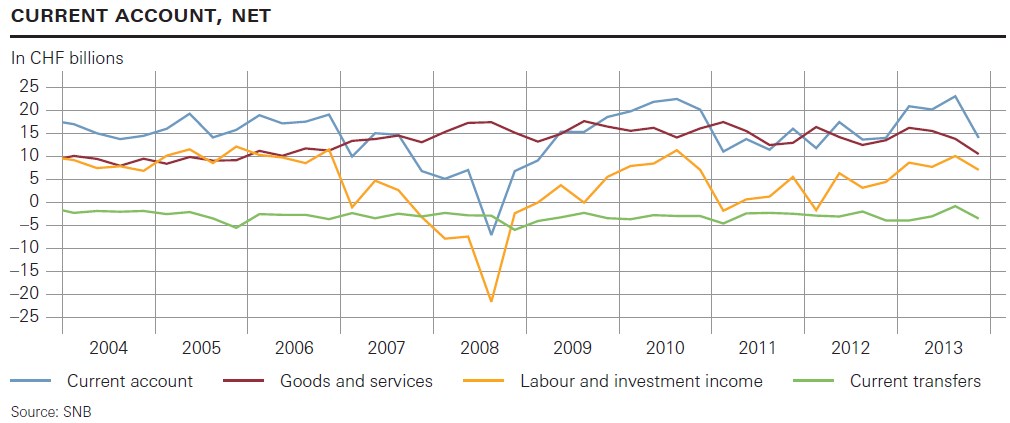

Current Account

As we anticipated in “Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money” the Swiss current account surplus weakened; we expect the Swiss current account surplus to shrink further.

The main reasons:

- Strong imports, in particular services:

The official SNB release states: “As regards foreign trade in services, receipts were up by 6%, while expenses increased by 16%.”

The reasons for us are the various regulatory projects (e.g. Too Big To Fail); banks outsource parts of these projects for example to German or Indian workers. - Due to the slowing in Emerging Markets and slow growth in Europe, exports cannot expand as much as previously.

“Receipts from exports remained at the previous year’s level.” - With slowing global growth in Q4 and the stronger franc investment incomes fell again after reaching highs in the second and third quarter.

The update for the quarters Q1 – Q3 of 2013 are on page3.

2 comments

wiesenda

2013-08-19 at 03:48 (UTC 2) Link to this comment

The position “net bank lending” merits deeper inspection. I suspect it is an aggregate made up of several, possibly quite large, positive and negative terms whose importance is on top of that changing over time. Therefore it is difficult to draw conclusions from the aggregate value alone. For example, the idea that foreign bank clients are the source of positive net bank lending in the years after 2007 is possible albeit an outflow of deposits due to tax regularization may also be taking place.

Be that as it may, these flows surely have to be orders of magnitude smaller than the deleveraging going on in the Swiss banking sector? Were the two big banks not major conduits for exporting capital? Their shrinking exercise must be bringing capital home. The effect of this would be very similar to what has happened in Germany. Its current account surpluses post 2000 had been reinvested in the Euro periphery through the banking conduit (German banks lending to periphery banks).

When trust among banks evaporated post 2007 – they had realized that, oops, mortgage loans can go sour in the US (where they were exposed through securities), therefore also in Europe (where they were exposed through interbank loans) – the ECB stepped in as an intermediary for short term lending, later joined by various other facilities for longer-term lending.

The result of all this assisted de-leveraging and these bailouts was that the cumulative current account surpluses landed on the balance sheet of the Bundesbank as a TARGET2 credit. It is easier to think of this as a stock phenomenon (the transfer of a foreign loan portfolio from the banking system to the Bundesbank) than as a flow phenomenon.

I believe a similar thing is happening in Switzerland for slightly different reasons in a different setting – but basically it’s a central-bank-assisted deleveraging of the banking sector. Now that the money is parked at the SNB what do we do with it? Leave it in the custody account at the SNB? Make it disappear by maintaining the peg and creating inflation (the German way in the EU system) or let the CHF appreciate and thereby restarting the virtuous circle of competitive pressure on industry and redistribution of the productivity gains to everyone through an appreciating CHF? The latter by the way is the reason that Bali is full of Swiss supermarket checkout personnel as one English writer once remarked with a mixture of envy and admiration.

DorganG

2013-08-23 at 07:11 (UTC 2) Link to this comment

Sorry for the late response due to time constraints during the working week:

I added the details for net bank lending in the text. https://snbchf.com/wp-content/uploads/2013/07/Foreign-Clients-Lending-to-Swiss.jpg

This number shows the gross lending of foreign bank clients to Switzerland. Both gross lending and net lending of foreigners to Switzerland is increasing.

You are right saying that Swiss lending to US and EU has excessively decreased.

Thanks for impressive

“Make it disappear by maintaining the peg and creating inflation (the German way in the EU system) or let the CHF appreciate and thereby restarting the virtuous circle of competitive pressure on industry and redistribution of the productivity gains to everyone through an appreciating CHF?”