Category Archive: 3.) Property

Finding a place to rent getting easier in Switzerland

A recent Credit Suisse report, entitled: Tenants Wanted, says capital continues to flow into Swiss real estate, boosting the supply of rental properties. Against a backdrop of negative interest rates at Switzerland’s central bank, investors continue to plough money into constructing new residential properties. At the same time, declining immigration has hit the demand for rental apartments.

Read More »

Read More »

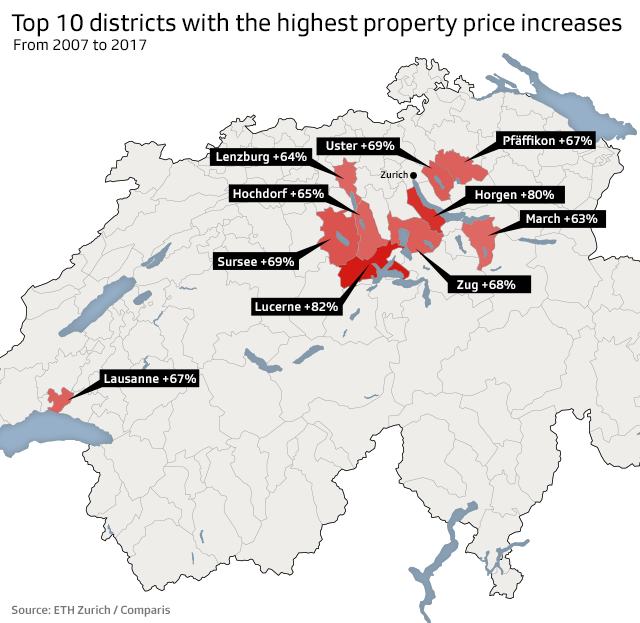

Highest Swiss Property Prices Recorded in Zurich

Zurich remains the dearest location for Swiss property at CHF12,250 ($13,000) per square metre. However, houses in Lucerne have gained the most in value over the past decade, with one square metre costing CHF8,500, up 82% on 2007.

Read More »

Read More »

Number of vacant homes rises again in Vaud

At 1 June 2017, 3,650 empty homes, of which 2,655 were for rent and 995 for sale, were on the market in Vaud. This brought the vacancy rate to 0.9%, a rise of 0.1% compared to the year before. This rise follows an increase of 0.1% in 2016 from a rate of 0.7% in 2015. The market is considered balanced when the vacancy rate reaches 1.5%. The last time it was above this mark in Vaud was in 1999.

Read More »

Read More »

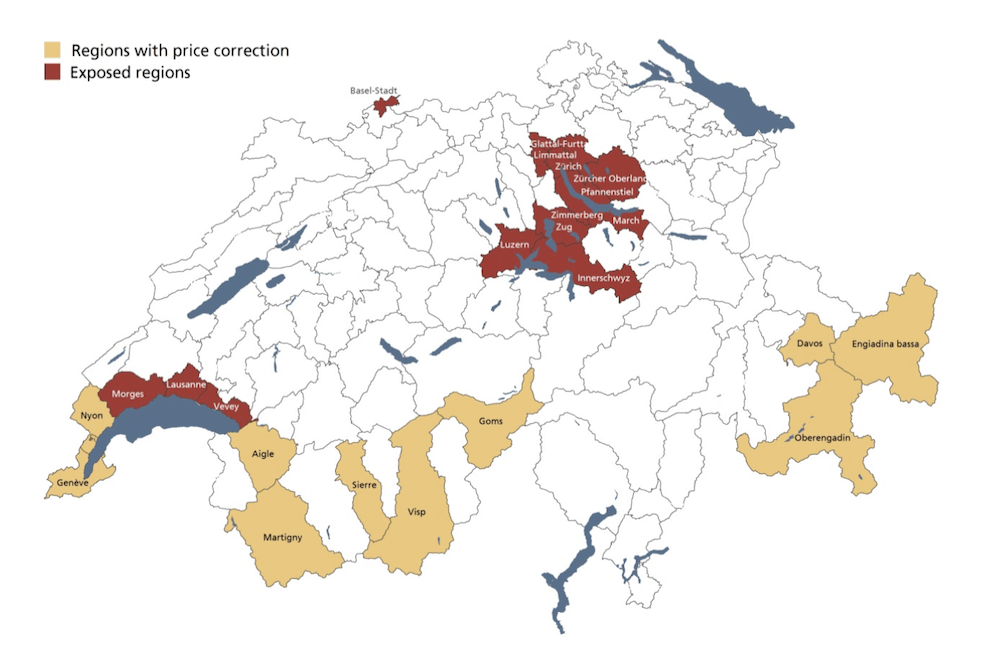

Property prices fall in Swiss resorts but climb elsewhere, says UBS report

A real estate report by the bank UBS, which looks at 25 top resorts in Switzerland, Austria, France and Italy, shows vacation home price drops across Switzerland. These price falls contrast with price rises in resorts in Austria, France and Italy.

Read More »

Read More »

Few tenants take advantage of rent controls

Anyone who rents a home in Switzerland (more than 60% of households) could qualify for a rent reduction after the Federal Housing Office reduced the reference rate on June 1. However, not everyone bothers to ask, and not all those who do get a positive response from landlords.

Read More »

Read More »

Mortgage reference rate falls opening way for Swiss rent cuts

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it dropped 0.25% to 1.50%. The interest rate used to set the reference rate was the average rate on Swiss mortgages at 31 March 2017 of 1.61% which rounds to 1.50% under the rounding rules, which round to the nearest quarter of a percent.

Read More »

Read More »

Poor not being pushed out of Swiss cities

It is widely believed that as the price of real estate climbs those on low incomes are forced out of city centres. A study by the University of Geneva, commissioned by the Swiss Federal Statistical Office focused on the period between 2010 and 2014, shows this is not true in Switzerland.

Read More »

Read More »

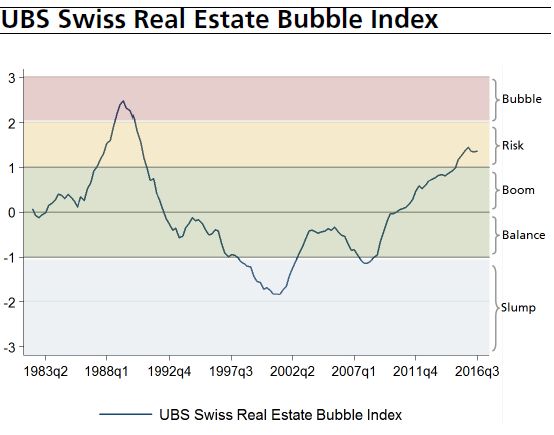

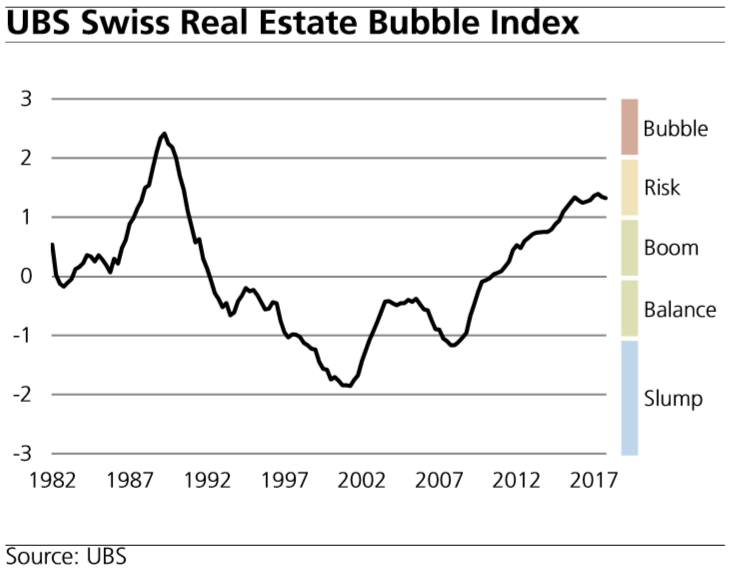

Swiss real estate market UBS Swiss Real Estate Bubble Index Q1 2017

The UBS Swiss Real Estate Bubble Index remained in the risk zone at 1.39 points in the first quarter of 2017 following a moderate increase. The increase in home prices outpaced the increase in rents and income. Demand for buy-to-let investments also rose, in spite of heightened market risks.

Read More »

Read More »

Swiss have never moved as much as they did in 2015

In Switzerland, more than a million people moved house in 2015, 12.1% of the population. The figure has never be higher, according to a report called Immo-Monitoring published by Wüest Partner. The home moving covered around 490,000 dwellings. Of those who moved, 344,000 stayed in the same commune (Gemeinde) while the other 659,000 changed municipality.

Read More »

Read More »

Fall in Swiss property prices accelerates

Over the year ending 31 March 2017, apartment prices across Switzerland dropped by 6.8%, according to a property price report published by the Zurich-based research and consulting firm Fahrländer Partner FPRE.

Read More »

Read More »

Swiss rents 40 percent too high, according to bank’s calculation

According to the bank Raiffeisen, if rents had followed the path prescribed in the Swiss Code of Obligations, they would be much lower. Their figures show that changes in interest rates have not flowed through to renters. If rents had fallen in step with mortgage interest rates they would be 40% lower than they are currently.

Read More »

Read More »

Proposal to remove Swiss home-owner tax rejected

In Switzerland, those who own the home they live in must add imputed rent to their income when calculating their income tax. This means owner-occupiers are taxed for living in their own homes, an odd concept for some who are new to Switzerland.

Read More »

Read More »

Bank drops plan to loosen Swiss mortgage restrictions

The bank Raiffeisen has dropped its attempt to reduce minimum deposit requirements for home loans, according to RTS. Last autumn, it unveiled plans to reduce loan deposit requirements. However, last week, the bank announced that FINMA, Switzerland’s financial regulator, was opposed to the idea.

Read More »

Read More »

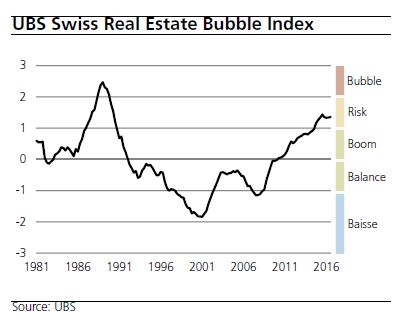

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2016

The UBS Swiss Real Estate Bubble Index stood in the risk zone at 1.35 points after a slight increase in the final quarter of 2016. The further increase in the ratio of purchase prices to rents and income reflects increasing interest rate risks. The stabilization of the index in the last few quarters is due to the sharp slowdown in household debt growth.

Read More »

Read More »

Swiss fact: Switzerland has one of the world’s lowest home ownership rates

In Romania, 96.1% of the population owns the home they live in. In Switzerland the percentage is 37.4%. Home ownership rates vary significantly across the country. The lowest rates are found in the canton of Basel-City (16.0%) and Geneva (18.3%). Relative to these two cities, home ownership abounds in Valais (57.2%), the highest. Vaud (31.4%), Zurich (28.5%), Bern (39.9%), and Luzern (34.8%) are all in between.

Read More »

Read More »

Swiss Real Estate Focus 2017: Vacancy rates rising at the end of the real estate cycle

Record-breaking purchase prices and increased vacancy rates are making property investments a careful balancing act. Achieving full occupancy for an investment property now requires active space management and discounted rents – in every segment. Rents for investment properties are expected to fall this year, while house prices stagnate.

Read More »

Read More »

Swiss regulator does not want to loosen mortgage restrictions

Swiss financial markets regulator Finma is not planning to loosen mortgage lending directives, according to its director Thomas Bauer, after the bank Raiffeisen expressed a desire for looser lending rules. In an interview with Zentralschweiz am Sonntag, Bauer said that this could allow certain households to get mortgages that they wouldn’t be able to service over the long term.

Read More »

Read More »

Swiss real estate market UBS Swiss Real Estate Bubble Index 3Q 2016

Risks to the Swiss property market remained elevated in the three months through September, according to UBS Group AG’s quarterly index. “While the buy-to-rent price ratio reached an all-time high, moderate mortgage growth and the slightly-improved economy prevented imbalances in the owner-occupied housing market from widening,” it said in a report.

Read More »

Read More »

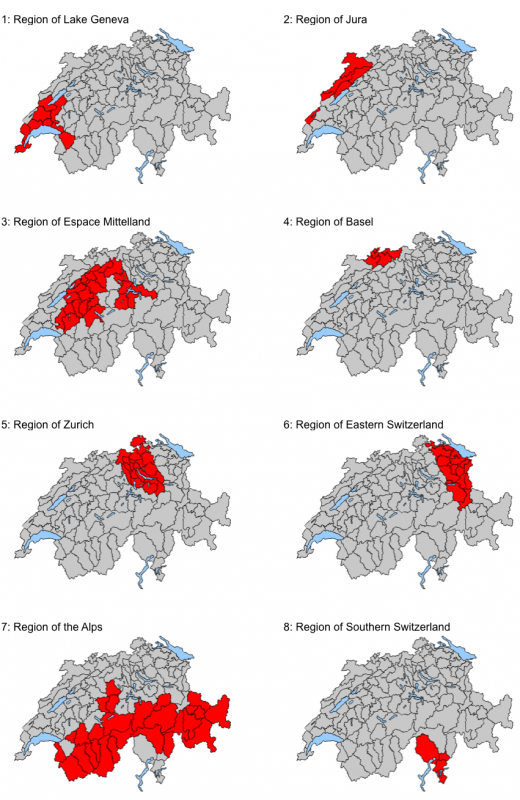

Swiss rents drop, substantially in the Lake Geneva region

Rents have dropped across Switzerland, declining substantially in the Lake Geneva region, according the the property consulting firm Wüest Partner. According to the firm, Swiss rents in the second quarter of 2016 were 1.6% lower than the same quarter in 2015. Geneva saw rents drop by 8.3% over the same period, while the region around Lake Geneva, known as the arc lémanique, saw a fall of 7.2%.

Read More »

Read More »

Vancouver tops list of cities at risk of housing bubble. Zurich 9, Geneva 11.

Vancouver, London and Stockholm rank as the cities most at risk of a housing bubble after a surge in prices in the past five years, according to a UBS Group AG analysis of 18 financial centers. Sydney, Munich and Hong Kong are also facing stretched valuations, UBS said in its 2016 Global Real Estate Bubble Index report, released Tuesday. San Francisco ranked as the most overvalued housing market in the U.S., while not yet at bubble risk.

Read More »

Read More »