Category Archive: 3.) Property

Swiss rents set to rise as much as 15 percent

Close to half of renters is Switzerland could face significant increases in rent, estimates Zürich Kantonalbank (ZKB), with rents potentially rising as much as 15% over the next five years, reported the newspaper Blick.

Read More »

Read More »

Swiss government changes solar electricity rules

On 2 June 2022, Switzerland’s parliament adopted two motions to accelerate the adoption of solar panels.

Read More »

Read More »

No weakening expected in Swiss house prices

The Swiss housing market continues to rise with no signs of weakening, reported RTS this week. According to the real estate platform immoscout24, the average price per m2 for a family home in Switzerland has risen from CHF 6,700 to CHF 7,200 over the last 12 months, a rise of 7%. Apartment prices have risen even further in some places.

Read More »

Read More »

Number of vacant homes in Switzerland drops for first time in 12 years

Finding a place to live in Switzerland is difficult. Home availability is low and prices are high. On 13 September 2021, the Federal Statistical Office published data showing a sharp drop in the number of vacant homes since 2020, a development that will make home hunting harder.

Read More »

Read More »

Swiss home prices rose over the third quarter of 2020

Over the third quarter of 2020, home prices in Switzerland rose by an average of 0.2%. However, the prices of some homes rose while others fell.

Read More »

Read More »

New Swiss initiative to further restrict construction

Land use is strictly governed in Switzerland. However, a new initiative, which aims to increase construction restrictions further, recently gathered enough signatures to qualify for a a popular vote.

Read More »

Read More »

Housing vacancies rise in 20 Swiss cantons

Recent figures show an annual 4.2% rise in the number of vacant homes in Switzerland, extending a trend that started 10 years ago, according to the Federal Statistical Office. At the start of June 2019, there were 75,323 vacant homes, representing 1.66% of Switzerland’s total stock of homes.

Read More »

Read More »

Steep drop in thefts in Switzerland

Comparing 2018 to 2012, thefts in Switzerland fell by nearly half, according to the Federal Statistical Office. In 2012, there were a record 219,000 thefts recorded in Switzerland. By 2018, the figure had fallen to 112,000, a drop of 49%.

Read More »

Read More »

No Relief for Swiss Renters as Mortgage Rates Barely Move

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 2 June 2017 when it fell to 1.5%, its lowest level since 2008.

Read More »

Read More »

Swiss Housing – the hardest and easiest places to find a home

Recent government figures show a 13% rise in the number of vacant homes over the 12 months to June 2018. The number has more than doubled since 2009 when there were close to 35,000 vacant dwellings. By 1 June 2018, there were more than 72,000, a vacancy rate of 1.62%.

Read More »

Read More »

House Prices Down in Verbier but Up in Some other Swiss resorts

A recent report published by UBS shows real estate price changes in european mountain resorts. Over the last year, Verbier (-3.2%) and Crans Montana (-3.0%) experienced the largest price declines, while Saas Fee (+14.3%) and St. Moritz (+7.4%) climbed the most.

Read More »

Read More »

Geneva’s mega apartment project now underway – 1,000 apartments and 2,500 jobs

Last week, work started on a project to construct 1,000 apartments in Geneva. The project known as the Quartier de l’Etang will unfold over an 11 hectare site in Vernier, not far from Geneva airport. The video above shows the commencement ceremony and a computer animation of the completed project.

Read More »

Read More »

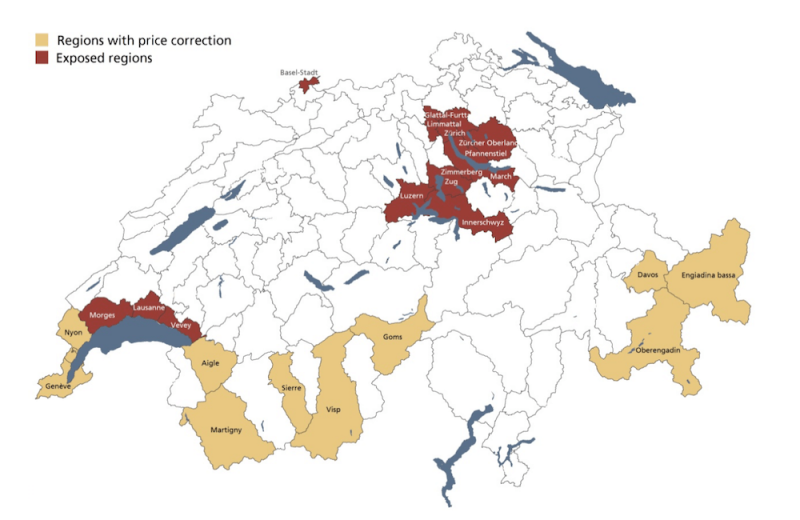

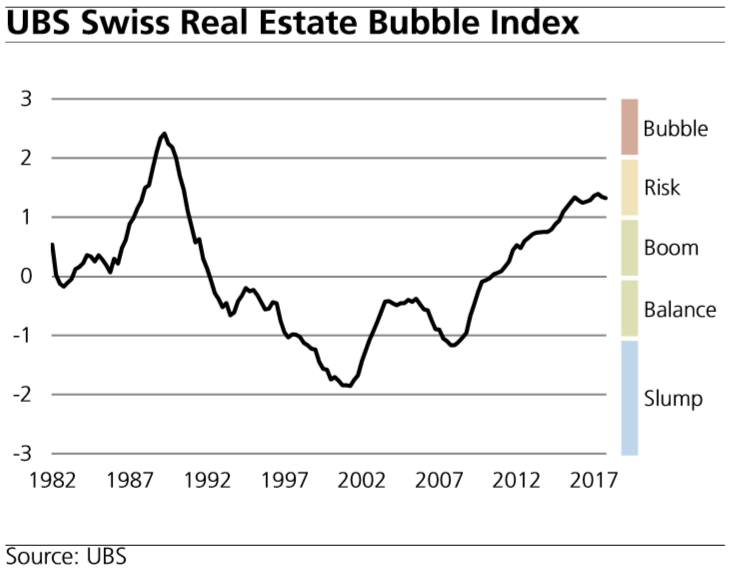

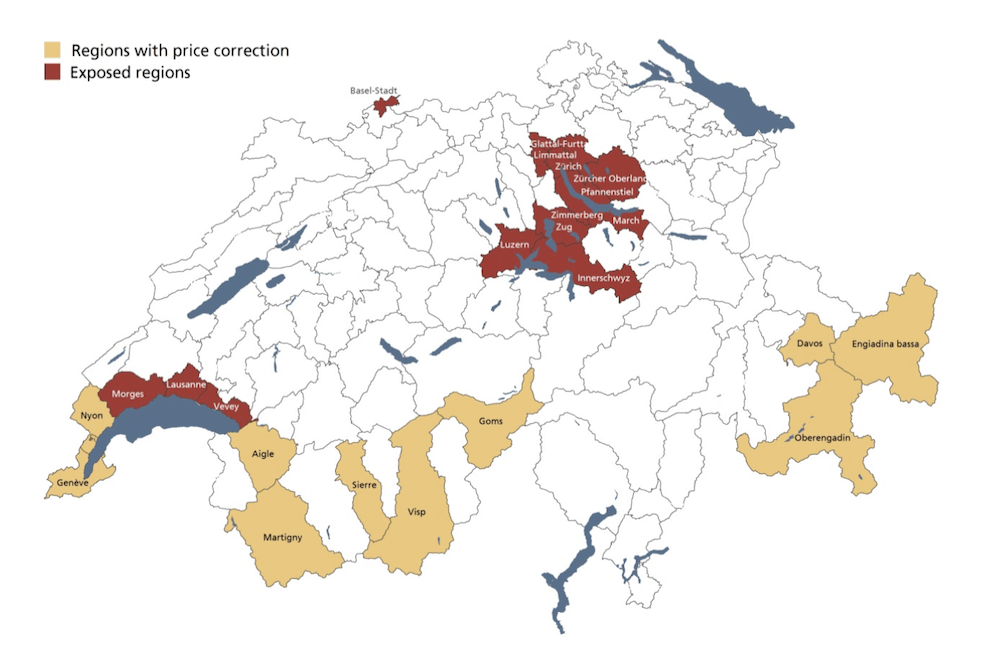

Swiss real estate risk falls two quarters in a row, says UBS

The UBS Swiss Real Estate Bubble Index declined in the last quarter of 2017, the second quarterly decline in a row. Prices are considered balanced when the index reaches zero. Between zero and 1 is considered a price boom, between 1 and 2 is considered at risk and above 2 a bubble. At the end of 2017 the index sat at 1.32, still in the zone where there is a risk of a price correction.

Read More »

Read More »

Swiss real estate market UBS Swiss Real Estate Bubble Index 4Q 2017

The UBS Swiss Real Estate Bubble Index declined in the fourth quarter of 2017, and is currently in the risk zone at 1.32 index points. This second fall in succession was driven by the persistently low increase of mortgage volumes. However, this may have been underestimated, as the records of mortgages granted by insurers and pension funds are inadequate. The majority of the sub-indicators remained unchanged in the last quarter.

Read More »

Read More »

Swiss fact: nearly half of Swiss rental properties owned by individuals

If you rent a home in Switzerland it is more likely to belong to an individual than a big real estate company or pension fund. In 2017, 49% of residential rental properties in Switzerland were owned by individuals, according to Statistics published by the Swiss Federal Statistical Office. The highest rate of rental home ownership by individuals was in the Italian-speaking canton of Ticino (71%). The lowest rate was in the Lake Geneva region (41%).

Read More »

Read More »

Housing in Zurich and Geneva only moderately overvalued, says UBS

The UBS Global Real Estate Bubble Index 2017 describes housing in Zurich and Geneva as only moderately overvalued. The two Swiss cities rank 6th (Geneva) and 9th (Zurich) in a list of 20 selected global cities.

The top eight: Toronto, Stockholm, Munich, Vancouver, Sydney, London, Hong Kong and Amsterdam are all classified as bubble risk. Only Chicago is undervalued.

Read More »

Read More »

Geneva and Lausanne remain Switzerland’s toughest home markets

Home vacancy rates in Switzerland’s main cities have all risen over the last few years, bringing some hope to those looking for a place to live. The latest 2017 data confirm this trend. While these percentage shifts might appear big, very low vacancy rates underly them. On 1 June 2012, none of these cities had a vacancy rate above 1%. Zurich (0.29%), Bern (0.48%), Basel (0.13%), Lausanne (0.28%) and Geneva (0.21%) were all well below 1% vacancy...

Read More »

Read More »

Switzerland’s home ownership illusion

When 10-year mortgage interest rates fall to 1%, home ownership becomes a very attractive alternative to renting. A recent report on home ownership shows why home ownership remains out of reach of the average Swiss household despite very low interest rates.The report, by Credit Suisse, says that despite the strong desire for people to own their own home, fewer and fewer households are able to afford them as the years go by.

Read More »

Read More »

Switzerland’s most expensive apartments in Zurich, Maloja and Lavaux

According to data from comparis.ch, Switzerland’s most expensive apartments are found in Zurich, Maloja – home to Saint-Moritz, and Lavaux-Oron. One square metre will cost you CHF 12,250 (US$ 13,000) in Zurich, CHF 11,500 in Maloja and CHF 11,250 in Lavaux-Oron. Lavaux-Oron contains posh parts of Greater Lausanne, such as Lutry, and the UNESCO-listed wine terraces of Lavaux on the shore of Lake Geneva.

Read More »

Read More »