Category Archive: 2) Swiss and European Macro

The Entrepreneurs, Munich

In this edition of The Entrepreneur Series, in partnership with Monocle, we meet with Munich based entrepreneurs to establish how old school tradition of craft and local heritage meet unparalleled industrial design and tech field innovation to create the basis for unique entrepreneurial successes.

Read More »

Read More »

“Finale in Brüssel – Wann kommt der Durchbruch?” – phoenix Runde am 24.06.2015

“Finale in Brüssel – Wann kommt der Durchbruch?” Reichen die Spar- und Reformvorschläge aus Athen aus? Wird es diese Woche eine Lösung geben? Ines Arland diskutiert in der phoenix Runde mit: – Andreas Kluth (The Economist) – Christiane Hoffmann (Der Spiegel) – Prof. Marcel Fratzscher (Präsident Deutsches Institut für Wirtschaftsforschung) – Nikos Chilas (Athener Zeitung …

Read More »

Read More »

Heiner Flassbeck: Der Staat ist keine schwäbische Hausfrau

Deutschland hat den Gürtel in den letzten Jahren immer enger geschnallt. War das ökonomisch gesund? Nein, meint Heiner Flassbeck, ehemaliger Direktor für Globalisierung & Entwicklung bei den Vereinten Nationen in Genf und ehemaliger Staatssekretär im Bundesfinanzministerium. Wie also kann Deutschland dazu gebracht werden, dass es jetzt mal eine Weile über seine Verhältnisse lebt, damit die …

Read More »

Read More »

Westend Redezeit auf Naxos mit Volker Handon und Heiner Flassbeck

Volker Handon, Börsenhändler und Autor von „Die Psycho-Trader. Aus dem Innenleben unseres kranken Finanzsystems“ im Gespräch mit Heiner Flassbeck, ehemaliger Direktor UNCTAD (Genf), Herausgeber flassbeck-economics.de. Zum Buch “Die Psycho-Trader”: „Geld mit Geld zu verdienen ist krank.“ Das sagt Volker Handon, der genau das tut und sich seit über 25 Jahren an vorderster Front durch die …

Read More »

Read More »

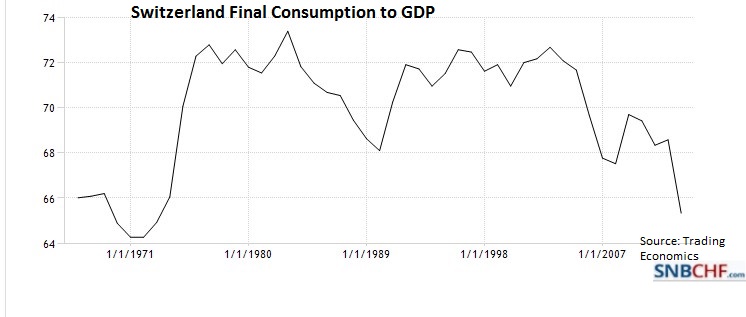

Q1/2015: Swiss Real GDP Rises by 15 percent … in Euro Terms

George Dorgan shows that Gross Domestic Product (GDP) is a measurement in the local currency. Effectively, Swiss real GDP rose by 15% in Euro terms, but fell slightly in CHF. He also emphasizes that Switzerland needs a big rebalancing of its economy, away from exports towards consumption. The Swiss National Bank was right to remove the euro peg. The move towards consumption is only possible when the Swiss franc is stronger because consumers will...

Read More »

Read More »

Heiner Flassbeck: «Bei einem Grexit ist die EU am Ende»

In zwei Wochen läuft das aktuelle Hilfsprogramm für Griechenland aus, dem Land droht die Zahlungsunfähigkeit. Die Regierung in Athen und die internationalen Geldgeber versuchen sich in verzweifelten Sitzungen auf einen Reformkatalog zu einigen so etwa auch morgen beim Treffen der Euro-Finanzminister. Die fehlenden Fortschritte in den Verhandlungen machen radikale Lösungen immer wahrscheinlicher: es mehren sich …

Read More »

Read More »

Equity markets: bubble or not?

As P/E ratios reach new highs, Christophe Donay, Chief Strategist at Pictet Wealth Management, explains why he believes central banks are sustaining the prices.

Read More »

Read More »

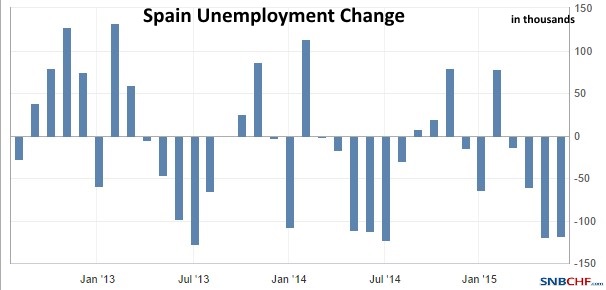

Eurocrisis, Myth and Reality, part 1: Big Job Creation in Spain

In the new series George Dorgan suggests that the euro crisis is a temporary development but not a long-lasting crisis. In the first part he shows that Spain actually created a lot of jobs in last twenty five years.

Read More »

Read More »

Prof. Marcel Fratzscher zur deutschen Wirtschaft im Tagesgespräch am 02.06.2015

Klaus Weidmann im Gespräch mit Prof. Marcel Fratzscher (Präsident Deutsches Institut für Wirtschaftsforschung) über Wirtschaft, den G7-Gipfel und die Krise in Griechenland

Read More »

Read More »

Der Vortrag – Prof. Marcel Fratzscher @ Berliner Mittwochsgesellschaft

Am 6. Mai 2015 fand die 21. Berliner Mittwochsgesellschaft statt. Auf Einladung der METRO GROUP in Kooperation mit dem Handelsverband Deutschland (HDE) und dem Bundesverband Großhandel, Außenhandel, Dienstleistungen e.V. (BGA) diskutierten rund 200 Gäste mit dem DIW Präsidenten, Prof. Marcel Fratzscher zum Thema “Investitionslücke – Warum Deutschland stärker in seine Zukunft investieren sollte”.

Read More »

Read More »

Der Bericht – Prof. Marcel Fratzscher @ Berliner Mittwochsgesellschaft

Am 6. Mai 2015 fand die 21. Berliner Mittwochsgesellschaft statt. Auf Einladung der METRO GROUP in Kooperation mit dem Handelsverband Deutschland (HDE) und dem Bundesverband Großhandel, Außenhandel, Dienstleistungen e.V. (BGA) diskutierten rund 200 Gäste mit dem DIW Präsidenten, Prof. Marcel Fratzscher zum Thema “Investitionslücke – Warum Deutschland stärker in seine Zukunft investieren sollte”.

Read More »

Read More »

Emerging debt is back in Fashion

In this video, Christophe Donay, Head of Strategy for Pictet Wealth Management, explains why emerging debt could benefit from a temporary coincidental re-synchronisation of economic growth.

Read More »

Read More »

Im Dialog: Alfred Schier mit Marcel Fratzscher am 02.05.2015

Für Marcel Fratzscher, Präsident des Deutschen Instituts für Wirtschaftsforschung (DIW), ist Griechenland “eigentlich schon seit fünf Jahren pleite”. Er warnt, dass das Land “nach wie vor über seine Verhältnisse” lebe.

Read More »

Read More »

Rede von Prof. Marcel Fratzscher Ph.D., Vorsitzender der Expertenkommission

Bundesminister Sigmar Gabriel eröffnete am 21.4.2015 den Investitionskongress. An der Konferenz nahmen hochrangige Gäste aus Wirtschaft, Politik und Wissenschaft teil. Die von Gabriel im Sommer 2014 einberufene Expertenkommission “Stärkung von Investitionen in Deutschland” stellte auf der Veranstaltung ihre Handlungsempfehlungen vor. Weiterführende Informationen finden Sie unter...

Read More »

Read More »

Interview Prof. Dr. Jan Egbert Sturm, Direktor KOF, ETH Zürich, zur Konjunkturlage

Professor Dr. Jan-Egbert Sturm, Director of KOF Zurich, explains his outlook for the Swiss Economy in relation to the strong Swiss Franc - on the Occasion of the S-GE-Event "strong swiss franc" in Zurich, April 1st.

Read More »

Read More »

Prof. Heiner Flassbeck – 10 Jahre Hartz4 (www.denkfunk.de)

Quelle: denkfunk: www.denkfunk.de Urheberrecht, Copyright und Eigentum: PatchworX Media GmbH.

Read More »

Read More »

Überlappung der Krisen – Interview mit Heiner Flassbeck

Antikrieg TV – Übernommen mit freundlicher Genehmigung durch Carsten Rose. http://carstenrose.jimdo.com http://www.radio-frei.de Was geht mich die Krise an? Kommt der Bumerang zurück? Interview mit Heiner Flassbeck Wir haben eine Überlappung der Krisen. Wir haben einen Mangel an Diskussion. Unsere Politiker sind einseitig und ideologisch beraten. Das Dogma und die Einfalt regiert. Deutschland hat sich seit …

Read More »

Read More »