Category Archive: 2.) Europe and Euro Crisis

Liliane Held-Khawam | NARRATIVE by Robert Cibis

Die Entmachtung der Bürger

Den Umbau der Gesellschaft in den letzten Jahrzehnten kann man sehr gut anhand der Finanzordnung erzählen. In präziser Analyse erklärt Liliane Held-Khawam wie Zentralbanken die Macht an sich gerissen haben, Regierungen und Unternehmen entmächtigen und damit helfen, die Bürger kontrollieren zu können. Robert Cibis fragt die Autorin von "Globaler Staatsstreich" nach der Denkweise dahinter.

Read More »

Read More »

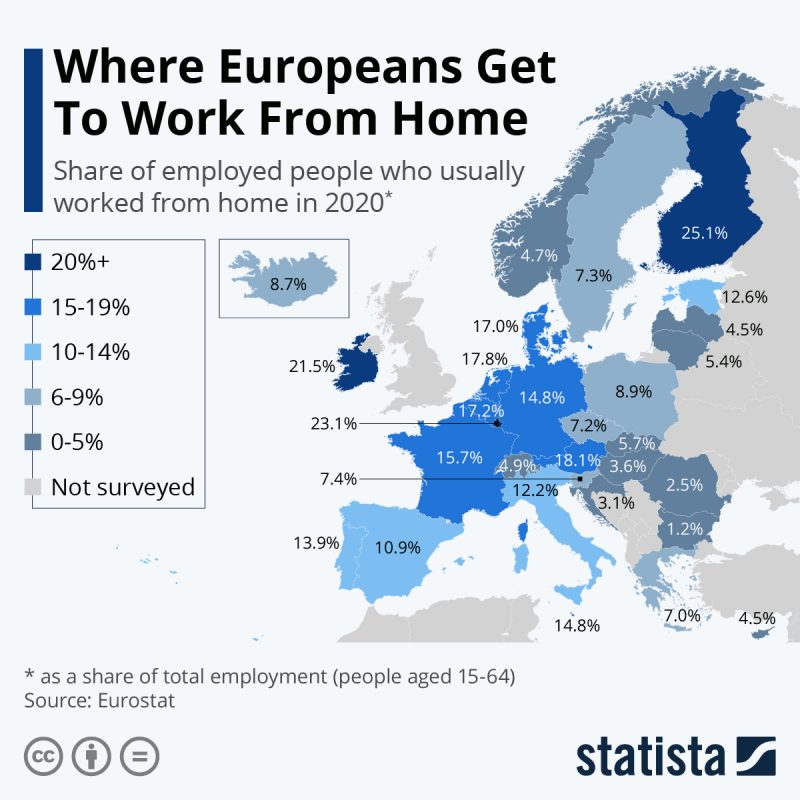

Where Europeans Get To Work From Home

The social distancing measures introduced in response to the Covid-19 pandemic has forced many people to work from home and accelerated the trend of remote working. Eurostat have released some interesting new data showing the share of employed people aged between 15 and 64 in Europe who usually do home office.

Read More »

Read More »

Covid-19, la BNS pendant le confinement

L'économiste Liliane Held-Khawam, auteure du livre "Dépossession", interviewée par Christian Campiche pour infoméduse.ch, le 1er juin 2020.

Read More »

Read More »

Lecture du billet “Tous cyber-prisonniers”, par Liliane Held-Khawam

Vous voyez nos libertés disparaître à mesure que les contraintes d’État s’accumulent, pour plus de 4 milliards de personnes qui se sentent parfois bien dépassées. Il ne faut continuer à construire la réalité dans laquelle nous voulons vivre mais il faut quand même demeurer très attentifs à ce qui se passe. C’est en ce sens …

Read More »

Read More »

“The Eurozone faces the worst combination of economic and systemic risk”

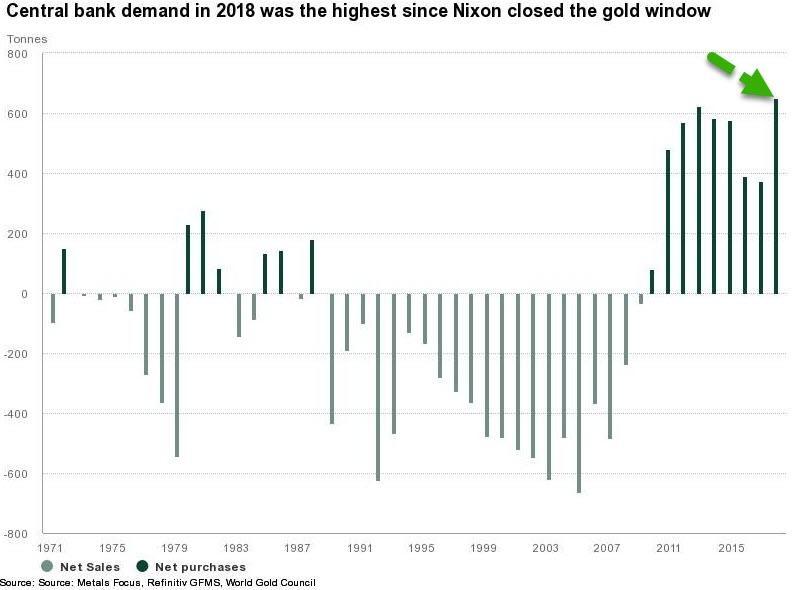

The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally.

Read More »

Read More »

World’s Central Banks End Pact That Limited Selling Of Gold

In a surprising announcement on Friday morning, the European Central Bank said the 21 signatories of the 4th Central Bank Gold Agreement (CBGA) "no longer see the need for formal agreement" as the market has developed and matured, and as a result the signatories "decided not to renew the Agreement upon its expiry in September 2019."

Read More »

Read More »

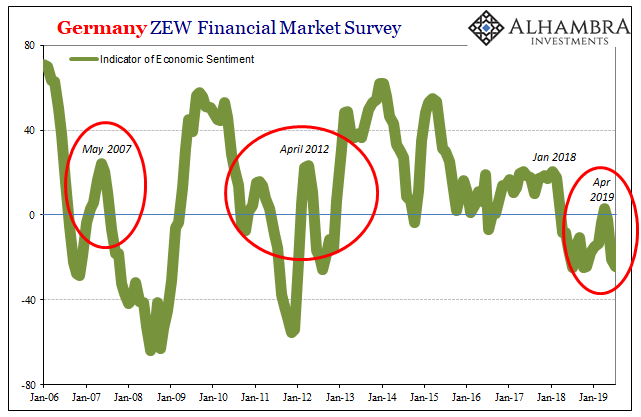

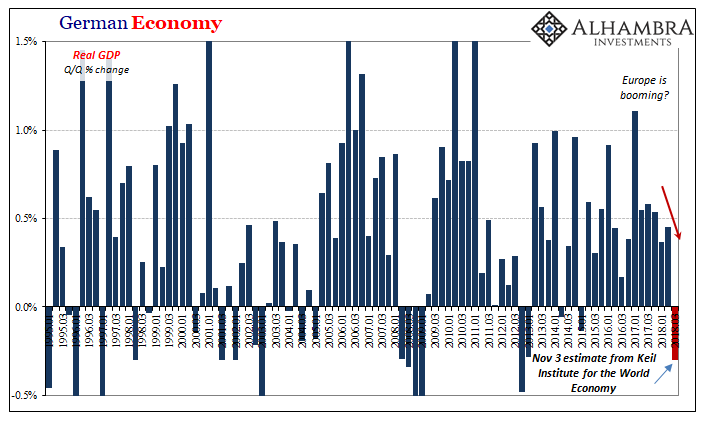

Germany Struggles On

The popular image of the German industrial machine politics is one which has Germany’s massive factories efficiently churning out goods for trade with the South of Europe (Club Med). Because of the common currency, numerous disparities starting with productivity differences had left the South highly indebted to the North just as the Global Financial Crisis would strike.

Read More »

Read More »

Downturn Rising, German Industry

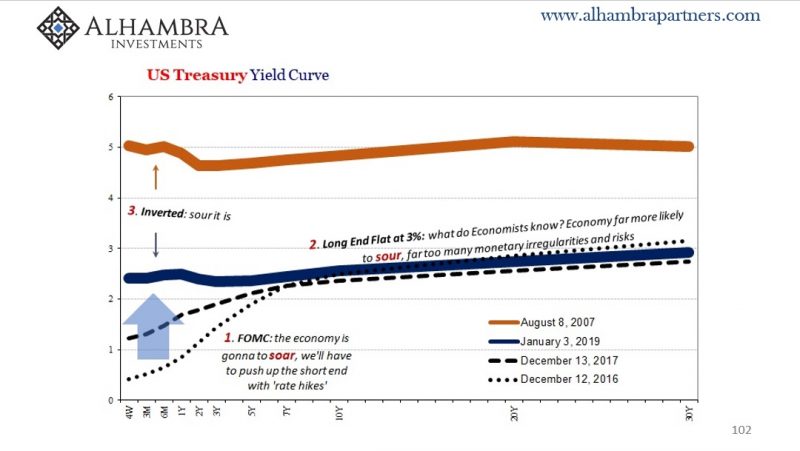

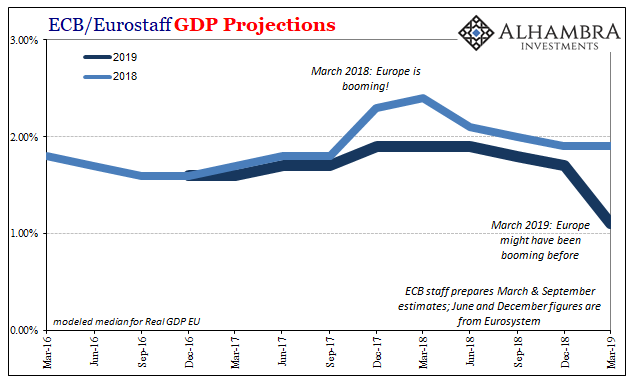

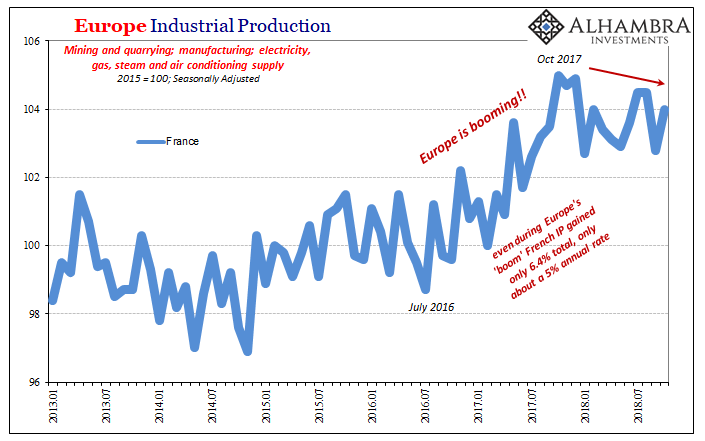

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were.

Read More »

Read More »

Not Buying The New Stimulus

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates.

Read More »

Read More »

…And Get Bigger

Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme.

Read More »

Read More »

EU Recession Imminent – Euro Disunion as Brexit, Italy and End of QE Loom

Someone asked recently how many times I had “crossed the pond” to Europe. I really don’t know. Certainly dozens of times. It’s been several times a year for as long as I remember. That makes me an extremely unusual American. Most of us never visit Europe, except maybe for a rare dream vacation. And that’s okay because our own country is wonderful and has a lifetime of sights to see.

Read More »

Read More »

‘Paris’ Technocrats Face Another Drop

How quickly things change. Only a few days ago, a fuel tax in France was blamed for widespread rioting. Today, Emmanuel Macron’s government under siege threatens to break its fiscal budget. Having given up on gasoline and diesel, the French government now promises wage increases and tax cuts.

Read More »

Read More »

Harmful Modern Myths And Legends

Loreley Rock near Sankt Goarshausen sits at a narrow curve on the Rhine River in Germany. The shape of the bluff produces a faint echo in the wind, supposedly the last whispers of a beautiful maiden who threw herself from it in despair once spurned by her paramour. She was transformed into a siren, legend says, a tantalizing wail which cries out and lures fishermen and tradesmen on the great river to their death.

Read More »

Read More »

London House Prices Fall At Fastest Rate Since Height Of Financial Crisis

– London house prices fall at the fastest annual rate since height of the financial crisis

– London house prices fall in 5th month in row, worst falls since 2009

– London rents dropped at the fastest rate in eight years – ONS

– Brexit, London property slump put brake on UK house price growth

– Consumer spending declined in July as inflation increased

Read More »

Read More »

London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy). London house prices still 50% above 2007 bubble peak (see chart). Brexit and weak consumer confidence to blame say experts. Little sign that U.K. property “weakness” is likely to change. London property bubble appears to be bursting.

Read More »

Read More »

Credit Spreads: Polly is Twitching Again – in Europe

The famous dead parrot is coming back to life… in an unexpected place. With its QE operations, which included inter alia corporate bonds, the ECB has managed to suppress credit spreads in Europe to truly ludicrous levels.

Read More »

Read More »

Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

Eurozone threatened by trade wars, Italy and major political and economic instability. Trade war holds a clear and present danger to stability and economic prospects. Italy represents major source of potential disruption for the currency union. Financial markets fail to reflect the “eurozone time-bomb” in Italy. Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon.

Read More »

Read More »

Euro area Flash PMIs: “Growing pains” but no reason to panic

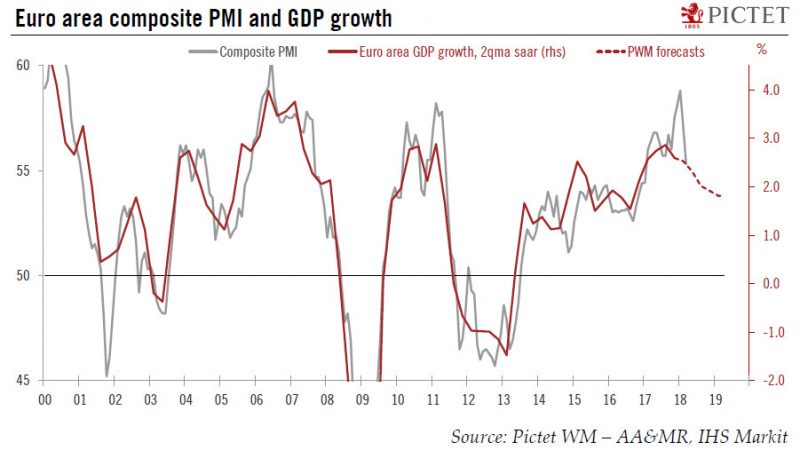

Today’s first batch of euro area March business surveys looks worrying at first sight. The drop in the euro area composite PMI index, from 57.1 to 55.3 in March (consensus: 56.8), was the second one in a row and the largest monthly decline in six years. New orders fell to a 14-month low. The correction in business sentiment was predominantly driven by the manufacturing sector, which could reflect broader concerns of a trade war.

Read More »

Read More »

Europe chart of the week – French unemployment

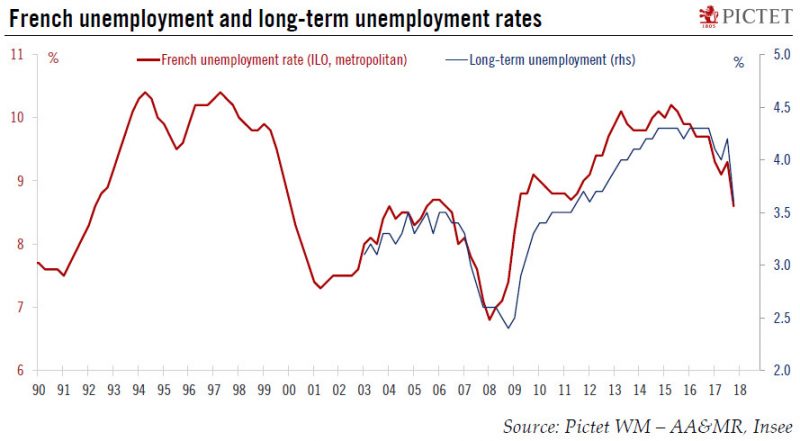

French unemployment fell surprisingly fast in Q4 2017, to a new cyclical low.France registered the largest drop in unemployment in about ten years in Q4 2017. In metropolitan France, the number of unemployed fell by 205,000 to 2.5 million people, pushing the ILO unemployment rate down to 8.6% of the labour force (-0.7pp), its lowest level since Q1 2009.

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »