Category Archive: 1.) SNB Press Releases

Swiss National Bank Results 2016 and Comments

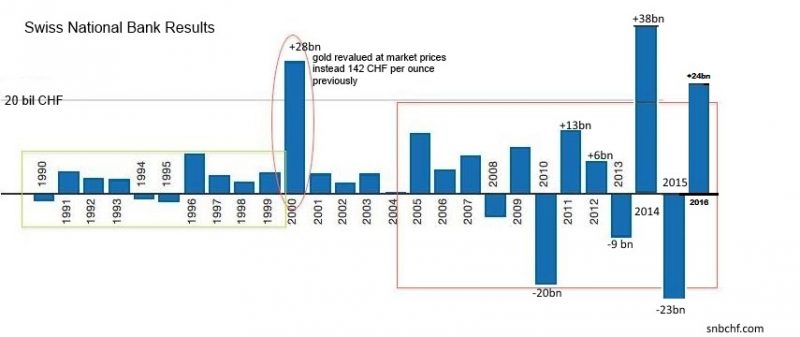

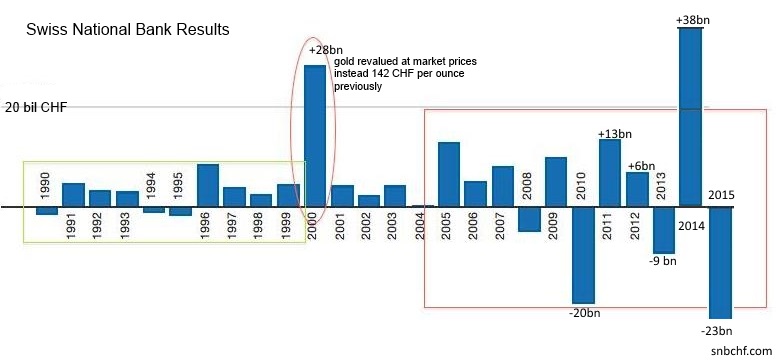

The Swiss National Bank (SNB) reports a profit of CHF 24.5 billion for the year 2016 (2015: loss of CHF 23.3 billion). The profit on foreign currency positions amounted to CHF 19.4 billion. A valuation gain of CHF 3.9 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.6 billion.

Read More »

Read More »

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

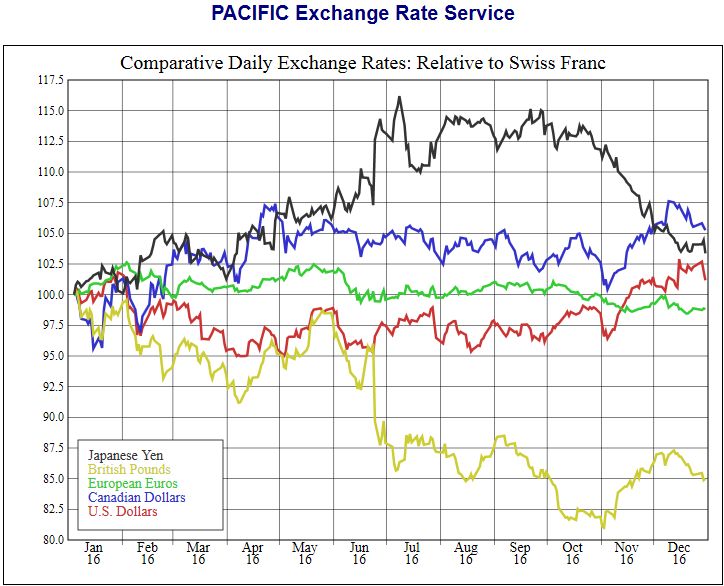

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

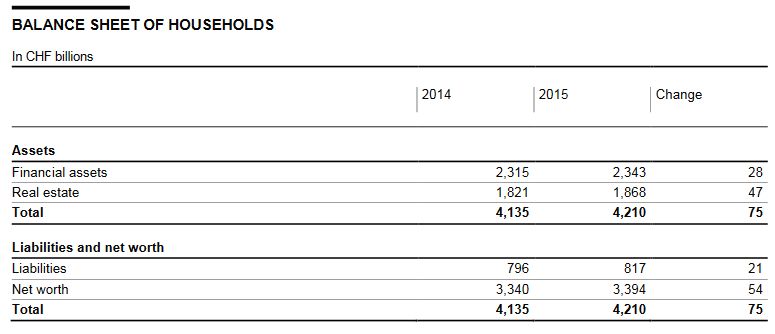

Swiss Financial Accounts, 2015 edition

This year, the Swiss financial accounts, which have been released by the Swiss National Bank since 2005, feature changes affecting both timeliness and presentation.

For the first time, data on the financial accounts are now published within eleven months of the reference date, reducing time to publication by one year. Moreover, the balance sheet of households, previously the subject of the press release on household wealth, is now included in the...

Read More »

Read More »

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

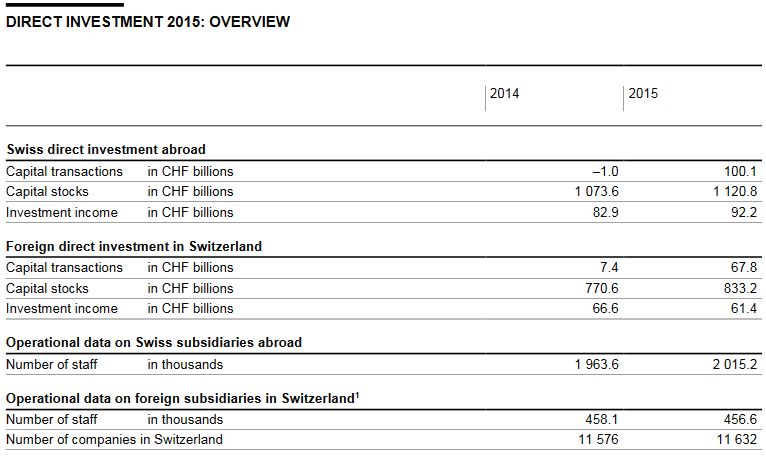

Direct Investments in 2015

Swiss direct investment abroad. Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion).

Read More »

Read More »

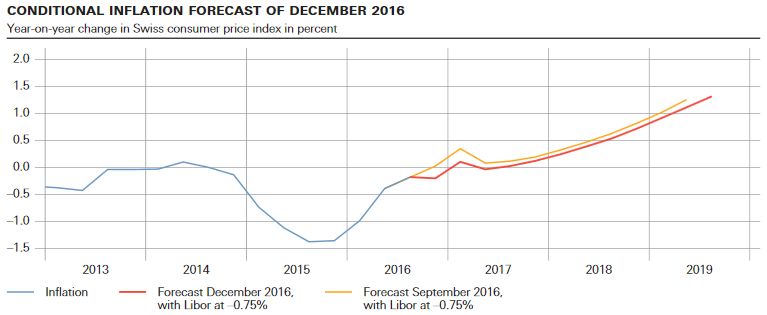

SNB Monetary policy assessment December 2016 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Federal Department of Finance and SNB enter new distribution agreement

The Federal Department of Finance (FDF) and the Swiss National Bank (SNB) have signed a new agreement regarding the SNB’s profit distribution for 2016 to 2020. Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution reserve allows this.

Read More »

Read More »

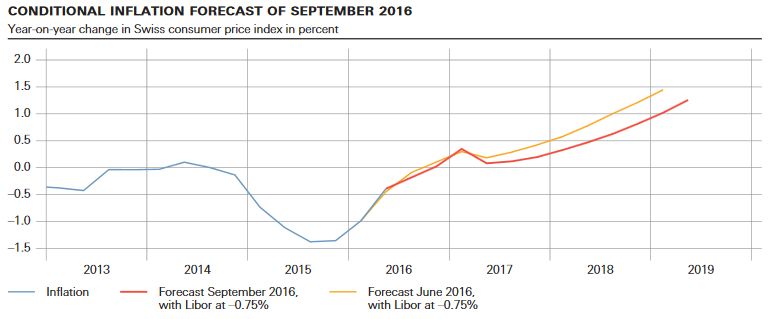

SNB Monetary policy assessment September 2016 and Comments

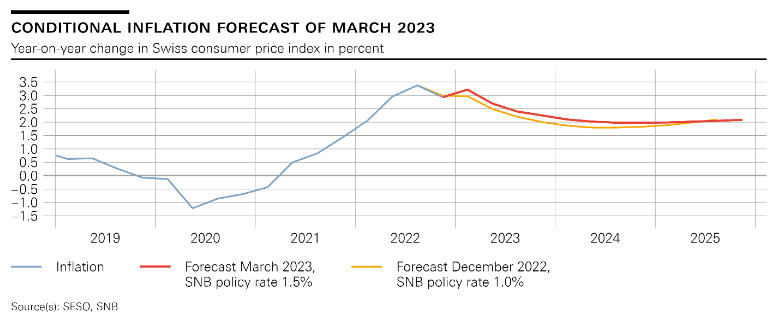

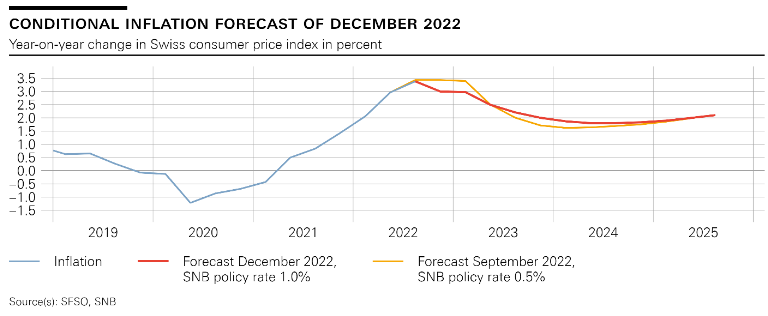

The SNB inflation forecast showed a strange diversion of conditional inflation forecasts: Draghi expected inflation to rebound to 1.2% next year and 1.6% in 2018.

The SNB, however, predicts 2017 inflation at 0.2% and 2018 at 0.6%. For us, one of the two is wrong.

Read More »

Read More »

Swiss National Bank: Carl Menger Prize

Despite her incredible money printing and FX purchases, the SNB has many roots in the Austrian School of Economics, a school that maintains that money printing leads to price inflation. One of the major Austrian economists was Carl Menger.

Read More »

Read More »

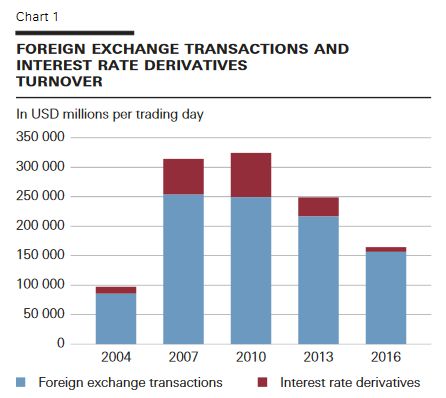

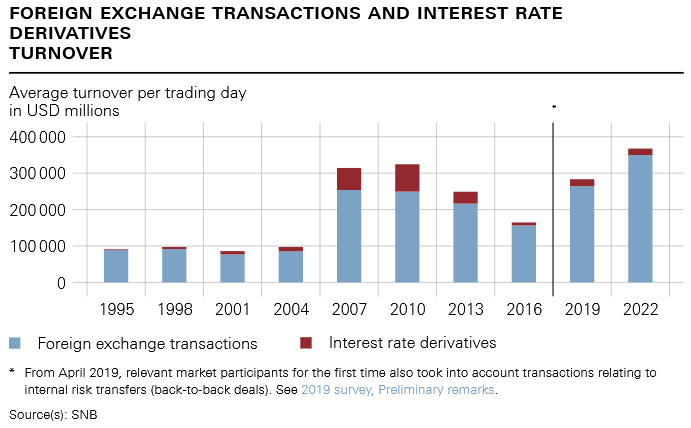

SNB Survey: 2016 Foreign Exchange Turnover

This press release presents the results for a Swiss National Bank (SNB) survey on turnover in foreign exchange and derivatives markets. The request for data was sent to 30 banks that operate in Switzerland and have a sizeable share in the foreign exchange and over-the-counter (OTC) derivatives markets. These banks reported the turnover of their domestic offices.

Read More »

Read More »

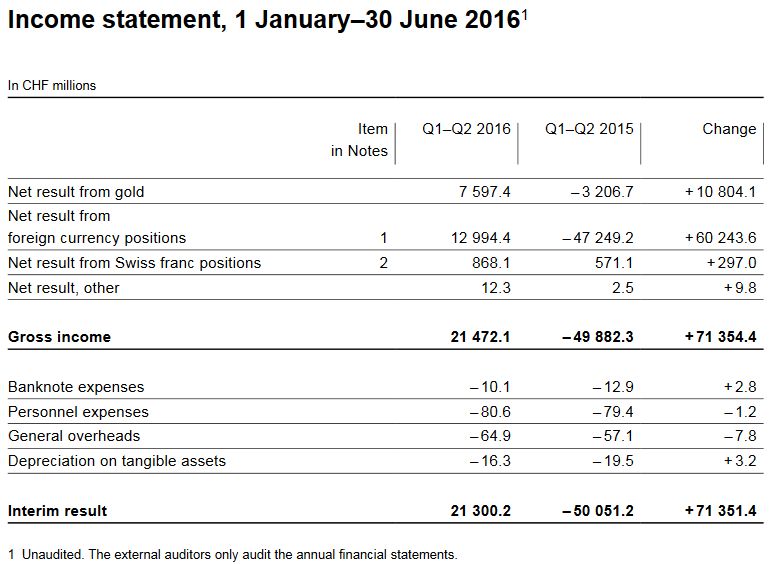

Interim results of the Swiss National Bank as at 30 June 2016

The Swiss National Bank (SNB) reports a profit of CHF 21.3 billion for the first half of 2016. A valuation gain of CHF 7.6 billion was recorded on gold holdings. The profit on foreign currency positions amounted to CHF 13.0 billion.

Read More »

Read More »

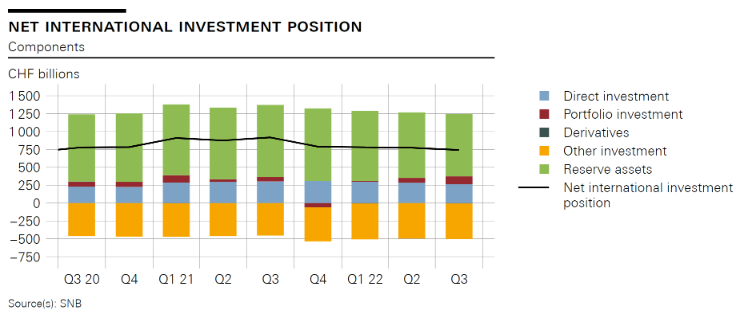

Swiss Balance of Payments and International Investment Position 2015

The Swiss National Bank (SNB) is publishing the annual Swiss Balance of Payments and International Investment Position report today. This year, the report is being released earlier – in May instead of August, as in previous years. It is based on the dataset for the fourth quarter of 2015, which was released with the press release of 21 March 2016 headed ‘Swiss balance of payments and international investment position, Q4 2015 and review of the year...

Read More »

Read More »

Swiss balance of payments and international investment position: Q1 2016

The current account surplus amounted to CHF 10 billion in the first quarter of 2016, CHF3 billion less than in the year-back quarter. The decline was primarily attributable to trade in goods, where the receipts surplus of CHF 8 billion was CHF 2 billion lower than in the first quarter of 2015. The receipts surplus for services remained stable at CHF 5 billion. In the case of primary income (labour and investment income), receipts and expenses were...

Read More »

Read More »

Monetary policy assessment of 16 June 2016

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market, as neces sary. The negative interest rate and the SNB’s willingness to intervene in the foreign exchange market are intended to make Swiss franc...

Read More »

Read More »

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »