Category Archive: 1.) SNB Press Releases

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

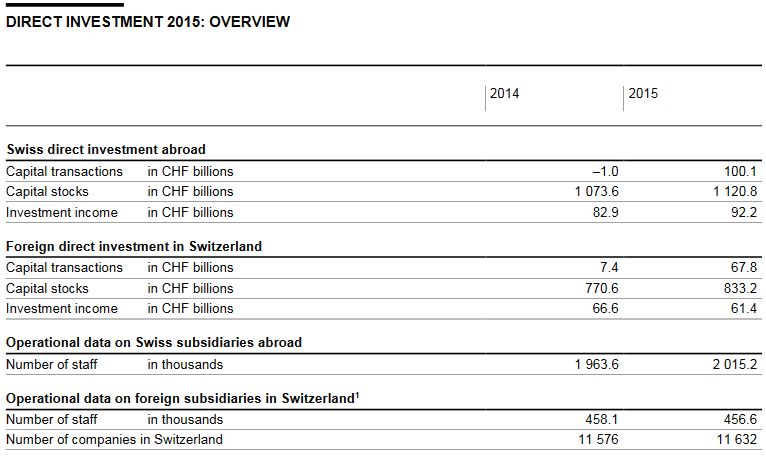

Direct Investments in 2015

Swiss direct investment abroad. Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion).

Read More »

Read More »

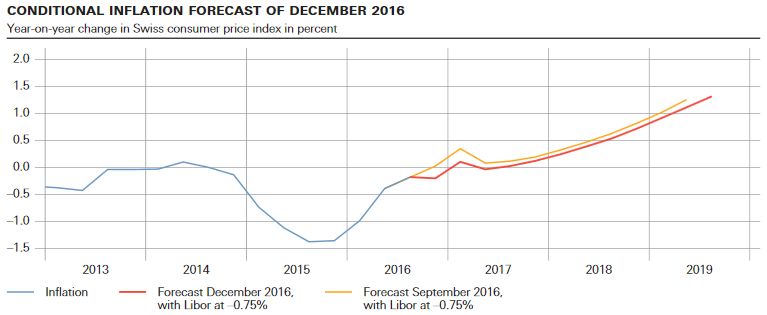

SNB Monetary policy assessment December 2016 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 15.12.2016

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 15.12.2016 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

Federal Department of Finance and SNB enter new distribution agreement

The Federal Department of Finance (FDF) and the Swiss National Bank (SNB) have signed a new agreement regarding the SNB’s profit distribution for 2016 to 2020. Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution reserve allows this.

Read More »

Read More »

Investing in an era where ‘everything is a bubble’ – George Dorgan

Financial Blogger, Banker – George Dorgan, speaks to Tip TV’s Zak Mir, and states the case for investing in this era where everything is noted as a bubble. Dorgan also shares comments on fintech, blockchain and bitcoin. Tip TV Finance is a daily finance show based in Belgravia, London. Tip TV Finance prides itself on …

Read More »

Read More »

Reaffirmation of minimum exchange rate (SNB news conference of June 2013)

This short film, which is included in the focus topic ‘The history of the minimum exchange rate’ on the SNB’s dedicated ‘Our National Bank’ website, shows the announcement of the monetary policy decision by Thomas Jordan, Chairman of the Governing Board, on 20 June 2013, while the minimum exchange rate was still in place.

Read More »

Read More »

Gros plan sur les pensions de titres

Ce film illustre le thème “La mise en oeuvre de la politique monétaire” traité dans le cadre de “Notre Banque nationale”. Il explique le fonctionnement des pensions de titres utilisées par la Banque nationale.

Read More »

Read More »

La fin du cours plancher (conférence de presse du 15 janvier 2015)

Ce film illustre le thème “Zoom sur l’histoire du cours plancher” traité dans le cadre de “Notre Banque nationale”. Thomas Jordan, président de la Direction générale de la Banque nationale, y annonce la décision de politique monétaire du 15 janvier 2015, soit la suppression du cours plancher.

Read More »

Read More »

La BNS valuta la situazione di politica monetaria (conferenza stampa di dicembre 2015)

Questo filmato è inserito in “L’importanza della stabilità dei prezzi”, una delle tematiche dell’offerta informativa “La nostra Banca nazionale” e mostra l’annuncio della decisione di politica monetaria da parte di Thomas Jordan, presidente della Direzione generale, del 10 dicembre 2015.

Read More »

Read More »

Mantenimento del cambio minimo (conferenza stampa di giugno 2013)

Questo filmato è inserito in “La storia del cambio minimo”, una delle tematiche specifiche dell’offerta informativa “La nostra Banca nazionale”. Mostra l’annuncio, del 20 giugno 2013, della decisione di politica monetaria da parte di Thomas Jordan, presidente della Direzione generale, durante il periodo in cui era attuata la difesa del cambio minimo.

Read More »

Read More »

Das Ende des Mindestkurses (Medienkonferenz vom 15. Januar 2015)

Dieser Kurzfilm gehört zum Fokusthema “Die Geschichte des Mindestkurses” des Informationsangebots “Unsere Nationalbank”. Er zeigt die Verkündigung des geldpolitischen Entscheids bei der Aufhebung des Mindestkurses durch Thomas Jordan, Präsident des Direktoriums der Nationalbank, am 15. Januar 2015.

Read More »

Read More »

The Swiss National Bank – what it does and how it works

The SNB film takes a behind-the-scenes look at the Swiss National Bank (SNB) and its monetary policy. It explains why the SNB has a mandate to ensure price stability, describes how it implements this mandate, and demonstrates what impact this has on our everyday lives.

Read More »

Read More »

La Banque Nationale Suisse – son action et son fonctionnement

Le film sur la Banque nationale suisse (BNS) donne un aperçu de l’institution et de la conduite de la politique monétaire. Il explique pourquoi la BNS a reçu le mandat d’assurer la stabilité des prix, comment elle remplit cette mission et quelles répercussions a son action sur notre quotidien.

Read More »

Read More »

La Banca Nazionale Svizzera – cosa fa e come opera

Il filmato sulla Banca nazionale svizzera si propone di presentare nelle linee essenziali la Banca nazionale e la sua politica monetaria. Vi si spiega perché essa ha il mandato di assicurare la stabilità dei prezzi, di quali strumenti dispone a tal fine e quali sono le conseguenze del suo operato sulla nostra vita quotidiana.

Read More »

Read More »