Category Archive: 1.) English Posts on SNB

“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence.

Read More »

Read More »

Lecture Series (online): Prof. Dr. Niepelt – Digital Money and Central Bank Digital Currency

This lecture series is about “Digital Money and Central Bank Digital Currency” with Dr. Prof. Dirk Niepelt, Director of Study Centre Gerzensee, Foundation of the Swiss National Bank. Associate Professor University Bern. About Central banks already issue digital money, but only to a select group of financial institutions. Central bank digital currency would extend this …

Read More »

Read More »

“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives.

Read More »

Read More »

Switzerland Peps Up SMEs

How Switzerland peps up SMEs: Banks are encouraged to extend credit (at 0%). The treasury guarantees the loans. The SNB refinances banks and accepts the guaranteed loans as collateral. Fast and efficient. Eventually, some of these loans will turn into grants of course. But that’s ok; the first-best response to a shock with asymmetric effects does involve transfers if markets are incomplete.

Read More »

Read More »

Jim Bianco: “This Is One Of The Biggest Moments Of Truth In Financial Market History”

To contain the economic and financial ramifications of the coronavirus pandemic, Central Banks are going all in. Jim Bianco, founder and chief strategist of Bianco Research, warns that this time, monetary policy might be unable to stop financial markets from collapsing.

Read More »

Read More »

“ECB Is Worst-Run Central Bank In The World” – Felix Zulauf Sees 30percent Plunge In US Stocks “Taking The World With It”

Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond.

Read More »

Read More »

Central Banks Zoom In on CBDC

According to a BIS press release, several leading central banks collaborate with the BIS on matters relating to the introduction of CBDC: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency...

Read More »

Read More »

UBS Tumbles After Biggest Swiss Bank Misses Key Targets As Investors Pull Money

The rift between the US (where rates are still positive) and European banks (where rates have never been more negative) continues to grow. While US banks have so far reported mostly better than expected results for Q4, the same can not be said for Europe, where UBS shares are down 5% as the bank misses fiscal year profitability and cost targets in addition to trimming its mid-term goals.

Read More »

Read More »

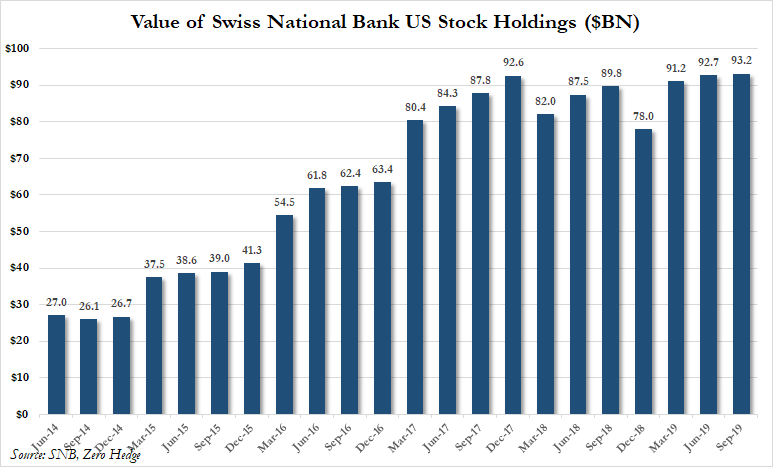

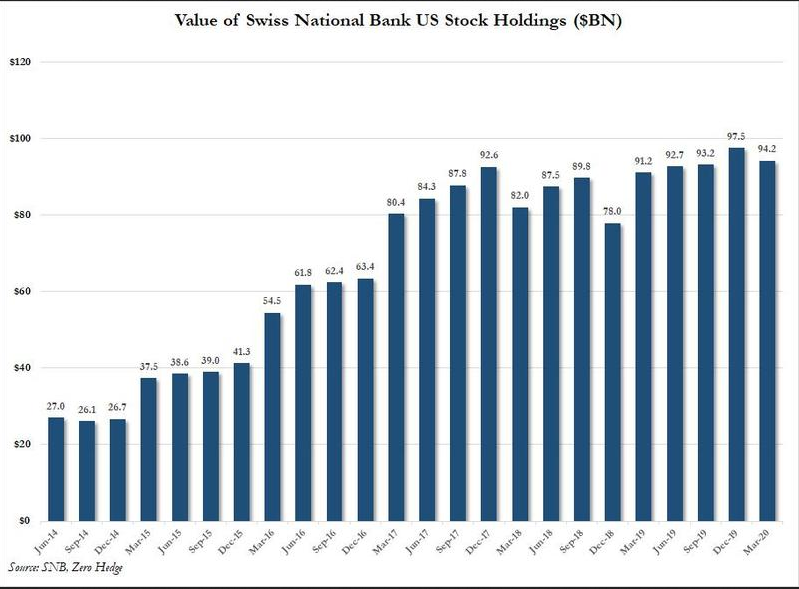

Swiss National Bank Now Owns Record $94 Billion In US Stocks After Q3 Buying Spree

In the third quarter of 2019, one in which the global economy continued to cycle lower, global central banks across the world continued to slash interest rates and launched/expanded quantitative easing programs with very little success at troughing global growth. Still, US equity indices powered to new highs, climbing a wall of worry of President Trump's "trade optimism" tweets.

Read More »

Read More »

UBS: “Negative interest rates harm Swiss economy”

A survey of Swiss companies commissioned by UBS bank concludes that negative interest rates are harming the wider economy. Switzerland’s largest bank, UBS, asked 2,500 companies about the impact of negative interest rates. “Nearly two-thirds of respondents said that the cost…for the economy outweighed their benefits overall,” UBS said in a press releaseexternal link on Thursday.

Read More »

Read More »

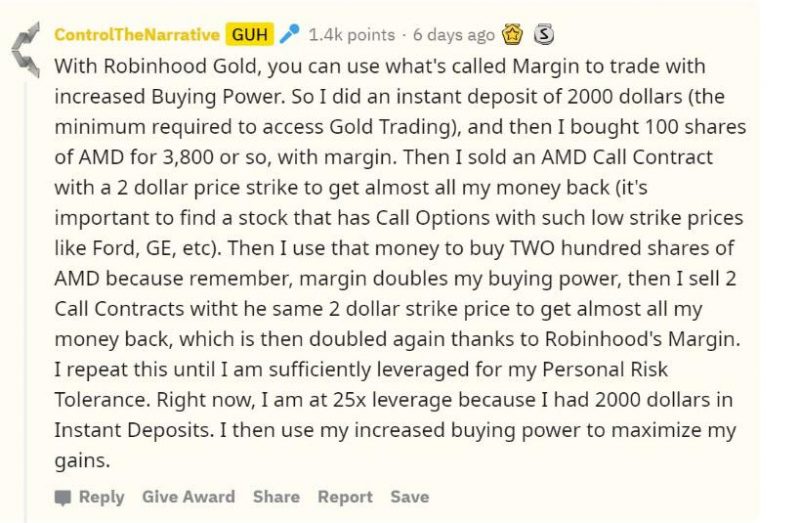

Robinhood’s “Infinite Money Cheat Code” Gives Traders Access To Unlimited Funds

If one is a central bank - such as the SNB and BOJ - life is easy: you just print as much money as you need out of thin air, and buy whatever you want, without regard for price. For those who are not central banks, having access to unlimited borrowed money may be the next best thing.

Read More »

Read More »

BIS Innovation Hub Centre in Switzerland

From the SNB’s press release regarding the newly established BIS Innovation Hub Centre in Switzerland: The Swiss Centre will initially conduct research on two projects. The first of these will examine the integration of digital central bank money into a distributed ledger technology infrastructure. This new form of digital central bank money would be aimed at facilitating the settlement of tokenised assets between financial institutions.

Read More »

Read More »

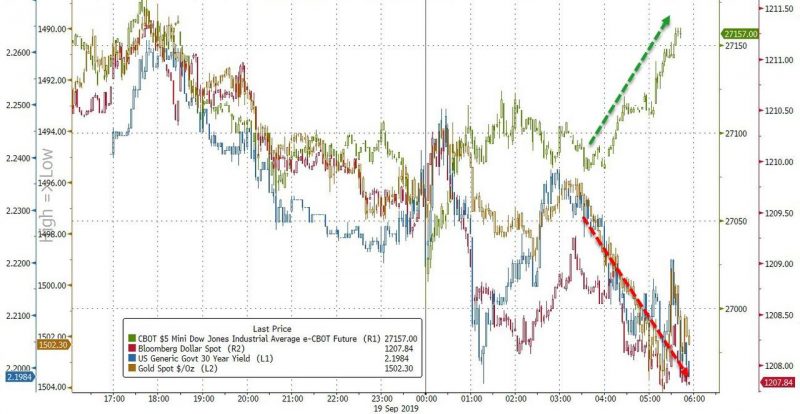

A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions.

Read More »

Read More »

Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews...

Read More »

Read More »

Future of Money Part 13 Dirk Niepelt

Public Versus Private Digital Money: Macroeconomic (ir)relevance, Dirk Niepelt is Director of the Study Center Gerzensee and Professor at the University of Bern. A research fellow at the Center for Economic Policy Research (CEPR, London), CESifo (Munich) research network member and member of the macroeconomic committee of the Verein für Socialpolitik, he served on the …

Read More »

Read More »

Towards A Globalist Utopia: “Negative Rates Are Coming, Whether You Like It Or Not”

There is nothing that a human mind can’t conceive. It can shoot for the stars or dive in the ocean which twinkles in the shadows of stars and ascend back with sparkling mind bearing uncanny ambition only to float contended. Today, we live in fear of losing wealth, we worry what economic consequences would do to our cash, we look through a microscope and scrutinize every word, every policy, every regulation or find something to put above ‘every’ and...

Read More »

Read More »

Rothschilds To Take Swiss Bank Private In 100 Million Francs Bid

Benjamin de Rothschild’s family plans to take Swiss Bank Edmond de Rothschild (Suisse) S.A. private as it consolidates and simplifies the bank's legal structure. According to Bloomberg, Edmond de Rothschild Holding SA will acquire all publicly held Edmond de Rothschild (Suisse) bearer shares at 17,945 francs per share, a 6.7% premium to Tuesday’s closing price, in a deal worth about $100 million.

Read More »

Read More »

SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it: "grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks.

Read More »

Read More »

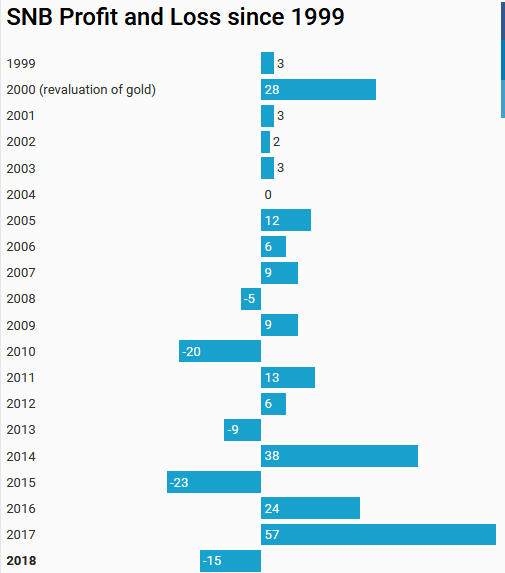

Provisional Results 2018: Will the SNB ever make profits again?

15 Billion Francs Losses in 2018. Given that the good years have finished: Will the SNB will ever make profits again? And compensate for the ever rising Swiss franc?

Read More »

Read More »