Click here to continue.

Read More »

Category Archive: 1.) English Posts on SNB

A Swiss central-banking scandal: Called to account

IT IS starting to look like a sustained attack. On January 4th an article in Die Weltwoche, a Swiss weekly magazine, accused Philipp Hildebrand, president of the Swiss National Bank (SNB), of personal currency speculation while the SNB was intervening to stabilise the Swiss franc/US dollar rate.

Read More »

Read More »

Expectations: Jedi monetary policy

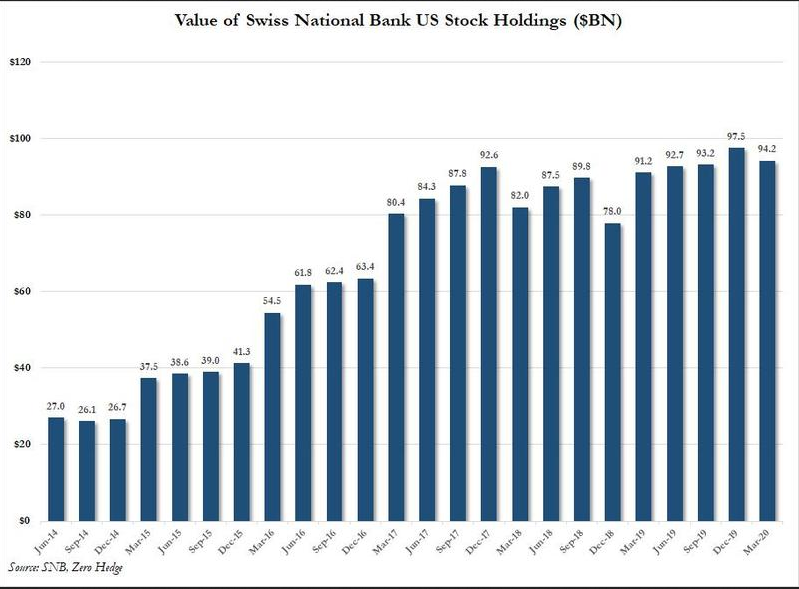

On Tuesday, the Swiss National Bank (SNB) adopted a bold policy of pledging to sell Swiss Francs in an unlimited amount to ensure that the exchange rate viz-a-viz the euro is at least 1.2 Swiss Francs per euro. The exchange rate promptly jumped over 8 percent to a bit more than 1.2 Swiss Francs per euro. The SNB can clearly weaken its currency in this way, so long as its commitment is unwavering.

Read More »

Read More »

Exchange-rate targets: Francly wrong

WHEN the going gets tough, the tough buy Swiss francs. That was true in the 1970s, when the Swiss were forced to impose negative interest rates on foreign depositors. And it has been true in recent years, with Switzerland's currency rising by 43% against the euro between the start of 2010 and mid-August this year.

Read More »

Read More »

Currency interventions: Francs for nothing

CENTRAL banks have historically been regarded as the guardians of a currency's value, but occasionally they want to drive their exchange rates down. Rarely have they acted as aggressively as the Swiss National Bank (SNB) did on September 6th.

Read More »

Read More »

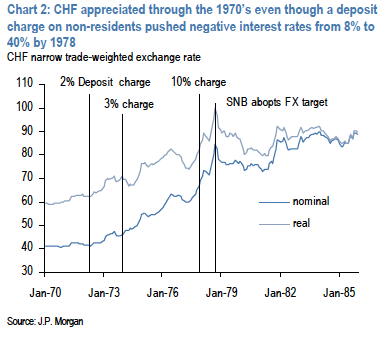

JP Morgan: Reflections on negative interest rates in Switzerland

Negative interest rates naturally attract attention given Switzerland’s use of these between 1972-1978.

Read More »

Read More »