Category Archive: 1) SNB and CHF

ICO – Le Linee GUIDA Ufficiali della FINMA Svizzera

ICO – Le Linee GUIDA Ufficiali della FINMA Svizzera Quante volte ti sei chiesto ?”COME fare una #ICO da ZERO?”? Nei #VIDEO precedenti puoi trovare i vari STEP MA in questo video ti chiarisco i ? PUNTI salienti della #GUIDA della #FINMA che puoi trovare nella versione integrale qui: https://goo.gl/pTcTnN Dopo aver ? VISTO il …

Read More »

Read More »

Favoritisme de la BNS: l’horlogerie suisse supplantée par Apple

La grande nouvelle du jour est que Apple aurait vendu plus de montrer dans le monde que toute l’horlogerie suisse réunie. Ces chiffres sont tout de même à relativiser fortement, car ils sont le fruit d’analyse de marché, diffusés par le CEO de Apple lui-même….En rouge, l’industrie horlogère suisse dans sa totalité face à Apple en bleu. Ainsi, selon ces chiffres, Apple aurait vendu 8 millions de montres contre 6,8 pour l’ensemble de l’industrie...

Read More »

Read More »

SNB-Jordan verkündet Kommunistisches – und lädt zum Gratis-Buffet

Es geht um die Sache und Institution – nicht um eine Person. Die Schweizerische Nationalbank (SNB) und ihr Chef Thomas Jordan sind aber mittlerweile dermassen eng miteinander verflochten, dass eine getrennte Beurteilung gar nicht mehr möglich ist. Thomas Jordan ist zum Gesicht der SNB und diese eine „One-Man-Show“ geworden.

Read More »

Read More »

Currency swap agreement between the Swiss National Bank and the Bank of Korea

The Swiss National Bank (SNB) and the Bank of Korea (BOK) will enter into a bilateral swap agreement. The agreement will be signed on 20 February 2018 in Zurich by the Chairman of the SNB Governing Board, Thomas Jordan, and the Governor of the BOK, Juyeol Lee. The swap agreement enables Korean won and Swiss francs to be purchased and repurchased between the two central banks, up to a limit of KRW 11.2 trillion, or CHF 10 billion.

Read More »

Read More »

Favoritisme délibéré ou perte de contrôle? La politique d’investissement chaotique de la Banque nationale suisse

Favoritisme délibéré ou perte de contrôle ? La politique d’investissement chaotique de la Banque nationale suisse. Je peux vous assurer que nos spécialistes en investissement connaissent parfaitement leur métier (Fritz Zurbrügg). La BNS n’a aucun spécialiste qui peut dire ‘il faut prendre le titre A plutôt que le titre B’ (Jean-Pierre Danthine). Nous décidons de nos placements avec le concours d’un prestataire externe.

Read More »

Read More »

When will the SNB start the process of policy normalisation?

When the Swiss National Bank (SNB) scrapped its currency floor three years ago, its monetary policy strategy was clear: to fight Swiss franc appreciation. It did so verbally, by calling the currency “significantly overvalued”, and physically, by implementing a negative interest rate and intervening in the foreign exchange market as necessary. Three years on, the interest rate on sight deposits at the SNB remains unchanged at a record low of -...

Read More »

Read More »

Budget busting burgers – Swiss franc still the most overvalued

The Economist has just published its January 2018 Big Mac index, a light-hearted measure of whether currencies are under or overvalued. The underlying assumption is that a Big Mac is the same whether bought in Kiev or Chur, so any price difference must be due to the exchange rate.

Read More »

Read More »

Thomas Jordan, SNB-Präsident, und Axel Weber, UBS-Präsident, im «ECO Talk»

10 Jahre nach der Finanzkrise: Können wir wieder Vertrauen haben? 2008 bebte die Weltwirtschaft – mit Folgen für Angestellte, für Unternehmen, für ganze Länder. Das Image von Banken hat beispiellos gelitten und hat die Akteure des Finanzsystems in die Öffentlichkeit rücken lassen. Wie agiert man, wenn Verantwortung und Misstrauen gleichermassen gross sind? Wie stellt man …

Read More »

Read More »

La BNS vend des euros et achète des dollars

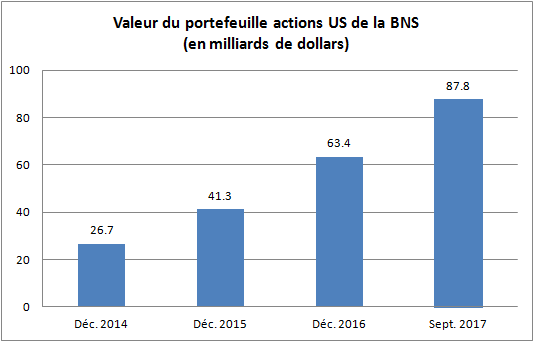

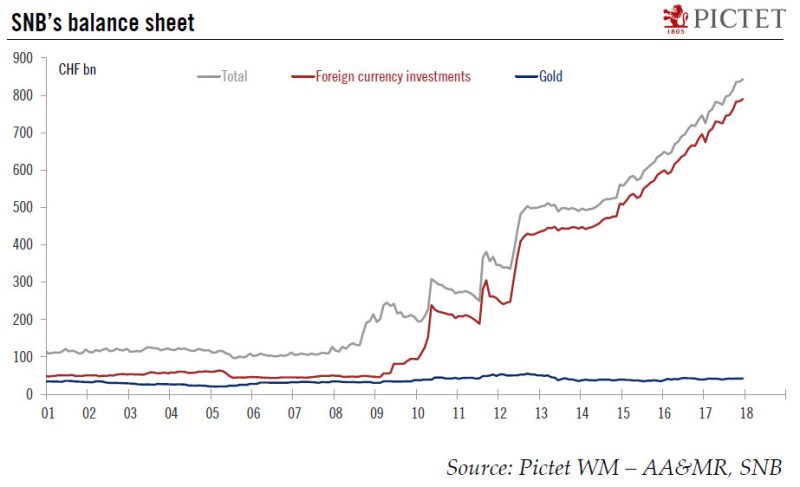

Entre la fin de l’année 2016 et la fin du 3ème trimestre 2017 (chiffres disponibles), les dirigeants de la BNS ont accru le volume des devises détenues par l’établissement de 65 milliards de francs environ. En 9 mois seulemen. Selon eux, ces investissements se justifient par le franc suisse qui serait trop fort face à l’euro. Et pour l’affaiblir, il faut acheter de l’euro, mécanisme qui expliquerait la croissance du bilan.

Read More »

Read More »

SNB Rejects Vollgeld and Questions ‘Reserves for All’

In the NZZ, Peter Fischer reports that SNB president Thomas Jordan rejects the Vollgeld initiative and stops short of endorsing the ‘reserves for all’ proposal.

Read More »

Read More »

Matías Salord: Trading USDCOP, USDMXN y USDCLP

Fecha de emisión: 03 agosto 2017. Ponente: Matías Salord. En esta sesión semanal, nuestro analista Matías Salord les hablará del panorama económico y del mercado de las principales divisas. SHARE AND SUBSCRIBE FOR MORE VIDEO– –Подпишись на канал– police fail / ДТП / cops crash / polizei unfall Street Race in Russia, Moscow [Уличные . … Continue reading »

Read More »

Read More »

Swiss franc could hit 1.22 by year end, according to economists

According to Le Matin, economists at Swiss Life think the rise of the Swiss franc could be over and predict it will weaken to 1.22 to the euro by the end of the year. At the same time they point to risks that could send the currency in the opposite direction, such as the election in Italy, Brexit negotiations and uncertainty surrounding government in Germany.

Read More »

Read More »

Dividendes de la BNS: le compte n’y est pas

La Banque nationale suisse s’attend à un bénéfice de 54 milliards de francs pour l’exercice 2017. Celui-ci résulte de: Un gain de 49 milliards de francs sur ses positions en monnaies étrangères. D’une plus-value de 3 milliards de francs sur l’or. D’un bénéfice de 2 milliards de francs sur ses positions en franc.

Read More »

Read More »

UBS-Präsident Axel Weber wird sein blaues Wunder erleben – mit der Zahlungsunfähigkeit der SNB

Axel Weber hat zwei Seelen in seiner Brust: eine als Ex-Notenbanker, eine als UBS-Präsident. Als Präsident der Deutschen Bundesbank hatte der Deutsche Weber gesagt, es gäbe keine Einlösungsverpflichtung der Deutschen Bundesbank für eine Banknote. „Wirtschaftlich gesehen sind unsere Banknoten eine Verbindlichkeit des Eurosystems.

Read More »

Read More »

Swiss National Bank expects annual profit of CHF 54 billion

According to provisional calculations, the Swiss National Bank (SNB) will report a profit in the order of CHF 54 billion for the 2017 financial year. The profit on foreign currency positions amounted to CHF 49 billion. A valuation gain of CHF 3 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to CHF 2 billion.

Read More »

Read More »

L’endettement des banques centrales est une réalité! Exemple de la BNS

Avant-propos: Le texte de la conférence de M Jordan de 2011 semble ne plus être disponible sur le net. Du coup, nous le publions ici malgré le Copyright. Ce genre de documents doit être connu du grand public, puisqu’il est le garant de cette institution privée (société anonyme cotée en bourse, soumise à une loi fédérale. L’actionnariat est réparti ainsi: https://www.snb.ch/fr/iabout/snb/org/id/snb_org_stock ), qu’est la BNS.

Read More »

Read More »

Die Magie des gesetzlichen Zahlungsmittels

Seit der Aufhebung der Golddeckung durch Präsident Nixon im Jahre 1971 sind die meisten Währungen der westlichen Welt reines Fiatgeld. Was heisst das? Zur Beantwortung der Frage beziehe ich mich ganz bewusst – wie übrigens soweit möglich im ganzen Text – auf keine Lehrbücher oder anderes universitäres Material. In Wikipedia (Stand 3.9.2017) steht:

Read More »

Read More »

Swiss National Bank buys paper factory for banknote production

To guarantee the smooth roll-out of its new banknote series, the Swiss National Bank (SNB) has bought a struggling paper factory in eastern Switzerland. The takeover of Landqart AG, valued at CHF21.5 million ($21.7 million), is split between the SNB (90%) and the security printing division of Swiss publisher Orell Füssli (10%).

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

Swiss National Bank acquires majority stake in Landqart AG

Yesterday, the Swiss National Bank (SNB) acquired 90% of the shares in Landqart AG. The remaining 10% of the share capital will be purchased by Orell Füssli Holding Ltd. The vendor is a subsidiary of Fortress Paper Ltd, which is listed on the Toronto stock exchange.

Read More »

Read More »