Category Archive: 1) SNB and CHF

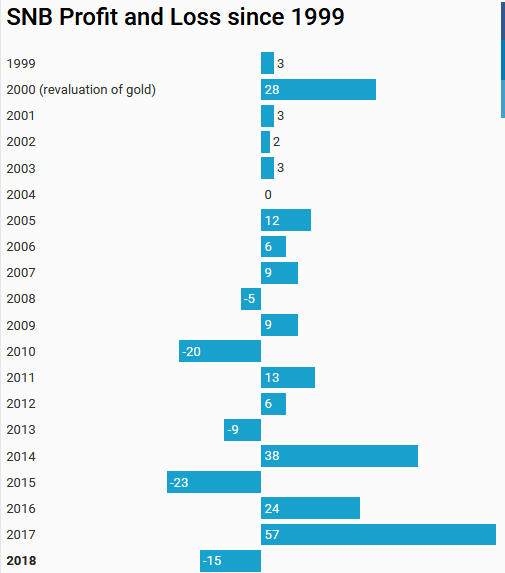

Provisional Results 2018: Will the SNB ever make profits again?

15 Billion Francs Losses in 2018. Given that the good years have finished: Will the SNB will ever make profits again? And compensate for the ever rising Swiss franc?

Read More »

Read More »

Swiss National Bank Suffers $15 Billion Loss On 2018 Market Rout

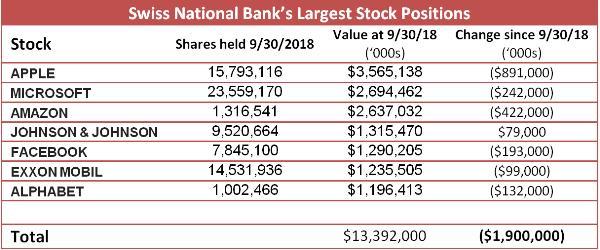

In the third quarter of 2018, the hedge fund known as the Swiss National Bank did something it had not done in years: it sold stocks. As we showed in November, the overall value of the SNB's US listed long holdings rose by over $2 billion to $90 billion, but all of this was due to the price appreciation as the central bank sold around $7bn of equities in Q3. This compares to purchases during 1H18 of around $6bn.

Read More »

Read More »

Brexit vote to dominate Pound to Swiss Franc exchange rates

Pound to Swiss Franc exchange rates. The value of the Pound against the Swiss Franc has remained in a fairly tight range since the start of the year. However, in the last couple of days the Pound has made some small gains after the Swiss National Bank confirmed that their currency reserves have dropped slightly.

Read More »

Read More »

GBP/CHF Forecast: Swiss Franc at Best Level against the Pound in over a year

Brexit uncertainty causes Swiss Franc to gain vs the Pound. The Pound is now trading at its lowest level to buy Swiss Francs in over twelve months as the political uncertainty surrounding the UK is continuing to negatively affect the value of Sterling exchange rates.

Read More »

Read More »

Police Warn of fake Swiss Franc Notes

Since the beginning of December 2018 more and more counterfeit 100 Swiss franc notes have been appearing in the Swiss canton of Valais in and around Sion and Conthey. The fake notes, which the local Police say can be spotted if compared to real ones, have been making their way into circulation via shopping centres, kiosks and service stations in the Sion and Conthey region.

Read More »

Read More »

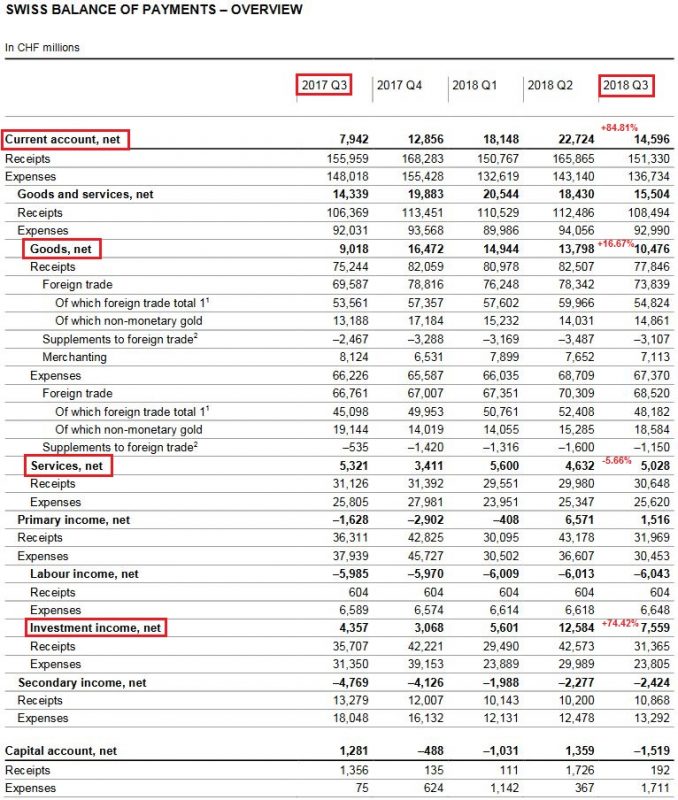

Swiss Balance of Payments and International Investment Position: Q3 2018

Current Account Key figures: Current Account: Up 85% against Q3/2017 to 14.6 bn. CHF of which Goods Trade Balance: Up 16.6% against Q3/2017 to 10.5 bn. of which the Services Balance: Minus 5.6% to 5.0 bn. of which Investment Income: Up 74.4% to 7.6 bn. CHF. Financial account Net acquisition of financial assets The … Continue reading »

Read More »

Read More »

SNB leave interest rates on hold, what next for GBP/CHF rates?

This morning the Swiss National Bank have left interest rates on hold at 0.75%, and market reaction between GBP/CHF has been limited. The Swiss Franc has rallied slightly against the US dollar and the Euro as forecasters were suggesting the SNB could cut interest rates further, however the events last night in the UK I believe outweighs the interest rate decision in Switzerland.

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 13.12.2018

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 13.12.2018

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas Jordan,...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 13.12.2018

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 13.12.2018 00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse – Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National …

Read More »

Read More »

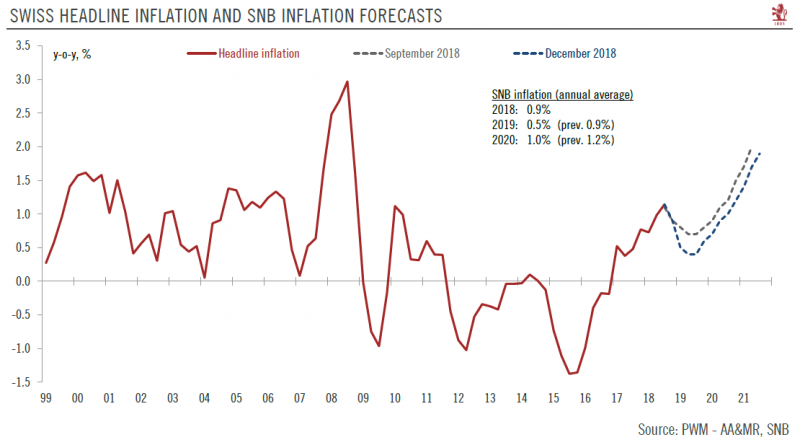

Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence.The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today.The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge.

Read More »

Read More »

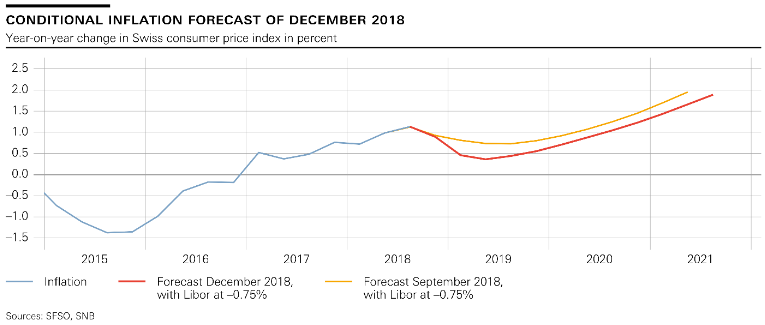

Monetary Policy Assessment of 13 December 2018

The Swiss National Bank (SNB) is maintaining its expansio nary mo netary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

The World’s Biggest Hedge Fund Is Getting Whacked, And Why “Moneyness” Matters

A few years ago the Swiss National Bank (SNB) - which traditionally held “monetary assets” like government bonds, cash and gold to back up the Swiss franc - decided to branch out into common stocks. This was a departure, but for a while a brilliant one.

Read More »

Read More »

BTC op jacht naar $4.400 + Positieve Nieuwe Zwitserse Crypto Regelgeving FINMA

BTC op jacht naar $4.400 + Positieve Nieuwe Zwitserse Crypto Regelgeving FINMA https://cryptoacademy.nl/

Read More »

Read More »

GBP/CHF Forecast: Brexit Uncertainty Ahead Causing Movement for GBP/CHF

In today’s GBP/CHF forecast we look at why the Pound has been coming under a huge amount of pressure recently against the Swiss Franc. Those that have been following the currency markets will be aware that the pressure on GBP is largely owing to the uncertainty caused by the ongoing Brexit talks.

Read More »

Read More »

Kaspar Uhlmann – FINMA

—————————————— Get in touch: https://goo.gl/forms/7zqfBX9ctwH8Nu4I2 —————————————— Cédric Bollag is an aspiring venture capitalist. Cédric decided to turn his passion about “Startups, Tech & Innovation” into a blog. He releases video interviews with entrepreneurs, investors and thought leaders in innovation. For any questions, suggestions and inquiries feel free to connect and reach out. Connect with me …

Read More »

Read More »

Further falls for GBP/CHF exchange rate

Over the last 4 weeks the pound has continued its decline against the Swiss Franc which is no surprise. Global events including Brexit, Italian debt problems and Trade wars are prompting investors to sell off their risky currencies and invest in safe havens such as the Swiss Franc.

Read More »

Read More »

Pound to Swiss Franc: CHF Strengthens Due to Events around the Globe

Brexit continues to put pressure on sterling and we are still waiting to find out if a vote of no confidence is called. The Prime Minister is in Brussels today meeting with Jean Claude Juncker. if the media get wind of any developments this could influence the Pound to Swiss Franc (GBP/CHF) rate, but in general the Pound remains under pressure which is helping the Franc to strengthen.

Read More »

Read More »

Swiss National Bank Unexpectedly Sold US Stocks In Q3, Dumping Over 1 Million Apple Shares

The SNB’s latest 13-F form filings (yes, the Swiss central bank lists its US equity holdings like the hedge fund that it is) to the SEC were released this week. And, like every other quarter, we take a closer look to see what stocks the world's only hedge fund central bank that prints money out of thin air bought, and on rare occasions, sold. This was one of those rare quarters.

Read More »

Read More »

Sterling hits highest buying level against Swiss Franc since August

The Pound has made good gains against the Swiss Franc over the course of November so far, hitting the highest level we have seen since August and smashing through the 1.30 level.

Sterling strength: Rumours of Brexit deal agreement lead to Sterling boost The main reasons behind the rise in value of Sterling is due to positive vibes surrounding Brexit.

Read More »

Read More »