Category Archive: 1) SNB and CHF

USD/CHF technical analysis: Greenback hits fresh October lows against the Swiss Franc

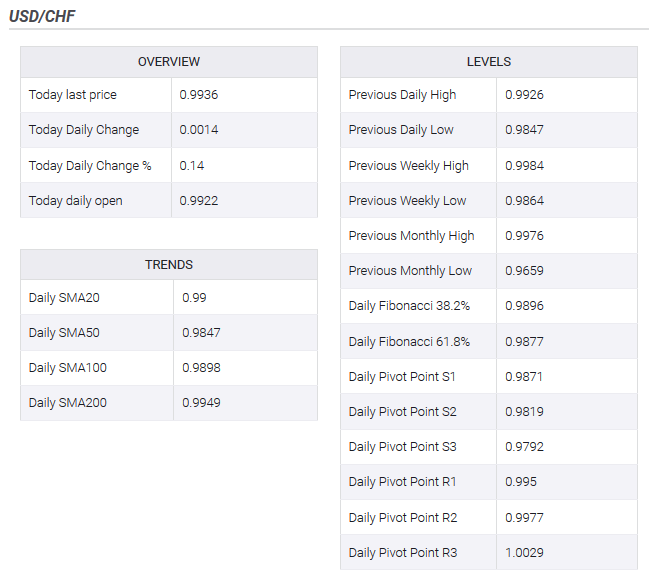

USD/CHF remains under heavy pressure after the London close. The level to beat for bears is the 0.9871 level. On the daily chart, USD/CHF is trading in a sideways trend, now challenging the 50 and 100-day simple moving averages (DSMAs) below the 0.9900 handle. the near term. Resistances can be seen at the 0.9881

Read More »

Read More »

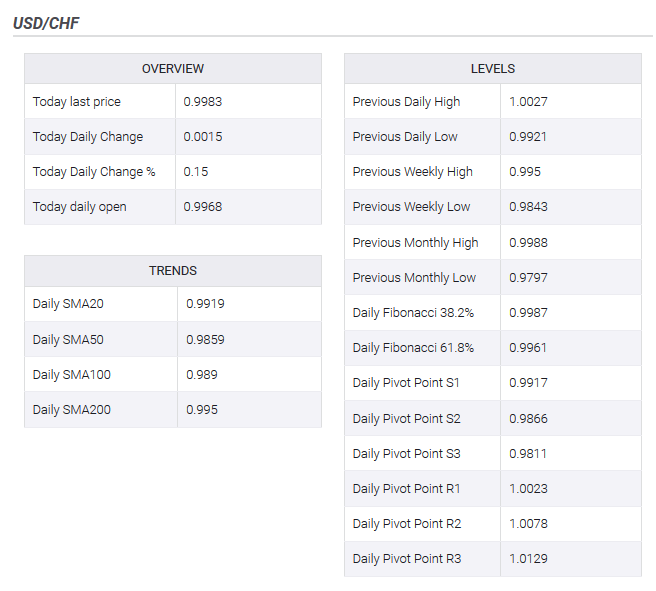

USD/CHF technical analysis: Breaks below 0.9940 confluence support, turns vulnerable

The pair remains under some selling pressure for the second straight session. The ongoing slide dragged it below a two-month-old ascending trend-channel. Bears might now aim towards challenging the 0.9900 round-figure mark. The USD/CHF pair extended this week's rejection slide from the vicinity of the key parity mark and remained under some selling pressure for the second consecutive session.

Read More »

Read More »

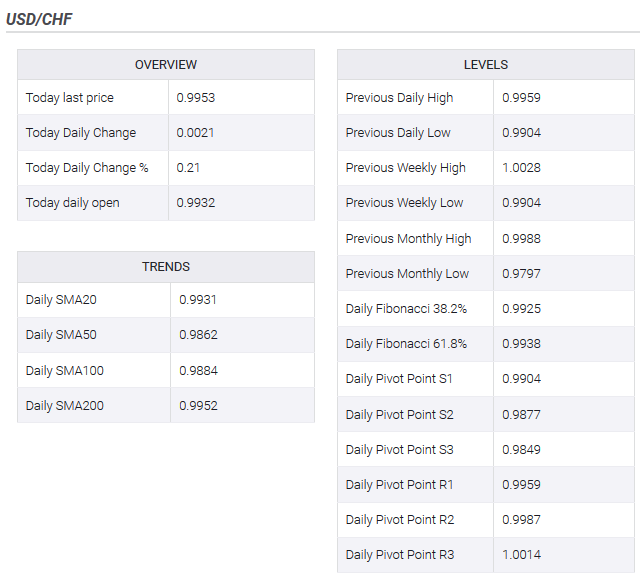

USD/CHF technical analysis: Intraday uptick falters just ahead of parity mark

Despite the intraday pullback, the pair has managed to hold above 200-DMA. The near-term technical set-up support prospects for some dip-buying interest. The USD/CHF pair failed to capitalize on its intraday positive move and faced rejection near the key parity mark, albeit has still managed to hold above the very important 200-day SMA.

Read More »

Read More »

Gefährliche Scheingewinne bei PKs

Die Schweizer Pensionskassen halten rund 30% ihrer Anlagen in klassischen Obligationen. Die meisten dieser Anleihen weisen eine negative Rendite aus. Dies, weil die Kurse so stark gestiegen sind, dass sich auf deren hohem Niveau trotz positivem Coupon (Nominalzins) eine Rendite auf Verfall von unter null ergibt. Das heisst, dass die erwarteten Kursverluste die Zinserträge übersteigen.

Read More »

Read More »

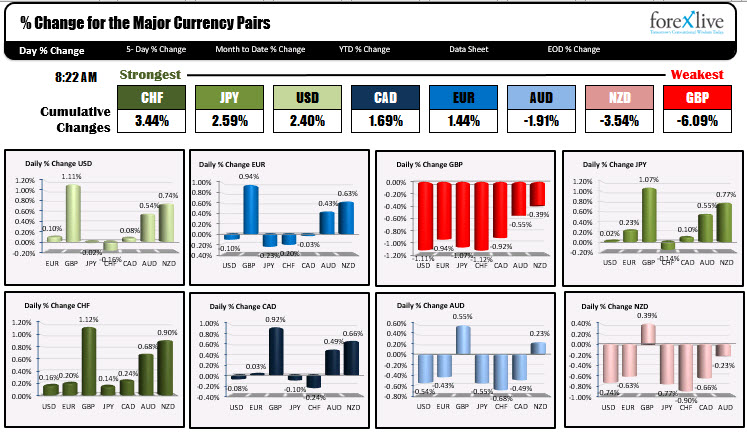

The CHF is the strongest, while the GBP is the weakest as NA traders enter for the day

Well...maybe some NA tradersThe US has a partial holiday with the bond market closed but the US stock markets open. Canada is off for Thanksgiving. So North American traders entering for the day, may be a little stretch today. However, the forex market is open. The CHF is the strongest as some of the euphoria from the events of last week (Brexit hope and China/US) fade and there is a flight into the safety of the CHF (and JPY).

Read More »

Read More »

USD/CHF technical analysis: Pivots around 200-day SMA, near mid-0.9900s

Continued with its struggle to extend the momentum beyond 200-DMA. Bears eye a decisive break below the ascending trend-channel support. Bulls are likely to await a sustained strength above the key parity mark. The USD/CHF pair failed to capitalize on last week's attempted rebound from a support marked by the lower end of a two-month-old ascending trend-channel and met with some fresh supply on Monday.

Read More »

Read More »

USD/CHF: Bulls have eyes on a break into the 1.000s in pursuit of channel resistance

USD/CHF has met a confluence of support as the US Dollar extends higher. Latest positioning data shows that CHF net shorts had been climbing for a third week. FOMC minutes at the top of the hour is next major risk. USD/CHF has met a confluence of support as the US Dollar extends higher on Wednesday ahead of the Federal Open Market Committee's Minutes today and US consumer Price Index tomorrow.

Read More »

Read More »

Nationalbank und SIX kooperieren bei digitalem Zentralbankgeld

Im Kontext des neu gegründeten BIZ-Innovation-Hub-Zentrum in der Schweiz kooperieren die SNB und SIX bei einer Machbarkeitsstudie für digitales Zentralbankgeld. (Bild: Pixabay)Die Schweizerische Nationalbank (SNB) und die Bank für Internationalen Zahlungsausgleich (BIZ) haben am Dienstag eine operative Vereinbarung zum BIZ-Innovation-Hub-Zentrum in der Schweiz unterzeichnet.

Read More »

Read More »

SNB and BIS sign Operational Agreement on BIS Innovation Hub Centre in Switzerland

The Swiss National Bank (SNB) and the Bank for International Settlements (BIS) have today signed an Operational Agreement on the BIS Innovation Hub Centre in Switzerland. The Hub will identify and develop in-depth insights into critical trends in technology affecting central banking, develop public goods in the technology space geared towards improving the functioning of the global financial system, and serve as a focal point for a network of...

Read More »

Read More »

BIS Innovation Hub Centre in Switzerland

From the SNB’s press release regarding the newly established BIS Innovation Hub Centre in Switzerland: The Swiss Centre will initially conduct research on two projects. The first of these will examine the integration of digital central bank money into a distributed ledger technology infrastructure. This new form of digital central bank money would be aimed at facilitating the settlement of tokenised assets between financial institutions.

Read More »

Read More »

SNB to cut rates in early 2020 as global economy sours – UBS

In the latest note to the clients, the UBS Economist Alessandro Bee indicated that he sees the Swiss National Bank (SNB) cutting interest rates next year. “Both the European Central Bank and the Federal Reserve to “react to recession risks” with more rate cuts.

Read More »

Read More »

AUD/CHF Technical Analysis: Bears seeking a break to channel bottoms, below 61.8 percent Fibo

Bulls target risk back to the top of the channel and recent highs of 0.6750. Bears seek a break of trendline support and a resumption of the downside within the bearish channel. AUD/CHF has been resilient against the odds, considering the risk-off tone in markets were otherwise, the CHF usually performs.

Read More »

Read More »

USD/CHF capped again by 1.0025, retreats below parity

Swiss Franc flat versus US Dollar, down against its European rivals. Another weak economic report from the US keeps the Greenback and markets under pressure. The USD/CHF pair again was capped by the 1.0025/30 area and pulled back. Near the end of the session it is hovering around 0.9980/85 after falling to 0.9950.

Read More »

Read More »

USD/CHF technical analysis: Bulls trying to defend multi-week old ascending trend-channel

Fading safe-haven demand undermined the CHF demand and extended some support. Bears await a sustained weakness below short-term ascending channel support. The USD/CHF pair struggled to register any meaningful recovery and remained well within the striking distance of near three-week lows set in the previous session, coinciding with the lower end of a multi-week-old ascending trend-channel.

Read More »

Read More »

USD/CHF consolidates gains above 0.9900, limited by 0.9950

US Dollar rises versus Swiss Franc for the second-day in-a-row. USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930.

Read More »

Read More »

Fourth Karl Brunner Distinguished Lecture, 19.09.2019

00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich

04:05 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank

17:05 Lecture by Raghuram Rajan, University of Chicago, Former Governor of the Reserve Bank of India

Read More »

Read More »

Fourth Karl Brunner Distinguished Lecture, 19.09.2019

00:00 Introductory remarks by Ulrich Weidmann, Vice President for Human Resources and Infrastructure, ETH Zurich 04:05 Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank 17:05 Lecture by Raghuram Rajan, University of Chicago, Former Governor of the Reserve Bank of India

Read More »

Read More »

The SNB Is a Passive Clearing House Rather Than an Active Currency Manipulator

This post is a long excursion to make two simple points: The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate. A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a.

Read More »

Read More »

CHF: Possible reversal? – Deutsche Bank

Deutsche bank analysts suggest that at current spot levels, risk-reward favours longs in EUR/CHF. “While Brexit and trade war outcomes look like coin tosses, the impact is likely to be asymmetric as the SNB caps the left tail. While a relief rally would be fully accommodated, they would likely intervene heavily and cut the policy rate in the event of no deal.”

Read More »

Read More »

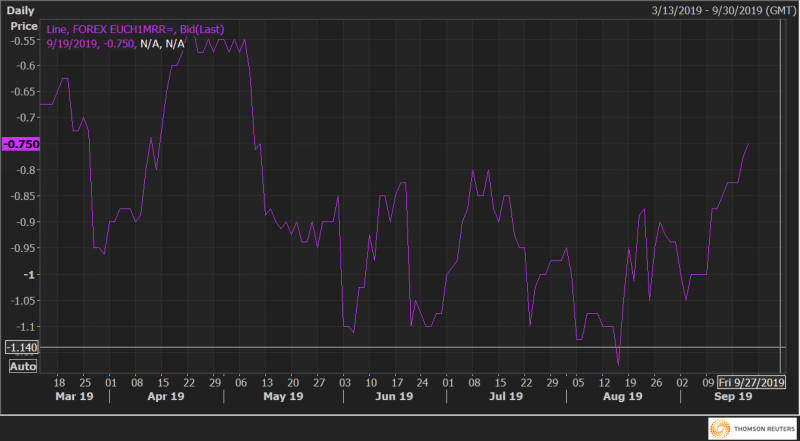

EUR/CHF risk reversals hit highest since May on call demand

EUR/CHF risk reversals have jumped to the levels last seen in May. Risk reversals indicate the demand for call options is rising. Risk reversals on EUR/CHF (EURCHF1MRR), a gauge of calls to put, jumped to the highest level since May on Friday, indicating the investors are adding bets to position for a rally in the common currency.

Read More »

Read More »

-637068826263809659-800x353.png)

-637067377269597535-800x353.png)

-637066508442585331-800x353.png)

-637049959004970218-800x353.png)