Category Archive: 1) SNB and CHF

EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

Read More »

Read More »

Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews...

Read More »

Read More »

100-franc note enters circulation today

SNB banknote app with information on all new denominations. Issuance of the new 100-franc note presented a week ago begins today, 12 September. The complete version of the Swiss National Bank’s ‘Swiss Banknotes’ app is now also available. It has been updated to include the 100-franc note and features information on all six new denominations.

Read More »

Read More »

CHF is ‘not strong in real terms’ – no need for SNB intervention

A note from Standard Chartered on the Swiss National Bank and the Swiss franc. The SNB monetary policy meeting is next week, September 19.In brief, Stan Chart argue the franc is not strong in real termsadjusting EUR/CHF for inflation leaves CHF around 10% weaker than (non-adjusted) current spotno need for SNB to intervene to try to weaken ittherefore the SNB is not likely to cut rates at their meeting, nor intervene in forex markets in the near...

Read More »

Read More »

Negativzinsen – Resultat des chaotischen SNB-Konzepts

Nach der Freigabe der Wechselkurse zu Beginn der 1970er Jahre bestand das geldpolitische Konzept der SNB in sogenannten „Geldmengenzielen“. Es wurde für das kommende Jahr ein Geldmengenziel angestrebt in der Meinung, so die Inflation unter Kontrolle zu halten. Trotzdem: Die Inflation hüpfte damals aufgrund der Angebotsschocks nach Belieben rauf und runter und die SNB schaute konsterniert zu.

Read More »

Read More »

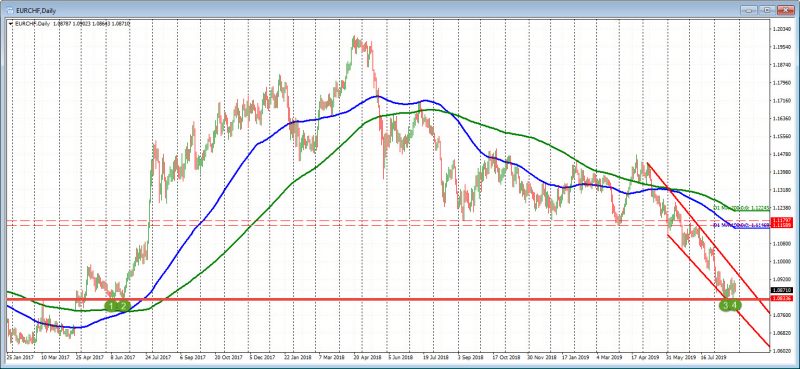

EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank - a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed.

Read More »

Read More »

SNB Jordan: Cannot say how long negative interest rates will last

SNBs Jordan on the wiresThe Swiss national banks Jordan is on the wires saying:He cannot say how long negative interest rates will lastNegative rates are necessary for nowInterest rate spreads like important role for exchange ratesThe USDCHF is trading higher today. It currently trades at 0.9861.

Read More »

Read More »

New 100 Swiss Franc Note Coming Soon

The note’s design is inspired by Switzerland’s tradition of humanitarianism, represented on the note by water. The note remains blue but is much smaller than the existing one, making it easier to fit into wallets.

Read More »

Read More »

Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten "eher den Charakter von spekulativen Anlageinstrumenten als von 'gutem' Geld", sagte der SNB-Präsident in einer Rede an der Universität Basel.

Read More »

Read More »

USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support.

Read More »

Read More »

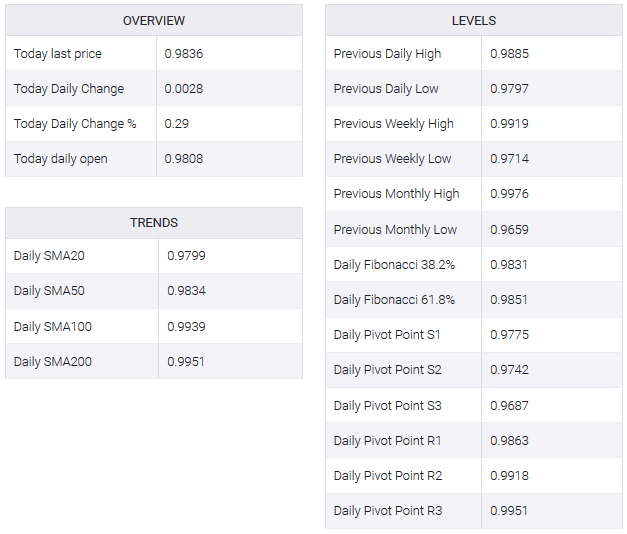

USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

Extends overnight retracement slide from an ascending trend-channel resistance. A follow-through selling has the potential to drag the pair towards channel support. The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session.

Read More »

Read More »

Swiss National Bank Presents New 100-Franc Note

The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals.

Read More »

Read More »

SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety. EUR/CHF is already trading close to the lows of the year. The Swiss National Bank's Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits - plenty of jawboning going on here.

Read More »

Read More »

More SNB Maechler: Right now we still have plenty of room for forex intervention

Right now is still plenty of room for forex intervention. As to negative rates are working, SNB's Maechler says "absolutely". Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall.

Read More »

Read More »

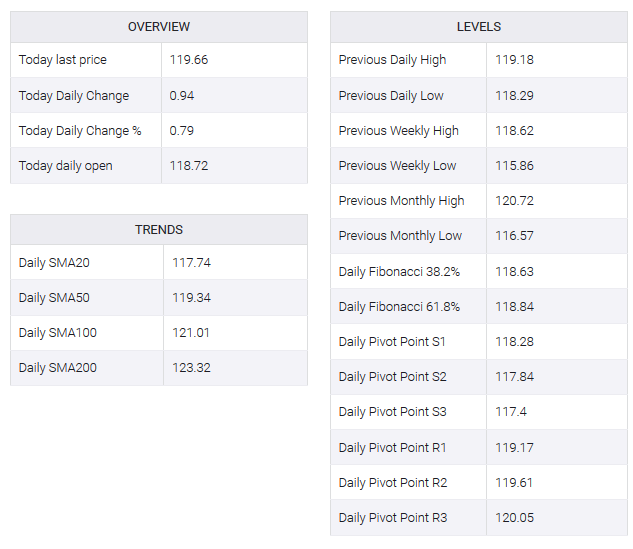

USD/CHF technical analysis: Manages to hold above 0.9800 handle, 200-hour SMA

The USD/CHF pair struggled to sustain above 61.8% Fibo. level of the 0.9879-0.9714 recent slump and seems to have stalled this week's recovery move from the 0.9700 neighbourhood. The intraday downtick remained cushioned near the 0.9800 handle, which coincides with 100/200-hour SMA confluence region and should act as a key pivotal point for intraday traders.

Read More »

Read More »

USD/CHF: Value of CHF calls hits highest since March 2018

Risk reversals on Swiss Franc (CHF1MRR), a gauge of calls to puts, dropped to the lowest level in 17-months, indicating the investors are adding bets to position for a rise in the Swiss currency. The USD/CHF one-month 25 delta risk reversals fell to -1.41 – a level last seen in March 2018.

Read More »

Read More »

Die Nationalbank riskiert Ärger mit Donald Trump

Die Deviseninterventionen der Schweizerischen Nationalbank sorgen für Spannungen. Die Schweiz läuft Gefahr, von den USA als Währungsmanipulatorin gebrandmarkt zu werden. (K)ein Grund zur Sorge?

In den vergangenen Wochen hat die Schweizerische Nationalbank (SNB) wiederholt am Devisenmarkt interveniert, um den Franken davor zu bewahren, noch stärker gegen die wichtigsten Handelswährungen wie Euro und Dollar zu steigen.

Read More »

Read More »

Philipp Hildebrands Coup: Gratisgeld für EU-Bürger

Vergangene Woche stellte Philipp Hildebrand, der frühere Präsident des Direktoriums der Schweizerischen Nationalbank (SNB), nun Vize-Präsident von Blackrock, auf Bloomberg ein Positionspapier vor.

Read More »

Read More »

SNB sicher&solvent? Ja, meint Bern, und verweist auf Fussnote von Fussnote

Der Bundesrat behauptet, es bestehe bei der SNB kein Solvenz-Risiko. Er begründet das in seiner Botschaft an das Parlament mit einer Fussnote zu einer anderen Fussnote, die es in einer Festschrift so gar nicht gibt. Das ist liederliche Arbeit in Bundesbern; und das zu einem Thema, das staatspolitisch von grösster Tragweite ist.

Read More »

Read More »

Nationalbank unter Interventionsdruck

Der Schweizer Franken wurde zuletzt deutlich stärker gegenüber dem Euro. (Bild: Pixeljoy/Shutterstock.com)Die Zinssenkunkung der US-Notenbank Fed und die von der EZB angekündigten Massnahmen zur Lockerung der Geldpolitik sowie die jüngsten Ereignisse im Handelskonflikt zwischen den USA und China haben den Druck auf den Franken erhöht. Die Schweizer Währung wurde zuletzt deutlich stärker.

Read More »

Read More »

-637031895419073883-800x353.png)

-637025933982178300-800x353.png)