Category Archive: 1) SNB and CHF

2020 IMF Michel Camdessus Central Banking Lecture with Thomas Jordan, 14.07.2020

Referat Thomas Jordan - Conférence de Thomas Jordan - Speech by Thomas Jordan - Discorso di Thomas Jordan, "Small country - big challenges: Switzerland's monetary policy response to the coronavirus pandemic", 2020 IMF Michel Camdessus Central Banking Lecture, 14.07.2020

00:00 Introductory remarks by Tobias Adrian, Financial Counsellor and Director of the Monetary and Capital Markets Department, IMF

01:35 Introductory remarks by...

Read More »

Read More »

Mediengespräch – Conférence de presse – News conference – Conferenza stampa, 18.06.2020

Mediengespräch - Conférence de presse - News conference - Conferenza stampa, 18.06.2020

00:00 Einleitende Bemerkungen von Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Thomas Jordan, président de la Direction générale de la Banque nationale suisse - Introductory remarks by Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive di Thomas...

Read More »

Read More »

Umsetzung FIDLEG/FINIG: FINMA bewilligt erste Aufsichtsorganisationen

Die Eidgenössische Finanzmarktaufsicht FINMA erteilt OSIF und OSFIN die ersten Bewilligungen als Aufsichtsorganisationen, zuständig für die Aufsicht über Vermögensverwalter und Trustees. Weiter liess sie die erste Registrierungsstelle für Kundenberaterinnen und Kundenberater zu. Das Eidgenössische Finanzdepartement anerkannte ausserdem die ersten Ombudsstellen nach FIDLEG für Finanzdienstleister.

Read More »

Read More »

Willkommen in einer Zukunft ohne Zins

Die SNB, die EZB und andere Zentralbanken erwarten auch langfristig keine Zinswende – und machen Nullzinsen zur Regel. Eine Übersicht der Prognosen. Diese Woche ist die Welt einer Zukunft ohne positive Zinssätze ein Stückchen näher gerückt. Schwedens Notenbank erneuerte ihren Zinspfad.

Read More »

Read More »

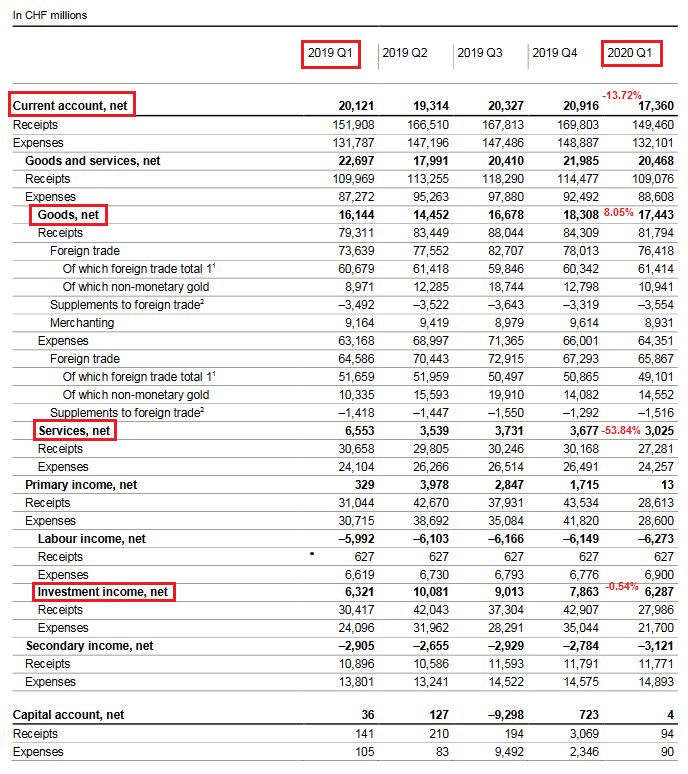

Swiss Balance of Payments and International Investment Position: Q1 2020

Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF.

Read More »

Read More »

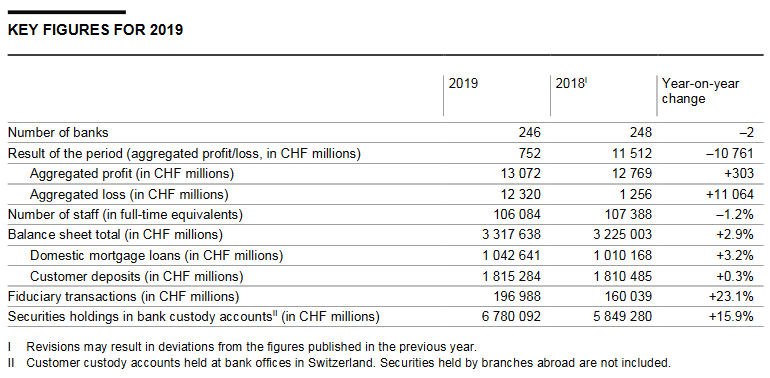

Banks in Switzerland 2019

The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics. The most important figures are summarised below.

Read More »

Read More »

Omkar Godbole (Market Reporter, Coindesk) | The Road to Metamorphosis Blockchain Summit by Octaloop

More details about the summit: https://www.octaloop.com/events/theroadtometamorphosis/

Our past and future events: https://www.octaloop.com/events/

Read More »

Read More »

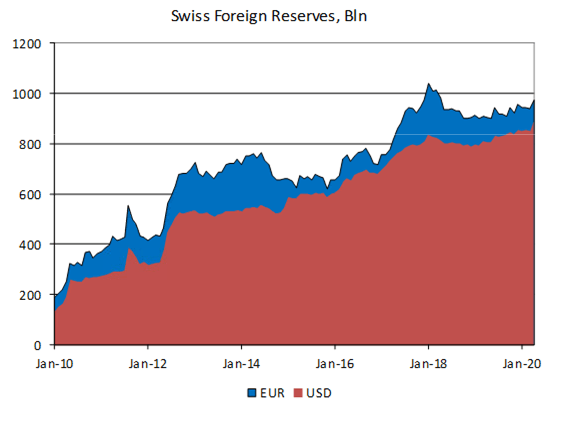

Swiss National Bank forecasts deflation until 2022

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market.

Read More »

Read More »

SNB Monetary Policy Assessment June 2020 and Videos

The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland.

Read More »

Read More »

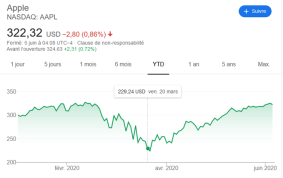

SNB Preview

The Swiss National Bank meets Thursday. It is widely expected to maintain its current policy stances but is likely to push back against CHF strength. Here, we highlight here the potential choices that lie ahead for the SNB.

Read More »

Read More »

Lecture Series (online): Prof. Dr. Niepelt – Digital Money and Central Bank Digital Currency

This lecture series is about “Digital Money and Central Bank Digital Currency” with Dr. Prof. Dirk Niepelt, Director of Study Centre Gerzensee, Foundation of the Swiss National Bank. Associate Professor University Bern. About Central banks already issue digital money, but only to a select group of financial institutions. Central bank digital currency would extend this …

Read More »

Read More »

Que fait une banque centrale pour soutenir l’économie locale par temps de confinement? La BNS au menu

Voici une vidéo tournée par Christian Campiche lors d’une rencontre matinale autour d’un café. Christian s’est mis à enregistrer alors que nous parlions de ce que la BNS faisait, et surtout ne faisait pas, pour soutenir la population suisse dans cette période de post-confinement.

Read More »

Read More »

“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives.

Read More »

Read More »

Zilliqa ZIL DeFi; Digibyte Announces Partnership; Crypto Bank Approved by FINMA

The Cryptoviser on YouTube.

Daily Cryptocurrency, Blockchain, Investing and Finance News and Discussions.

*************

Want to help support The Cryptoviser, there are 3 ways:

1. CashApp me directly $TheCryptoviser

2. JOIN CHANNEL MEMBERSHIP - by clicking the Join Button (or www.youtube.com/channel/UCq41LOyktVBW_CaVi2WKKXw/join)

3. Become a PATREON Member - www.patreon.com/TheCryptoviser

*************

Join COINBASE using my code,...

Read More »

Read More »

Swiss central bank could take negative rates lower

The rate on deposits at the Swiss National Bank (SNB) is currently -0.75%. And while taking the rate further into negative territory is not the base case scenario, it cannot be excluded, according to some economists at the bank UBS.

Read More »

Read More »

FINMA-Aufsichtsmitteilung 06/2020: Verlängerung oder Auslaufen von Erleichterungen infolge der COVID-19-Krise

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht eine weitere Aufsichtsmitteilung im Kontext der COVID-19-Krise. Sie passt darin die Fristen von diversen, bereits erteilten Erleichterungen an und präzisiert die Berechnung der Finanzierungsquote NSFR.

Read More »

Read More »

Why is the Pound to Euro Rate Falling? Will it Continue?

U.K jobless claims were released in early morning trading today, much like many economic data releases the figures were posted at an earlier than usual 07:00, we normally would see a release such as this out at 09:30. The figures, as expected were not particularly great reading for the U.K economy however there was a slight surprise in the fact that the official unemployment rate came in at 3.9% as opposed to the 4.3% which had been expected.

Read More »

Read More »

Announcement regarding recall of banknotes from eighth series

The issuance of the ninth banknote series was concluded on 12 September 2019. The Swiss National Bank intends to communicate the statutory recall of the banknotes from the eighth series two months in advance in the first half of 2021.

Read More »

Read More »

Questions That Need Answering [feat. Jonathan Watson]

Guest Worship Leaders Austin and Lindsey Adamec from Jacksonville,FL. Jonathan Watson from Charleston Southern University helps us to understand The Trinity.

With THE BLOC Online you can join us every Thursday for 7pm!

—

Follow Austin and Lindsey Adamec:

https://www.youtube.com/channel/UCIHRWN8MV6uzP9yaLURmRDg

Subscribe to our channel to see more messages from THE BLOC:

https://www.youtube.com/channel/UCVEI...

Follow us on Instagram:...

Read More »

Read More »