Category Archive: 9a.) Real Investment Advice

1-6-24 Santa Was a No-Show

We're baaack from our Winter Break, and it seemed as if Santa arrived on Christmas Eve, pushing the markets back above the important 50-DMA. However, by the end of the year, it seemed investors were naughty this year and received a “lump of coal,“ with markets selling off back toward recent lows. One important note was that momentum and relative strength remained weak, keeping selling pressure intact. There is no way to sugarcoat the market’s poor...

Read More »

Read More »

Identifying a Good Financial Advisor: Key Tips and Red Flags

Don't settle for a financial advisor pushing products like annuities to solve all your problems. Look for someone who focuses on holistic financial management. #finance #advice

Watch the entire show here: https://cstu.io/d2a0ff

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Corporate Executives Are Bullish And Bearish

Corporate executives are sending vastly different messages to their respective investors. Based on one indicator, they must be pretty bearish, yet another reeks of bullishness. Let's take a look at corporate executives' Jekyll and Hyde-like behavior and try to make some sense of their actions and what they might portend for their companies. As we …

Read More »

Read More »

1-5-24 Pre-show Test Feed

New live shows return on Monday, January 6, 2025 with RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned in this report:

"2024 Review – Another 20% Year. What’s Next?"

https://realinvestmentadvice.com/resources/newsletter/

-------

The latest installment of our new feature, Before the Bell, "The Fed is Never Right," is here:...

Read More »

Read More »

Why You Might Need a Financial Advisor For More Than Investing

Managing money is just one part of what we do here at RA Advisors. Let's break the misconception about financial advisor meetings! #FinanceTips

Watch the entire show here: https://cstu.io/c349a7

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Stark Reality of Emergency Savings: How Many Americans Struggle

Let's talk savings and financial security. Social Security is a reliable option without leakage. Invest in yourself wisely! ?? #FinancialLiteracy

Watch the entire show here: https://cstu.io/333f14

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

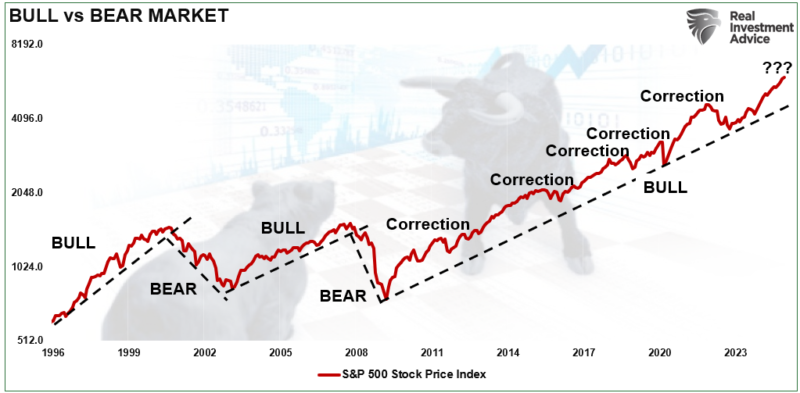

2024 Review – Another 20% Year. What’s Next?

Inside This Week's Bull Bear Report Last Chance For Early Bird Registration Since New Year's fell in the middle of the week, I am extending the "Early Bird Discount" for our upcoming RIA 2025 Economic Summit through Sunday for our weekly newsletter readers. Don't miss the opportunity to get your tickets for the 2025 Economic …

Read More »

Read More »

How to Master Buy Low and Sell High Strategy in Investments

Buy low, sell high! ? Don't follow the crowd, invest when others aren't. That's the key to success in investing! #InvestingTips #FinancialAdvice

Watch the entire show here: https://cstu.io/82c278

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Is A Breadth Rotation In Order?

The percentage of S&P 500 stocks outperforming the index on a rolling 21-day period fell below 15% late last year. That aligns with the record low set last July. Needless to say, the market's breadth is historically horrendous. Last July, after months of significant outperformance by the mega-cap stocks, the poor market breadth corrected quickly. …

Read More »

Read More »

The Rules Of Bob Farrell – An Updated Illustrated Guide

In a recent discussion on TheRealInvestmentShow, Bob Farrell and his 10 investment rules were discussed, which elicited several email questions asking, "Who is Bob Farrell, and where are these rules?". I often forget how old I have become, and the investing legends of my youth are no longer there and are lost to the sands of time. …

Read More »

Read More »

The Importance of Regular Portfolio Rebalancing

Investing is not a "set it and forget it" endeavor. Over time, changes in market conditions can shift the balance of your portfolio, causing it to stray from your intended asset allocation. Regular portfolio rebalancing is a crucial step to ensure your investments align with your financial goals and risk tolerance. This article explores the …

Read More »

Read More »

How CFOs Manufacture Earnings and the Impact on Wall Street Estimates

Are company revenues telling the whole story? CFOs admit to manufacturing earnings to meet Wall Street estimates. Dive deeper into the economy with us! ? #EarningsManipulation #WallStreetInsights

Watch the entire show here: https://cstu.io/1a8cc6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Back To Back 20 Percent Gains: What’s Next?

While 20% gains in the S&P 500 are not uncommon, as circled below, back-to-back 20% gains have only occurred three times since 1950. The most recent back to back 20%+ gain was 2023 and 2024. Accordingly, given the rare performance of the last two years, lets look back and see what history teaches us. The … Continue reading...

Read More »

Read More »

Understanding Taxable vs. Non-Taxable Benefits: Key Insights from a Financial Advisor

? Understanding the tax implications of benefits can be tricky! Remember, it all depends on how it's paid for. Stay informed! ? #taxes #benefits

Watch the entire show here: https://cstu.io/fd173c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Mastering Stop Loss Strategies to Avoid Mistakes and Protect Investments

Stop losses can be frustrating for investors! Giving a little room below the moving average may help avoid getting tripped out too soon. ?? #InvestingTips

Watch the entire show here: https://cstu.io/27058f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Scenarios For 2025

Over the past couple of weeks and into the next few weeks, you will likely be inundated with economic forecasts and stock market scenarios for 2025.

Read More »

Read More »

The Overlap Trap: Risks of Having Multiple Financial Advisors

Diversification myth debunked! Having multiple advisors doesn't mean you're diversified. It could lead to overlap risk and concentrated positions. ? #InvestingTips #RiskManagement

Watch the entire show here: https://cstu.io/fa2fb9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

A Complete Guide to Investment Strategies for Building Wealth

Building wealth through investing requires a clear understanding of foundational principles and a disciplined approach to asset allocation. Whether you’re new to investing or looking to refine your strategy, this guide explores key investment strategies for wealth creation, offering insights on diversification, risk tolerance, and how to build a portfolio that aligns with your goals. …

Read More »

Read More »

Google’s New Quantum Chip is Out of This World

AI machine learning receives most of the publicity concerning today’s technological advancements, but the potential in quantum computing is just as exciting, if not more so. There’s a fundamental difference between quantum computing and AI. Artificial intelligence utilizes classical binary computing, where information is processed in bits, which can either be in an on or …

Read More »

Read More »

How Government Spending Affects Corporate Profitability and Market Risks

Government spending impacts economics & markets. With overbought markets & high speculation, there's a higher risk ahead. Stay informed! ?? #Economics #MarketInsights

Watch the entire show here: https://cstu.io/aaf1b6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »