Category Archive: 9a.) Real Investment Advice

2-14-25 What If You Live to 100?

Healthy living accounts for about 70% of longevity until one’s 90s, after which favorable genetics dominate, concludes a long-running study. Richard Rosso & Matt Doyle examine the financial implications of becoming a Centenarian: Retirement Planning for 100-Year Life, How to Retire and Live to 100, and the implications of Longevity and Financial Planning; also Investing for a Long Retirement and Outliving Your Savings Solutions.

Hosted by RIA...

Read More »

Read More »

The Impact Of Tariffs Is Not As Bearish As Predicted

There are many media-driven narratives about the impact of tariffs on the economy and the markets. Most of them are incredibly bearish, predicting the absolute worst possible outcomes. For fun, I asked ChatGPT what the expected impact of Trump's tariffs will likely be. Here is the answer: "One of the immediate consequences of increased tariffs …

Read More »

Read More »

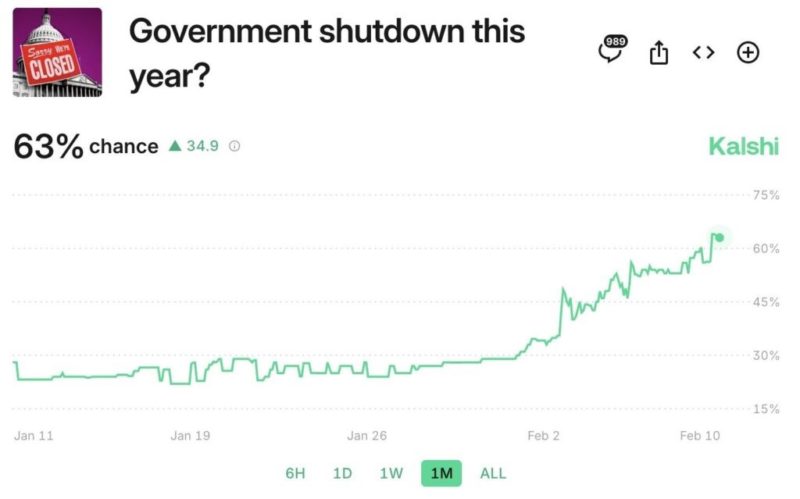

The Fiscal Freeze Is Coming

In mid-March, the government is expected to hit the debt ceiling. As has seemingly become the norm, dire threats from both political parties will start shortly. However, despite the fiery rhetoric, they often get resolved before the government shuts down. Might the coming fiscal standoff be a little different? Our colleague Greg Valliere, a long-time …

Read More »

Read More »

Fed’s Mortgage Strategy: Rates Cut But Markets React Differently

Fed cutting rates, but still doing quantitative tightening. Selling bonds increases yields. Will they expand balance sheet to bring rates down? ? #economics #Fed #interestrates

Watch the entire show here: https://cstu.io/455712

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Market Reactions to Rate Changes Are Influenced by Misleading Data

Small changes in economic numbers can have a big impact on the market! ?? #Stocks #Bonds #Economy #MarketReactions

Watch the entire show here: https://cstu.io/4d4e5d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Growth and Valuation Techniques in Investment Analysis

? Growth is key! ? Don't just focus on past valuations, look ahead! Some companies, like the Magnificent Seven, show consistent growth rates. #InvestingTips #GrowthIsKey

Watch the entire show here: https://cstu.io/bceba5

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Bond Strength During Market Volatility

Bonds shining during market volatility! ?? #InvestingTips #Bonds #MarketInsights

Watch the entire show here: https://cstu.io/0afee0

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-13-25 Inflation on the Rise: What Does it Mean?

Lance's Valentine's Day PSA (the short version) & Jerome Powell's annual Congressional testimony: Everything is volatile; headline generator. Cracks in the economy are emerging: Jobs numbers are full of "seasonal adjustments:" Indicators that employment and Labor Market are weakening. The impact of hot CPI: Markets hold support and price compression; in a wait-and-see mode. Trump reciprocal tariffs coming. Lance & Michael discuss...

Read More »

Read More »

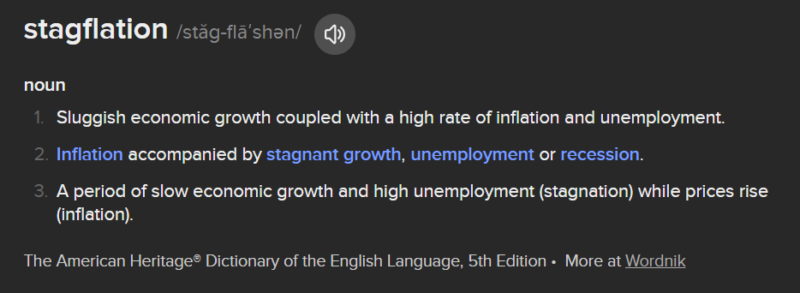

CPI Rose More Than Expected

The January CPI report was troubling as it rose more than expected. The monthly rate rose by 0.5%, about 0.2% above expectations. The core monthly rate was a tenth of a percent above expectations, at 0.4%. The year-over-year CPI rate rose to 3% from 2.9%. The latest CPI data argues inflation is stuck in a … Continue reading »

Read More »

Read More »

The Definitive Guide to Managing Risk in Your Investment Portfolio

Managing risk is one of the most critical aspects of successful investing. While all investments carry some degree of risk, effective investment portfolio risk management can help you preserve wealth, achieve financial goals, and weather market fluctuations. Understanding and employing strategies such as diversification, asset allocation, and hedging can significantly reduce your exposure to potential …

Read More »

Read More »

2-12-25 Lance’s Valentine’s Day Advice

Men, the clock is ticking, and Friday is Valentine's Day.

Lance and Danny issue our annual public service announcement for the betterment of relationships (and pocketbooks).

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

REGISTER FOR OUR NEXT CANDID COFFEE (3/29/25) HERE:

https://streamyard.com/watch/Gy68mipYram2

-------...

Read More »

Read More »

educing Stock Position: A Strategy for Managing Concentrated Holdings

? Planning is key! Just like we plan for retirement and finances, having a strategy for reducing your stock position is crucial. #FinancialTips ?

Watch the entire show here: https://cstu.io/7ae172

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-12-25 CPI Day

Today's market activity will hing upon this morning's CPI Print (which showed consumer prices rising higher than expected). WEven more telling will be tomorrow's PPI numbers showing input costs. The question to be answered by investors is what the trend of inflation is, and what the Fed will do next. Will companies be able to pass along higher costs to consumers? What is driving inflation? Oil price increases are a short-term indicator, but have a...

Read More »

Read More »

Truflation Data Points To A Coming Decline In CPI

The graphs below, courtesy of Truflation, are very telling. The Truflation US Inflation Index uses over 30 million data points to assess price changes and, as a result, provide a robust forecast for the BLS CPI number. Moreover, their data have proven to be an incredibly accurate forecasting tool. As we share in the graph …

Read More »

Read More »

Growth And Value Are Not Mutually Exclusive

Might Nvidia and Tesla, with price-to-earnings ratios (P/E) nearly double and quadruple that of the S&P 500, respectively, be value stocks? Conversely, is it possible that Ford is not a value stock despite a P/E of 10, a price-to-sales ratio (P/S) of .20, and a 7.5% dividend yield? Based solely on that information, answering the …

Read More »

Read More »

Mastering 401k Contributions and Traditional IRA Funding Techniques

?? Super savers, here’s a key financial tip! ?? Always track where your contributions are coming from—whether it’s your paycheck, bonuses, or other sources. Smart saving starts with smart planning! #FinancialWisdom #SavingsGoals

Watch the entire show here: https://cstu.io/6e70ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

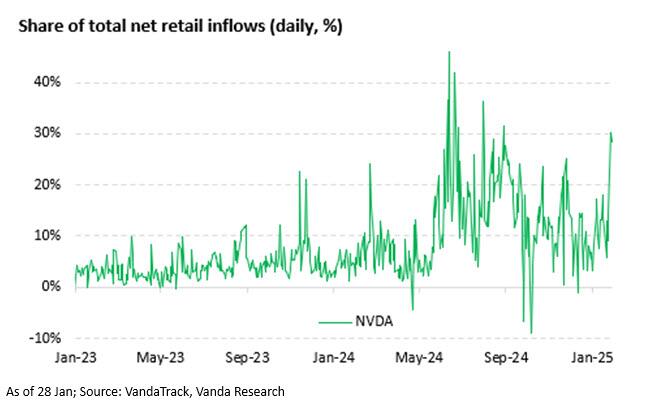

2-11-25 FOMO is Alive & Well

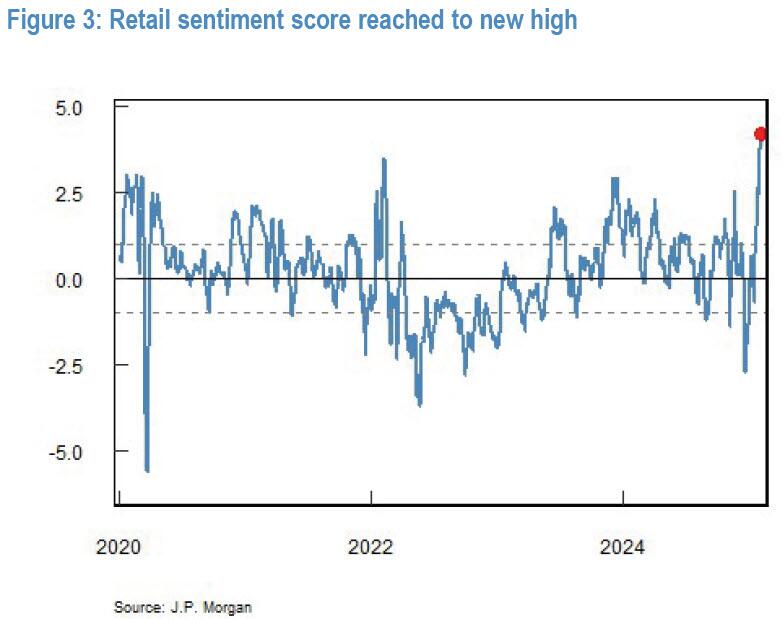

Markets are coming to grips with that Trump Tariffs really mean, and are adapting through sector rotations. Lance & Jonathan discuss the prices of eggs & milk and grocery dates. The market defies more negative news because retail investors continue to step in and “buy the dip.” Retail sentiment is quite remarkable. Since the pandemic, retail investors have never been this bullish on the stock market. Such is amazing, given that their...

Read More »

Read More »

Ethereum Falters Due To Massive Short Positions

If one weren't paying attention to the cryptocurrency market, one would think that all cryptocurrencies were doing well. For instance, meme coins are all the rage, and Bitcoin has been up about 50% since the election. Donald Trump and his pro-crypto rhetoric help explain the rally. Moreover, Trump has nominated pro-crypto people to serve important …

Read More »

Read More »

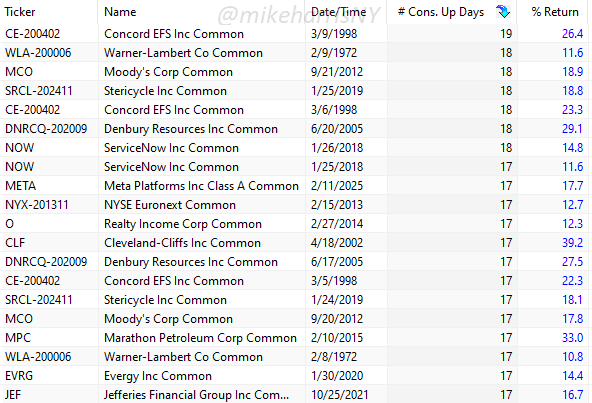

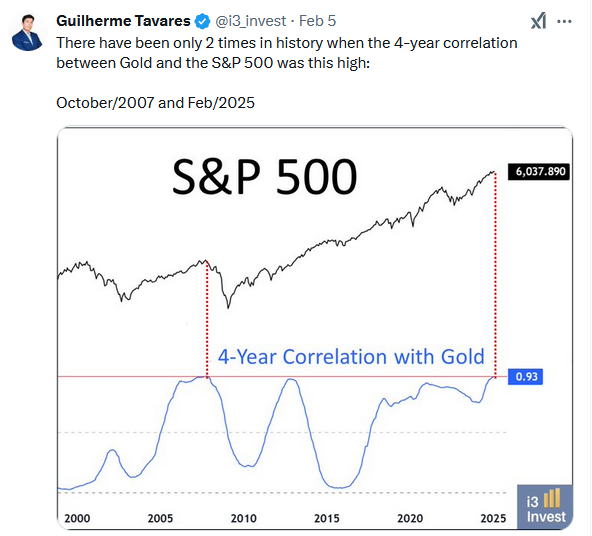

Bull Bear Report – Technical Update

I could not produce our weekly Bull Bear Report this past weekend as I presented at Michael Campbell's Moneytalks Conference in Vancouver. However, I wanted to use today's technical update to review some of the statistical analysis we produce each week in that commentary. Such is mainly the case given last Monday's "tariff" shock and …

Read More »

Read More »

Strategies to Maximize 401k and IRA Savings for Super Savers

Check out this important financial tip for super savers! ?? Make sure you're aware of where your contributions are coming from. #FinancialAdvice #SavingsTips

Watch the entire show here: https://cstu.io/3fc979

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »