Category Archive: 9a.) Real Investment Advice

3-17-25 Recession Fears Emerge

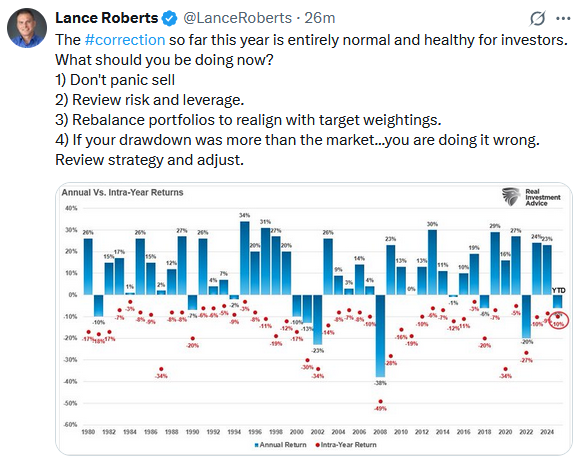

Markets last week ripped through one of the fastest 10% corrections ever; that's what happens when markets are over bought. Media headlines whip investors into a frenzy with Recession talk, ignoring the fact that in order for a moving average to remain the average, markets must ebb and flow, above and below, in order to provide the average. The Government is shedding non-essential employees (which begs the question of why they were hired in the...

Read More »

Read More »

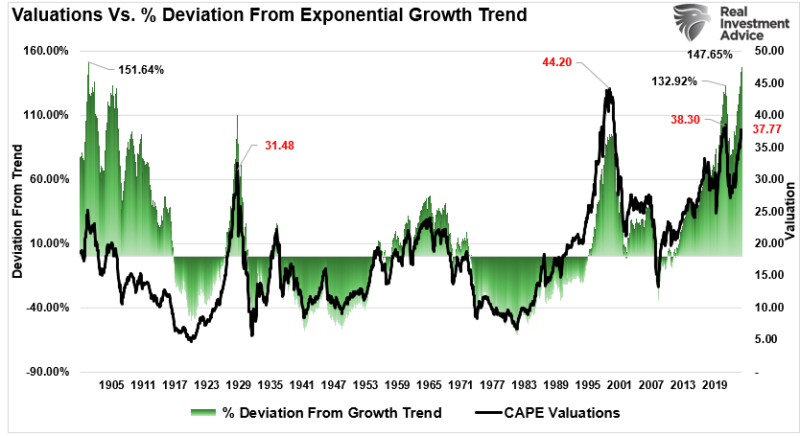

Investors Dismiss Fundamentals: Valuations Hold Little Weight in Modern Markets

Valuations haven't mattered. Fundamentals don't matter much due to the Momo chase. A whole generation of investors haven't seen this before. ? #Investing

Watch the entire show here: https://cstu.io/054b76

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How to Avoid Common Retirement Planning Mistakes That Could Cost You Thousands

Planning for retirement requires careful preparation and smart financial decisions. However, many retirees make critical errors that can drain their savings, reduce their income, and leave them financially vulnerable. Avoiding financial pitfalls is essential to ensuring a comfortable and stress-free retirement. Here’s a look at some of the most common retirement planning mistakes and how …

Read More »

Read More »

Orange Juice And Egg Prices Provide Welcome Relief

As we have mentioned numerous times, consumer sentiment greatly impacts economic activity. Accordingly, the price activity of particular goods can have an outsized influence on consumer inflation views. For example, orange juice and egg prices have been leading some consumers to have flashbacks of the recent high inflation. Based on the recent price trends of …

Read More »

Read More »

Understanding How Valuations Impact Future Returns in Investments

Unpredictable market returns explained! ?? It's a rollercoaster - 10% up, 20% down, then back up! Who knows what the future holds? ? #investing101

Watch the entire show here: https://cstu.io/d25fe1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Market Downturns: What Shrinkage Reveals About Hidden Investment Mistakes

? Market insights: Don't rely on a bull market to cover mistakes. Plan your portfolio wisely for long-term success! ?? #InvestingTips #Finance

Watch the entire show here: https://cstu.io/38a112

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Sell Off Accelerates As Recession Fears Emerge

Inside This Week's Bull Bear Report Market Volatility Spikes Last week, we discussed that the market continues to track Trump's first Presidential term as he launched a trade war with China. "However, despite the deep levels of negativity, the current correction is well within the context of the volatility seen during Trump's first term as …

Read More »

Read More »

The Rotation To Value From Growth: What Comes Next?

In hindsight, markets are easy to assess, yet extremely challenging to forecast. For example, as we will show, it's undeniable that value, particularly large-cap value stocks, have been in vogue during the recent decline, while growth is being kicked to the curb. This rotation from growth to value is an example of how investors rotate …

Read More »

Read More »

Stupidity And The 5-Laws Not To Follow

Human stupidity is the one thing you can rely on in financial markets. I recently read a great piece by Joe Wiggins at Behavioral Investment, which discusses why "Investing is hard." The entire article is worth reading, but here are the five key reasons investors often fail at investing: These are great points, particularly now that …

Read More »

Read More »

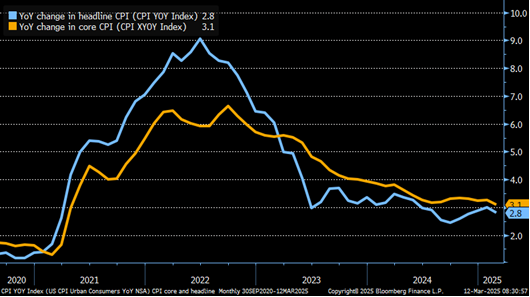

CPI Is Cooler Than Expected

Following a hot January CPI set of inflation data, the BLS CPI report cooled down in February. Headline CPI rose +0.2% versus +0.3% consensus and +0.5% in January. Core CPI was also +0.2% for the month. The year-over-year headline and core rates fell 0.2% from last month's figures to 2.8% and 3.1%. The 3.1% core … Continue reading »

Read More »

Read More »

The Importance of Asset Allocation in Building a Resilient Investment Portfolio

A well-structured asset allocation strategy is the foundation of a resilient investment portfolio. It determines how your investments are distributed across different asset classes, balancing risk and return to align with your financial goals. Proper asset allocation can help you navigate market fluctuations, protect wealth, and optimize long-term performance. In this article, we’ll explore the …

Read More »

Read More »

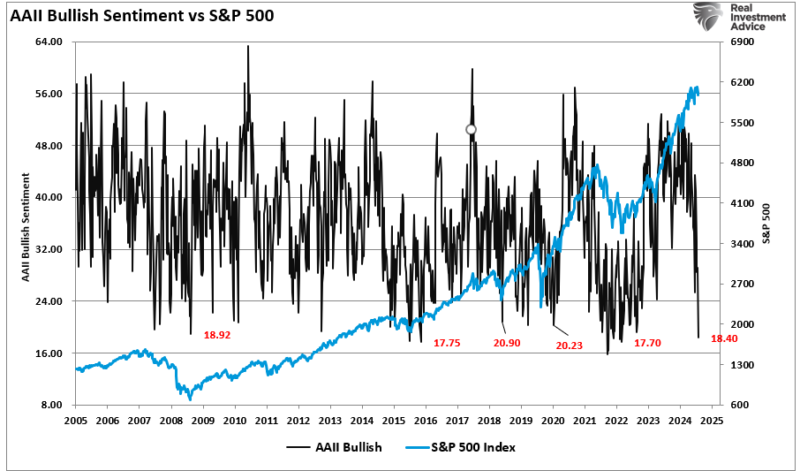

Buy The Dip Or Sell The Rip?

The rally over the last two years has helped investors forget that markets also go down. After two +20% consecutive years, a sudden 8% drop from recent highs has investors panicking. Bear in mind, no pun intended, that the S&P 500 is only down 4% for 2025. Consider the graph below. It shows that the … Continue reading »

Read More »

Read More »

Tokenization: The New Frontier For Capital Markets

There is tremendous value in the world of crypto! Given some of our recent opinions (linked below), you probably did not expect to hear those words from us. Digital tokenization of assets, made possible by the crypto-blockchain construct, can boost efficiency in the capital markets, thus greasing the wheels that drive the economy. Our …

Read More »

Read More »

Knowing When to Hold or Fold in Modern Financial Markets

Know when to hold, when to fold ? Important in trading and life! #KennyRogers #FinancialMarkets #InvestWisely

Watch the entire show here: https://cstu.io/8b9d2e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

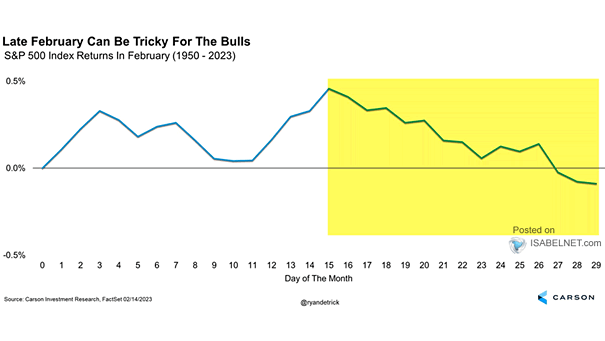

CFNAI Index Suggests Economy Is Slowing

Inside This Week's Bull Bear Report February Weakness And The Outlook For March Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. Over the previous week, the market fell sharply following news of a potential viral outbreak in China and more concerns about tariffs from the …

Read More »

Read More »

CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull …

Read More »

Read More »

Retail Investors Are Suddenly Bearish

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this …

Read More »

Read More »

Understanding Required Minimum Distributions (RMDs) and Their Tax Implications

Required Minimum Distributions (RMDs) are an essential part of managing your retirement accounts and income in retirement. While they provide a way to access your savings, RMDs can have significant tax implications if not handled properly. Understanding how RMDs work, which accounts they affect, and strategies to minimize their tax impact can help you optimize …

Read More »

Read More »

2-27-25 Nvidia beats. What now?

Earnings season is all but done after last night's Q4 Report from Nvidia, which beat estimates, but did not inspire markets. The next dynamic to affect markets will be the closing of the buy back window ahead of Q2 Earnings reporting season. Investor behavior and market psychology is as bearish as ever. We're now seeing risk-off rotation; Lance revisits the effective use of stop-loss settings, and the importance of allowing market activity to...

Read More »

Read More »

Understanding the Value of Guaranteed Income for Peace of Mind

Calculating average income & inflation rates is key. Having a guaranteed income brings comfort beyond just the numbers. Peace of mind is priceless ?✨ #FinanceTips

Watch the entire show here: https://cstu.io/9ff1b6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »