Category Archive: 9a.) Real Investment Advice

Understanding Market Downturns: What Shrinkage Reveals About Hidden Investment Mistakes

? Market insights: Don't rely on a bull market to cover mistakes. Plan your portfolio wisely for long-term success! ?? #InvestingTips #Finance

Watch the entire show here: https://cstu.io/38a112

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Sell Off Accelerates As Recession Fears Emerge

Inside This Week's Bull Bear Report Market Volatility Spikes Last week, we discussed that the market continues to track Trump's first Presidential term as he launched a trade war with China. "However, despite the deep levels of negativity, the current correction is well within the context of the volatility seen during Trump's first term as …

Read More »

Read More »

The Rotation To Value From Growth: What Comes Next?

In hindsight, markets are easy to assess, yet extremely challenging to forecast. For example, as we will show, it's undeniable that value, particularly large-cap value stocks, have been in vogue during the recent decline, while growth is being kicked to the curb. This rotation from growth to value is an example of how investors rotate …

Read More »

Read More »

Stupidity And The 5-Laws Not To Follow

Human stupidity is the one thing you can rely on in financial markets. I recently read a great piece by Joe Wiggins at Behavioral Investment, which discusses why "Investing is hard." The entire article is worth reading, but here are the five key reasons investors often fail at investing: These are great points, particularly now that …

Read More »

Read More »

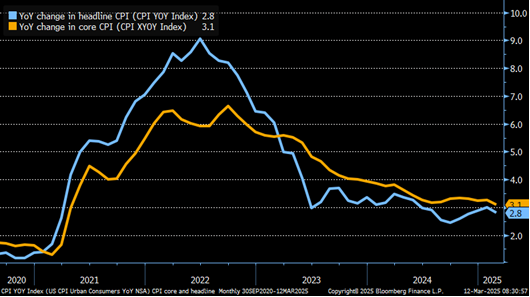

CPI Is Cooler Than Expected

Following a hot January CPI set of inflation data, the BLS CPI report cooled down in February. Headline CPI rose +0.2% versus +0.3% consensus and +0.5% in January. Core CPI was also +0.2% for the month. The year-over-year headline and core rates fell 0.2% from last month's figures to 2.8% and 3.1%. The 3.1% core … Continue reading »

Read More »

Read More »

The Importance of Asset Allocation in Building a Resilient Investment Portfolio

A well-structured asset allocation strategy is the foundation of a resilient investment portfolio. It determines how your investments are distributed across different asset classes, balancing risk and return to align with your financial goals. Proper asset allocation can help you navigate market fluctuations, protect wealth, and optimize long-term performance. In this article, we’ll explore the …

Read More »

Read More »

Buy The Dip Or Sell The Rip?

The rally over the last two years has helped investors forget that markets also go down. After two +20% consecutive years, a sudden 8% drop from recent highs has investors panicking. Bear in mind, no pun intended, that the S&P 500 is only down 4% for 2025. Consider the graph below. It shows that the … Continue reading »

Read More »

Read More »

Tokenization: The New Frontier For Capital Markets

There is tremendous value in the world of crypto! Given some of our recent opinions (linked below), you probably did not expect to hear those words from us. Digital tokenization of assets, made possible by the crypto-blockchain construct, can boost efficiency in the capital markets, thus greasing the wheels that drive the economy. Our …

Read More »

Read More »

Knowing When to Hold or Fold in Modern Financial Markets

Know when to hold, when to fold ? Important in trading and life! #KennyRogers #FinancialMarkets #InvestWisely

Watch the entire show here: https://cstu.io/8b9d2e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

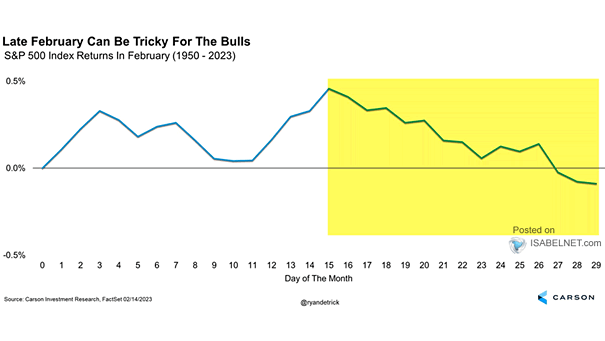

CFNAI Index Suggests Economy Is Slowing

Inside This Week's Bull Bear Report February Weakness And The Outlook For March Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. Over the previous week, the market fell sharply following news of a potential viral outbreak in China and more concerns about tariffs from the …

Read More »

Read More »

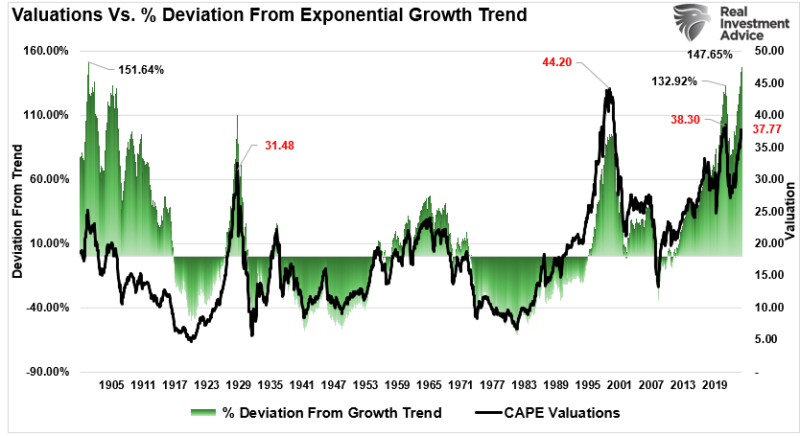

CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull …

Read More »

Read More »

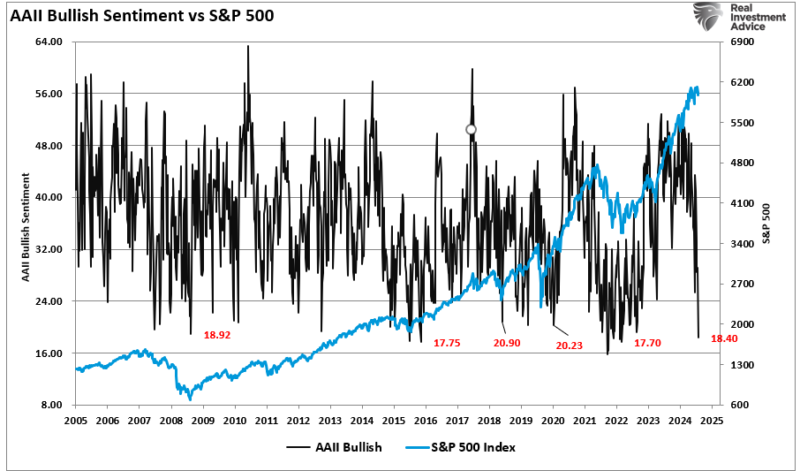

Retail Investors Are Suddenly Bearish

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this …

Read More »

Read More »

Understanding Required Minimum Distributions (RMDs) and Their Tax Implications

Required Minimum Distributions (RMDs) are an essential part of managing your retirement accounts and income in retirement. While they provide a way to access your savings, RMDs can have significant tax implications if not handled properly. Understanding how RMDs work, which accounts they affect, and strategies to minimize their tax impact can help you optimize …

Read More »

Read More »

2-27-25 Nvidia beats. What now?

Earnings season is all but done after last night's Q4 Report from Nvidia, which beat estimates, but did not inspire markets. The next dynamic to affect markets will be the closing of the buy back window ahead of Q2 Earnings reporting season. Investor behavior and market psychology is as bearish as ever. We're now seeing risk-off rotation; Lance revisits the effective use of stop-loss settings, and the importance of allowing market activity to...

Read More »

Read More »

Understanding the Value of Guaranteed Income for Peace of Mind

Calculating average income & inflation rates is key. Having a guaranteed income brings comfort beyond just the numbers. Peace of mind is priceless ?✨ #FinanceTips

Watch the entire show here: https://cstu.io/9ff1b6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Consumers Are Losing Confidence

Consumer Confidence, as surveyed by the Conference Board and University of Michigan, shows consumers are starting to lose economic confidence. Given that consumer spending drives the economy and influences inflation, confidence and the means to spend can significantly impact markets. Based on recent job data, the means (i.e., wages) to consume appear to be in …

Read More »

Read More »

Retirement Savings Tips: Balancing Roth and Traditional Accounts for a Secure Future

? Planning for retirement? Remember, it's YOUR money first! Enjoy your lifestyle while securing your future. Diversify your savings for a stable retirement! ??️ #RetirementPlanning #FinancialTips

Watch the entire show here: https://cstu.io/1c9b19

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-26-25 How to Avoid an Inheritance Nightmare

Planning ahead has never been so vital to preserving your estate and hat happens to it after you're gone. Lance and Danny tackle the in's and out's of inheritance planning, and examine returning legislation to cut the estate tax in half and loer gift taxes. They'll expose Inheritance planning mistakes, provide important Estate planning tips that can help you avoid family inheritance disputes; plus, Wills and trusts guidance and financial legacy...

Read More »

Read More »

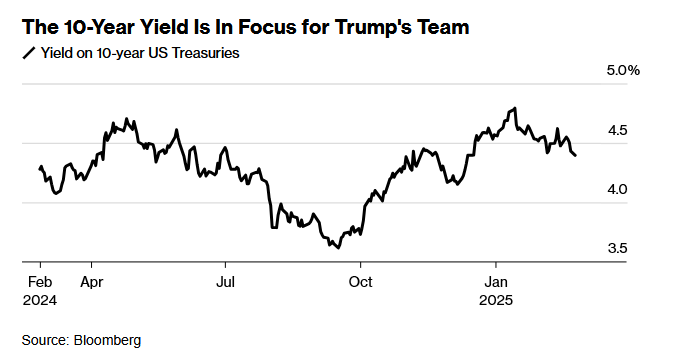

The Trump 2.0 Put: Got Bonds?

During Donald Trump's first term, some investors bought into the Trump 1.0 Put. The trade was based on the market's belief that Trump believed the stock market's performance was a referendum on his presidency. Accordingly, investors thought that Trump would do everything he could to backstop the stock market if it fell. Thus, some investors …

Read More »

Read More »

Behavioral Economics: Managing Your Inner Voice

The combination of extremely rich equity valuations, high interest rates, and a new President taking bold actions will likely continue to whip stocks around for the foreseeable future. Alongside those volatility-provoking factors is that the S&P 500 just posted two annual twenty-plus percent gains in a row. Accordingly, seeing average or below-average returns this year …

Read More »

Read More »