Category Archive: 9a.) Real Investment Advice

5-28-25 Nvidia Day!

It's “Nvidia Day!” The Big Dog in the Tall Grass for AI reports earnings after the closing bell today. Lance Roberts & Danny Ratliff delve into the anticipation surrounding Nvidia's upcoming earnings report, set to be released after today's market close. We'll explore market expectations, potential impacts on NVDA stock, and the broader implications for the AI and semiconductor sectors. Also a discussion about the inimitable Mrs. Roberts, and...

Read More »

Read More »

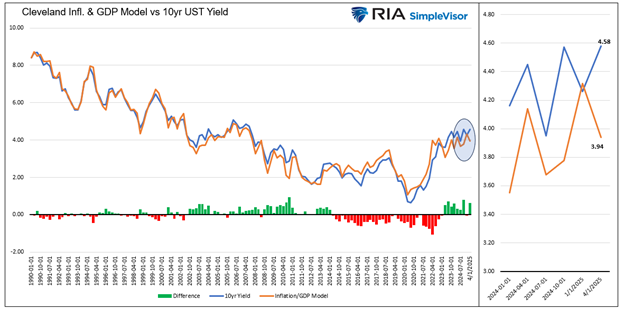

Narratives vs. Fundamentals: Battle In The Bond Market

On January 8, 2025, we answered many of your questions with an article entitled Why Are Bond Yields Rising? Since then, bond yields initially fell but have recently risen back to early January levels. Unsurprisingly, our email boxes are again filled with the same questions we got in early January. This article presents a different …

Read More »

Read More »

Assessing Credit Spreads After The USA Downgrade

A reader of our Daily Commentary asked how we measure corporate credit spreads in light of the Moody's downgrade of the USA credit rating. Specifically, "Without having a AAA benchmark to calculate the credit spread of corporate bonds against, what other measure can help me assessing stress in the corporate bond market." First its important …

Read More »

Read More »

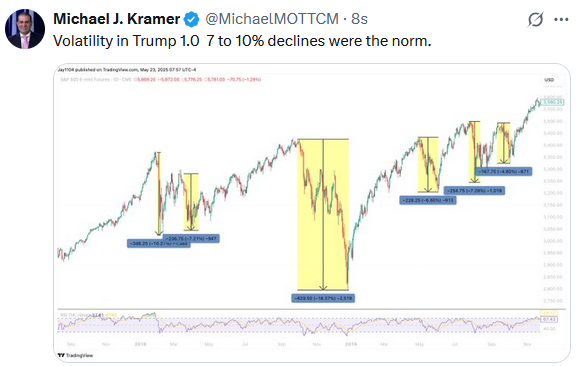

5-27-25 More Money is Lost Trying to Avoid Corrections than In Corrections

Our goal is to grow money in the markets that are presented to us today and adjust in the future. Peter Lynch is credited for noting that more money is lost avoiding correction than that is lost during correction. Corrections are never as bad as expected, and the really bad ones that are so feared rarely ever occur.

Hosted by Chief Investment Strategist, Lance Roberts, CIO w Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton,...

Read More »

Read More »

The Anchoring Problem & How to Solve It

Discover the hidden influence of anchoring bias on investment decisions and learn actionable strategies to overcome it. Lance Roberts and Jonathan Penn share behavioral finance concepts and provide practical solutions for navigating cognitive pitfalls in today’s markets.

#AnchoringBias #BehavioralFinance #CognitiveBiases #InvestmentPsychology #SmartInvesting

Read More »

Read More »

How to Balance Growth and Safety in Your Retirement Portfolio

As retirement approaches—or begins—investors often find themselves at a crossroads: How can you preserve the wealth you’ve accumulated while still ensuring it continues to grow? Striking the right balance between growth and safety in your retirement portfolio is one of the most important financial decisions you'll make. The key is understanding the trade-offs and creating …

Read More »

Read More »

The EU And Apple Hit With Tariffs

After a bout of relative market tranquility, investors were rudely awakened Friday with a barrage of new tariff actions targeting the EU and Apple. Via Truth Social, Trump recommended a 50% tariff on European Union imports starting June 1, 2025, and a 25% tariff on all iPhones made outside the US. Regarding the EU, the … Continue reading...

Read More »

Read More »

The Stealth Bear Market

Is this a "stealth" bear market? Of course, you may be asking yourself what I mean by that. Historically, bear markets have tended to be pretty evident, as highlighted in the chart below. These bear markets are often more protracted affairs that lead to investors developing profoundly negative sentiment towards markets. This article will use …

Read More »

Read More »

An Unstoppable Bull Market?

Inside This Week's Bull Bear Report Even Trump Can't Kill The Rally Last week, we discussed how the rally had repaired much of the previous damage following the correction. As we noted: "This past week, the market continued its advance. There is little reason to be bearish with key overhead resistance levels broken. However, as …

Read More »

Read More »

5-23-25 The CBO is About as Accurate as a Meteorologist

Malcolm Gladwell once wrote that weather forecasters are only good for about three days, after which, the accuracy are their predictions are no better than a coin toss. The Congressional Budget Office (CBO) track record is no better. So how can the CBO reliably predict what the US economy will be like by 2055?

Hosted by Chief Investment Strategist, Lance Roberts, CIO w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive...

Read More »

Read More »

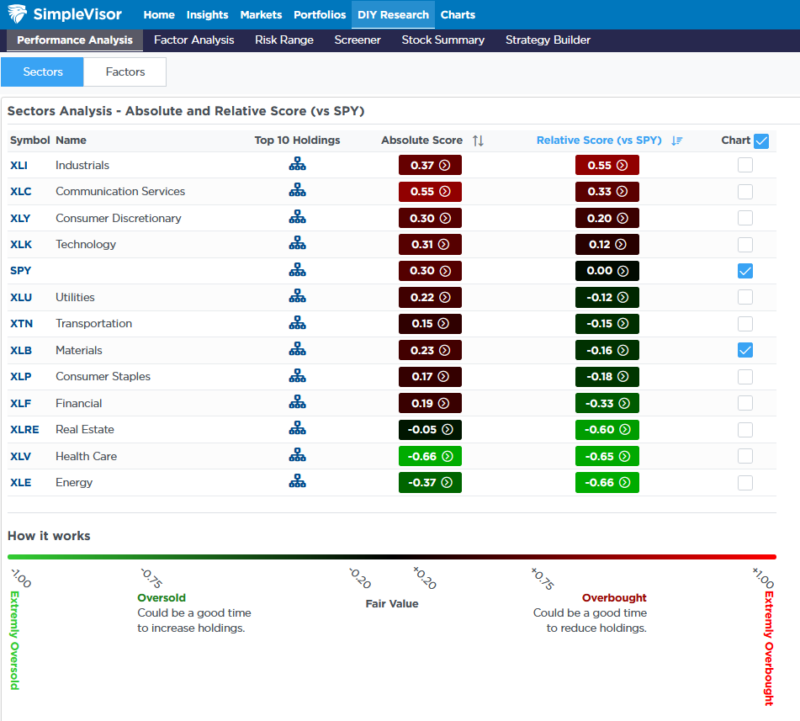

5-23-25 Debunking Bad Bond Narratives

Lance Roberts & Michael Lebowitz discuss whether or not bonds are a good buy now, with a composite bond market outlook, and the relationship of interest rates and bond prices.

Headlines herald a bond auction that "goes badly." Bond auctions tell you absolutely nothing about what's going on with bonds. Another "scary" headline about the rising gap between USD-JPY and Ten Year yields: The reality is there is a somewhat loose...

Read More »

Read More »

5-23-25 Are There Warts on The One Big Beautiful Bill?

Are there hidden flaws in the One Big Beautiful Spending Bill?

Danny Ratliff & Jonathan Penn expose what they're not telling you, diving into the fine print of the 2025 federal spending bill. Is it as beautiful as they claim—or are there costly warts hidden beneath the surface?

Danny & Jon break down the economic risks inherent in the politics and pork.

0:18 - Will Investors Pause for Memorial Day Weekend?

11:55 - Wart on the One Big...

Read More »

Read More »

Why Are Yields Surging In Japan?

The short answer is that the Bank of Japan (BOJ) is letting the market set yields. For years, the BOJ has run an extremely loose monetary policy, including capping yields at extremely low levels and negative interest rates. Limited economic growth and disinflation made such a policy possible. However, inflationary pressures and a weak yen …

Read More »

Read More »

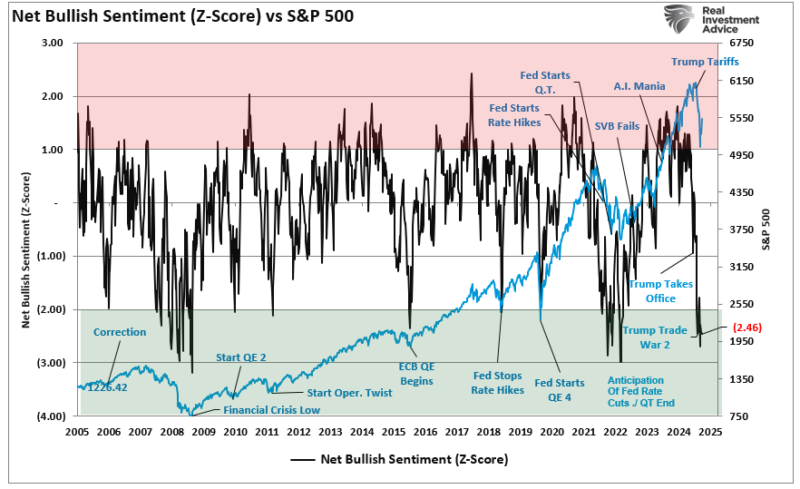

The Anchoring Problem And How To Solve It

Market perspective is essential in avoiding investing mistakes. With the media constantly pushing a “Markets In Turmoil” narrative, it’s no wonder that investor sentiment recently reached some of the lowest levels since the financial crisis. The following chart is the z-score of the retail and professional investor sentiment composite index of bullish sentiment. Notably, we …

Read More »

Read More »

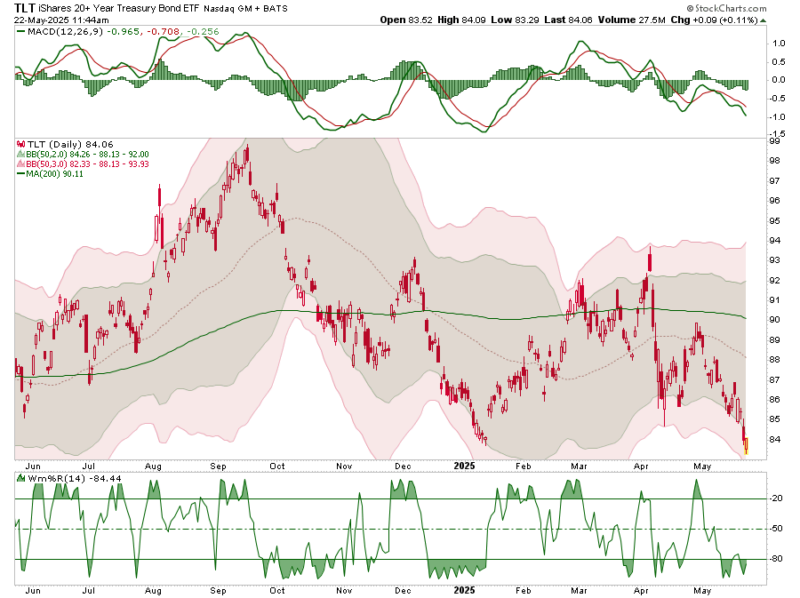

5-22-25 Bonds are Cheap?

Are bonds cheap?

Lance Roberts & Michael Lebowitz discuss whether or not bonds are a good buy now, with a composite bond market outlook, and the relationship of interest rates and bond prices.

0:22 - Hurricane Season & Market Pullback

11:53 - Bond Auction Reality - What did the dealers do?

27:42 - Debunking the Narratives & Bad, Scary Charts

41:26 - Why Bonds Are a Good Buy Now

Hosted by RIA Advisors Chief Investment Strategist, Lance...

Read More »

Read More »

The Role of Bonds in a Well-Balanced Investment Portfolio

When building a strong and diversified portfolio, most investors focus heavily on stocks. But bonds play an equally important role—especially when it comes to managing risk and providing consistent income. Incorporating bonds into your investment portfolio can lead to more […] The post The Role of Bonds in a Well-Balanced Investment Portfolio appeared first on …

Read More »

Read More »

Bond Yields Are Surging: Narratives Vs. Fundamentals

Fiscal worries, the dollar’s imminent demise, and soaring tariff-related inflation expectations are among the concerns driving bond yields higher. At the same time, inflation, the historical determinant of US Treasury yields, continues normalizing. As a bond investor, it is difficult […] The post Bond Yields Are Surging: Narratives Vs. Fundamentals appeared first on RIA.

Read More »

Read More »

5-21-25 Has the Correction Started?

Is this the beginning of a market correction—or just a healthy pullback?

Lance Roberts & Danny Ratliff break down recent volatility, key technical signals, and what smart investors should be watching right now; a review of Target & WalMart's earnings reports. Lance rebuts claims by Fisher Investments that stock buy backs do not affect markets. Convincingly. A review of Jamie Dimon's market complacency warnings, and Lance and Danny discuss...

Read More »

Read More »

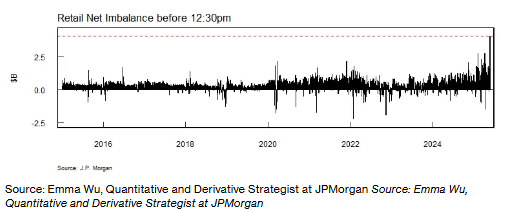

Retail Is Fearless: Buy The Dip Is On Steroids

Monday was a record-setting day. Stocks opened down 1% on news that Moody's downgraded the US credit rating to AA. While some perceived the downgrade as problematic, retail investors, aka individuals, bought stocks at the highest rate ever. Per JP Morgan, retail investors purchased a net of $4.1 billion of US stocks in the first …

Read More »

Read More »

Death Of The Dollar: An Eternal Tale

The following paragraph, courtesy of Amazon, reviews the book Death of the Dollar by William Rickenbacker. Death of the Dollar by William F. Rickenbacker is a critical examination of the economic policies and monetary mismanagement that the author argues are eroding the value of the U.S. dollar and threatening financial stability. Rickenbacker contends that the …

Read More »

Read More »