Category Archive: 9a.) Real Investment Advice

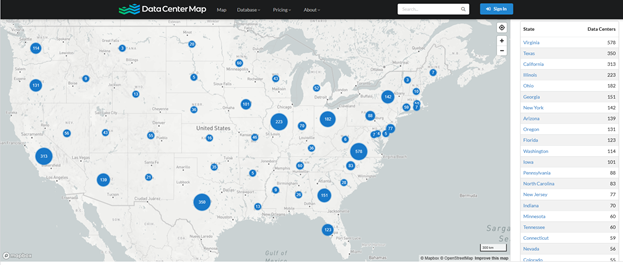

Behind The Meter Solutions Investment Guide- Part 2

Part 1 of this article (Fueling AI Data Centers: Behind The Meter Solutions) explained how data centers are leveraging the abundance and relative affordability of natural gas to fuel Behind the Meter (BTM) power generators. Part Two advances the discussion to investing in this promising innovation. This article looks past the data center operators and …

Read More »

Read More »

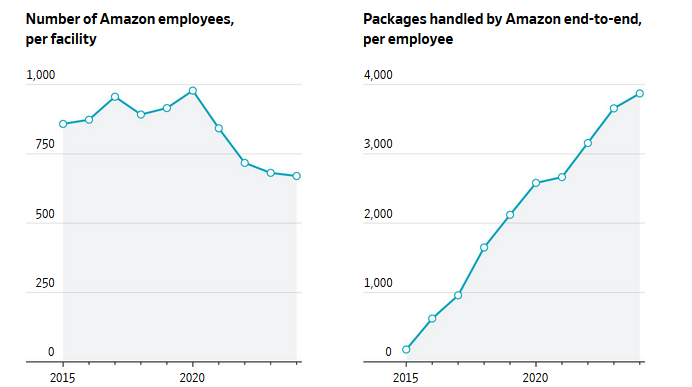

Amazon Has Over One Million Robots!

The age of robotics is no longer a futuristic concept. Per a Wall Street Journal article entitled, Amazon Is On The Cusp Of Using More Robots Than Humans In Its Warehouses, Amazon now has over one million robots in its warehouses doing the work that humans once handled. More impressively, the million robots are nearing … Continue...

Read More »

Read More »

How Executive Compensation Planning Can Boost Long-Term Wealth

For many executives, compensation isn’t just a paycheck—it’s a portfolio. Stock options, restricted stock units (RSUs), deferred compensation plans, and bonuses can significantly impact long-term financial security. Yet too often, these benefits are left underutilized or poorly timed. That’s where executive compensation planning plays a pivotal role. With the right strategies in place, you can …

Read More »

Read More »

The UM Survey: It Ain’t What It Used To Be

Recently, the media have highlighted anomalies in the University of Michigan (UM) consumer sentiment survey compared to other financial/economic sentiment surveys. It turns out UM changed their data gathering methods between April and July 2024. While it's challenging to determine the impact of these changes and whether they are responsible for the recent divergences from …

Read More »

Read More »

6-28-25 Candid Coffee – Financial Independence

Lance Roberts & Danny Ratliff host our mid-year review of markets, money, and financial mayhem: How to be a better investor without the tedium of the mainstream media noise.

INTRO/Origins

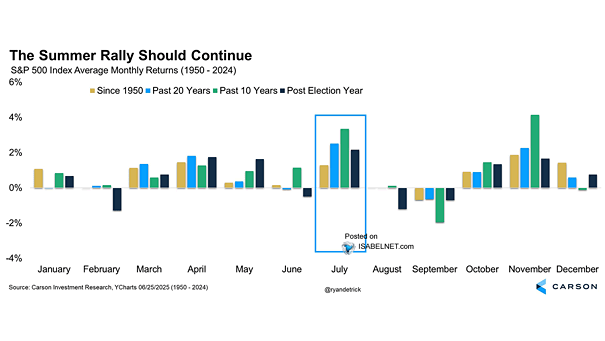

01:56 - Market Commentary - Markets at All-time Highs. Again.

(Jan 7 "Curb Your Enthusiasm")

Looking for another draw down this Fall - normal

End of Year Preview, Newsletter: What Do I Do If I Missed the Rally?

(Hope & Fear article)

06:00 -...

Read More »

Read More »

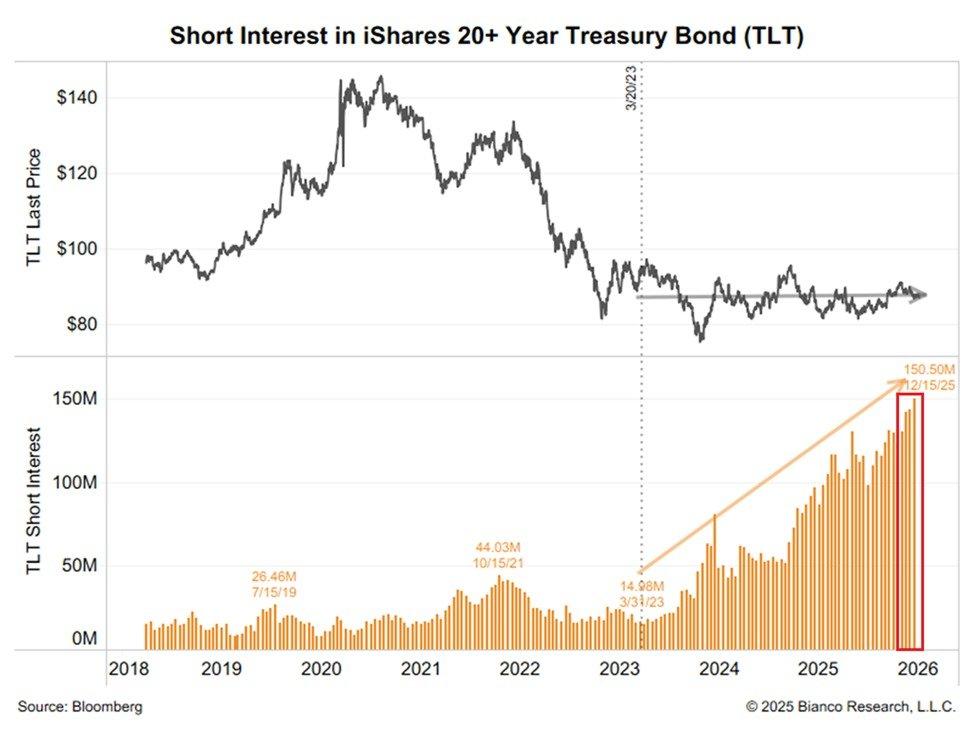

SLR: Could It End The Bond Bear Market

On June 25th, the Federal Reserve quietly announced a significant change to the Supplementary Leverage Ratio (SLR). While the headlines were muted, the implications for the U.S. Treasury market were anything but. For sophisticated investors, this technical shift marks a subtle but powerful pivot in monetary mechanics. It could create demand for Treasuries, improve market …

Read More »

Read More »

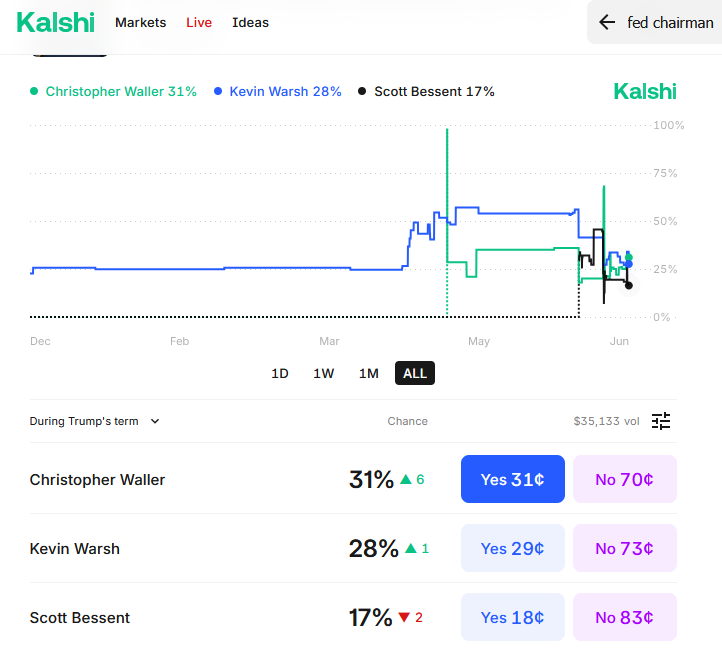

Shadow Fed Chair: Good Idea?

Donald Trump’s frustration with Chairman Powell increases by the day. Consequently, per The Wall Street Journal, expectations are that Trump will announce Powell's successor sooner than typical. Powell’s term expires May 2026. If Trump goes through with an early nomination, this "shadow Fed Chair" would espose views on the economy and monetary policy until Powell's retirement. Consequently, …

Read More »

Read More »

WWIII – The Death Of Another Narrative

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 📊 …

Read More »

Read More »

6-27-25 Ken FIsher Doesn’t Need an Annuity; You Might

Annuities are not your enemy, despite their bad rap; part of the fault lies with the financial industry, which too often SELLS annuities instead of PLANNING for them with a client.

Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

2025 July Vacay

We are on vacation this week (6/30-7/4), returning with more fresh, live-content on Monday, July 7. In the meantime, feel free to peruse our playlists of features, market commentary, and financial advice segments here on our YouTube Channel.

Wishing you and your family a safe and happy Independence Day!

RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Register for our next live...

Read More »

Read More »

6-27-25 Annuities Are Not Your Enemy

Are annuities always a bad deal? Not so fast.

In today’s episode, Richard Rosso & Jonathan McCarty tackle the myths and misconceptions around annuities. From income guarantees to tax-deferred growth, find out how annuities can actually support your retirement strategy—if used the right way. Jonathan shares his changed life as a new father, and a discussion of investor confirmation bias, who's likely to be the replacement for Jerome Powell,...

Read More »

Read More »

Dollar Reversal: What It May Mean For Gold and Bonds

Yesterday's Commentary noted that the dollar is very oversold and likely due for a reversal. To wit: The dollar is deeply deviated from its longer-term mean, oversold on multiple levels, and has been basing since April. As noted last Friday, the incredibly negative bias and position against the dollar are excellent contrarian signals for a …

Read More »

Read More »

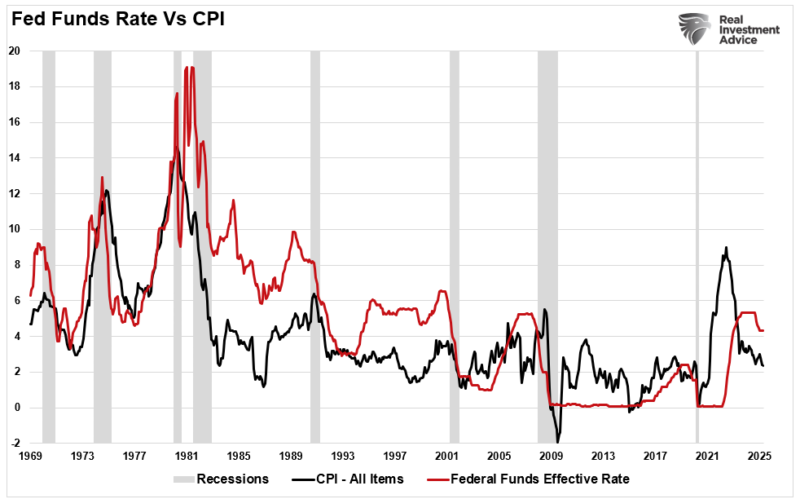

The Fed’s “Transitory” Mistake Is Affecting Its Outlook

In 2023 and 2024, the Fed was under intense public and media scrutiny for calling the post-pandemic surge in inflation “transitory.” Critics argued that the Fed's failure to anticipate the persistence and severity of rising prices undermined its credibility. Yet, with the benefit of hindsight and historical context, the Fed's position wasn't entirely misguided. Inflation …

Read More »

Read More »

6-26-25 The Federal Reserve: Financial Economic Socialism

Has the Federal Reserve become more famous/infamous than the President of the United States? The Fed's ever-growing footprint on the U.S. economy is undeniable, perhaps even a form of financial, economic socialism.

Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

6-26-25 The Fed’s Next Mistake

Is the Fed setting the stage for another policy blunder?

As inflation pressures linger and economic growth slows, Lance Roberts & Michael Lebowitz break down the risks of the central bank's next move—and what it could mean for your money on this morning's episode of #TheRealInvestmentShow. The Market Rally is ON, yet oil prices are telling a different story about the economy. President Trump could be picking a successor to Fed Chairman Jerome...

Read More »

Read More »

How to Align Your Financial Plan with Your Life Goals

For high-net-worth individuals, wealth is more than a measure of financial success; it’s a means to achieve personal fulfillment, support cherished causes, and leave a lasting legacy. Traditional financial planning often emphasizes asset accumulation and tax efficiency. However, a more […] The post How to Align Your Financial Plan with Your Life Goals appeared first …

Read More »

Read More »

SNB Brings Back Zero Percent Interest Rates

With interest rates in developed economies falling but still significantly higher than their respective troughs in 2021-2022, some pundits are claiming that we are entering a new interest rate regime. Gone, they say, are the days of near-zero or even negative interest rates. The Swiss National Bank (SNB) may lead some pundits to rethink their logic. On June 19, 2025, the SNB reduced its policy rate by 25 basis points to 0.00%. Here are some reasons...

Read More »

Read More »

6-25-25 Speculative Demand is Off the Chain

When there is a massive amount of demand for something, and Wall Street sees there is money to be made from it...they're going to figure out a way. There is record call-option volume presently in levels we've never seen, historically. And Wall Street is happy to sell it to you. This will end the way SPACs and some IPO's have ended...not well for investors.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive...

Read More »

Read More »

6-25-25 The Bulls Are Back in Town

Wall Street is buzzing again — but is the bull market really back? Lance Roberts & Danny Ratliff break down what’s fueling the latest stock market rally, what investors should watch next, and whether this rebound is the real deal or just a bear market trap. Market speculation is at an all time high, yet there are economic surprises in store that could shake things up. There is now an illusion of economic strength. Lance discusses the recent...

Read More »

Read More »

Powell Testifies On Monetary Policy To Congress

Fed Chair Jerome Powell presented his quarterly testimony to the House yesterday and will testify to the Senate today. The market reaction was minimal as much of his speech was a repeat of last week’s FOMC meeting and press conference. […] The post Powell Testifies On Monetary Policy To Congress appeared first on RIA.

Read More »

Read More »