Category Archive: 9a.) Real Investment Advice

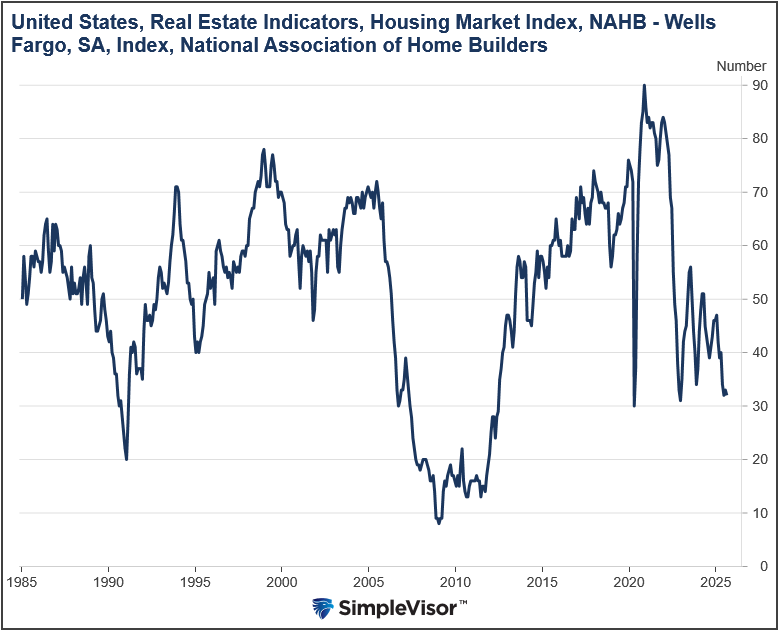

Homebuilders Are Pessimistic But Buffett Likes Them

In Warren Buffett’s Berkshire Hathaway's latest SEC disclosures, the company reported buying a nearly $1 billion stake in homebuilders Lennar (LEN) and D.R. Horton (DHI). The purchases signal anticipation of a housing market rebound, possibly piqued by the possibility of the Fed starting a rate-cutting regime. However, while Buffett appears confident of the new home …

Read More »

Read More »

8-19-25 How Small Habits Drain Your Budget

You'd be surprised at how much money you could save by cutting out those little, everyday habits that sap your earnings. Saving $500/month is $6k a year towards your personal nest egg!

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a...

Read More »

Read More »

8/19/25 Do You Really Need a Local Financial Advisor? Why Location Doesn’t Matter Anymore

Do you really need a local financial advisor to manage your money? Geography doesn’t matter anymore when it comes to building wealth and securing your financial future.

Lance previews this week's Jackson Hole consortium; what will Jerome Powell Infer?

Lance Roberts & Jonathan Penn cover the conundrum of local vs virtual financial advisors; how college students are lured by credit card offers, and the dangers of credit accounts. This leads to a...

Read More »

Read More »

Will Powell Turn Dovish In Jackson Hole?

The Jackson Hole Economic Symposium, hosted by the Federal Reserve Bank of Kansas City, is an annual event in which central bankers from the Fed and around the world gather with policymakers, economists, and financial market participants to discuss economic issues.

Read More »

Read More »

How to Build a Multi-Generational Wealth Strategy That Lasts

Creating wealth is a remarkable accomplishment, but preserving it across generations is a different challenge altogether. Families who want to build a lasting impact must go beyond investment portfolios. They need a clear, cohesive plan to pass on not just money, but purpose, values, and financial confidence.

Read More »

Read More »

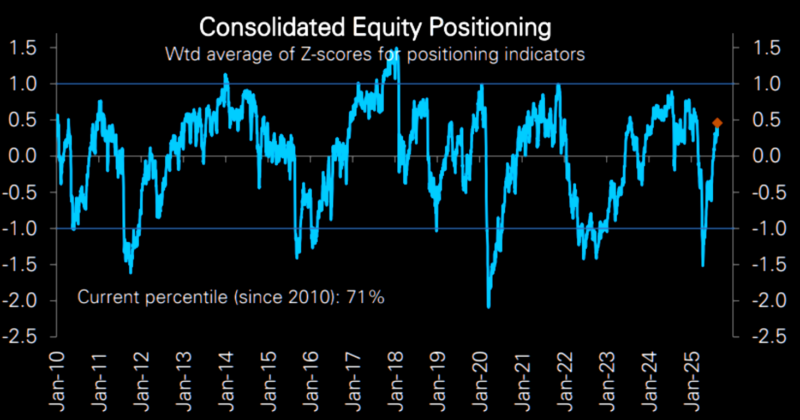

8/18/25 Ten Rules for Navigating Excessive Market Bullishness

Are investors too optimistic right now?

Lance Roberts breaks down ten rules for navigating excess market bullishness so you can protect your portfolio while still participating in market gains. Also in today's show: Lance's assessment of earnings season so far, and the role Nvidia will play in determining market moods. We've got a special interview segment planned for Wednesday's (8/20) show [Premier link is below]; Lance reveals yet another saga...

Read More »

Read More »

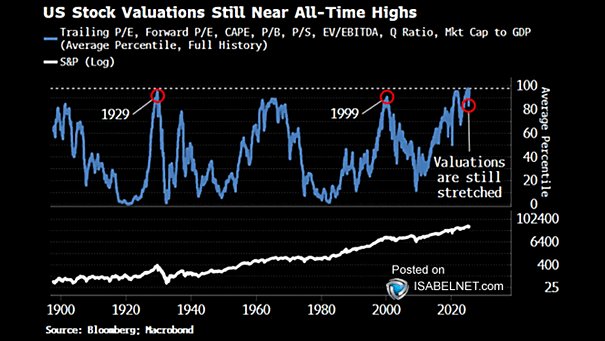

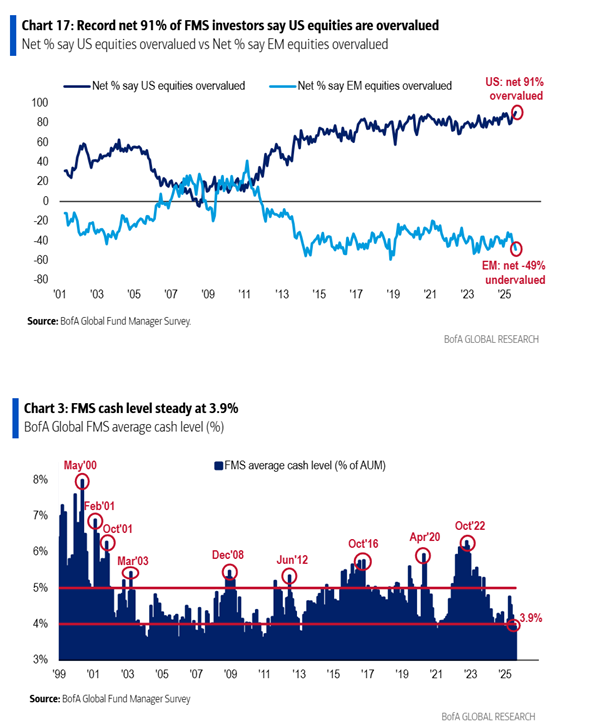

Excess Bullishness & 10-Rules To Navigate It

There is little doubt that excess bullishness has invaded the general market psyche. Just a couple of months following the market decline in March and April, where sentiment turned exceedingly bearish, the S&P 500 hovers near its highs. Furthermore, analysts are rushing to raise price targets to 7,000 or more.

Read More »

Read More »

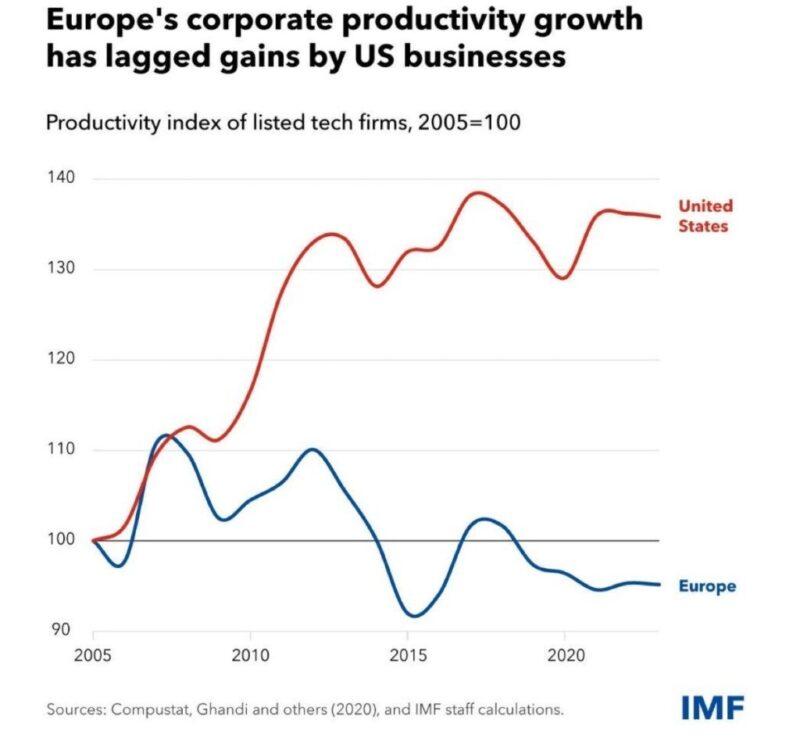

Euro Stocks Are In Vogue: Do Valuations Justify The Rotation?

Since 2015, the performance of the S&P 500 has been more than double that of stocks from the Euro STOXX 50 (FEZ) and the iShares developed markets ETF (EFA). However, recently the tide has turned, and the Euro and broader foreign stock indices are beating the S&P 500.

Read More »

Read More »

Inflation Data Sends Markets To New Highs

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

8-15-25 The Importance of Financial Alignment in Marriage

One of the most important decisions in life is whom to marry; a compatible financial mindset can affect a lifetime of wealth.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Jonathan McCarty, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live...

Read More »

Read More »

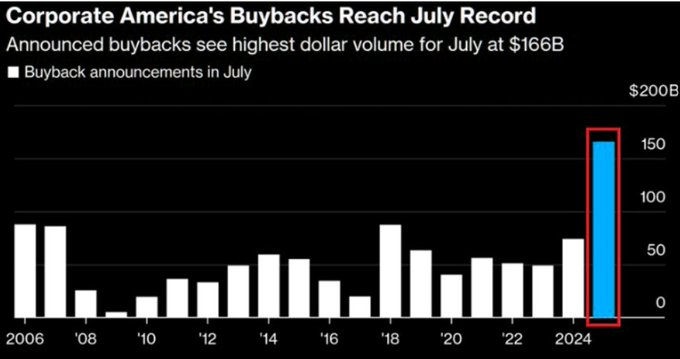

Insider Selling Reveals Fallacy Of Buyback Theory

Mainstream commentary repeats a simple refrain: “Buybacks return capital to shareholders.” The logic sounds convincing. A company reduces its outstanding shares, giving each shareholder a larger slice of the earnings pie. But as I’ve discussed in past work like “Stock Buybacks Aren't Bad, Just Misused,” the reality is more complex. If corporate buybacks were an …

Read More »

Read More »

Is Conviction The Biggest Risk To The Stock Market?

Edward Harrison of Bloomberg recently made the following important market observation: “buying stuff you don’t believe in creates downside risk.” Conviction is a measure of how much investors believe in their holdings. When conviction runs high, investors are often more willing to tolerate lower prices. In fact, some may add to their positions at lower prices. …

Read More »

Read More »

8-14-25 The Risks of Over-Valued AI Stocks

What happens if Nvidia reports slowing earnings or lowered guidance in their next quarterly report? Anything that might change the narrative of the AI cap-ex cycle will have consequences.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

8/14/25 Will the Fed Cut Rates NOW??

Will the Federal Reserve blink and cut rates now? Lance Roberts & Michael Lebowitz break down the latest inflation data, economic trends, and market signals that could force the Fed’s hand and what it means for your portfolio on

#TheRealInvestment Show streaming-live starting at 6:00a CDT on YouTube, Meta, & X!

#FederalReserve #RateCut #InterestRates #USEconomy #StockMarketNews

Read More »

Read More »

The Hidden Cost of Not Having an Investment Policy Statement

When it comes to managing wealth, especially for high-net-worth families and business owners, investment decisions can feel overwhelming. Market volatility, emotional reactions, and competing priorities can quickly lead to inconsistent choices that erode long-term success. That’s where an Investment Policy Statement (IPS) comes in. Yet despite its value, many investors skip this crucial document, unknowingly …

Read More »

Read More »

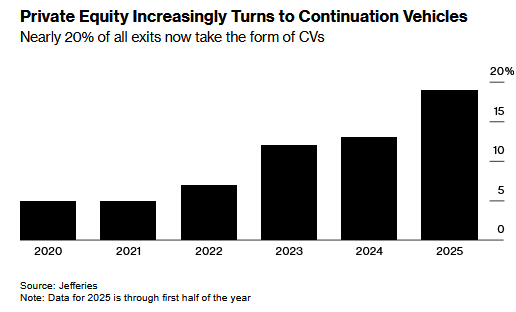

CVs Signal Maturity In Private Equity

Private equity funds often buy assets intending to sell them and realize a profit over a specific period. However, recently it's become more common that their assets are not ready to be sold when they had initially forecasted. While the fund can hold the assets longer than expected, fundholders may demand liquidity. Instead of selling …

Read More »

Read More »

8-13-25 Investing Without a Target is Like Throwing Darts in the Dark

It's often been said, "if you fail to plan, you plan to fail," and the same holds true for investing without a strategy in mind.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube...

Read More »

Read More »

8/13/25 Portfolio Concentration: Hidden Risks That Can Sink Your Returns

Many investors unknowingly take on portfolio concentration risk—placing too much money in one stock or sector. Lance Roberts & Danny Ratliff break down why concentrated stock portfolios can be dangerous, how lack of investment diversification can magnify losses, and what smart risk management investing looks like.

Whether you’re building long-term wealth or protecting what you’ve earned, understanding the hidden dangers of over-concentration...

Read More »

Read More »

The Index Isn’t Always Accurate: Factors Influencing Yields

How was the weather yesterday in the United States? You could answer by citing an average temperature or precipitation level. However, doing so would severely misrepresent the weather in many parts of the country. Similarly, the typical response to “What did the market do today?” is often to quote the change in the S&P 500 …

Read More »

Read More »