Category Archive: 9a.) Real Investment Advice

Gold Miners Are Benefitting From The Speculative Boom

As we noted in a recent article entitled The High Beta Melt Up: Echoes of 1999, there has been a notable change in investor preferences since the April lows. To wit: "What we do know is that, starting from the April lows, the market’s attitude toward riskier, more speculative activities has become much more intense." …

Read More »

Read More »

How to Build a Wealth Management Plan That Adapts to Life Changes

Most of us start financial planning with a basic idea: save, invest, and retire comfortably. But what happens when life throws something big your way, good or bad? Maybe you will sell your business sooner than expected. Maybe you receive an inheritance. Maybe life takes a sharp left turn through divorce, or you decide to …

Read More »

Read More »

T8-25-25 The Dangers of Margin Debt in Investing

Buying stocks on margin debt may seem like a great idea when markets are on the rise; but when markets decline, it's not up to you when margins are called.

RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Rich mentions on our website, and sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our...

Read More »

Read More »

8/25/25 “Buy Every Dip” Remains The Winning Strategy…For Now”

“Buy every dip” has been the mantra of this bull market — and so far, it has rewarded investors. Lance Roberts explains why the buy the dip strategy continues to work in today’s market, even as valuations stretch and risks build beneath the surface.

Lance looks at how investors are approaching stock market pullback investing, what history tells us about short-term market trends versus long-term risks, and the potential turning points that could...

Read More »

Read More »

“Buy Every Dip” Remains The Winning Strategy…For Now

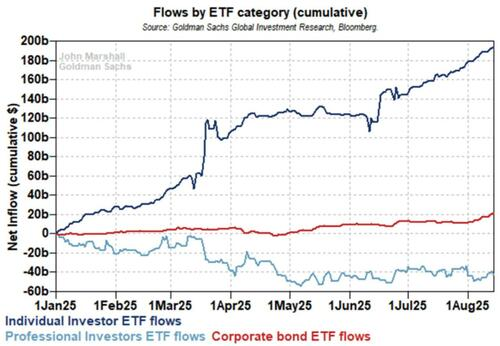

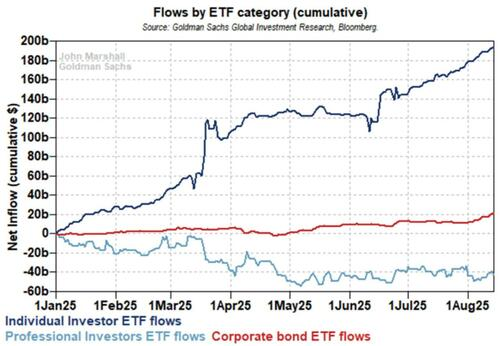

"Buy Every Dip" has lately been the "Siren's Song" for this market. Such is seen in the flows into ETFs over the course of this year. Retail investors treat pullbacks as temporary noise, and their behavior borders on mechanical. Every sell-off is seen as an opportunity, not a warning. Meanwhile, institutional managers sit it out. …

Read More »

Read More »

Start Your Financial Journey with Real Investment Advice | Wealth Management That Works

Discover how RIA Advisors can help guide your financial future with confidence.

We have a unique approach to financial planning, portfolio management, and real-world economic insight—all tailored to help you achieve long-term success.

Whether you're planning for retirement, growing your investments, or just getting started, RIA offers the tools, expertise, and personalized support to make a difference.

Start your journey today:...

Read More »

Read More »

Balance Of Risks Allows Powell To Pivot

"Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance." That key line from Chairman Powell's opening speech at the Fed's Jackson Hole symposium effectively summarizes Powell's view on monetary policy. Simply, the change in the balance of risks since the BLS jobs revisions …

Read More »

Read More »

Market Valuations Don’t Matter…Until They Do

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

8-22-25 Delayed Gratification is the Gateway to Financial Literacy

How can you enhance the chance for financial success in children?

Teach them to abstain from marshmallows...or develop their sense of delayed gratification.

RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Jonathan McCarty, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Rich mentions on our website, and sign up for Lance's newsletter:...

Read More »

Read More »

8/22/25 Raising Money-Smart Kids | How to Teach Kids About Money & Saving

Raising money-smart kids is one of the most valuable lessons you can give them for life. Richard Rosso & Jonathan McCarty break down how to teach kids about money, from saving and budgeting to making smart financial decisions early on.

You’ll learn practical strategies for financial literacy for children, including:

Simple ways to explain money to kids

How to teach kids to save money and set goals

Smart money habits that last a lifetime...

Read More »

Read More »

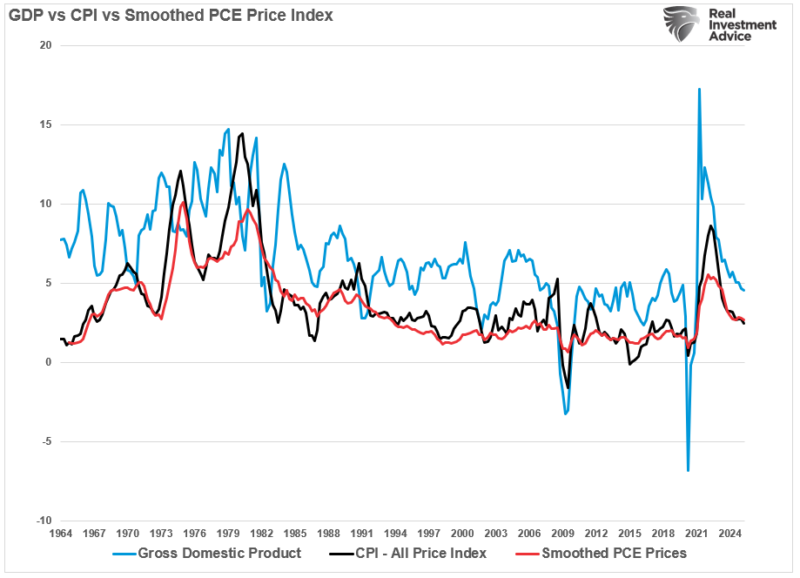

US Economy: Recent Data Suggests Risk To Earnings

The latest economic data suggests the US economy is decelerating. That means growth is slowing, jobs are shrinking, and households are spending less. As we showed in a recent #BullBearReport, economic growth, inflation, and personal consumption are trending lower. Unsurprisingly, with job growth weakening, consumer sentiment also took a hit in the latest report, with …

Read More »

Read More »

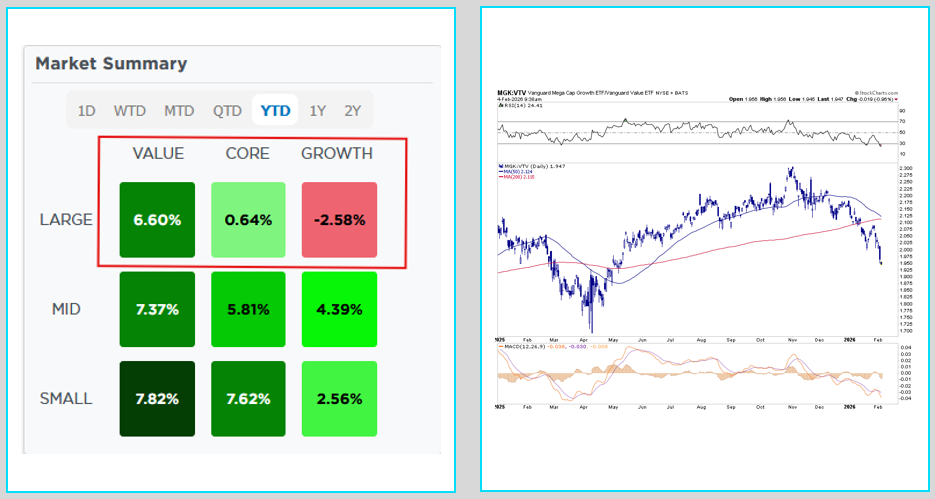

Significant Rotations Hidden By Calm Markets

The market seas are calm, but beneath the surface, there is some intense churning, or in market terminology, significant stock rotations. Over the last week, the Dow, S&P 500, and Nasdaq were relatively flat. Such gives the appearance of a low volatility, typical late August market with little going on. However, beneath the calm of …

Read More »

Read More »

8-21-25 The Impact of Lower Interest Rates on Housing

Incredibly, new home prices are actually less expensive than exiting homes; and no one is selling, and no one is buying. Imagine the impact if interest rates were to be lower to spur more home sales...

RIA Advisors Senior Financial Advisor, Danny Ratliff, CFP, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

Read the article Danny & Michael mention on our website, and sign up for Lance's...

Read More »

Read More »

8/21/25 Speculative Frenzy – Fading or Re-fueling?

Markets are showing signs of a speculative frenzy once again—but is the fire burning out or just getting started?

Danny Ratliff & Michael Lebowitz break down the latest stock market speculation, shifts in investor sentiment 2025, and the risks of a potential market bubble forming. We’ll look at how speculative trading trends are driving prices higher, what this means for long-term investors, and where financial market volatility could take...

Read More »

Read More »

Retirement Income in Overvalued Markets.

Financial planning industry thought leader Michael Kitces, CFP®, CLU®, ChFC®, RHU, REBC, and professor of retirement income at the American College, Wade D. Pfau, Ph.D., CFA, penned a seminal work for the Journal of Financial Planning titled Reducing Retirement Risk with a Rising Equity Glide Path. Their work and several tips can help with retirement income …

Read More »

Read More »

What to Expect From a Personalized Financial Planning Experience

Financial planning is not one-size-fits-all. Your goals, responsibilities, and lifestyle are all unique to you. Your financial strategy is no different. Building wealth, or preparing for retirement? Life transitions like these require some help from personalized financial planning instead of a run-of-the-mill algorithm. Find clarity, confidence, and a strategy that involves YOU with RIA Advisors. …

Read More »

Read More »

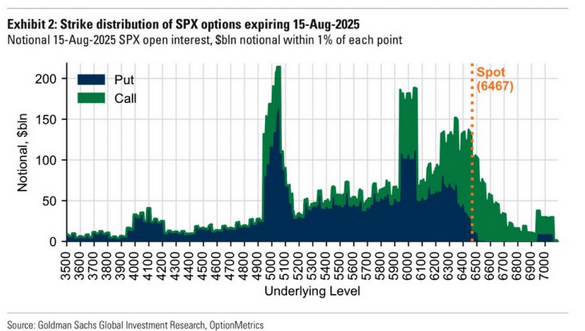

OPEX Overload: How 3 Trillion In Expirations Can Move Markets

Nearly $3 trillion of notional stock options expire on Friday's open expiration (OPEX day). Over half of the OPEX volume is in S&P 500 options, with the remainder in single stock options. The graph below provides details on the split between puts and calls, and the strike prices and open interest of the options. Almost …

Read More »

Read More »

8-20-25 The Rest of the World Must See Our Economic Future as Blindingly Bright

Our conversation with Real Clear Markets Editor, John Tamny, on the economic health of the US as evidenced by $37-Trillion in debt the rest of the world continues to clamor to buy.

Watch the entire interview on our YouTube channel:

Chief Investment Strategist, Lance Roberts, CIO, w John Tamny, Editor/Real Clear Markets

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

8-20-25 John Tamny – Money is Ruthless

Lance Roberts interviews John Tamny, author, economist, and editor of RealClearMarkets. Tamny’s provocative new book, Deficit Delusion, reframes how we think about debt and growth. He makes a bold case: Trump-style protectionism and fear-driven immigration policies are economically self-defeating—even for conservatives.

Trade is the greatest foreign policy mankind has ever devised, plus it's great for workers as is any scenario that expands the...

Read More »

Read More »

UPS Is At Pandemic Lows: Value Or Value Trap?

Shares of UPS are around the same price they were in March 2020, when the pandemic shut down economic activity. At the time, the global economy was decimated. In unprecedented fashion, the unemployment rate skyrocketed from 3.5% to 14.8% in one month. While the economic impact was tremendous, there was no relief in sight. The …

Read More »

Read More »