Category Archive: 9a.) Real Investment Advice

9-26-25 College Planning 2025 – FAFSA, Scholarships, & Smart Funding Tips

College planning season is here — and the last quarter of 2025 brings critical deadlines for students and parents. Jonathan Penn and Sarah Buenger break down what you need to know about FAFSA, scholarships, and smart funding strategies for higher education.

🎓 Topics Covered:

Applications: Why applying to multiple in-state schools boosts negotiating power.

FAFSA 2025–26: Key deadlines, why it’s required (even if you don’t qualify for aid), and...

Read More »

Read More »

Slowdown Signals: Are Leading Indicators Flashing Red?

Lately, there’s been a growing sense of confidence among investors that the U.S. economy has dodged the proverbial bullet. Despite a historic rate-hiking cycle by the Federal Reserve, two years of stubborn inflation, and signs of strain in global trade, the dominant Wall Street narrative is now a curious mix of “soft landing,” “no landing,” …

Read More »

Read More »

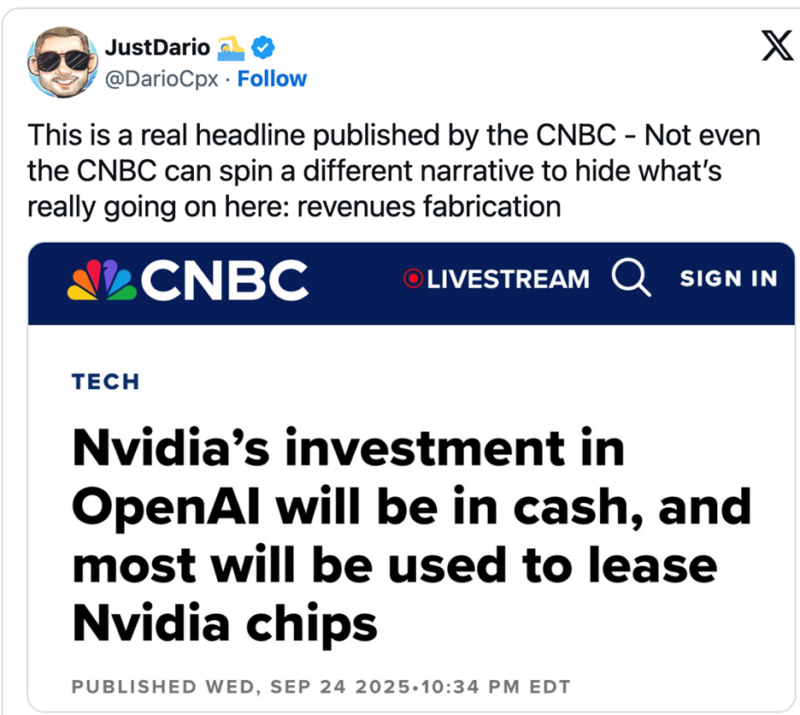

Is Nvidia Recycling Profits?

Several articles and social media posts have recently discussed the irregular partnerships that Nvidia is forming with some of its clients. The gist of the story is that Nvidia is investing in its clients, who then use the funds to buy Nvidia chips. This is what CNBC stated in a headline on Wednesday. This is … Continue reading »

Read More »

Read More »

9/25/25 Accommodative Or Restrictive? Decoding The Fed’s Latest Move

The Federal Reserve’s latest move has investors asking: Is policy turning more accommodative or staying restrictive? Lance Roberts and Michael Lebowitz decode the Fed’s decision, cut through the jargon, and explain what it means for markets, rates, and your money.

We’ll cover:

What the Fed actually signaled last week

The difference between accommodative and restrictive policy

How markets typically react to these shifts

Key risks for stocks,...

Read More »

Read More »

Pfizer Tries To Fatten Its Profits With Weight Loss Drugs

Eli Lilly (LLY) and Novo Nordisk (NOVO) dominate the market for weight loss drugs. The monopoly has proven incredibly profitable for both companies. Consider that in the last quarter, LLY reported that $8.58 billion of its $15.56 billion in total revenue came from its two GLP-1 weight loss drugs Mounjaro and Zepbound. Even a greater percentage …

Read More »

Read More »

9/24/25 Strange Recession Signals: What Markets & Odd Indicators Are Telling Us

Are we really on the edge of a recession—or are investors just overthinking the signals?

Beyond unemployment and consumer spending, unusual data points like men’s underwear sales, cardboard box demand, and even giant Halloween skeleton purchases are popping up as quirky economic indicators.

Lance Roberts & Danny Ratliff break down:

• Traditional recession signals like jobless claims, consumer spending, and market fundamentals.

• Technical...

Read More »

Read More »

Meme Stocks On Fire: Another Sign Of Animal Spirits

Meme stocks are highly speculative stocks, heavily traded by retail traders, and characterized at times by rapid price surges and equally sharp declines. The extreme volatility is often the result of social media platforms such as Reddit's WallStreetBets pushing these stocks. Among the most noteworthy meme stocks of the last few years have been GameStop …

Read More »

Read More »

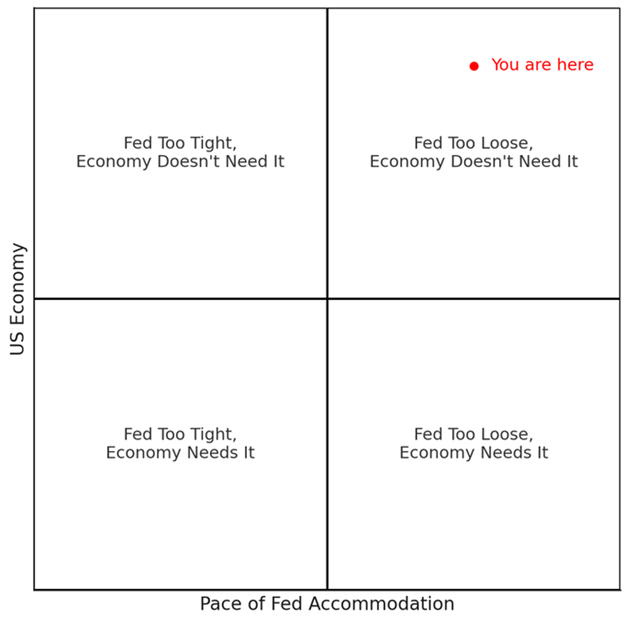

Accommodative Or Restrictive? Decoding The Fed’s Latest Move

Some Wall Street pundits believe that the recent Fed rate cut makes its policy too accommodative, and they also argue that the Fed is creating a “Goldilocks” scenario for the stock market. To wit, we recently saw the following comment and graph on X, which suggests we are in the “Goldilocks zone.” “Market is …

Read More »

Read More »

Equity Fund Outflows Soar: Blip or Warning?

Our friend Jim Colquitt, in his Weekly Chart Review, brought to our attention a large and irregular outflow from equity funds last week. He cites a Reuters article stating that investors withdrew $43 billion from US equity funds last week. That was the largest outflow since December 2024. The graph below shows that equity fund …

Read More »

Read More »

9/22/25 Stock Market Outlook: Bullish or Bearish?

Are markets set to keep climbing, or are we staring down the next pullback? Lance Roberts breaks down the bullish vs. bearish case for stocks, exploring what could fuel the rally—and what risks could trip it up.

From the Federal Reserve’s latest moves, to earnings trends, market breadth, and money flows, we’ll cover the key factors driving sentiment. Whether you lean bullish or bearish, this analysis will help you understand the forces shaping...

Read More »

Read More »

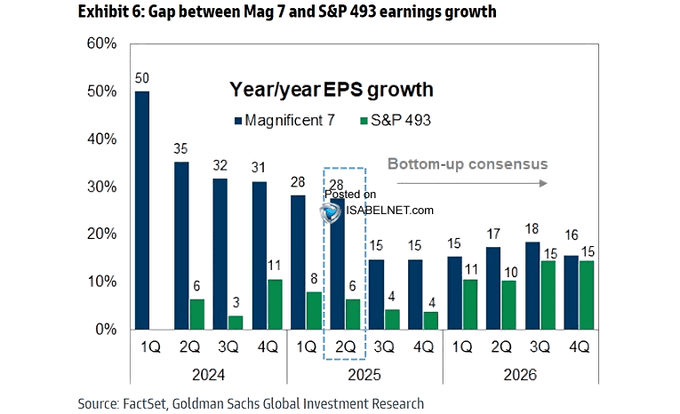

Size Matters: Can The Largest Stocks Continue To Lead?

Does size matter? Since the Pandemic, and judged by the recent performance of the Magnificent Seven and mega-cap indexes, many investors would say it matters, likely claiming that the greater the size, the better the returns. Those with data going back decades, rather than years, would also agree that size matters. However, their conclusion would …

Read More »

Read More »

Markets: Bullish Vs Bearish Case

Just recently, Scott Rubner of Citadel Securities wrote an excellent piece discussing the bull versus the bear case for the markets. You look at the markets today and see a tension between expectation and reality. On one hand, equities—especially tech and growth—are pushing to fresh highs. Optimism about rate cuts, AI and productivity gains, global …

Read More »

Read More »

Overbought Conditions Across Multiple Markets

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

9/19/25 Why Fighting The Data Is A Losing Trade

Regardless of whether you believe CPI or jobs data reflects reality, markets trade on the official numbers.

In this short video, @AxelMerk & I discuss that even if employment or inflation numbers are flawed, what matters is how the Fed reacts, since liquidity and rate policy drive asset prices.

Watch the full episode here:

#CPIInflation #JobsReport #FederalReserve #MarketTrading #AxelMerk

Read More »

Read More »

9-18-25 Savvy Medicare Planning –

Planning for Medicare can feel overwhelming, but understanding your options is the key to protecting your health and finances in retirement. In this Savvy Medicare Planning Webinar, Richard Rosso & Danny Ratliff walk you step-by-step through what Medicare covers, who’s eligible, enrollment periods, penalties, premiums, Medigap, Medicare Advantage, and long-term care planning.

✅ What you’ll learn in this Medicare webinar:

The basics of...

Read More »

Read More »

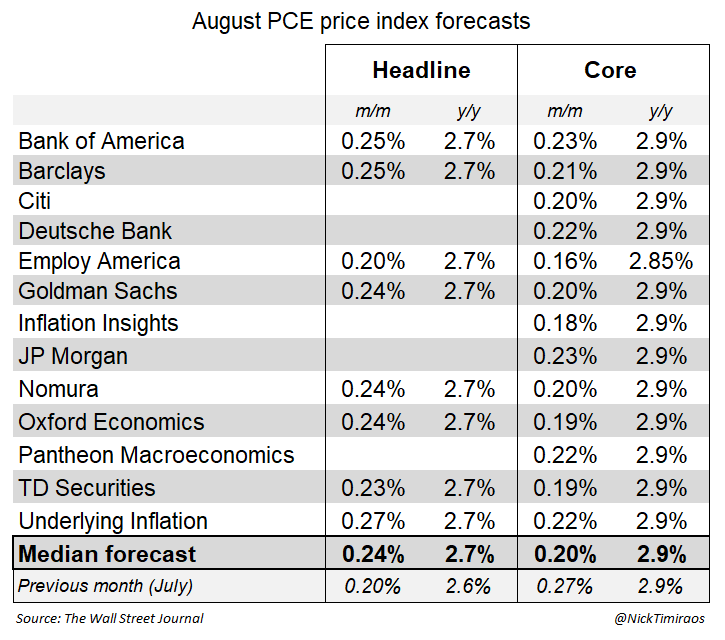

9/11/25 There Ain’t No Inflation

Markets and the Fed keep talking about inflation, but what’s really happening? Lance Roberts previews the upcoming CPI, PPI reports, and real-world data to explain why the official numbers don’t always match what you're feeling. From wages and rents to energy prices--is inflation is truly under control, or just hiding in plain sight.

Discover how “disinflation” differs from “deflation,” why Wall Street’s narrative matters for stocks, and what it...

Read More »

Read More »

Data Centers And The Power Grid: A Path To Debt Relief?

Could data centers and the power grid be America's next "renaissance?" With the U.S. national debt exceeding $37 trillion and interest payments surpassing defense spending, many articles have been written about the "debt doomsday" event coming. Such was a point we made in "The Debt and Deficit Problem." "In recent months, much debate has been …

Read More »

Read More »

Market Mechanics Override Weakening Economic Data

Since the middle of July, UST 10-year yields have fallen from 4.50% to 4.00%. While the yield decline has been profitable for bondholders, it has also aided many other investors. Such a finding may seem counterintuitive, considering that lower yields are the result of a significant weakening in the labor market and a range of …

Read More »

Read More »

9/18/25 The Real Reason The Market Popped After the Fed Cut

The Fed cut rates as expected, but Powell admitted uncertainty and insisted policy is still "restrictive."

@michaellebowitz and I discuss why markets see it as "accommodative" and are rallying on that perception, with $INTC & $NVDA helping big.

#FedRateCut #StockMarketRally #PowellSpeech #NvidiaStocks #InterestRates

Read More »

Read More »

9/18/25 No Risk-free Path for the Fed

The Federal Reserve cut rates on Wednesday, September 17, 2025 — but the path forward is anything but risk-free. Markets had already priced in much of the move, leaving investors to wonder if Powell’s guidance will calm volatility or spark fresh uncertainty.

Lance Roberts and Michael Lebowitz look at what the Fed’s latest decision means for stocks, bonds, and the economy.

Why Powell’s words may matter more than the rate cut itself.

The risks of...

Read More »

Read More »