Category Archive: 9a.) Real Investment Advice

11-21-25 Why Narratives Break & Markets Correct

$SPY / $QQQ correct even in strong uptrends, but it feels worse because media panic amplifies every dip.

In this short video, I explain why big narratives like rate cuts, AI or #Bitcoin liquidity always break and why this pullback is still normal for a bull market.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-28-25 Black Friday Special Edition

It's a cornucopia of content for this Friday following Thanksgiving, and Richard Rosso and Jonathan McCarty bemoan the demise of the U.S. Penny, the fallacy of risk tolerance questionnaires, Rich's Financial Fitness Garage and creating Retirement income; plus Rich's salutation for Thanksgiving.

0:00 - INTRO

0:44 - The Demise of the U.S. Penny

4:54 - Financial Risk Surveys - Rich & Jonathan's Scores

11:05 - Rich's Fitness Garage - Creating...

Read More »

Read More »

11-21-25 Roth Conversion Strategy: What Actually Works

Not all Roth conversions are created equal — and new research shows a clear winner.

Richard Rosso breaks down a study that modeled hundreds of thousands of retirement scenarios to determine which Roth conversion strategy performs best over a 10-year period:

• Staying in a traditional IRA/401(k) and taking RMDs

• A one-time Roth conversion

• A gradual, multi-year conversion strategy

We examine how taxes, RMDs, longevity, and investment returns...

Read More »

Read More »

Capex Spending On AI Is Masking Economic Weakness

The U.S. economy’s recent growth has a distinctive engine: large‑scale capital expenditures (capex) tied to artificial intelligence (AI). Firms such as Microsoft, Alphabet (Google), Meta Platforms, and Amazon have announced massive investments in data centers, servers, networking equipment, and AI infrastructure. As noted by Investing.com: "Artificial intelligence is consuming capital faster than investors can recalibrate. …

Read More »

Read More »

Rate Cut Odds Slip Due To Lack Of Data

As we share below, the odds of a Fed Funds rate cut at the December FOMC meeting are down to 33%. On Wednesday, there was an abrupt repricing of rate cut odds after the BLS cancelled the October employment report and delayed the November data until December 19th. Furthermore, the BLS JOLTS report for September … Continue reading »

Read More »

Read More »

11-20-25 Wall Street Is Turning Bitcoin Into Just Another Volatile Asset

The #Bitcoin original promise of decentralization is fading as ETFs like $IBIT pull it deeper into Wall Street’s ecosystem.

In this Short video, Michael Lebowitz and I discuss how short-term traders and arbitrage flows now drive more volatility, diluting true holders and turning $BTCUSD into just another tradable asset.

📺Full episode: _r_I

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-20-25 How The Fed Deals Liquidity: The Monetary Toolbox

How does the Federal Reserve actually supply liquidity to the financial system? And why have markets become so dependent on the Fed since 2008?

Lance Roberts & Michael Lebowitz break down the complete Fed liquidity toolkit—from QE and QT to the Standing Repo Facility, IORB, ON RRP, OMO, and the Discount Window—and explain why these tools create the “floor and ceiling” of overnight rates.

0:00 - INTRO

0:18 - Nvidia Kill It; Rate Cut Odds...

Read More »

Read More »

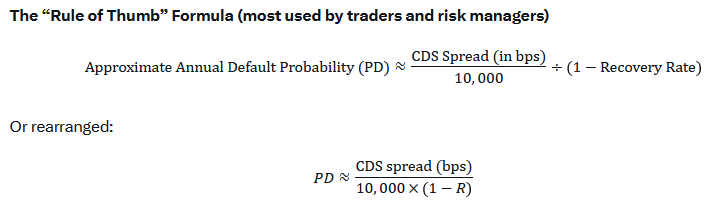

Oracle And CoreWeave CDS Spreads Widening: Omen Or Jitters

Fear is being spread on social media that some AI players are nearing default. The evidence, some say, lies in the Bloomberg graphs below showing the widening CDS spreads of Oracle and CoreWeave. Before getting into some details about what the CDS markets may be warning about Oracle and CoreWeave, let's explain what CDS is. …

Read More »

Read More »

11/25/25 The System Is Broken: What Money Really Means Now

The financial system we rely on today isn’t what it used to be. From the Fed’s creation of “reserves” instead of real money to the collateral-driven markets that emerged after 2008, Lance Roberts & Garrett Baldwin break down how the game has changed—and what it means for your wealth.

We cover everything from repo markets, ETFs, and the Buffett Indicator to the rise of passive investing and why sovereign nations are quietly buying gold. Plus,...

Read More »

Read More »

11-19-25 Risk-Range Report: We Are Still In a Bull Market

$SPY / $QQQ pullback is not the start of a bear market.

In this short video, I look at the Risk-Range data confirming the broader bull trend and explain why this dip is an opportunity, not a danger.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-26-25 Confidence, Chaos, and The K-Shaped Economy

Peter Atwater, one of the leading voices on confidence-driven behavior in markets and society, joins Lance Roberts to share how certainty, control, and herd mentality shape every major trend investors face today.

Lance and Peter discuss The Confidence Map, why people behave differently when they’re in the “comfort zone” versus the “stress center,” and how these shifts explain the rise of speculative investing, the bifurcated K-shaped economy, and...

Read More »

Read More »

11-19-25 Pension or Lump Sum – What’s the Smarter Move?

Choosing between a company pension and a lump-sum payout is one of the biggest financial decisions many pre-retirees will ever face—especially for workers in industries facing layoffs or restructuring, like the major oil companies in Houston right now.

Lance Roberts & Danny Ratliff break down the key factors to consider when comparing a lifetime pension annuity versus taking a lump-sum distribution you can invest or convert into a private...

Read More »

Read More »

How The Fed Deals Liquidity: The Monetary Toolbox

In our last article, QE Is Coming, we focused on why the capital and financial markets have become so dependent on the Fed for liquidity. The article explains that, in the aftermath of the crisis, a slew of regulations drastically changed the liquidity landscape. As a result, the Fed—not the private market—is now the primary …

Read More »

Read More »

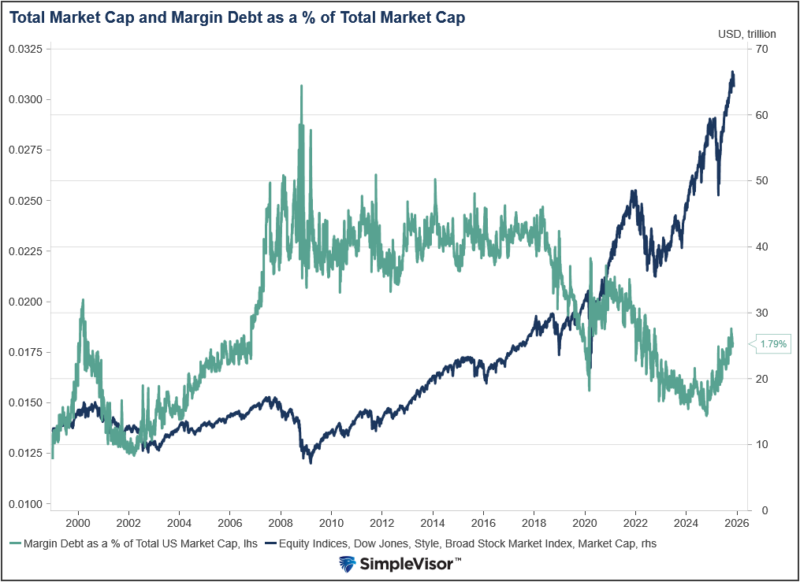

Margin Debt Sets Records: Should We Be Concnered?

There is a strong historical relationship between margin debt and the stock market. Given that margin debt just set a record at $1.18 trillion, it's worth appreciating the mechanics that support this relationship and what it may tell us about how much longer the bull market may run. When stocks rise, the wealth effect kicks …

Read More »

Read More »

11-18-24 The Simple Rule That Keeps You On The Right Side Of The Market

$SPX / $SPY just broke below its 50-day moving average, making the next support levels crucial.

In this short video, I show how to read these trend shifts so you know when to stay invested and when the weakening momentum may call for trimming exposure.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-18-25 Indicators & Income: What Retirees Must Know (Who Can You Trust)?

Lance Roberts & Jonathan Penn tackle two of the biggest gaps in financial education:

How to actually use RSI, MACD, Money Flow, and MACD Histogram together, and why post-retirement planning (the “decumulation” phase) is so overlooked—yet absolutely critical.

If you’re an “Ole Coot” looking to better understand technical indicators… or a younger “You’t” trying to build financial literacy early… Lance and Jon break down the mysteries of...

Read More »

Read More »

Apple Out Google In: Warren Buffett’s Latest Moves

Warren Buffett's Berkshire Hathaway has long viewed Apple as its crown jewel. In early 2024, Apple shares accounted for nearly 25% of the Berkshire Hathaway portfolio. However, Buffett has been selling out of Apple since then, trimming its stake by over 40%. Based on Buffett's comments, they are reducing their holdings due to concerns about …

Read More »

Read More »

11-27-25 Market Cycles, Tariff Checks, & 50-Year Mortgages

Out Thanksgiving Day special, featuring Lance Roberts, Danny Ratliff, and Michael Lebowitz opining what he would do, were he to run the Federal Reserve, and why you shouldn't spend that $2k tariff refund just yet.

Read More »

Read More »

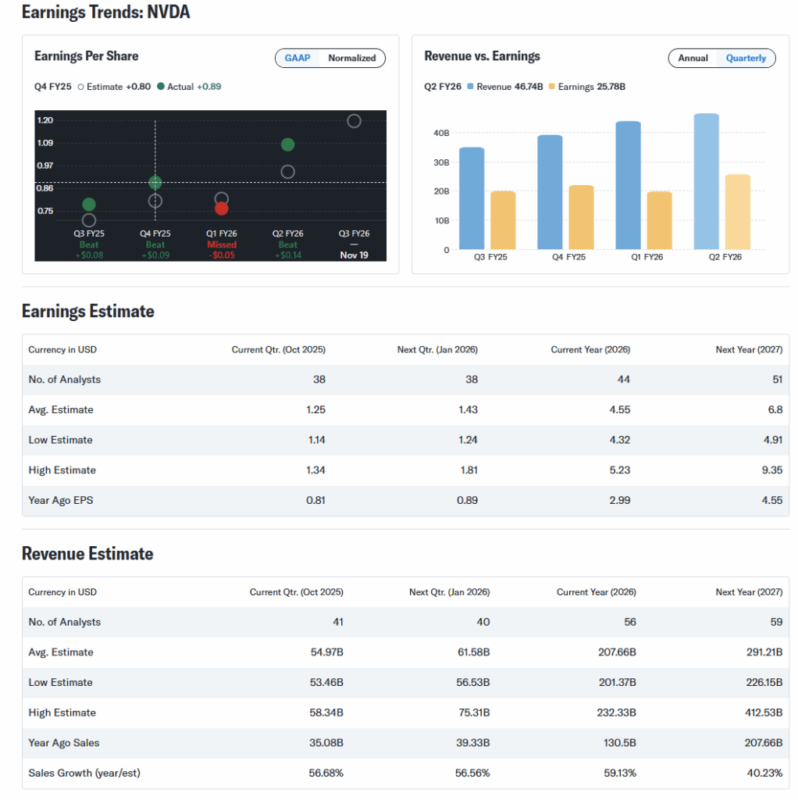

11-17-25 Wall Street’s 2026 Earnings Expectations: Real Growth or Just a Dream?

The market is betting on big earnings growth in 2026, but the economy may not deliver.

In this short video, I break down why strong forecasts clash with weak labor data and what that tension means for the outlook ahead.

📺Full episode: -K-dbfV_o

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

$SPX / $SPY $NDX / $QQQ

Read More »

Read More »

11-17-25 Full Market Cycles: Why Bull Runs Always Meet Their Match

Full market cycles matter more today than at any point in the last 15 years. Lance Roberts breaks down why valuations, history, and market structure all point to a simple truth:

Every bull market is only half the story. The other half is the bear. Lance's approach isn’t bullish or bearish. It’s risk-focused. Your job as an investor isn’t to predict the next crash—it’s to avoid catastrophic losses that erase years of gains during the completion of...

Read More »

Read More »