Category Archive: 9a.) Real Investment Advice

12-2-25 Don’t Buy The “Death of the Dollar” Story$DXY

The #USDollar isn’t dying and its global dominance isn’t under threat.

In this short video, I explain why the fear-driven “death of the dollar” narrative ignores economic reality and relies on misleading charts rather than facts.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

12-2-25 LIVE Q&A: Ask Us Anything About Markets & Money

Welcome to our LIVE Q&A session!

Lance Roberts is taking your questions directly from the YouTube live chat—covering markets, investing, retirement planning, inflation, interest rates, the Federal Reserve, portfolio strategy, risk management, and your personal finance questions.

No scripts, no agenda—just real-time answers based on data, history, and risk-focused investing principles.

We’ll break down what’s moving the markets, how to think...

Read More »

Read More »

How to Reduce Taxes on Investment Gains: Advanced Strategies for High Net Worth Investors

Building wealth requires more than market awareness; it requires keeping as much of your earnings as possible. High net worth investors face steeper tax exposure, wider reporting thresholds, and more complex investment structures. Learning how to reduce taxes on investment income is one of the most effective ways to strengthen long‑term performance. Below are the …

Read More »

Read More »

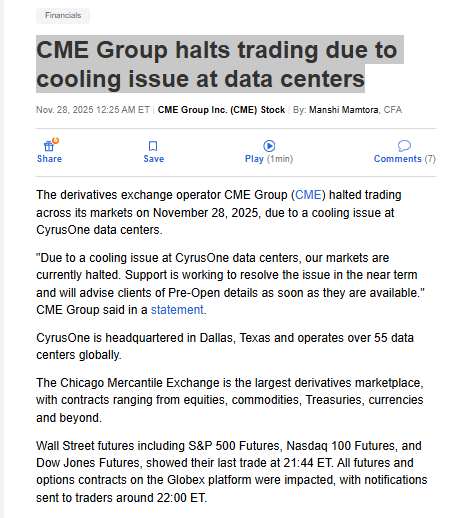

Overheating Financial Markets Highlight Data Centers Handicap

The Chicago Mercantile Exchange (CME) trading platforms were shut down for approximately 4 hours due to overheating after its cooling system at its Illinois data center failed. The outage began around 10:00 p.m. ET on November 27, halting about 90% of global derivatives volume on the Globex platform across futures and options for equities, bonds, …

Read More »

Read More »

12-1-25 A Perfect Year-End Rally Setup But With One Big Warning

Markets $SPX $NDX followed classic seasonality with a November dip that set up a potential year-end rally. But after six straight monthly gains, the odds of a pullback are rising.

In this short video, I explain why seasonality supports upside, but this streak makes risk management more important than ever.

Read More »

Read More »

12-1-25 Bear Markets Are a Good Thing

Bear markets aren’t the enemy—they’re the reset that creates future returns.

Lance Roberts breaks down why market downturns are a normal, necessary, and even healthy part of a full market cycle. We explore how bear markets cleanse excess speculation, reset valuations, restore forward returns, and give disciplined investors long-term opportunities to improve financial outcomes.

We’ll discuss why drawdowns feel worse than they are, why expectations...

Read More »

Read More »

A Bear Market Is A Good Thing.

One of my favorite writers for the WSJ is Spencer Jakab, who recently penned an article explaining why a bear market is not necessarily a bad thing. He starts with a quote from "The Godfather." "“These things gotta happen every five years or so, ten years. Helps to get rid of the bad blood…been ten … Continue reading »

Read More »

Read More »

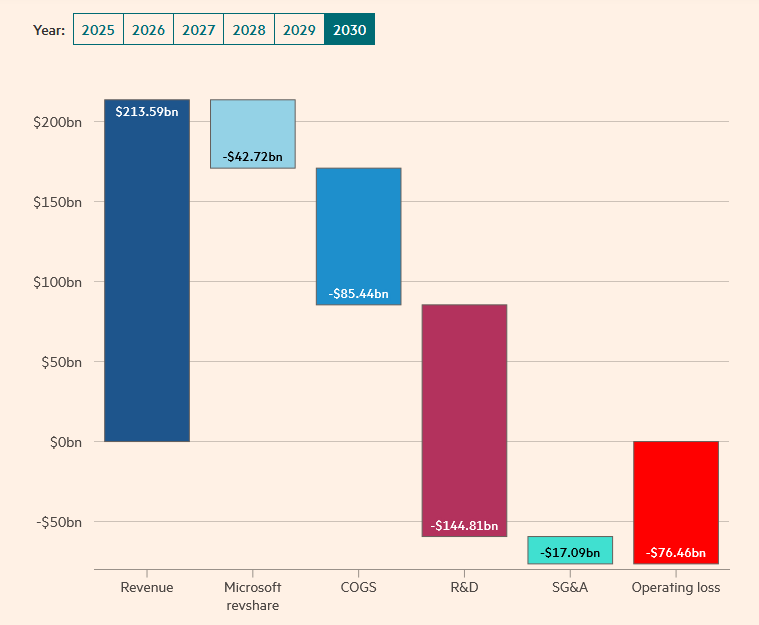

HSBC Casts Doubt On OpenAI’s Future

Per the Financial Times (LINK), HSBC has serious doubts about OpenAI's financial wherewithal. The following bullet points outline HSBC's assumptions, which highlight the challenging financial path OpenAI faces. The graphic below from the article shows that HSBC expects OpenAI to run a massive operating loss in the year 2030. Accordingly, they have serious concerns about …

Read More »

Read More »

Year-End Rally Begins

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

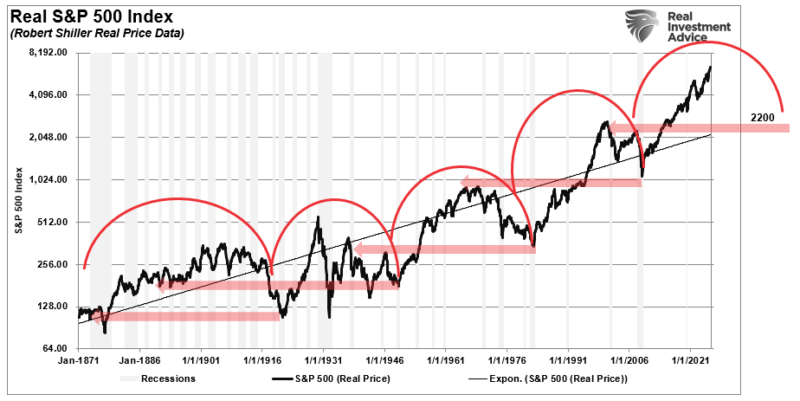

From Secular Bull To Secular Flat: The Next Likely Market Regime

We’re nearing the end of a remarkably long secular bull market.

In this short video, I explain why the next phase is usually a long period of sideways, volatile returns as valuations reset and the market shifts into a secular flat regime.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

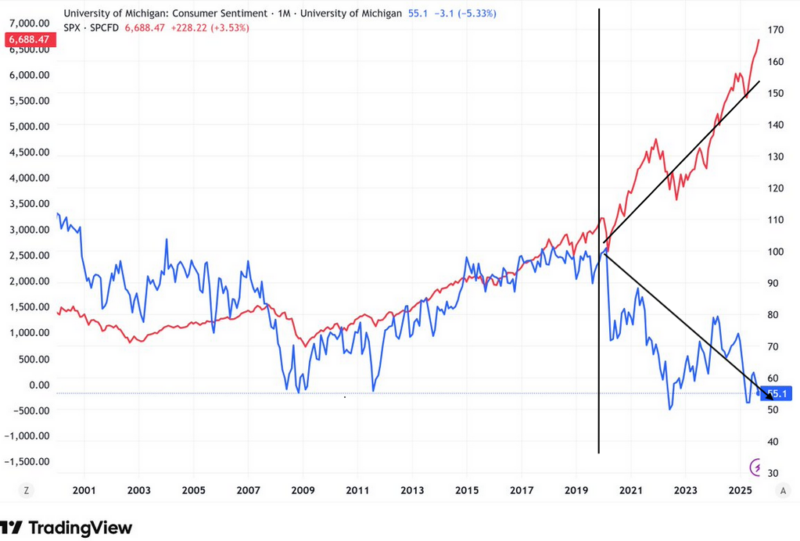

The K Shaped Economy In One Graph

Tuesday's weak Consumer Confidence report was a good reminder of why some economists are calling our economy the K shaped economy. The Conference Board Consumer Confidence Index fell 6.8 points to 88.7 in November, below expectations of 93. Moreover, it sits at levels similar to those of early 2020, when the pandemic shuttered the economy. …

Read More »

Read More »

Why Peak Confidence Is At Market Peaks

When investors feel certain and in control, risk is actually at its peak.

In this short video, @Peter_Atwater and I discuss how this “comfort zone” blinds investors to uncertainty and inflates market optimism.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

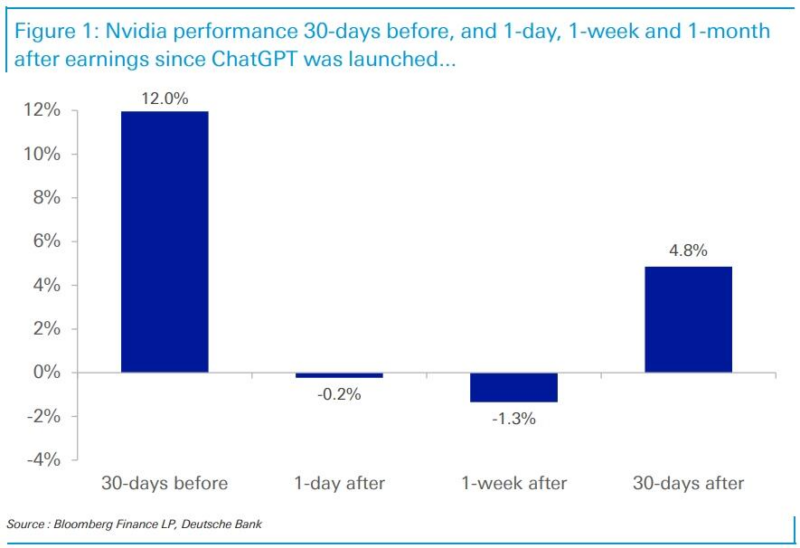

TPUs Or GPUs: Is Nvidia’s Moat Eroding?

Markets have priced Nvidia as the clear winner in AI chip production. To some, its moat appears impenetrable. Google's developments suggest there may be some competition. Google has been training and serving its AI platform with in-house tensor processing units (TPUs). These chips are more cost-effective and power-efficient than Nvidia’s GPUs. By using TPUs in …

Read More »

Read More »

The Biggest Myth About “Money Printing” Explained

The Fed doesn’t print money.

In this short video, Garrett Baldwin and I discuss how real money is created through government debt issuance and bank lending, why Fed actions are just asset swaps, and why modern money is always lent into existence rather than printed.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

Ray Dalio Says Sell: But Not Yet

Ray Dalio is considered by many investment professionals to be a market maven. This is because of the wild success of his hedge fund, Bridgewater, with assets under management of $136 billion, as well as several best-selling economics/finance books he has written. In recent times, Ray Dalio has repeatedly emphasized that markets are in a … Continue...

Read More »

Read More »

Bitcoin Isn’t as Scarce as You’ve Been Told

In this short video, Parker White, CFA from @defidevcorp and I discuss how #Bitcoin infinite fractionalization mirrors monetary expansion and why the real advantage comes from who gets new money first, not just how much money exists.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

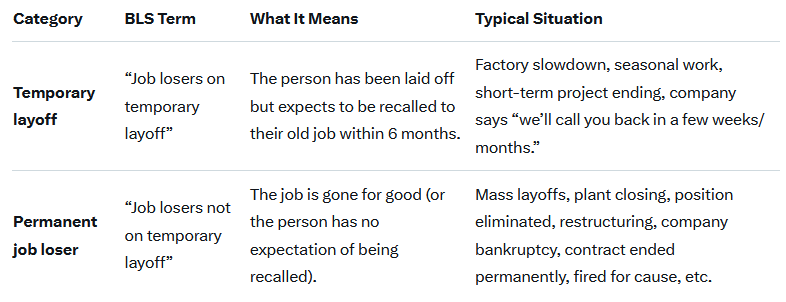

Permanent Job Losers: A Worrying Facet Of Today’s Economy

Given the two-month delay, Thursday's BLS employment report on September labor market conditions was not nearly as pertinent as the BLS data typically is. Despite it being old news, it is worth sharing that the number of jobs increased by 119k, but the unemployment rate ticked up from 4.3% to 4.4%. The markets didn’t seem …

Read More »

Read More »

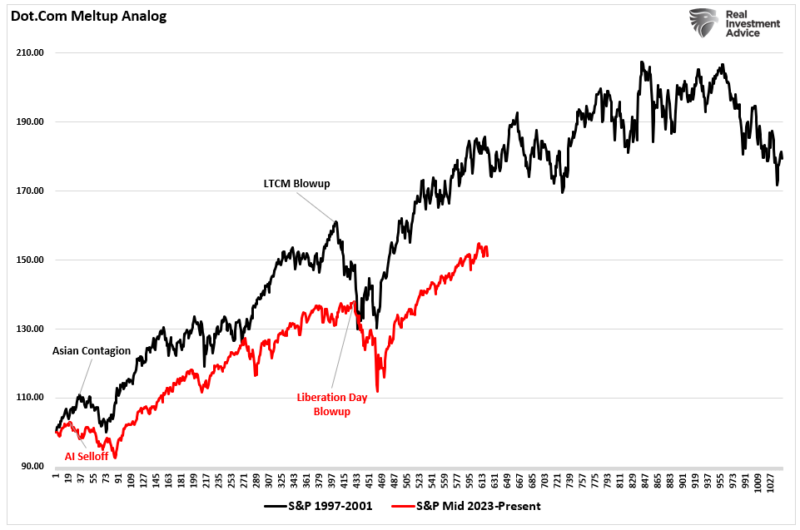

Market Bubbles: A Rational Guide To An Irrational Market

We’re hearing it everywhere: AI is in a bubble. The surge in capital, the parabolic stock charts, and the bold claims from CEOs all have a familiar rhythm. Nvidia’s valuation has soared, along with AI-related startups raising billions with little to no revenue. Investment in data centers, chips, and infrastructure is happening at a scale …

Read More »

Read More »

11-22-25 How the Fed Controls Every Asset You Trade

The Fed is now the single most important source of liquidity in every major market.

In this short video, Michael Lebowitz and I break down the key signals that reveal when liquidity stress is building and why they matter for every asset you trade.

📺Full episode: _r_I

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

The AI Trade: Opportunity Or Warning?

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »