Category Archive: 9a.) Real Investment Advice

Longest Bond Bear Market Since 1790: Are Better Days Ahead?

? Are we out of the woods yet with bonds? ? This bear market is the longest since 1790! Economic slowdown and low inflation are driving yields down. #FinanceFacts #EconomicTrends

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-2-24 Is Inflation Beating or Benefiting You?

Richard and Danny discuss the week's market moves, and how bad news is actually bad news now; Intel's poor performance should be no surprise to astute investors; sometimes "value" stocks are value traps. Understanding (and avoiding) the day-to-day media hype. How to use "Money Buckets" to balance risks and demands on retirement funds; 2024 looks to be a mirror of 2023, with weaker economics. How to balance two sides of the...

Read More »

Read More »

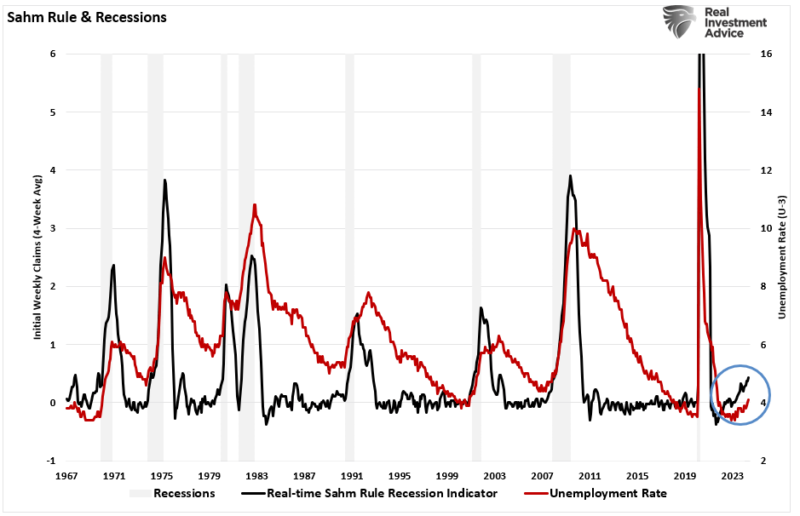

The Sahm Rule, Employment, And Recession Indicators

Economist Claudia Sahm developed the “Sahm Rule,” which states that the economy is in recession when the unemployment rate’s three-month average is a half percentage point above its 12-month low. As shown, the latest employment report has triggered that indicator.

So, does this mean a recession is imminent? Maybe. However, we can now add this indicator to the long list of other recessionary indicators, also flashing warning signs.

As...

Read More »

Read More »

Inflation Drops Below Fed’s 2% Goal, Signaling Weakening Economic Pressures

Inflation index drops to 1.5% below Fed's target. Wage growth declining, no real pressure seen. Stay tuned for more insights in tomorrow's article (8/2) on the SAHM rule.

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Using Home Equity to Maintain Financial Independence

Survival mode activated! My house may be a frozen asset, but it's also a lifeline for income. Not selfish, just smart. #financialfreedom

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

8-1-24 The Fed Stands Pat

Jerome Powell & Co. hold fast to the current doctrine...Lance and Michael discuss the ramifications for investors now.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned in this report:

"Is There Value In Small Cap Value Versus Large Cap Growth?"...

Read More »

Read More »

Aging in Place: How Reverse Mortgages Can Help You Stay Comfortable

Considering aging in place? Learn how a reverse mortgage line of credit can help maintain your lifestyle without worrying about lawn mowing. #FinancialTips #ReverseMortgage

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-31-24 Should You Share Your Wealth Sooner than Later?

Many wealthy people choose to pass on wealth when they die, but that's not the only way. Passing on assets during your lifetime can have big benefits, both psychological and practical, and beyond alleviating financial stress, early inheritance can provide a test run for future big gifts.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive...

Read More »

Read More »

How Your Confidence Can Boost or Break the Economy

Confidence is key for a thriving economy! Feeling good about finances drives spending & market growth. Investor sentiment plays a vital role too! ?? #EconomicImpact

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-30-24 Why Market Comparisons Can Hinder Your Portfolio’s Performance

Earnings season continues with 39% of S&P reporting this week; by week's end, 79% of companies will have shared results...and the buy back window opens anew. The Fed meeting begins today, with a slim chance for a surprise rate cut; a more dovish tone will encourage markets, however, and anticipate rate cut by September. Commentary on markets' 3% correction & Japanese Yen carry trade effects. Addressing the correct response to correction:...

Read More »

Read More »

Economic and Financial Stress Signals Emerging in Market Trends

?? Economic and financial stress signals emerging in the bond market. Stay alert for potential surprises ahead! #marketinsights #Fed #economy

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-29-24 What Does the Fear and Greed Index Mean for Investors?

Markets prepare to wrap July; what will the Fed do this week? McDonald's Quarterly Report showing consumer pullback. Article tease on trying MMT and the Sam Altman experiment. Market correction last week followed by rally bounce; sell-signals are still in place, indicating the correction isn't over. Commentary on Olympic Sacrilege and electric karma; will there be a deeper correction? Lance explains the shifts in investor sentiment from fear to...

Read More »

Read More »

Why Markets Thrive Regardless of Election Results

Market benefits from election outcomes as money flows into trades post-election. Markets adapt quickly to new policies, gravitating higher over time. #ElectionImpact

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How to Spend Your Retirement Savings Wisely

? Planning for retirement? Moving from saving to spending is key! Let's talk about managing your retirement accounts wisely. ? #retirementplanning

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How to Invest in High Safety Corporate Bonds

Understanding the importance of safety when investing in corporate bonds. Choose wisely to avoid defaults. #InvestingTips #CorporateBonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-26-24 Should You Tap Your Home Equity for Retirement Income?

Rich & Danny recap Danny's recent accident; Rich's market summary includes a preview of today's PCE release. Markets are awaiting confirmation of a trend. Dealing with the election fallout on your money; markets have already priced-in everything you know. PCE will move markets today; there is still $500-billion in unspent government funds from the Inflation Reduction Act. Dealing with data breaches. Retirees' biggest worry is about income: What...

Read More »

Read More »

How Inflation Impacts Demand for Loans and Interest Rates

Understanding the correlation between inflation, loan demand, and interest rates is key. Learn more about longer duration bonds and their impact! ?? #Finance101 #InterestRates #Bonds

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-25-24 How Your Confidence Can Boost or Break the Economy

The S&P Global Services Index is "great," in contradiction to other eocnomic metrics; the first estimate of Q2 GDP is released today (up 2.8%); this will be revised. Important to note the behavior of GDP prior to past recessions, which are always back-dated. 350-days without a 2% correction, until Wednesday. Bill Dudley is calling for lower interest rates now; Lance Roberts & Michael Lebowitz explain the crucial link between...

Read More »

Read More »

Inflation and Retirement: Adjusting Your Spending Plan

Retirees must adjust their budgets and spending to compensate for inflationary forces. #FinancialPlanning #Budgeting

Want to learn more? Subscribe to our YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

7-24-24 How to Invest, or not, in a Presidential Election

Trump Hasn’t Won the Election Yet. The Stock Market Is Acting Like He Already Has. Lance Roberts & Danny Ratliff discuss what-if's and which sectors to watch...either way. Plus, which strategy wins the Retirement Spending smack-down, and why you need to plan to spend-down your retirement nest egg.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Planner, Danny Ratliff, CFP

Produced by Brent Clanton,...

Read More »

Read More »