Category Archive: 9a.) Real Investment Advice

Smart ETF Tax Strategy: Avoid Losses and Maximize Profits

Did you know you can sell one ETF at a loss and buy another similar one without tax implications? ETFs play by different rules! ?? #InvestingTips

Watch the entire show here: https://cstu.io/b79ad1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Dollar And Domestic – International Relative Stock Returns

The U.S. dollar index is up over 6% this year, almost all attributable to a post-election surge. As many developed nations show stagnant economic growth or even contraction, the U.S. economy continues to hum. Further bolstering the dollar is the likelihood that the Fed will slow rate cuts or stop them after this Wednesday's FOMC …

Read More »

Read More »

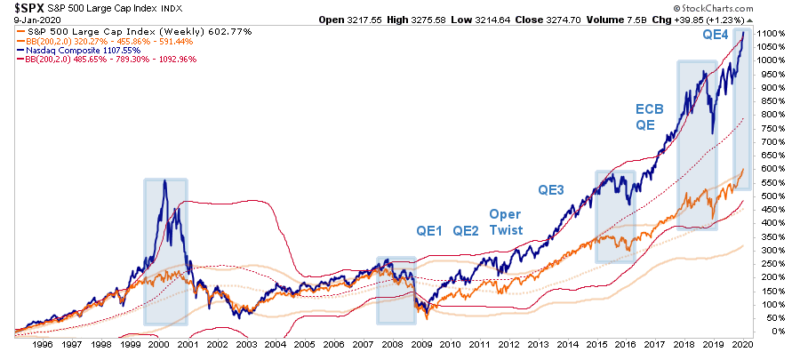

Permabull? Hardly.

I never thought someone would label me a "Permabull." This is particularly true of the numerous articles I wrote over the years about the risks of excess valuations, monetary interventions, and artificially suppressed interest rates. However, here we are. "Lance, you are just another permabull talking your book. When this market crashes you will still be telling …

Read More »

Read More »

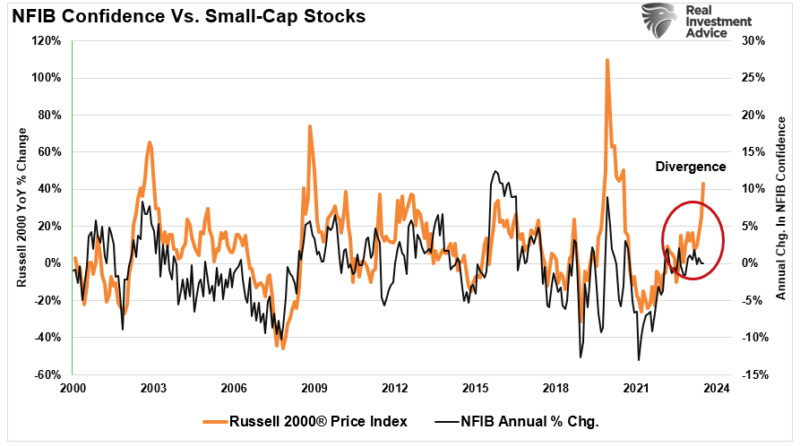

12-16-24 Why NFIB Optimism Matters

Over the last several years, we have regularly discussed the importance of the National Federation Of Independent Business Survey (NFIB) concerning the economy. As noted in our most recent update (October 12th) on the index:

“While Wall Street’s bullish narrative is compelling, the latest data from the NFIB Small Business Optimism Index provides a stark contrast. Small businesses are the backbone of the U.S. economy, and the sentiment captured in...

Read More »

Read More »

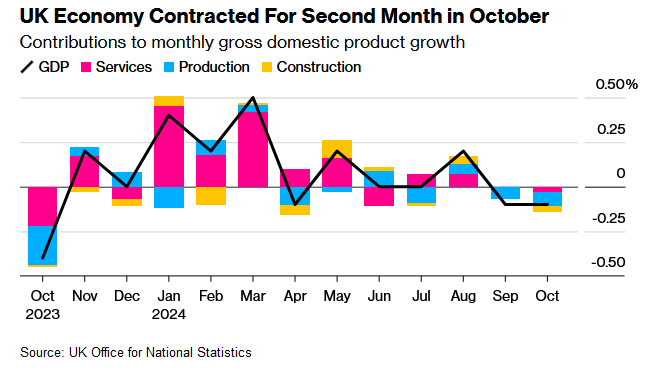

Britain And European Economic Growth Sputters

Yesterday's Commentary touched on the divergence between robust economic growth in the U.S. and near-recessionary conditions in Canada. We highlighted the importance of this to U.S. investors because of the historically strong correlation between the two economies. Unfortunately, Canada is not a one-off instance. Britain, Europe, and China also exhibit poor economic growth. Given the …

Read More »

Read More »

The Role of Tax-Efficient Investing in Wealth Accumulation

When it comes to building long-term wealth, it’s not just about how much you earn but how much you keep. Taxes can significantly impact your investment returns, making tax-efficient investing a crucial component of any wealth accumulation strategy. By utilizing tax-advantaged accounts, employing strategies like tax-loss harvesting, and selecting tax-efficient funds, investors can reduce their …

Read More »

Read More »

How Expectations Drive Short-Term Market Returns

Invest wisely! Market values depend on expectations. Don't just follow the crowd. #investingtips #marketexpectations #stocks ??

Watch the entire show here: https://cstu.io/c78d89

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Technical Analysis: Your Market Navigation Tool

Technical analysis is like a roadmap for navigating the market in real-time. It helps us understand market trends and make informed decisions. ? #StockMarket #Investing

Watch the entire show here: https://cstu.io/ebfef4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Trump Election Sends NFIB Optimism Surging

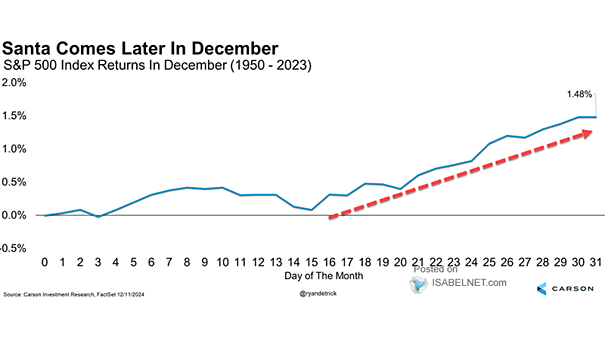

Inside This Week's Bull Bear Report First Comes The Fed, Then Santa Last week, we discussed that the risk to the markets was the annual portfolio rebalancing process. To wit: "With the year-end approaching, portfolio managers need to rebalance their holdings due to tax considerations, distributions, and annual reporting. For example, as of this writing, …

Read More »

Read More »

Understanding Market Corrections and Bear Markets with Lance Roberts

Market correction vs crash explained! A 50% decline doesn't mean a bear market. Stay informed to navigate the stock market like a pro! ?? #investingtips

Watch the entire show here: https://cstu.io/0621ba

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

12-13-24 Looking Ahead to 2025: Realize Gains or Change Exposure?

Everyone has a forecast for 2025. What does that really mean for you and your money? Should you realize gains or change exposure? Danny and Matt also explore what happens at age 73, proper RMD strategies and Inherited IRA uncertainties, and whether you should work with a Donor Advised Fund or private charitable foundation? Danny and Matt will share some investment strategies for 2025 and the implications of realizing capital gains, plus Portfolio...

Read More »

Read More »

Is Canada A Canary In The Economic Coalmine?

On Wednesday, the Bank of Canada cut its key benchmark rate by 50bps. They have now cut by 150 bps in 2024, compared to what will likely be 100 bps for the Fed after next week's meeting. Unlike the Fed, Canada’s central bank is fighting off a recession. Canadian real GDP for the last four … Continue reading »

Read More »

Read More »

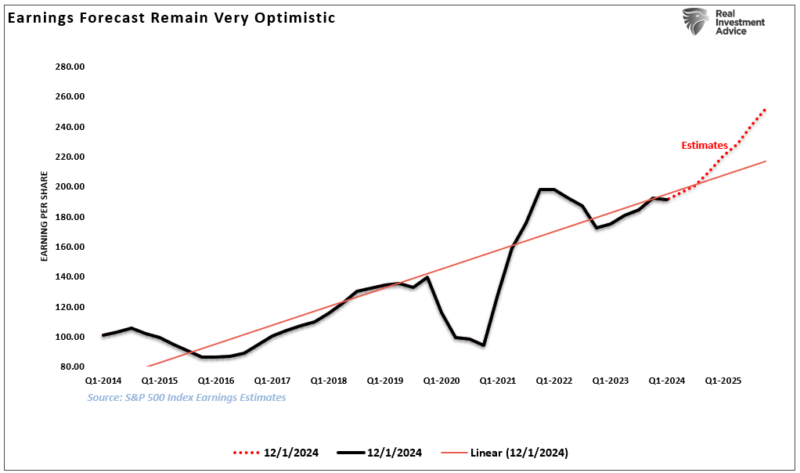

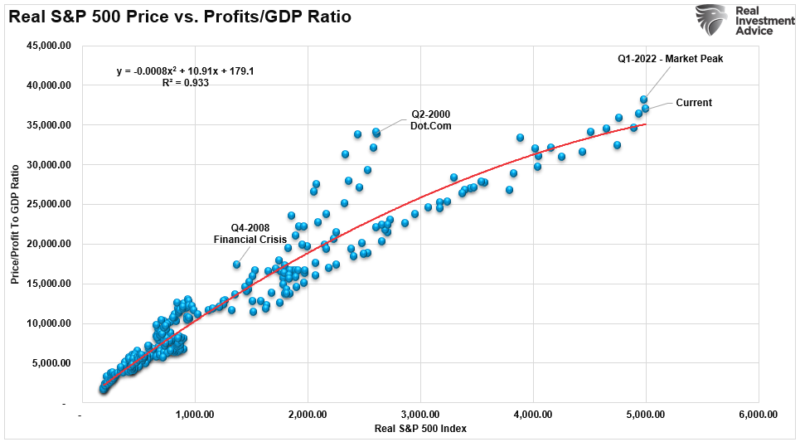

Economic Indicators And The Trajectory Of Earnings

Understanding the trajectory of corporate earnings is crucial for investors, as these earnings significantly influence stock valuations and market performance. Economic indicators such as Gross Domestic Product (GDP), the Institute for Supply Management (ISM) Manufacturing Index, and the Chicago Fed National Activity Index (CFNAI) provide valuable insights into the economic environment that shapes company profitability. …

Read More »

Read More »

The Benefits of Starting Retirement Planning Early in Your Career

Retirement may seem like a distant milestone when you’re in the early stages of your career, with other financial priorities like paying off student loans, building an emergency fund, or saving for a home often taking center stage. However, starting your retirement planning early offers significant advantages that can make a profound difference in your …

Read More »

Read More »

12-12-24 CPI Gives The Fed a Green Light for Rate Cut

Yesterday’s CPI report was seemingly the last hurdle for the Fed to cut interest rates. With the CPI index matching Wall Street forecasts, the Fed Funds futures market now implies a 97% chance the Fed will cut rates next Wednesday. The data was OK but elicits fears that the downward price progress has stalled.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Portfolio Manager Michael Lebowitz, CFA

Produced by Brent Clanton,...

Read More »

Read More »

Predicting Market Crashes Without Timing Hurts Investors More Than It Helps

Ever feel frustrated with vague forecasts? ? Don't worry, you're not alone! Timing is key when it comes to predicting the stock market crash! ⏰? #StockMarket #TimingIsEverything

Watch the entire show here: https://cstu.io/386b3e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Rosso’s Top 2025 Reads and Holiday Gift Idea.

As most know, books are my passion. For me, it's all about gifting knowledge for the holiday season. There's nothing more exciting to me than to peruse used book outlets and antique stores that sell ancient reads for pennies on the dollar. Also, new book releases excite me. My reading topic interests vary. However, most …

Read More »

Read More »

CPI Was On The Screws: The Fed Has The Green Light

Yesterday's CPI report was seemingly the last hurdle for the Fed to cut interest rates. With the CPI index matching Wall Street forecasts, the Fed Funds futures market now implies a 97% chance the Fed will cut rates next Wednesday. The data was OK but elicits fears that the downward price progress has stalled. The … Continue...

Read More »

Read More »

Market Uncertainty: Will Earnings Meet Expectations Amid Policy Hurdles?

Feeling uncertain about future policies & earnings? ? Experts warn of potential surprises next year. Stay tuned! ? #EconomicOutlook #StayInformed

Watch the entire show here: https://cstu.io/7c9238

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

China Is No Longer The Marginal Buyer Of Oil

From 2010 through 2022, the US Energy Information Administration (EIA) calculates that global oil demand grew by 10 million barrels per day (Mb/d). Over 60% of the demand growth was due to China's phenomenal economic growth. For context, American demand increased by less than 10%. The graph below shows that China once drove global oil …

Read More »

Read More »