Category Archive: 9a.) Real Investment Advice

A Comprehensive Guide to Retirement Planning for Every Stage of Life

Planning for retirement is a lifelong journey that evolves as you progress through different stages of life. A well-thought-out strategy not only ensures financial security but also helps you achieve the lifestyle you desire during your golden years. This retirement planning guide breaks down the process into manageable phases—from early career to post-retirement—emphasizing the importance …

Read More »

Read More »

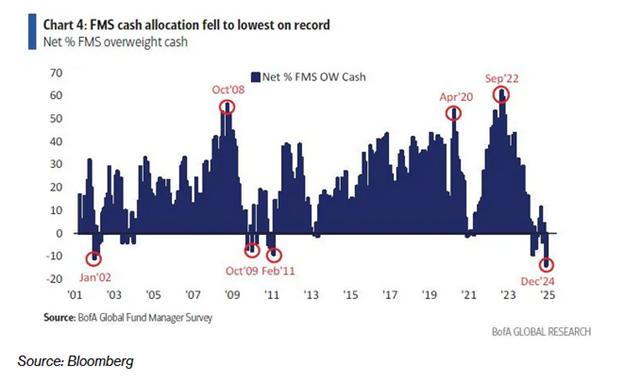

Cash Allocations Send an Ominous Signal

Administrative Note: We will not publish a daily market commentary tomorrow or Wednesday. Everyone at RIA Advisors would like to extend our sincere blessings to you and your families and our wishes for a very Merry Christmas. _________________ According to Bank of America, institutional fund managers are sitting on record low cash allocations as they …

Read More »

Read More »

The Impact of Regulation and Taxes on Consumer Prices and Economic Growth

Prices rising due to regulations and taxes are passed on to consumers. As wages increase, so do goods/services prices. It's all connected! ? #EconomyGrowth

Watch the entire show here: https://cstu.io/584ca2

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Why Mississippi Is Wealthier Than France: The Power of Free Markets

Why is America the richest country? In Mississippi, the poorest state, GDP per capita is higher than France. ?? #wealth #economy

Watch the entire show here: https://cstu.io/747d6d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

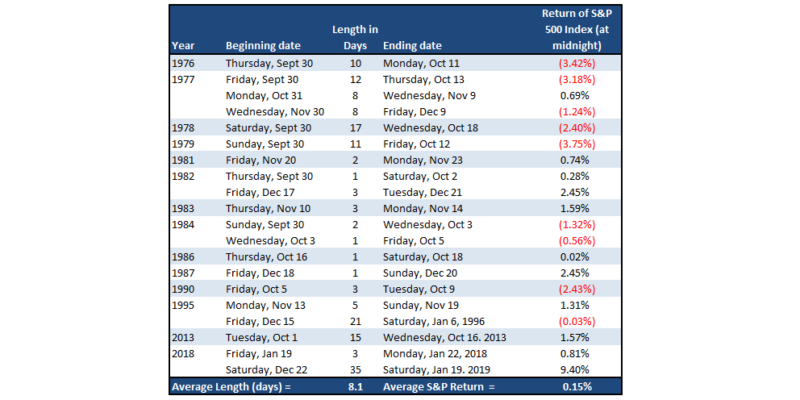

Santa Claus Rally Or Did The Fed Steal Christmas?

Inside This Week's Bull Bear Report Powell & A Government Shutdown Hits Stocks Last week, we noted the ongoing market churn that could last into this week's Fed meeting. To wit: "That certainly seemed the case this past week, with the market trading being fairly sloppy. Attempts to push the market higher were repeatedly met …

Read More »

Read More »

2024 Christmas Break

Yup--we're on a break until the New Year!

Wishing you and your family a safe and happy holiday, and while we're away you can playback your favorite audio podcast on iTunes and Spotify and other popular streaming platforms. The link to Audio on the Go is here on our website:

https://realinvestmentadvice.com/resources/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/

➢ RIA SimpleVisor: Analysis, Research, Portfolio...

Read More »

Read More »

Understanding Moving Averages: Essential Insights for Investors

? Understanding moving averages in trading! Shorter term rising faster = divergence, markets rising quickly. Closer averages = slowing momentum. #TradingTips #StockMarket ?

Watch the entire show here: https://cstu.io/e48796

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

12-20-24 What the Trump Win Means for Your Taxes

Rich & Danny's final live show of the year starts with coverage of Tariffs, inflation vs deflation, and Jerome Powell's performance as Fed Head. Being cautiously optimistic: We've been living in a government-driven economy: Markets aren't red or blue; they're green. How estate planning may evovled during the Trump presidency; will the SALT deduction return? Debt focus will change perspective. Richard discovers the NOK Box for estate planning....

Read More »

Read More »

Prediction For 2025 Using Valuation Levels

It’s that time of year when Wall Street polishes up its crystal balls and predicts next year's market returns. Since Wall Street never predicts a down year, these forecasts are often wrong and sometimes very wrong. For example, on December 7th, 2021, we wrote an article about the predictions for 2022. “There is one thing …

Read More »

Read More »

China Yields Collapse

Treasury yields rose sharply following the Fed meeting on Wednesday, yet they are collapsing in the world's second-largest economy, China. While our economy is robust, large foreign economies, including China, struggle. Our recent article Global Conditions and Commentary, highlights the strong historical relationship between the global economy and the U.S. Moreover, it summarizes the economic …

Read More »

Read More »

Will BRICS Countries Truly Dominate the Global Market: An In-depth Analysis

? Did you know about the BRICS countries' market domination theory? ? Watch to learn more! #BRICS #EconomicTheory #GlobalMarket

Watch the entire show here: https://cstu.io/4d9295

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

12-19-24 Did the Fed Steal Christmas?

Heads-up: We're on vacation for the next two-weeks starting Monday (12/23); audio podcasts will be available on iTunes, Spotify, and a host of other audio platforms. Check our website, www.realinvestmentadvice.com for complete links. The House's Continuing Resolution fails to pass muster, thanks to pressure from president-elect Donald Trump and the emerging D.O.G.E. team. Meanwhile, the Fed cuts rates, as expected, but adds a hawkish slant to their...

Read More »

Read More »

Strategies for Generating Reliable Income During Retirement

Creating a reliable income stream during retirement is essential to maintaining your lifestyle and achieving your financial goals. With longer lifespans and rising costs, having a clear plan for generating income is more important than ever. In this article, we’ll explore key retirement income strategies, including annuities, dividend-paying stocks, and bond ladders, and provide tips …

Read More »

Read More »

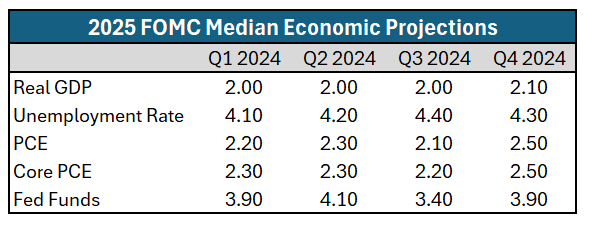

Cut And Pause: FOMC Summary

As widely expected, the Fed cut the Fed Funds rate by 25bps, to 4.25-4.50%, at yesterday’s FOMC meeting. Moreover, they intimated that after cutting rates by 1% since September, they are likely to be more data-dependent, which may slow the pace of further rate cuts. They want to see inflation trend lower again and/or the … Continue...

Read More »

Read More »

Use Drone Mentality to Financial Success.

Beware of the mysterious drones hovering over eight cities! They're causing quite a stir. However, what if a drone mentality to financial success truly existed? We probably wouldn't mind. Not long ago, Jeff Bezos, the CEO of Amazon, made big media headlines by suggesting that drones will be used to deliver light packages in the …

Read More »

Read More »

12-18-24 Dump the 60/40 for 100% Stock Retirement Portfolio?

It's Fed Day with it's much anticipated rate cut; what will matter more is the Fed's dot-plot and comments on expectations for 2025. Meanwhile on Wall Street, sloppy trading continues as fund manager rebalance portfolios. Markets are sitting on the 20-DMA and holding firm. The Healthcare Sector is the year's worst performer: Will it offer the most opportunity in 2025? This sector tends to perform better AFTER elections. Lance reveals a new...

Read More »

Read More »

Understanding the Impact of Inflation on Your Retirement Savings

Is a million dollars enough for retirement? ?? Watch to learn why inflation is a key factor to consider! #retirementplanning #financialtips ?

Watch the entire show here: https://cstu.io/9ecc27

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

More Revisions Coming To Employment Data

In August, the BLS revised 2024 employment growth lower by 818k jobs in its preliminary revision of its Current Employment Statistics (CES). Despite the substantial revision, more reductions to the official employment data are likely to come next month. In January, the BLS will release its final benchmark revision. The preliminary and final revisions to …

Read More »

Read More »

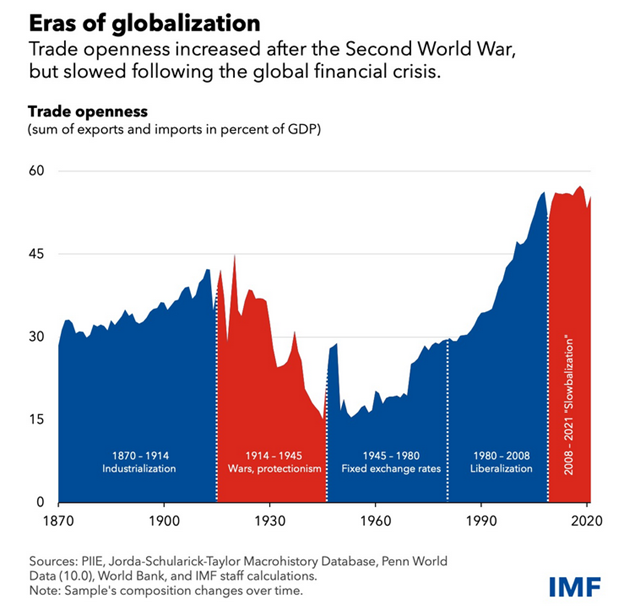

Global Conditions Portend A Catch-Down In America

For $20,000, you can buy a global airline pass to see the world. Or, for the low price of free, you can take a quick trip with us worldwide. Unfortunately, our global trip is not as exciting as an around-the-world pass. Still, it may enlighten you about some economic struggles abroad. Moreover, why, in time, …

Read More »

Read More »

12-17-24 This is Nuts

Retail Sales numbers this week will feed into expectations for 2025. Fed meeting tomorrow: Cut and pause, or cut and slow? Employment revisions are also due, but markets won't care. The stock market is still hitting all time highs, but that's not necessarily the case, sector by sector: Basic Materials, Industrials, Financials, and Energy are not mirroring the S&P 500; the Magnificent 7 is responsible for the bulk of growth. It's a very narrow...

Read More »

Read More »