Category Archive: 9a.) Real Investment Advice

2-6-25 Where Money Comes From

Markets remain in a bullish trend for the moment, despite disappointing economic news in the Trade Deficit and the ISM Services Index. Improving relative strength is also providing lift for the market. Technically, everything is fine despite disappointing news from AMD, Google, and others. Money flows continue to creep upward with continued buying. Lance and Michael spend the remaining segments of the show discussing money, currencies, and concepts...

Read More »

Read More »

The Role of Annuities in a Retirement Income Plan

Planning for retirement involves building a diverse and stable income strategy that ensures financial security throughout your golden years. Among the tools available, annuities in retirement planning offer a unique advantage: the ability to create a reliable, guaranteed income stream. However, understanding their types, benefits, and potential drawbacks is essential to determining whether they fit …

Read More »

Read More »

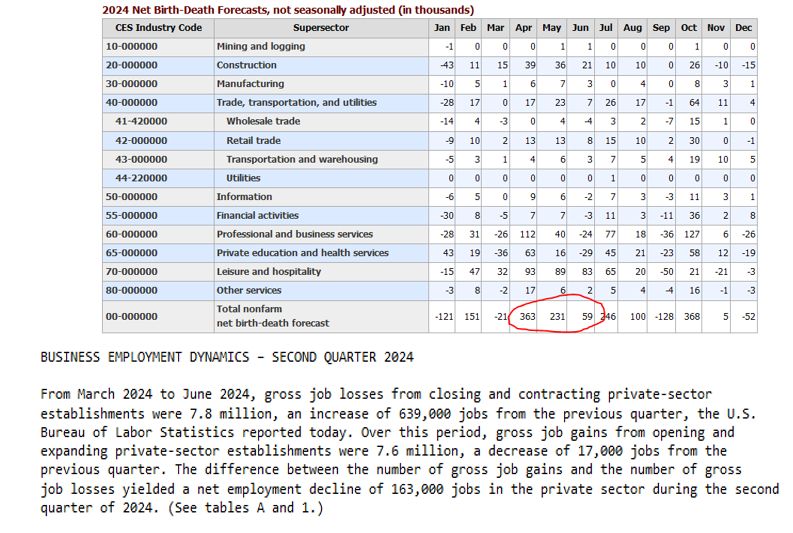

The Birth Death Adjustment: Trade With Caution

When formulating its monthly employment data, the BLS includes an adjustment for the net number of new jobs coming from new businesses and those lost by companies that have shut down. This adjustment is logical, as neither new nor closing firms are included in their surveys. While the so-called birth death adjustment is rational, the …

Read More »

Read More »

Master Discipline: Respecting Stop Loss Levels in Trading

Stay disciplined with your stop loss levels! Don't fall into the trap of constantly waiting for the price to go back up before selling. Approach trading with a different mindset. ? #TradingTips #Discipline

Watch the entire show here: https://cstu.io/354a00

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

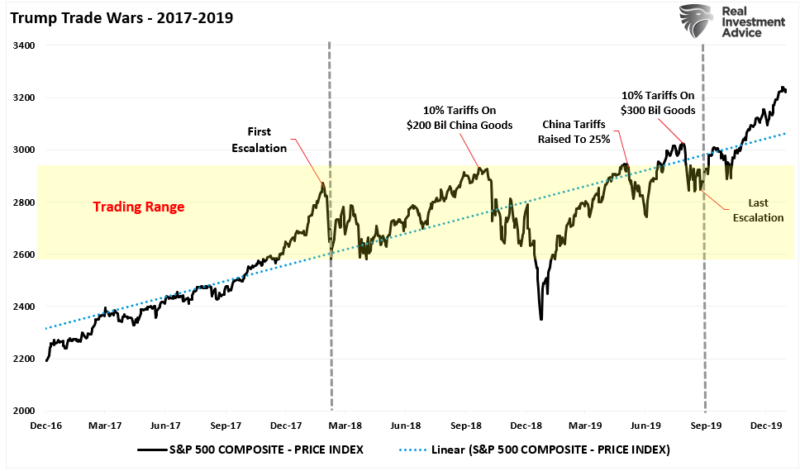

2-5-25 What the Bond Market is Telling Us About Trump 2.0

Markets are recovering from tariff troubles on Monday; a brief history of Trump's past trade wars & results; Google's earnings miss & correction; earnings have been okay, but epectations are slipping. The China Trade War retaliation begins; it's all about posturing. Markets rally from Monday; if you're worried about the volatility, there's too much risk in your portfolio. Lance razzes Danny "Bulldog" Ratliff about his absenteeism...

Read More »

Read More »

DOGE Deficit Reductions

The newly formed Department of Government Efficiency (DOGE), headed up by Elon Musk, is tasked with reducing government waste and increasing efficiency and productivity. The big question bond investors are keying on is how effectively DOGE can reduce the deficit. Tracking DOGE savings is now easy. As we share below, the US Debt Clock shows …

Read More »

Read More »

Where Does Money Come From?

All money is lent into existence. The Federal Reserve or the government does not print money. Those two facts are vital to understanding our lead question: where does money come from? Furthermore, knowing who does and doesn't print money and the incentives and disincentives that change the money supply are critical to inflation forecasting. …

Read More »

Read More »

Stay Balanced and Monitor Market Trends for Optimal Investment Performance

Don't let fear of a bear market hold you back! Stay informed with Simple Visor's tools to analyze the market trends. ? #InvestingTips #MarketAnalysis

Watch the entire show here: https://cstu.io/d4f84b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-4-25 Trade War Over!

Well that was fast.

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. The announcement of tariffs set the market on its heels Monday morning as media writers quickly pushed narratives about the potential impacts. However, as suggested on the “Real Investment Show” before the market opened on Monday, the best thing to do would be “nothing.” We stated the market’s opening would...

Read More »

Read More »

Tariffs Roil Markets

Over the weekend, President Trump announced tariffs of 25% on both Canada and Mexico, as well as a 10% tariff on China. Such was not unexpected, as contained in the Trump tariff Executive Order {SEE HERE}. Specifically, that order stated: "[Sec 2, SubSection (h)]: Sec. 2. (a) All articles that are products of Canada as defined …

Read More »

Read More »

New Tariffs Torpedo Global Markets

Investors woke up Monday morning to a sea of red. On Friday, after the markets had closed for the weekend, President Trump announced a new series of tariffs levied against Mexico, Canada, and China. Moreover, he threatened that those tariffs could increase and that new tariffs would be announced for the Euro-region. Cryptocurrencies, technology, and …

Read More »

Read More »

Is This the Start of a Market Correction? Traders Watch Key Support Levels

Watch how the markets respond to support levels. Holding them = no big deal. Breaking them = potential for a larger corrective cycle. ? #MarketAnalysis

Watch the entire show here: https://cstu.io/242abd

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

How Tariffs Affect Corporate Profitability and Consumer Prices

Consumer reactions to tariffs impact companies' profitability. Watch how prices may increase due to tariffs affecting both earnings and consumer wallets. #EconomicImpact

Watch the entire show here: https://cstu.io/19c7dc

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Impact of Trade Tariffs and Border Policies

Colombia and Panama react differently to tariffs. Leaders need to understand the impact. #TradeWars #Tariffs #Leadership

Watch the entire show here: https://cstu.io/90d4ff

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-3-25 SPECIAL REPORT: Tariff Talk

President Trump's 25% tariffs on Canada and Mexico may be short-lived (indeed, following this morning's show, Mexico blinked, promising to send troops to the border, and Trump's tariff was suspended for 30-days). The difference between the 2017 Tariffs and now: No tax cuts in place this time around. Watch for more market volatility in the wake of tariff talks. Lance reviews the ins, outs, and possibilities of the Trump Tariffs: What is the...

Read More »

Read More »

2-3-25 Tariff Trouble

Tariffs and Trade Wars top the news, and are rattling markets. Lance looks at President Donald Trump's proposed US-China Tariffs 2025 and the economic impact of tariffs, the dynamic between the Stock Market and Tariffs, and how to address Global Trade Policy.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

REGISTER FOR OUR NEXT CANDID COFFEE (2/8/25) HERE:...

Read More »

Read More »

Beware Media Hype: Making the Right Social Security Decision

Deciding when to take Social Security can be emotional. Don't fall for clickbait headlines scaring you. Be careful and informed! #RetirementTips

Watch the entire show here: https://cstu.io/9f84cd

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Comprehensive Approach to Crafting a Future Financial Plan

Securing your financial future begins with a comprehensive plan. This guide explores the fundamentals of financial planning, building a holistic strategy, and effective retirement techniques. Readers will learn how to navigate financial statements, manage tax planning, and engage with a financial advisor for wealth planning. Whether dealing with a single audit or seeking to enhance …

Read More »

Read More »

Can Musk Be The Bond Whisperer

The media holds bond vigilantes out as do-gooders looking to force the government to be fiscally responsible. In reality, these vigilantes are traders who are short bonds, and use the fear of deficits and inflation to drive yields higher. While the term has been around for 25+ years, their recent success is unlike any past. … Continue reading...

Read More »

Read More »

Planning Retirement: Insights on Maximizing Benefits for Hard Workers

Check out how Richard Rosso’s clients are making bank and planning for the future! ? #financialplanning #clients #moneygoals

Watch the entire show here: https://cstu.io/133399

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »