Category Archive: 9a.) Real Investment Advice

Government Job Cuts May Be The Tip Of The Iceberg

The coming unprecedented government job cuts will undoubtedly impact the job market. Given the labor market's importance to Fed policy and the economy, it's worth fully appreciating the size of the government workforce and other employees whose jobs might be affected. The following graph, courtesy of John Burns Research & Consulting, shows that 3.8 million …

Read More »

Read More »

How to Incorporate Real Estate Investments Into Your Retirement Portfolio

Real estate has long been considered a valuable investment option due to its potential for steady income, appreciation, and diversification benefits. For individuals planning for retirement, incorporating real estate retirement investments into a financial strategy can enhance income streams, hedge against inflation, and provide long-term stability. However, like any investment, it comes with risks and …

Read More »

Read More »

Understanding Your Investments: Importance of Knowing What You Own

Know what you own! ? Don't invest blindly based on recommendations. Take control of your portfolio and make informed decisions. #investingtips

Watch the entire show here: https://cstu.io/a995e1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Portfolio Sizing for Risk Management in Investments

Regular portfolio check-ins are crucial! Evaluate sizing and impact of each position to avoid trouble. #investingtips #financialplanning

Watch the entire show here: https://cstu.io/1f237a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Margin Balances Suggests Risks Are Building

Inside This Week's Bull Bear Report New Coronavirus Discovery Shakes Markets Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. As we noted then, introducing an unexpected, exogenous event can soon lead to a price decline if investors begin to reprice forward expectations. On Friday, that …

Read More »

Read More »

2-21-25 When Bears Come Out Of Hibernation – Hour-2

Richard & Jonathan are covering the 7am CST hour for the host of our terrestrial Radio partner; think of it as a bonus show: arkets aren't Red or Blue, per elections, but Green; learning from mistakes we made curing COVID; deflation and price consciousness; why tariffs will not be inflationary;; consumers will make product substitutions. Why Social Security has become the defactor pension; notes from William Shatner's "Wrath of Khan"...

Read More »

Read More »

2-21-25 When Bears Come Out Of Hibernation

Richard & Jonathan discuss market activity for the week; the price of admission that investors must pay. Consumers (and companies) do not have a lot of pricing power. The European Conundrum: What happens when the US drops Ukraine support? Tariff talk & pressure on small cap companies; why we don't have to be invested in every asset class (where diversification really came from). Dad pants, Build-a-Bear, leanring to give up some stocks, and...

Read More »

Read More »

The Impact of Ignoring PE Ratios and Valuations in Today’s Market

Understanding PE ratios made simple! It's the price you pay vs. earnings per share. For example, a PE ratio of 10 means paying $10 for $1 in earnings! ? #Investing101

Watch the entire show here: https://cstu.io/ab7a6b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Alien Technology: Are ETFs Getting Too Creative?

The ETF industry has undoubtedly gotten creative over the last few years. However, nothing tops the latest ETF proposed by Tuttle Capital. Per its SEC registration, the Tuttle Capital UFO Disclosure AI Powered ETF (UFOD) will purportedly invest over 80% of the fund's assets in companies that they believe "have potential exposure to advanced or …

Read More »

Read More »

The Tariff Risk Isn’t In Inflation (Part II)

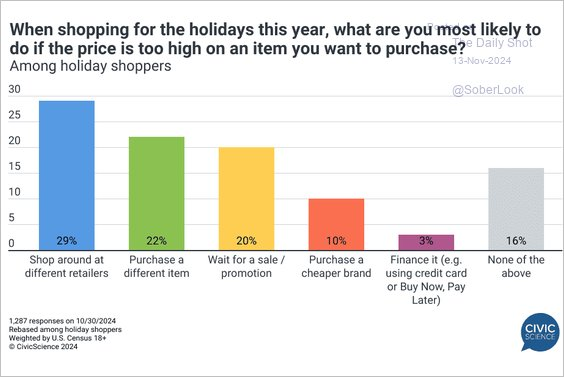

For Part 1 on "Tariff Risk" read: Tariff Impact Not As Bearish As Predicted. In "Trumpflation" we discussed why the tariff risk was not inflation. To wit: "Today, globalization and technology give consumers vast choices in the products they buy. While instituting a tariff on a set of products from China may indeed raise the …

Read More »

Read More »

2-20-25 Why Bitcoin Will Not Replace The Dollar

The latest Fed Meeting Minutes are out with a bit of insight; Trump's economic policies appear to be deflationary, as consumer strength is weakening; WalMart and Costco are tempering their forward guidance in anticipation. Palantir CEO is selling LOTS of shares as the Defense Dept. is being pushed by DOGE to cut spending. Market pullbacks may offer investors' opportunity; markets continue to do well, but there's a dichotomy between weighted indexes...

Read More »

Read More »

How Consumer Choice Drives Business Pricing Strategies and Inflation Impacts

Can I pass on the cost of goods/services to customers by raising prices? Consumer choice is key. ?? #BusinessTips #ConsumerChoice #Marketplace

Watch the entire show here: https://cstu.io/99054e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Wages And Rents Portend Easing Inflation Tailwinds

Wages and rents were two of the most impactful factors driving higher inflation and, of recent importance, keeping it stubbornly above the Fed's 2% target. As we will share, the good news is that wage growth and rents should be easing. The graph on the right shows that the Atlanta Fed wage growth tracker is …

Read More »

Read More »

How to Maximize Social Security Benefits in Retirement

Social Security benefits are a cornerstone of retirement income for many Americans, but the amount you receive can vary significantly based on when and how you claim. Understanding the factors that affect your benefits and implementing strategies to maximize them is essential for optimizing retirement income and securing financial stability during your golden years. 1. …

Read More »

Read More »

2-19-25 SPECIAL REPORT: Severance Package Strategies

As thousands of government workers are being invited to leave, and Chevron offers severance packages to a swath of its employees, what's the best strategy if you're offered an opportunity to retire? Take a lump-sum or annuitize the dollars? Lance Roberts and Danny Ratliff offer helpful suggestions if you're facing "permanent furlough" with severance package advice and suggestions on how to invest severance pay; how to manage a severance...

Read More »

Read More »

2-19-25 What You Should Do with a Severance Package

As thousands of government workers are being invited to leave, and Chevron offers severance packages to a swath of its employees, what's the best strategy if you're offered an opportunity to retire? Take a lump-sum or annuitize the dollars? Lance Roberts and Danny Ratliff offer helpful suggestions if you're facing "permanent furlough" with severance package advice and suggestions on how to invest severance pay; how to manage a severance...

Read More »

Read More »

Rethinking Consumption Patterns: Is ‘No Buy 2025’ the Smart Way Forward?

Reconsidering our consumption habits is crucial, especially for financial planning. Would you pay double the price for it? ? #financialtips

Watch the entire show here: https://cstu.io/1e0cc8

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Gold Is Getting Ahead Of Itself

To appreciate the recent gold price surge, we discuss three critical factors. Money Supply—The chart below shows that the ratio of gold to the money supply (M2) and the money supply tend to follow each other, albeit gold prices are more volatile. The ratio is well extended as it was in 2011. In September 2011, … Continue reading »

Read More »

Read More »

Why Bitcoin Will Not Replace The Dollar

Some will rightfully say we are a glutton for punishment. Our previous articles on Bitcoin and cryptocurrencies have been met with boos and hisses (to be kind) from laser-eyed crypto crusaders. Despite what many of our critics think, we are agnostic about cryptocurrency, but we are willing to expose details that most crypto supporters refuse …

Read More »

Read More »

Discover What Income Is Taxed in Investments Beyond Your IRA Distributions

Unpacking the evil formula of taxation and what's not included. ? #taxes #finance #moneytips

Watch the entire show here: https://cstu.io/9ccb65

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »