Category Archive: 9a.) Real Investment Advice

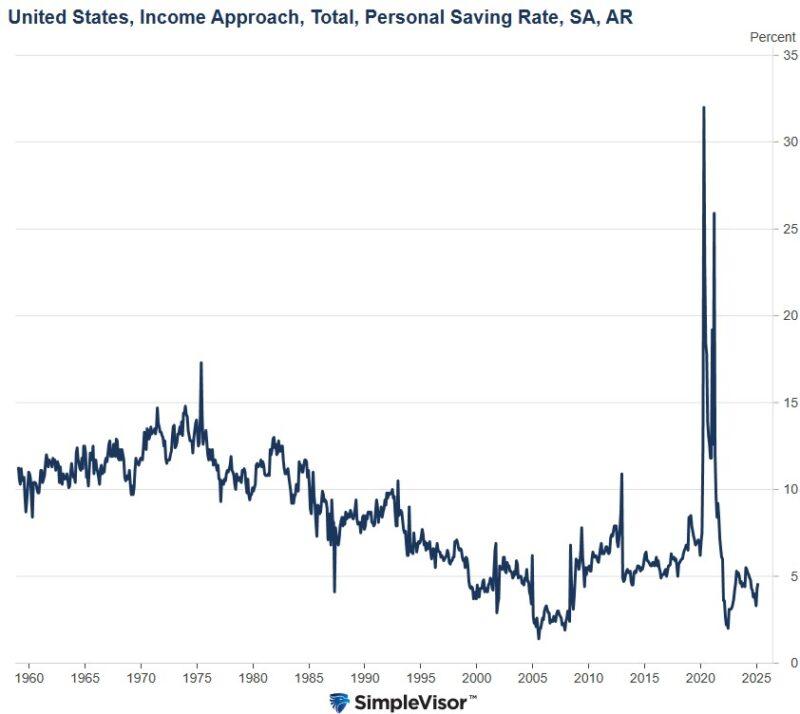

Personal Savings: An Unpolitical Sentiment Gauge

Yesterday's Commentary discussed the vast divergence in the economic sentiment of Democrats versus Republicans. In the piece, we wrote: "Democrats think today’s economic outlook is worse than during the peak of Covid and the financial crisis of 2008. Sentiment is tricky to convert into an economic forecast. Sometimes, sentiment is bad, but consumers continue to …

Read More »

Read More »

Understanding Market Trends: The Power of Buyers and Sellers

Understanding market trends: More buyers drive prices up, more sellers bring them down. Learn how futures impact gold prices! 📈💰 #MarketInsights

Watch the entire show here: https://cstu.io/25b2ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

4-1-25 Failure At The 200-DMA – Correction Continues

Investors must remember that we're coming off two years of exceptional market returns, and that market corrections must be viewed in their proper context...and expected. Lance discusses the positive and negative impact of Mag-7 stocks on markets due to their weighting; meanwhile, the First Quarter has ended with institutional buyers acting in the final minutes of Monday's trading day, boosting stocks to a less than 1% gain at the close. Markets...

Read More »

Read More »

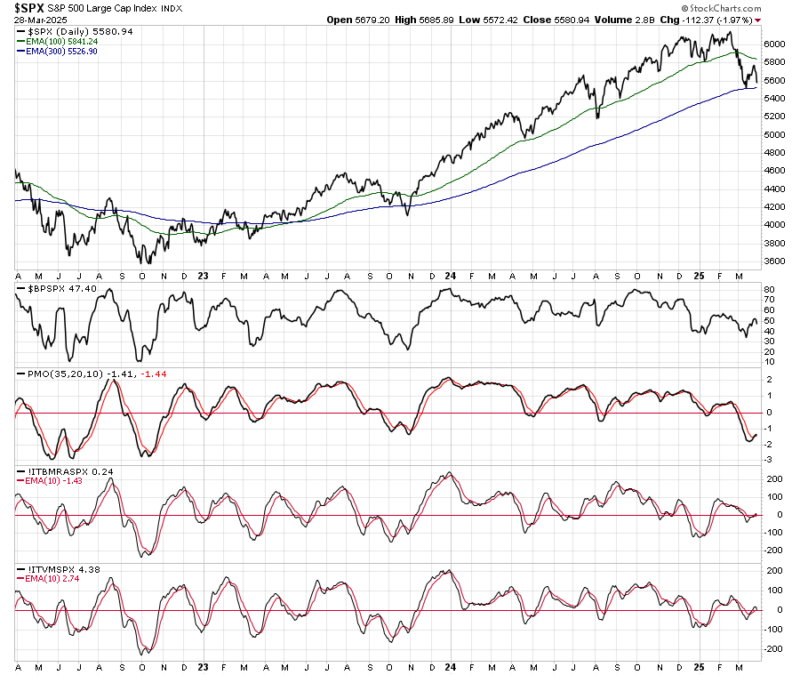

Failure At The 200-DMA

In last week's post, "Is the correction over?" we wrote about the potential for a rally back to the 200-DMA. However, the failure of that test increased short-term concerns. As we noted in that post, there were early indications of buyers returning to the market. To wit: "The chart below has four subpanels. The first … Continue reading...

Read More »

Read More »

Liberation Day: A Bullish Scenario

Stocks are hitting the skids as April 2nd, or Liberation Day, quickly approaches. Investors are rightfully scared that tariffs announced on Liberation Day will be crippling to the economy and harm corporate earnings. Based on recent comments from Donald Trump, that is a logical concern. However, what if Trump is playing with emotions to make …

Read More »

Read More »

Mastering Buy Low, Sell High: Essential Tips for Investors

Learn to take profits and buy declines! Investing tip: Sell high and buy low. Don't miss the buy signal for Bitcoin at 80,000! 💰📈 #Investing101

Watch the entire show here: https://cstu.io/6f035d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

3-29-25 Savvy Social Security Planning

Much has been reported and speculated about the recently passed Social Security Fairness Act. In this episode of Candid Coffee, Richard Rosso and Danny Ratliff discuss what the repeal of WEP and GPO mean for you; understanding Social Security Spousal Benefits and survivor benefits; and rethinking retirement planning with an income boost from Social Security. They take a clear-eyed look at the Social Security Fairness Act, Windfall Elimination...

Read More »

Read More »

3-31-25 Sellable Rally Or “Buy The Dip”?

There are no discernable signs of economic stress...yet, bu tconsumers are concerned about wages and job security. The question begging to be asked: When is the Fed going to step in (Fed purview: Employment and price stability...AND by extension, consumer confidence). How will markets react to Liberation Day (4/2)? Corporate buy backs will resume 3rd week of April. Markets pulled back on Friday (mimicking four similar pull backs last year.) Make no...

Read More »

Read More »

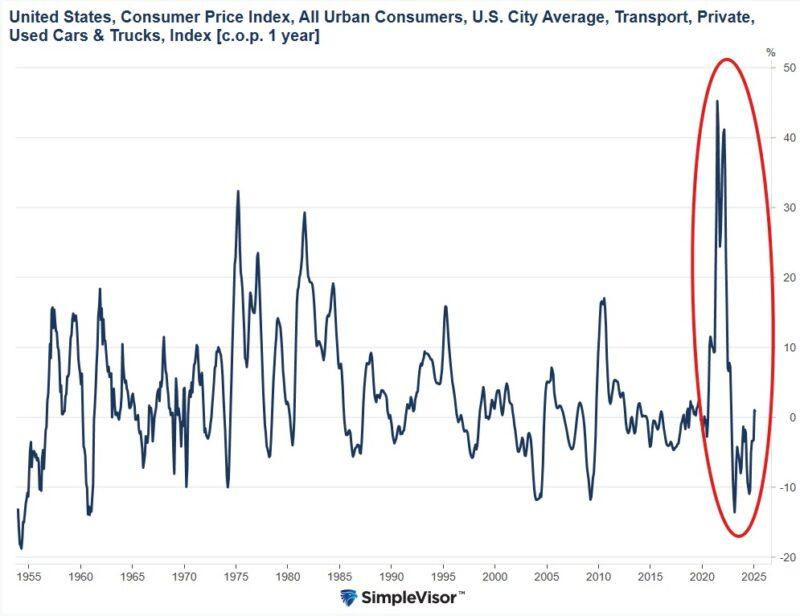

Are Used Car Prices Set To Soar Again?

It wasn’t that long ago that used car prices were soaring as the production of new cars was crimped due to Covid-related supply line shortages. Since then, used car prices have stabilized as the supply lines have healed. However, like many goods, prices haven't retreated to pre-pandemic levels. As we wrote in yesterday's Commentary, the …

Read More »

Read More »

Why Letting Big Banks Go Bankrupt Won’t Destroy the Economy

Letting big banks go bankrupt during the financial crisis could have been a better move! Find out why in this eye-opening video. 💰 #Finance #Economy

Watch the entire show here: https://cstu.io/4ea134

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

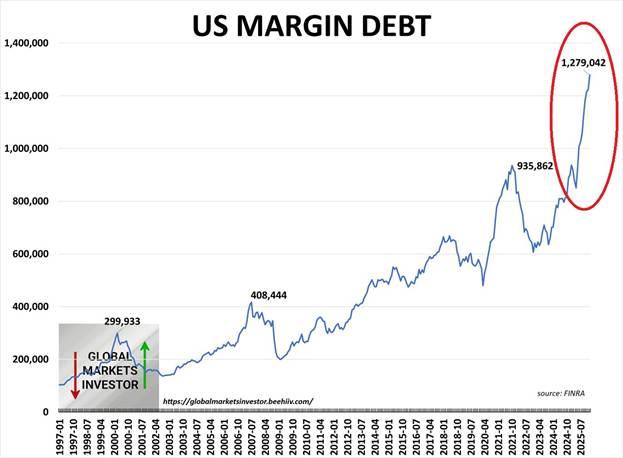

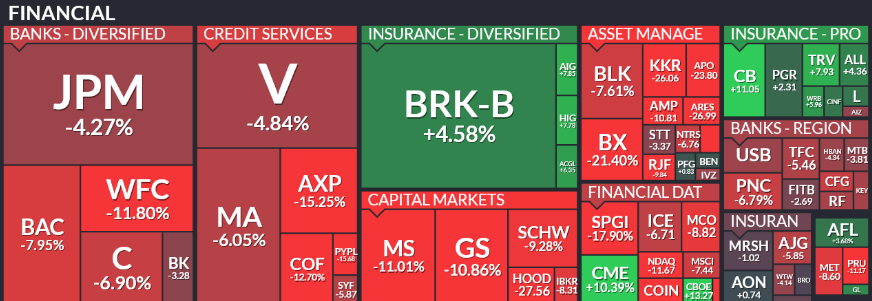

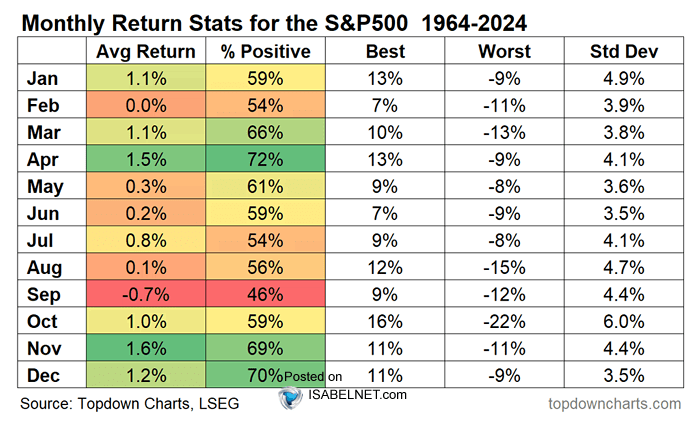

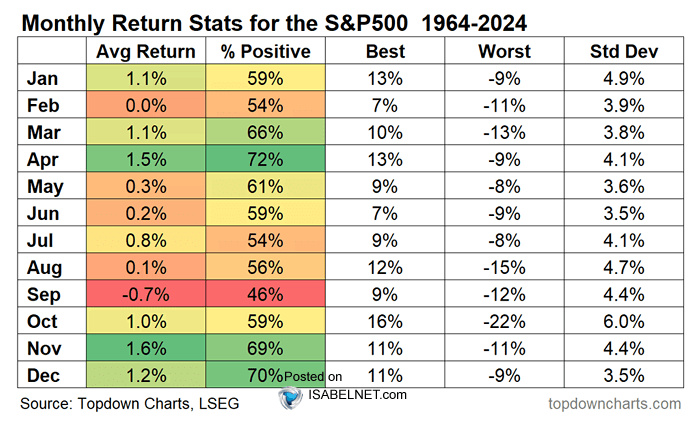

Sellable Rally Or “Buy The Dip”

Inside This Week's Bull Bear Report Failure At The 200-DMA Last week, we noted that the market performance, while distressing as of late, has been well within regular correctionary market cycles from a historical perspective. To wit: "While Trump's tariffs and bearish headlines currently dominate investors' psychology, we must remember that corrections are a normal …

Read More »

Read More »

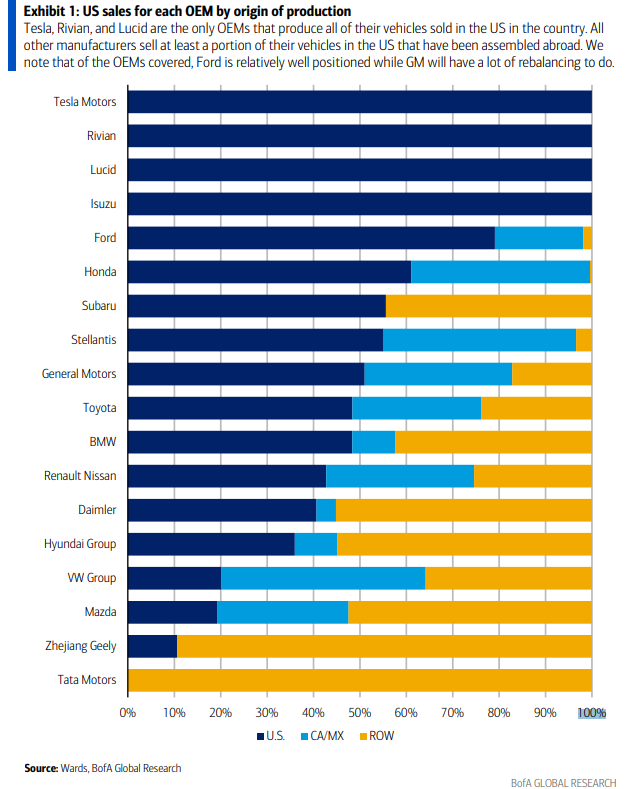

Auto Tariffs Impact Automakers Differently

Despite what some may think, the impact of the new 25% auto tariffs will not necessarily benefit all US auto companies to the detriment of their foreign counterparts. For example, as we share below courtesy of Bank of America, Ford produces about 80% of their US-sold cars in the US. However, GM and Stellantis, the …

Read More »

Read More »

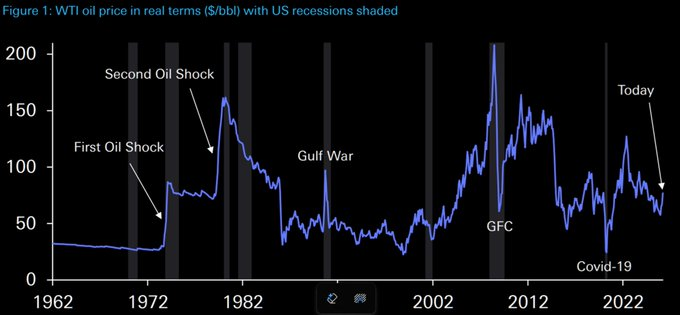

Stagflation Panic: A Misdiagosed Media Spin

Following the latest Federal Reserve meeting, there was a massive surge in media headlines stating "stagflation." The media's stagflation panic is unsurprising as it elicits memories of the late 1970s during the Arab oil embargo. Of course, a "stagflation" is excellent fodder for clicks and views as it scares the “bejeebers” out of people. Over the last …

Read More »

Read More »

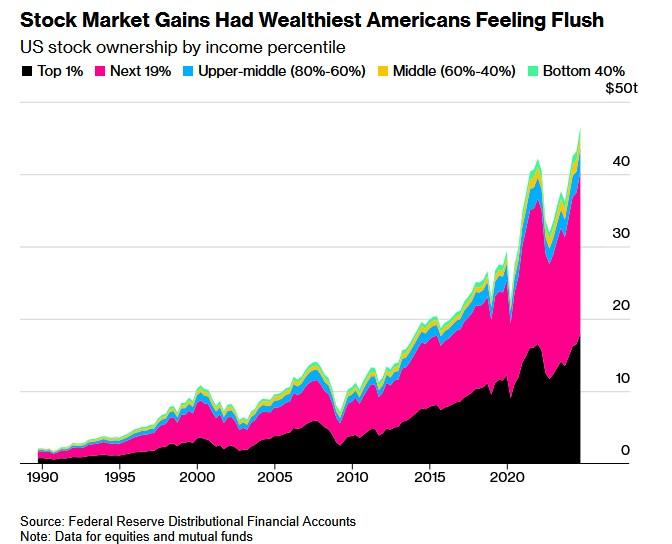

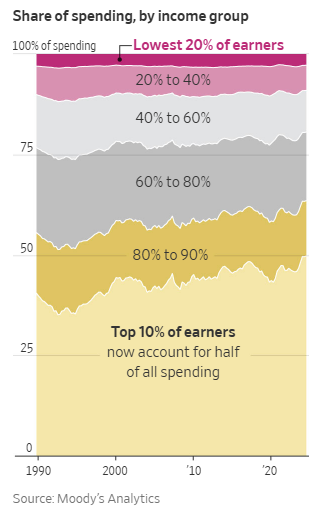

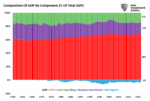

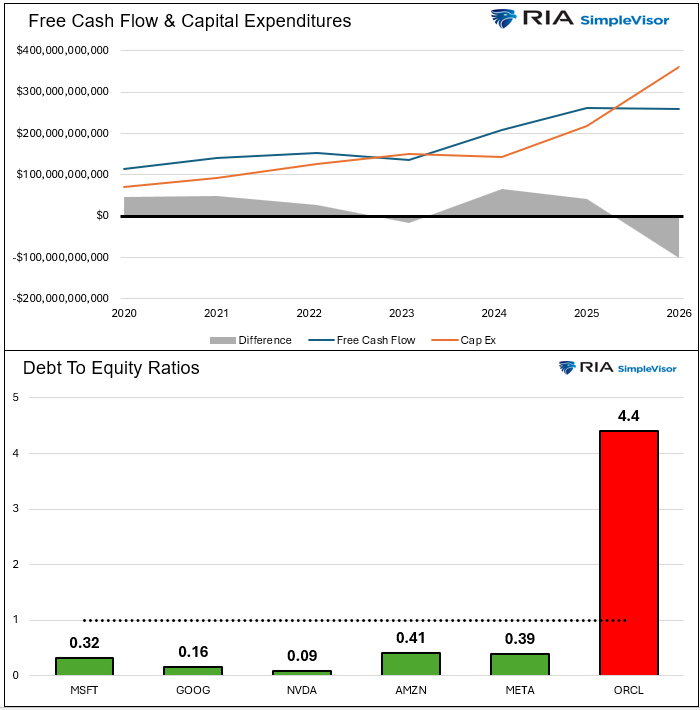

The Wealth Dissipation Effect

Ben Bernanke popularized the wealth effect theory during the financial crisis in 2008. In his words, "higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending." Moreover, he argued this would create a "virtuous circle" of increased spending, higher incomes, and further economic growth. Since then, the Fed has …

Read More »

Read More »

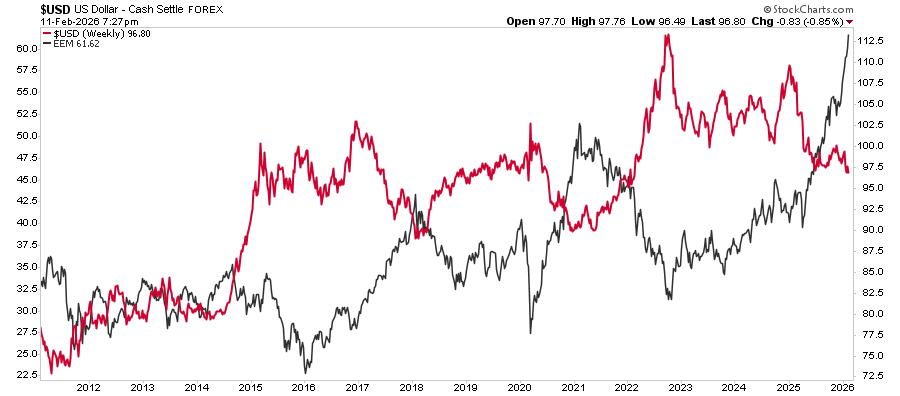

3-26-25 Is the Risk of Recession Rising?

Is the risk of recession rising? Consumer sentiment is flagging following last week's market correction. Investors cannot dismiss sentiment and money flows. Everything that drives the market gets down to earnings. The next round of earnings reports will commence in a couple of weeks. It appears the Dollar has bottomed, and markets are setting up for a rally short term. Lance and Danny address misinformation about recession vs stagflation; there...

Read More »

Read More »

3-24-25 Is The Correction Over?

Markets are wrapping up the final week of March, dealing with the uncertainty of the on-again, off-again tariffs. Manager are prepping for the end of the quarter, and will be rebalancing portfolios that are under-weight in stocks; the corporate buy back window is closed, removing a source of buyers. The markets' sharp 10% decline over three weeks appears to have abated, momentum is about to trigger a MACD buy signal; money flows are turning...

Read More »

Read More »

The Key to Lower Inflation May Start with Stock Prices

The key to lower inflation may start with the stock market and feed into the economy rather than vice versa. The wealth effect describes the behavioral phenomenon where individuals' perceived wealth changes impact their spending decisions.

Read More »

Read More »

A Comprehensive Guide to Retirement Income Strategies for a Secure Future

Planning for retirement is about more than just saving—it’s about ensuring a steady income stream that lasts throughout your retirement years. Without a well-structured plan, you could risk outliving your savings or facing financial hardship due to inflation, taxes, or unexpected expenses. This guide will walk you through retirement income strategies to help you achieve sustainable retirement income while balancing withdrawals, taxes, and long-term...

Read More »

Read More »

Is The Correction Over?

Inside This Week's Bull Bear Report Is A Bottom Beginning To Form? Last week, we noted that the market performance, while distressing as of late, has been well within regular correctionary market cycles from a historical perspective.

Read More »

Read More »

Retail Sales Are Better Than Advertised

Within the headline retail sales figure is a lesser-followed data point called the retail sales control group. Following the trend of both figures is important because although the headline figure receives more attention, the control group is the measure that feeds into the GDP calculation.

Read More »

Read More »