Category Archive: 9a.) Real Investment Advice

The Future of US Large Company Stocks: Why 2025 Could Be Their Year

? Are large company growth stocks the place to be in 2025? ? Probably yes, but not for the reason you think! ? #Stocks #Investing #2025Prediction

Watch the entire show here: https://cstu.io/7a5c4d

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Consolidation Continues

Inside This Week's Bull Bear Report One Week Left To Get Your Tickets Don't miss the opportunity to get your tickets for the 2025 Economic and Investing Summit. Seating is extremely limited, and this year's event is almost sold out. We have set aside time to visit with attendees one-on-one to answer your burning questions … Continue...

Read More »

Read More »

1-10-25 What the Social Security Fairness Act Means for Your Retirement

Richard and Jonathan discuss the narratives that are driving the markets, and the fear factor for bond investors. Is the response to tariff threats an over-reaction? How to deal with emotions in investing. Menwhile, job satisfaction is highest among the 60+ crowd: The group has been working longer, and understands the value of socialization; retirement planning shold include qualitative elements. A look at Gen-z Worth Ethic. The Social Security...

Read More »

Read More »

Examining Policy Impact on Economic Growth and Corporate Earnings

Possible economic risks ahead due to government policies like tariffs or deportations impacting economic growth and earnings. Stay informed! ?? #Economy #PolicyChanges

Watch the entire show here:https://cstu.io/6601c6

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Investor Resolutions For 2025

I publish an updated version of my New Year “investor” resolutions yearly. The purpose of the process is to take an annual inventory of what I did and did not do over the last year to improve my portfolio management practices. As with all resolutions made at the beginning of a new year, it is not uncommon … Continue reading...

Read More »

Read More »

The Quantum Computing Bubble Is Leaking

The latest stock market bubble may be one of the shortest-lived bubbles in recent times. Quantum computing stocks rose in November and took off in December when Google touted the immense power of quantum computing. The following is from Google (LINK): Willow performed a standard benchmark computation in under five minutes that would take one …

Read More »

Read More »

Debunking Tariff Myths: A Historical Perspective on Tariffs vs Taxes

Did you know? In the past, most taxes came from tariffs, not personal income tax. Learn how this historical perspective can change our views on tariffs! ?? #TaxFacts #EconomicHistory

Watch the entire show here: https://cstu.io/bff20e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Differences Between Traditional and Roth IRAs

When planning for retirement, choosing the right Individual Retirement Account (IRA) is a crucial decision. Traditional and Roth IRAs are two popular options, each with distinct advantages and limitations. Understanding the differences between traditional vs Roth IRA accounts will help you make an informed decision based on your financial situation and retirement goals. Contribution Limits …

Read More »

Read More »

1-9-25 Why Are Bond Yields Rising?

Markets barely achieved a positive close on Wednesday, to create a string of positive action for the first five trading days in January. (Markets are closed today in honor of the late President Jimmy Carter.) There's a market consolidation underway, with the 20-DMA and 50-DMA about to cross. Lance & Michael discuss the Fed's sentiment shift about inflation, and the non-corellation between interest rates and inflation. The Fed may have cut...

Read More »

Read More »

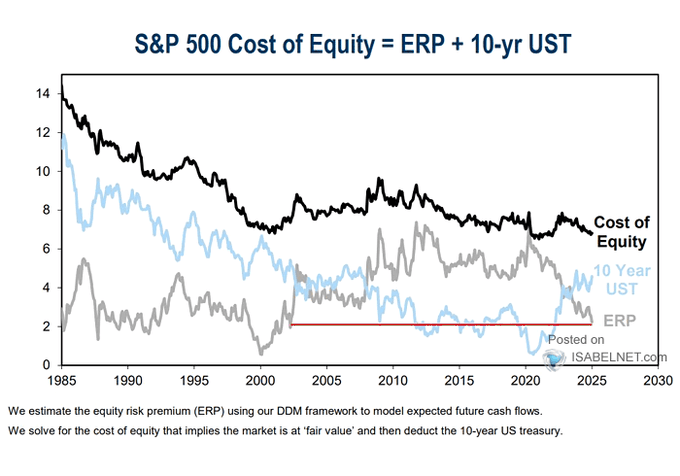

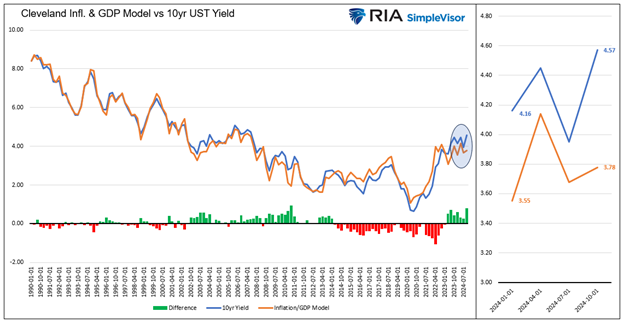

Inflation Concerns Scare The Bond Market

As we share below, bond market sentiment, known officially as the term premium, has been almost entirely responsible for the recent surge in bond yields. Specifically, behind the move is investor concern regarding another round of inflation stemming from the recent Fed's rate cuts. The poor sentiment is very apparent when comparing news to a …

Read More »

Read More »

1-8-25 The Most Important Investing Lesson You’ll Ever Need

Lance discusses the importance of an investing process: Rules to offset emotional bias. Write them down, learn them, live them. Fundamentals matter over the long term. Understand how you got to the decision that you made to buy a stock. Lance also addresses the importance of balance, bonds vs stocks.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

This segment is...

Read More »

Read More »

How to Buy Smart and Position Investments for Market Growth

? Want to be smart with your investments? Check out why buying when others aren't could be the key to success! ? #InvestingTips #StockMarket

Watch the entire show here: https://cstu.io/ec6fbb

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-8-25 Market Reversal: Implications Now

With Friday's December Employment Report waiting in the wings, it's fair to ask what happened to the December JOLTS Report. Investors are questioning whether we'll see continued growth from December. What does Q4 GDP at 2.7% really mean? Understanding the data and reading the January Barometer (so far). Lance shares his screen in commenting on sector rotations. Dan Niles' predciton of a 20% correction this year: Lance's reality check. Crash vs...

Read More »

Read More »

Credit Spreads Send A Warning For Stock Investors

Bloomberg led its article "Credit Markets Signal Warning for a Relentless Equity Rally" with the following paragraph: Stocks are close to the most overvalued against corporate credit and Treasuries in about two decades. The earnings yield on S&P 500 shares, the inverse of the price-earnings ratio, is at its lowest level compared with Treasury yields …

Read More »

Read More »

Why Are Bond Yields Rising?

The question asked of us most often recently: "Why are bond yields rising?" After verbally answering it plenty of times, it's time to put our answer in writing for everyone to see. The answer will help you understand what is causing bond yields to rise, and more importantly, it will help you better appreciate when … Continue reading...

Read More »

Read More »

Fundamentals vs Speculation in Stock Picking Success

? Get ready for a shift in the stock market game! ? Fundamentals will matter more than ever in the upcoming year. Stay tuned! ? #StockMarket #InvestingTips

Watch the entire show here: https://cstu.io/5d392e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-7-25 Curb Your Enthusiasm in 2025

As we enter 2025, the financial markets are optimistic. That optimism is fueled by strong market performance over the last two years and analyst’s projections for continued growth. However, as “Curb Your Enthusiasm” often demonstrates, even the best-laid plans can unravel when overlooked details come to light. Lance Roberts & Jonathan Penn discuss five reasons why a more cautious approach to investing might be warranted in 2025, plus client...

Read More »

Read More »

“Curb Your Enthusiasm” In 2025

"Curb Your Enthusiasm," which ran its series finale last year, starred Larry David as an over-the-top version of himself in a comedy series that showed how seemingly trivial details of day-to-day life can precipitate a catastrophic chain of events. The show never failed to deliver a laugh but also reminded me that unexpected events can …

Read More »

Read More »

Outflows Of TLT Are Tremendous

Outflows from bond ETFs, such as TLT, have been tremendous over the last two months. ETFs, unlike mutual funds, allow dealers to redeem shares for the underlying securities and vice versa. The exchanges most often occur when the demand to buy or sell the ETF is high, thus creating a small arbitrage for the dealer. … Continue reading...

Read More »

Read More »

Navigating Market Volatility: Tips for Investors

Market volatility is an inherent part of investing, and while it can be unsettling, it’s not necessarily a bad thing. For disciplined investors, periods of market fluctuation present opportunities for growth and long-term wealth building. To navigate these uncertain times, understanding the causes of volatility, managing your emotional responses, and employing sound investment strategies are …

Read More »

Read More »