Category Archive: 9a.) Real Investment Advice

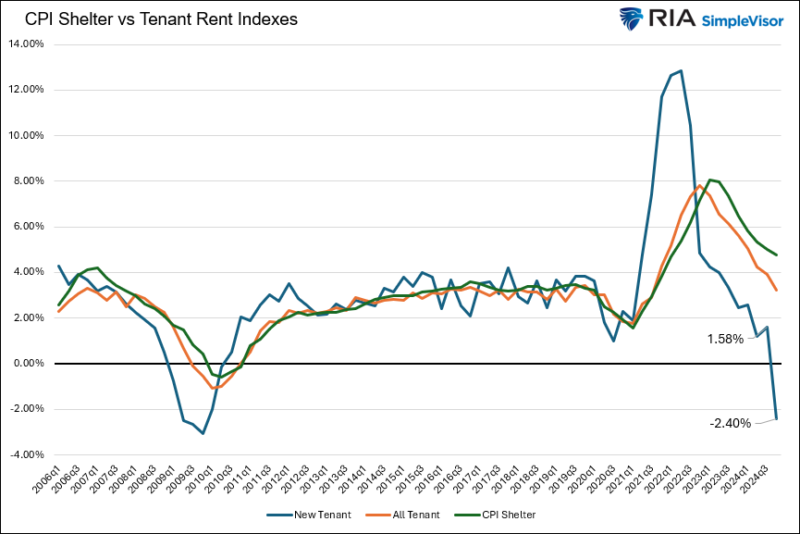

New Tenant Rent Prices Plummet

The latest BLS and Cleveland Fed release of their quarterly new tenant rent index was lower by 2.43% year over year and over 5% from the prior quarter. The sharp rate of decline was surprising. Moreover, the update gives us more confidence that inflation is heading toward the Fed’s 2% target. Unlike CPI shelter prices, … Continue...

Read More »

Read More »

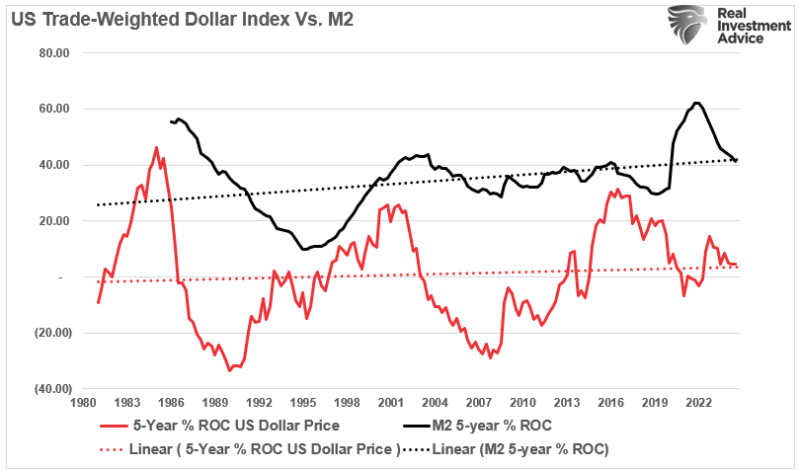

Do Money Supply, Deficit And QE Create Inflation?

I recently debated with Michael Pento, who made an interesting statement that increases in the money supply, the deficit, and a return to quantitative easing (QE) will lead to 1970s-style inflation. The recent experience of inflation in 2021 and 2022 would seem to justify such a view. However, is that historically the case, or was …

Read More »

Read More »

1-23-25 It’s the Dollar, Stupid!

Lance Roberts & Michael Lebowitz discuss the recent strong correlation between the appreciating dollar and rising yields and the reasons for the relationship, covering the US Dollar Impact on Economy, Global Currency Trends for 2025, and

Dollar Strength and Investments. Lance & Mike will also touch on Foreign Exchange Markets Analysis and USD vs Global Currencies.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w...

Read More »

Read More »

Analyzing Tax Implications in Light of New Abilities

? Planning for taxes just got more interesting! Who knows what the future holds? ?? #taxplanning #futureuncertainty #IRSvsERs

Watch the entire show here: https://cstu.io/59949e

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Ultimate Guide to Income Planning in Retirement

Retirement is a time to enjoy the results of years of hard work and saving, but ensuring you have enough income to maintain your lifestyle is a challenge that requires careful planning. Effective retirement income planning focuses on creating a sustainable retirement income strategy that balances guaranteed income sources, investment growth, and the need to …

Read More »

Read More »

The Tariff Rollercoaster

With Donald Trump now officially President, we will learn which campaign promises were rhetoric and negotiating tactics and which he plans to enact. For many economists and nations, tariffs are at the top of the list of importance. China, in particular, closely followed by Canada and Mexico, appears to be at the most risk of … Continue...

Read More »

Read More »

Essential Tips for Creating Cash Flow and Savings for Beginners

Investing tip: ? Want to start investing? It's about creating cash flow, savings, and building wealth, not just throwing a dollar into the S&P! ?? #InvestingTips

Watch the entire show here: https://cstu.io/49f2e4

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

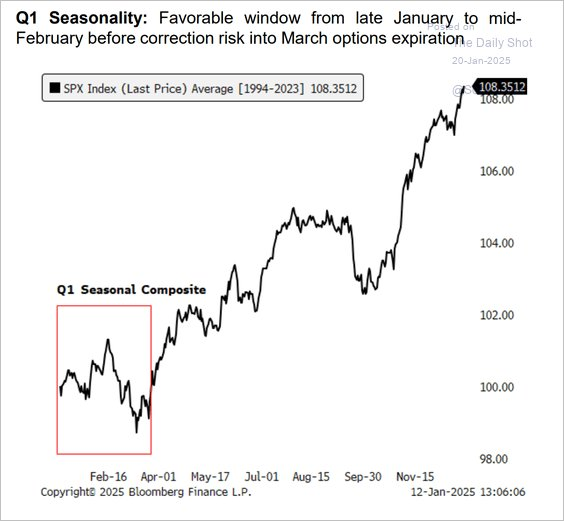

1-22-25 Are Return Expectations For 2025 Too High?

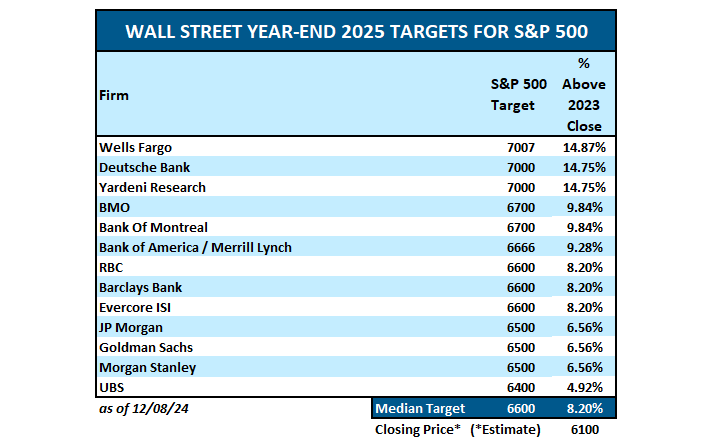

It isn’t just Wall Street analysts who are optimistic about 2025 returns. Retail investors are the most optimistic about higher stock prices in 2025 by the most on record. Unsurprisingly, that sentiment resulted in the psychological rush to overpay for assets, pushing forward 1-year valuations sharply higher.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Watch today's...

Read More »

Read More »

Meme Coins Transfer Wealth Not Create It

A reader of Tuesday's Daily Commentary made a very astute comment. The title of the Commentary was "Trump Meme Coin Creates Billions Out Of Thin Air." It doesn’t create anything… It transfers He is 100% correct. Meme coins and other forms of cryptocurrency do not create dollars. They transfer dollars from one person or entity …

Read More »

Read More »

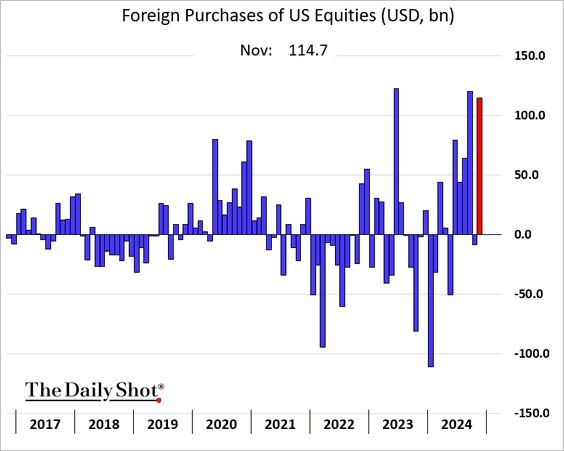

Its The Dollar Stupid

Our recent article, Why Are Bond Yields Rising, explains that the recent 1% increase in yields, as shown below, is almost entirely due to negative sentiment. As we wrote, the bond market calls sentiment the term premium. Of the 1% yield increase, only 10% is due to fundamental factors, leaving 90% a function of bond … Continue reading »

Read More »

Read More »

Enhance Portfolio Stability with Growth to Value Rotation Strategy

? Understanding market rotations is key! Shifting from growth to value can lower portfolio volatility. Diversification is key! #InvestingTips ?✨

Watch the entire show here: https://cstu.io/29386c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Are Return Expectations For 2025 Too High?

In a recent post, I discussed Wall Street's return estimates for 2025 for the S&P 500 index. To wit: "We have some early indications of Wall Street targets for the S&P 500 index, and, as is always the case, they are optimistic for the coming year. The median estimate is for the market to rise … Continue reading »

Read More »

Read More »

Trump Meme Coin Creates Billions Out Of Thin Air

With markets closed over the long holiday weekend and Donald Trump's inauguration and related politics taking center stage, no one thought the financial markets would make the headlines. They did. On Friday night, Donald Trump launched the largest meme coin in history. A meme coin is a cryptocurrency based on a meme. Like a baseball …

Read More »

Read More »

Strategic Investing Guide: Buying Beaten Stocks for Long-Term Gains

Investing tip: When stocks are down, it could be a good time to buy! Have a solid reason for each investment in your portfolio. ?? #InvestingTips #StockMarket

Watch the entire show here: https://cstu.io/2e3374

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Was CPI Better Than Good

The latest CPI inflation news was OK. The 0.4% headline increase is higher than in prior months but aligns with expectations. Core CPI, excluding food and energy, is .1% lower than the consensus at .2%. The report relieved Wall Street as it did not show a resurgence in inflation. Stocks and bonds are trading much … Continue reading »

Read More »

Read More »

Estate Planning Essentials: Protecting Your Legacy

Creating an estate plan is a critical step in protecting your legacy and ensuring your assets are distributed according to your wishes. Estate planning essentials like wills, trusts, and beneficiary designations provide clarity for your loved ones while safeguarding your financial legacy. Whether you have a large estate or modest assets, an effective plan can …

Read More »

Read More »

Optimize Your Portfolio for Consistent Investment Success: Key Strategies and Tips

Diversification is key! Make sure a significant chunk of your portfolio is active in the market to grow your assets while you wait. ?? #InvestingTips #GrowYourWealth

Watch the entire show here: https://cstu.io/b7f9ab

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Strategic Loss Management for Optimal Gains

Offsetting losses with gains, managing trends effectively! ? #financialtips #investing #moneymanagement

Watch the entire show here: https://cstu.io/14d96c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Should Social Security Be Tax-Free? Examining Fairness

Why should I pay taxes on Social Security when I've already paid in? That money should come back tax-free! Double taxation isn't fair. #taxes #SocialSecurity

Watch the entire show here: https://cstu.io/705d46

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-17-25 What Fiduciary Advisors Can Learn from Jimmy Carter

The nation recently laid to rest former President Jimmy Carter who died at age 100. While his Presidency is still being measured by history, there is no dispute over the noble life he lived following his term as our 39th Commander-in-Chief. Richard and Matt glean important lessons from his sense of public fiduciary, as well as discuss the current state of stocks vs bonds in a new rate environment. Why the Fed doesn't need to cut rates, and a look...

Read More »

Read More »