Category Archive: 9a.) Real Investment Advice

2-14-26 This “Flat” Market Is Hiding Massive Rotations

Markets may look flat on the surface, but beneath the surface, massive rotations are taking place. Large-cap value is up sharply while growth has stalled, even as $SPX barely moves.

In this short video, Lance Roberts & Michael Lebowitz discuss how passive flows are driving capital aggressively between sectors and styles, pushing areas to historical extremes.

These divergences create opportunity, but also risk. When rotations stretch this far,...

Read More »

Read More »

The Weak Dollar Narrative

🔎 At a Glance 🏛️ Market Brief - February Lives Up To Its Name We noted last week that February tends to be a weaker month for returns. So far, it has certainly lived up to its name. This past week opened with investors selling technology, and particularly software stocks, to buy value sectors. Energy, … Continue reading »

Read More »

Read More »

2-13-26 AI in HR

AI is transforming HR and payroll—but most mid-sized companies are still stuck doing critical work manually.

Tom Allen and Da'Miere Glover break down what’s real vs. hype in “AI in HR,” including where AI is already delivering value today: payroll accuracy and anomaly detection, recruiting and screening, employee self-service chatbots, and workforce forecasting. Tom and Da'Miere also cover the downside risks business owners must understand—bias...

Read More »

Read More »

2-13-26 Why The Market Didn’t Buy the “Strong” Jobs Report

The latest jobs report looked strong at first glance, but revisions wiped out much of last year’s gains, and underlying trends show slower growth.

Wage pressures continue to ease, and alternative payroll data suggest job creation is running far below headline numbers.

Lance Roberts & Michael Lebowitz explain why the bond market’s muted reaction suggests investors saw through the headline strength and remain unconvinced that the labor market is...

Read More »

Read More »

2-13-26 529 Leftovers, Retirement First, & the Real Cost of Cars

What happens when the “perfect” plan doesn’t happen—your kid skips college, your retirement clock is ticking, and the family budget gets ambushed by costs you never saw coming?

Jon Penn and Jonathan McCarty connect three real-world money stress points that are showing up everywhere right now:

1) The kid isn’t going to college—now what about that 529?

2) Retirement vs. college: the household tug-of-war

3) Hidden car ownership costs: the budget...

Read More »

Read More »

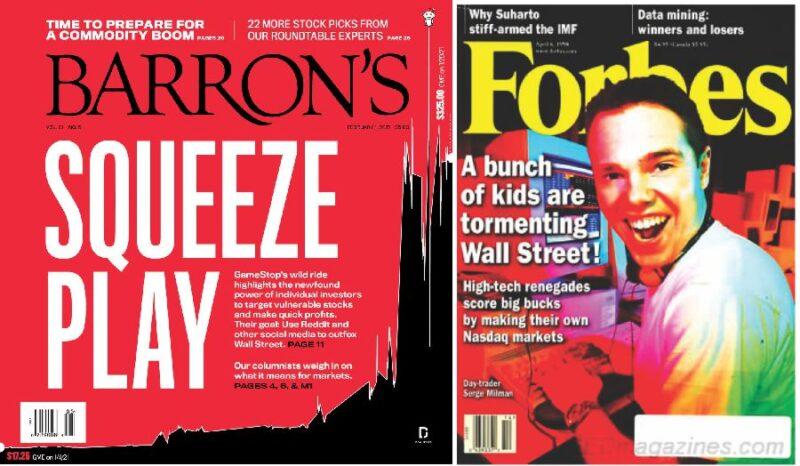

Financial Nihilism & The Trap Young Investors Are Walking Into

The article from the Wall Street Journal titled “Why My Generation Is Turning to Financial Nihilism” by Kyla Scanlon argues that Gen Z is embracing high-risk financial behavior out of despair and detachment. Of course, it is essential to recognize that Kyla, although well-intentioned, is a young twenty-something influencer with limited real-life experience, and sees …

Read More »

Read More »

Century Bonds: A Long Term Bet On Google

Google's parent, Alphabet, just issued $32 billion in global debt, including £1 billion of rare century bonds. Alphabet's century bonds are called such because they do not mature for 100 years (2126). While the century bond is a small piece of its recent debt offering and even less of its outstanding debt ($78 billion), the … Continue...

Read More »

Read More »

2-12-26 The Contrarian View on The Value Rally

In this short video, Lance Roberts & Michael LebowitzI explain how value stocks were deeply hated just months ago. Since then, capital has rotated aggressively into defensive “value” names, pushing many to extreme overbought levels.

Ironically, several of these stocks, including $WMT $PG and $PEP, now trade at elevated multiples, making them expensive by traditional metrics.

Be careful chasing the crowd. Focus on where money is likely to move...

Read More »

Read More »

The ECB Unexpectedly Raises Rates But Pauses

"Based on its current assessment, the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to target." And with that statement, the European Central Bank (ECB) appears to have halted its rate hiking cycle. …

Read More »

Read More »

The Pros and Cons of Investing in Gold and Other Precious Metals

Understanding Gold and Precious Metal Investments Exploring the Appeal of Precious Metals Investing in gold and other precious metals has long been regarded to preserve wealth and hedge against economic uncertainties. Discover the potential benefits and drawbacks of including these commodities in your investment strategy. The Role of Precious Metals in Diversification Adding precious metals …

Read More »

Read More »

Understanding Different Types of Investment Vehicles: Stocks, Bonds, and Mutual Funds

Exploring Investment Vehicles: An Overview Navigating the Investment Landscape Investing wisely requires a thorough understanding of various investment vehicles. Delve into the essentials of stocks, bonds, and mutual funds to make informed choices that align with your financial goals. The Role of Investment Vehicles Investment vehicles serve as the channels through which individuals can invest …

Read More »

Read More »

The Pros and Cons of High-Yield Bonds

Understanding High-Yield Bonds: An Overview Defining High-Yield Bonds High-yield bonds, also known as junk bonds, are debt securities issued by companies with lower credit ratings. These bonds offer higher interest rates compared to investment-grade bonds, but they come with their own set of benefits and risks. The Role of High-Yield Bonds High-yield bonds can play …

Read More »

Read More »

How to Avoid Common Bond Investing Mistakes

Navigating the World of Bond Investing: A Comprehensive Guide The Importance of Informed Bond Investing Bond investing can be lucrative, but avoiding mistakes is crucial for maximizing returns and minimizing risks. Learn about the common pitfalls and how to steer clear of them. The Role of Bonds in Investment Portfolios Bonds offer stability and income, …

Read More »

Read More »

How to Buy Commodity ETFs: A Guide for Investors

Understanding Commodity ETFs: What You Need to Know Exploring the World of Commodity ETFs Commodity Exchange-Traded Funds (ETFs) offer investors exposure to a diverse range of commodities, such as precious metals, energy resources, agricultural products, and more. Learn how to navigate this investment option and incorporate it into your portfolio. Benefits of Investing in Commodity …

Read More »

Read More »

The Different Types of Commodity Investments and Their Characteristics

An Introduction to Commodity Investments Understanding Commodity Investments Commodity investments involve putting money into raw materials or primary agricultural products that are typically traded on commodity markets. These investments offer exposure to the fluctuations in commodity prices, making them a unique and potentially rewarding addition to investment portfolios. Why Invest in Commodities? Commodities serve as …

Read More »

Read More »

Register for Our Next Candid Coffee

Our next Candid Coffee is set for Saturday, February 21, 2026 at 8am with Richard Rosso & Danny Ratliff. It's an open-forum, kitchen table kind of conversation about what's on your mind, financially. We'll launch the conversation with a discussion about annuities, but really, anything is game.

Register today at this link: ttps://streamyard.com/watch/Wq3Yvn9ny5GV

#CandidCoffee #Registration #Annuities

Read More »

Read More »

2-12-26 The Value Rotation Illusion

“Value is back,” the headlines say—so investors rush from mega-cap growth into “boring” staples, utilities, and healthcare. But here’s the problem: sector labels aren’t valuation metrics. In many cases, the so-called “value rotation” is an illusion—because investors may be rotating into expensive stocks while selling the actual value hiding inside “growth.”

Lance Roberts & Michael Lebowitz break down why value and growth aren’t mutually...

Read More »

Read More »

BLS Labor Report Defies Consensus

The delayed BLS employment report came in well above expectations, showing the economy added 130k jobs in January. Furthermore, the unemployment rate slipped to 4.3% versus expectations of a 0.1% increase to 4.5%. The more encompassing U6 unemployment rate fell from 8.4% to 8.0%. The BLS labor report contradicts the monthly and weekly ADP reports, …

Read More »

Read More »

2-16-26 Margin Debt & the One-Stock Myth

Happy Presidents Day—today’s show blends portfolio risk management with real-life planning (and a little chili controversy).

Lance Roberts breaks down margin debt and how leverage turns routine volatility into forced selling and permanent losses. Then he pivots with Jonathan Penn to weddings, pre-nups, and money conversations—what couples should sort out early to protect goals and reduce future stress.

Lance and Danny address the “one stock...

Read More »

Read More »

2-11-26 Q&A Wednesday: You Ask ’em, We’ll Answer

It’s Q&A Wednesday—you bring the questions, we bring the answers.

Lance Roberts & Danny Ratliff tackle what’s on your mind right now: market volatility, Fed policy, inflation and rates, earnings, portfolio risk management, and what to do (and not do) when headlines get loud.

Lance & Danny break down the why behind the market’s moves, translate the macro data into what it means for portfolios, and walk through practical, process-driven...

Read More »

Read More »