Category Archive: 9a.) Real Investment Advice

Dollar Reversal: What It May Mean For Gold and Bonds

Yesterday's Commentary noted that the dollar is very oversold and likely due for a reversal. To wit: The dollar is deeply deviated from its longer-term mean, oversold on multiple levels, and has been basing since April. As noted last Friday, the incredibly negative bias and position against the dollar are excellent contrarian signals for a …

Read More »

Read More »

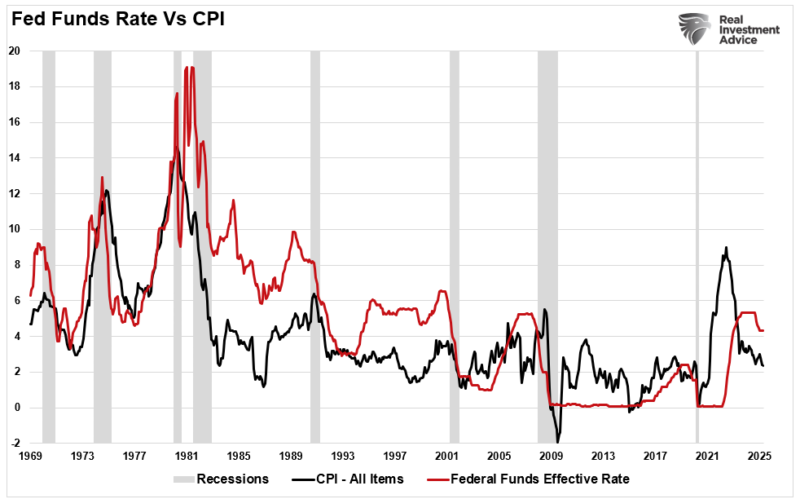

The Fed’s “Transitory” Mistake Is Affecting Its Outlook

In 2023 and 2024, the Fed was under intense public and media scrutiny for calling the post-pandemic surge in inflation “transitory.” Critics argued that the Fed's failure to anticipate the persistence and severity of rising prices undermined its credibility. Yet, with the benefit of hindsight and historical context, the Fed's position wasn't entirely misguided. Inflation …

Read More »

Read More »

6-26-25 The Federal Reserve: Financial Economic Socialism

Has the Federal Reserve become more famous/infamous than the President of the United States? The Fed's ever-growing footprint on the U.S. economy is undeniable, perhaps even a form of financial, economic socialism.

Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

6-26-25 The Fed’s Next Mistake

Is the Fed setting the stage for another policy blunder?

As inflation pressures linger and economic growth slows, Lance Roberts & Michael Lebowitz break down the risks of the central bank's next move—and what it could mean for your money on this morning's episode of #TheRealInvestmentShow. The Market Rally is ON, yet oil prices are telling a different story about the economy. President Trump could be picking a successor to Fed Chairman Jerome...

Read More »

Read More »

How to Align Your Financial Plan with Your Life Goals

For high-net-worth individuals, wealth is more than a measure of financial success; it’s a means to achieve personal fulfillment, support cherished causes, and leave a lasting legacy. Traditional financial planning often emphasizes asset accumulation and tax efficiency. However, a more […] The post How to Align Your Financial Plan with Your Life Goals appeared first …

Read More »

Read More »

SNB Brings Back Zero Percent Interest Rates

With interest rates in developed economies falling but still significantly higher than their respective troughs in 2021-2022, some pundits are claiming that we are entering a new interest rate regime. Gone, they say, are the days of near-zero or even negative interest rates. The Swiss National Bank (SNB) may lead some pundits to rethink their logic. On June 19, 2025, the SNB reduced its policy rate by 25 basis points to 0.00%. Here are some reasons...

Read More »

Read More »

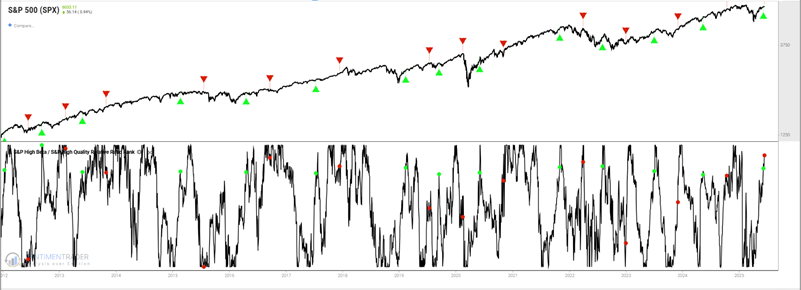

6-25-25 Speculative Demand is Off the Chain

When there is a massive amount of demand for something, and Wall Street sees there is money to be made from it...they're going to figure out a way. There is record call-option volume presently in levels we've never seen, historically. And Wall Street is happy to sell it to you. This will end the way SPACs and some IPO's have ended...not well for investors.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive...

Read More »

Read More »

6-25-25 The Bulls Are Back in Town

Wall Street is buzzing again — but is the bull market really back? Lance Roberts & Danny Ratliff break down what’s fueling the latest stock market rally, what investors should watch next, and whether this rebound is the real deal or just a bear market trap. Market speculation is at an all time high, yet there are economic surprises in store that could shake things up. There is now an illusion of economic strength. Lance discusses the recent...

Read More »

Read More »

Powell Testifies On Monetary Policy To Congress

Fed Chair Jerome Powell presented his quarterly testimony to the House yesterday and will testify to the Senate today. The market reaction was minimal as much of his speech was a repeat of last week’s FOMC meeting and press conference. […] The post Powell Testifies On Monetary Policy To Congress appeared first on RIA.

Read More »

Read More »

Fueling AI Data Centers: Behind The Meter Solutions- Part 1

“AI is big business” is a gross understatement. The IEA estimates that “the market capitalization of AI-related firms in the S&P 500 has grown by around USD 12 trillion since 2022.” For perspective, the chart below shows that only the […] The post Fueling AI Data Centers: Behind The Meter Solutions- Part 1 appeared first …

Read More »

Read More »

6-24-25 How Much Risk Do You Think You Can Handle?

Each incremental increase in the rate of return you want from your portfolio requires a geometric increase in risk to achieve.

What do you want your portfolio to do for you?

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

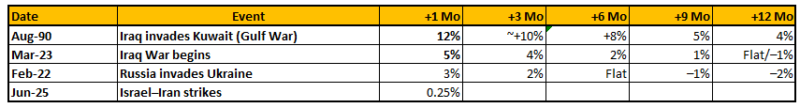

6-24-25 Is WW III Off the Table?

Is the threat of World War III finally off the table?

Lance Roberts breaks down the latest developments in global conflict and what they mean for financial markets. From oil prices and defense stocks to safe-haven assets like gold and Treasuries, we’ll unpack how investors should think about geopolitical risk now. Are markets too complacent—or is the worst truly behind us? Is Apple dead? Lance addresses a YouTube Chatroom query with analysis of...

Read More »

Read More »

The Role of Behavioral Finance in Protecting Your Wealth

Behavioral finance is a powerful lens through which we can better understand the relationship between human psychology and financial decision-making. While numbers and logic drive traditional investing models, real-world choices are often heavily influenced by emotions like fear, greed, and […] The post The Role of Behavioral Finance in Protecting Your Wealth appeared first on …

Read More »

Read More »

Strait Of Hormuz Closure: Why It Hurts Iran Too

Closing the Strait of Hormuz would have severe implications for global trade, most importantly oil. As the graphic below, courtesy of the EIA, shows, about 14 million barrels of oil and condensate flow through the Strait daily. That equates to […] The post Strait Of Hormuz Closure: Why It Hurts Iran Too appeared first on …

Read More »

Read More »

6-23-25 Investing Tactically, Not Emotionally

Lance Roberts shares the process of logical evaluation and portfolio risk management when markets experience turmoil: What matters most to investors? What do these attacks mean for earnings?

How might geopolitics affect EOQ activity?

Comparing the Japanese Carry Trade blow up vs the most recent Iran Bombings: There is not the same sense of urgency this time; markets have already moved-on.

How will the Israel-Iran conflict play out?

Likely...

Read More »

Read More »

6-23-25 This, too, Shall Pass

Historically speaking, events such as the bombing of the Iranian nuclear sites tend to be short-lived. This is most likely NOT the start of WW-3, but expect retaliations from Iran, and expect market volatility. But don't over-think it.

Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen...

Read More »

Read More »

6-23-25 U.S. Strikes Iran: How to Invest When Geopolitics Explode”

Over the weekend, the U.S. launched strikes against Iran’s nuclear facilities. Of course, for Americans and the financial markets, the response from not only Iran but also Iran’s allies will be critical. Lance Roberts describes a process of logical evaluation and portfolio risk management when markets experience turmoil: What matters most to investors? What do these attacks mean for earnings? How might geopolitics affect EOQ activity? [NOTE: Lance...

Read More »

Read More »

Behind The Meter Solutions: The Gas Powering AI

As the building of AI and cloud data centers expands rapidly, the demand for energy to power these data centers grows. The problem, however, is that the existing power grid can’t keep up with the rapidly increasing demand. Furthermore, improving and expanding the power grid takes longer than building data centers.

Read More »

Read More »

Iran Stuck By U.S.: Markets, Risk, and Rational Investing

Over the weekend, the U.S. launched strikes against Iran's nuclear facilities. Currently, I only have the details reported by major mainstream outlets. However, given that stock market futures are trading sharply lower on Sunday, I wanted to get something in print before the market opens relating to navigating this event over the next few days.

Read More »

Read More »

Oil Price Rise, Not Tariffs, Will Cause CPI To Tick Up

Inside This Week's Bull Bear Report Back To Extreme Optimism Last week, we discussed that the bull rally continues despite all of the negative narratives lately, from tariffs to the deficit to the potential onset of WWIII. "The market's bullish trend continued this week, and it is rapidly approaching all-time highs.

Read More »

Read More »