Category Archive: 9a.) Real Investment Advice

Retail Speculation Is Back With A Vengeance

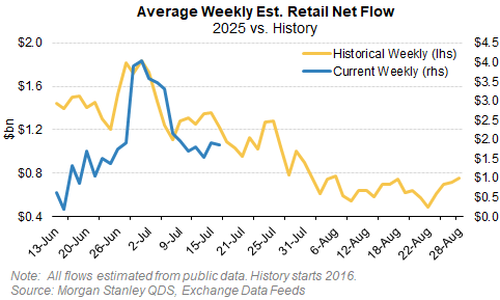

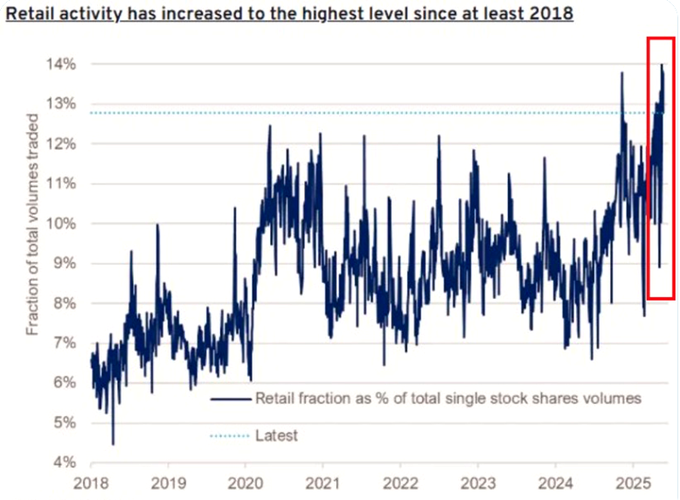

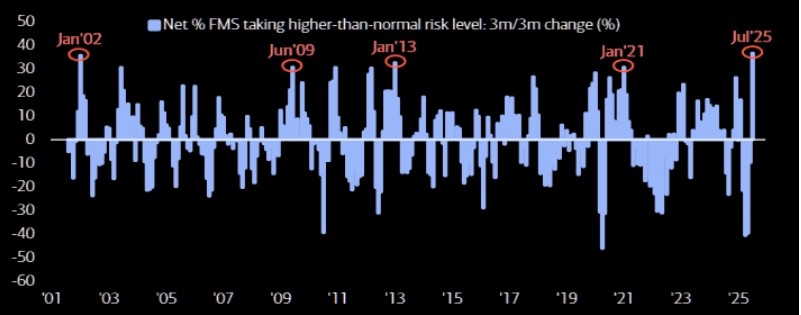

Retail speculation is once again gripping the markets. A recent Wall Street Journal article highlighted how the latest retail gambling vehicle—zero-days-to-expiration (0DTE) options—has exploded in popularity. According to CBOE, trading volumes in these contracts have surged nearly sixfold over the past five years, with retail traders now accounting for more than half of all transactions. …

Read More »

Read More »

Company Buybacks Are Surging

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

July Rate Cut Now Has One Fed Vote

Fed Governor Christopher Waller was crystal clear in a speech on Thursday that he would like the Fed to cut rates in July. Importantly, consider the first line of his speech at NYU: My purpose this evening is to explain why I believe that the Federal Open Market Committee (FOMC) should reduce our policy rate … Continue reading »

Read More »

Read More »

7-18-25 Money Scripts & Credit Scores

Richard Rosso & Matt Doyle host Rich's last live Radio-episode* and reveal the reason for Matt's recent absence from the show. Airport Security parameters; strong start to Earnings Season; references to '80's TV sit-coms; market futures, Lance's charts, the ultimate Death Cross; Richard previews Saturday's (7/19) Candid Coffee, and the genesis of the partnership with Lance Roberts; understanding Money Scripts; Netflix & streaming services;...

Read More »

Read More »

Trump Tests The Waters On Firing Powell

It appears President Trump set a test for the market to see what investors would think of him firing Jerome Powell. The bond and stock markets provided a swift answer to Trump's test. The test originated inconspicuously from a post on X by Florida Republican Anna Paulina Luna, who had been on the phone with … Continue reading...

Read More »

Read More »

China’s Economic Demise And Its Impact On The U.S.

Few are as candid and historically accurate as hedge fund manager Kyle Bass when identifying structural breaks in the global economy. In a recent interview, Bass painted a grim but telling picture of China's economic condition, warning: “We are witnessing the largest macroeconomic imbalances the world has ever seen, and they are all coming to …

Read More »

Read More »

7-17-25 Are Tariffs the Fed’s Best Friend?

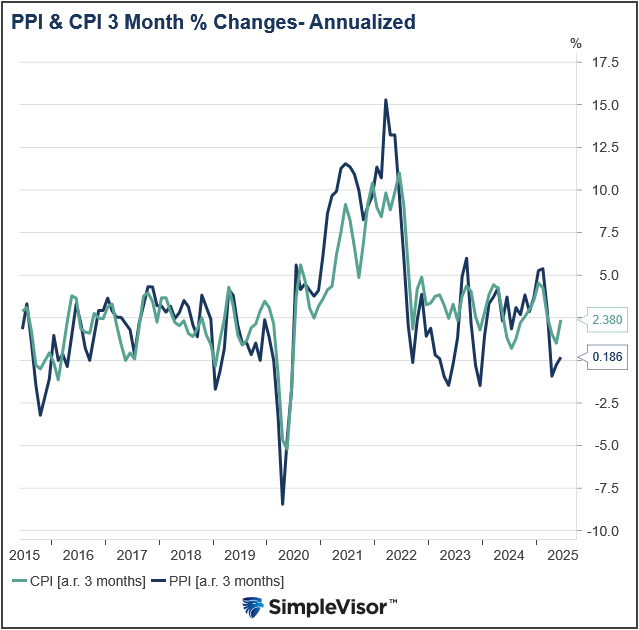

What is the Fed thinking now, with PPI reflecting virtually zero inflation in June, and calls from all sides to cut rates? Could the implied economic threat of tariff troubles actually be a savior for the Federal Reserve?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

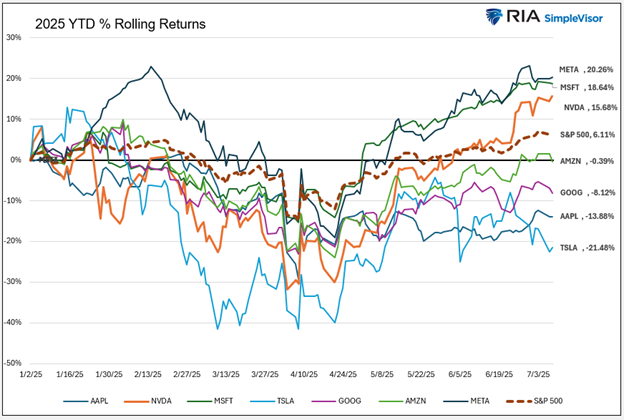

7-17-25 The Magnificent Seven are Mediocre

Are the Magnificent Seven losing their magic? Lance Roberts and Michael Leobiwtz get the real story behind Magnificent Seven stocks performance and what it means for your investment strategy. As Tech stocks underperform and market concentration risks grow, it’s time to reconsider where market leadership is heading in 2025.

📌 Topics Covered:

Why Magnificent Seven returns are slowing

Comparing FAANG vs Magnificent Seven stocks

Risks of stock...

Read More »

Read More »

PPI Takes A Bite Out Of The Tariff-Inflation Narrative

The BLS Producer Price Index (PPI), measuring wholesale prices, surprised to the downside, showing a zero percent increase in prices for June. PPI came in lower than what all 50 forecasters in Bloomberg’s survey predicted. To wit, both the core and headline figures were 0.20% below estimates. Notably, the headline PPI for the last three …

Read More »

Read More »

The Power of Tactical Asset Allocation in Risk Management

A static approach to investing is not enough. While long-term strategies remain foundational, flexibility in execution is key to preserving wealth and maximizing returns. That’s where tactical asset allocation comes in. Tactical asset allocation is a hands-on investment strategy that allows advisors to actively shift portfolio allocations based on changing market conditions. It’s not about …

Read More »

Read More »

7-16-25 The Rise and Fall of SPAC’s

SPAC's were so hot, sports figures like A-Rod and Shack were endorsing them: Give us your money, and we'll go find something to invest in. Unsurprisingly, the results were disastrous. And now, they're back.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

7-16-25 SPAC’s are Back!

SPACs (Special Purpose Acquisition Companies) are making headlines again. Lance Roberts & Danny Ratliff break down why SPAC investing is back in 2025, what’s driving the latest SPAC market trends, and what investors need to know before jumping in. Are these deals a golden opportunity or another speculative bubble? Earnings Season continues with Banks' reports and the effects of stock buy backs beginning to wane. Tuesday's CPI print had...

Read More »

Read More »

The Magnificent Seven Are Mediocre

In 2023, the "Magnificent Seven" (NVDA, META, TSLA, AAPL, MSFT, AMZN, and GOOG) became a popular nickname for the seven largest stocks by market capitalization. “Magnificent” was used because these stocks led the S&P 500 higher throughout the year. These same stocks had a strong showing again in 2024, as all seven were among the …

Read More »

Read More »

CPI Data Has Something For Everyone

Yesterday's CPI data was viewed by many as the first monthly BLS report to capture the full impact of tariffs. The headline CPI rose 0.3% and the core CPI data showed a 0.2% increase. The CPI data was slightly lower than Wall Street's expectations for a 0.3% increase for both figures. Those claiming that tariffs … Continue reading...

Read More »

Read More »

7-15-25 Before You Invest, Have an Emergency Fund First

How can you invest money when you don't have any? Life happens; be prepared. Have an emergency fund ready to cover life's little surprises to that you're not dipping into your investments to pay bills.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on...

Read More »

Read More »

7-15-25 Two Dad’s on Money

What's the best Money Advice you'd give your kids?

Lance Roberts & Jonathan Penn host our "Two Dad's on Money" episode of #TheRealInvestmentShow.

#FinancialAdviceForKids #MoneyLessonsFromDad #TeachingKidsMoney

Read More »

Read More »

Tariffs Cause The First June Surplus In Nine Years

For the first time since 2016, the Federal government ran a budget surplus in June. Before the Financial Crisis, a surplus was the norm. However, since then, deficits have been the rule, not the exception. The cause of the $27 billion surplus was $27 billion in tariffs taken in. For reference, the government took in …

Read More »

Read More »

How a Risk-Managed Investment Strategy Reduces Emotional Decision-Making

Investing is as much about mindset as it is about markets. When volatility strikes or headlines spark fear, even experienced investors can fall prey to emotional decision-making. Selling too soon, buying too late, or abandoning a plan entirely. These responses often do more harm than good. That’s where a risk managed investment strategy can make …

Read More »

Read More »

7-14-25 Market Predictions Need Three Things to be Valid

There need to be three things to quantify any market prediction to make it of any use whatsoever to investors: When? Why? ANd what course of action should be taken. If those three facts are missing, the outlook is useless.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow...

Read More »

Read More »

7-14-25 Relative Returns Or Absolute: What’s More Important?

Earnings Season has commenced with lowered expectations, meaning higher "beat" rates for companies, thanks to the lowered bar. Market react mildly to Mexican & Canadian 30% Tariffs; a warning for this week's CPI Report: The past four reports have been lower than expected, so a much higher number may be printed this time around. A three-month preview of market probabilities shows 50-50 chance of continued bullish activity; BUT, markets...

Read More »

Read More »