Category Archive: 9a.) Real Investment Advice

The Week Ahead: Volatility Is In The Forecast

Typically, in Monday's Commentaries, we share a few paragraphs titled "The Week Ahead' in a lower section. This week, the amount and importance of the data could have a meaningful impact on markets and the Fed. Thus, this week's' "The Week Ahead' gets top billing. Let's review the calendar: Between this week's labor and inflation … Continue...

Read More »

Read More »

Retail Data Sends A Warning

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

7-25-25 Are You a Meme Stock Mania DORK?

Is your portfolio full of DORKs? Jonathan Penn and Jonathan McCarty unpack the return of meme stock mania and four speculative favorites: DNUT (Krispy Kreme), OPEN (Opendoor), RKLB (Rocket Lab), and KSS (Kohl's). These retail-loved names are soaring again—but should you follow the hype or stay grounded? We'll discuss why these stocks are rallying, the behavioral finance behind retail speculation, and the portfolio risks in chasing "lottery...

Read More »

Read More »

Is Private Equity A Wolf In Sheep’s Clothing?

In July 2007, just before the financial crisis erupted, Citigroup CEO Chuck Prince summed up Wall Street's dangerous exuberance: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing.” Eighteen years later, Wall Street is …

Read More »

Read More »

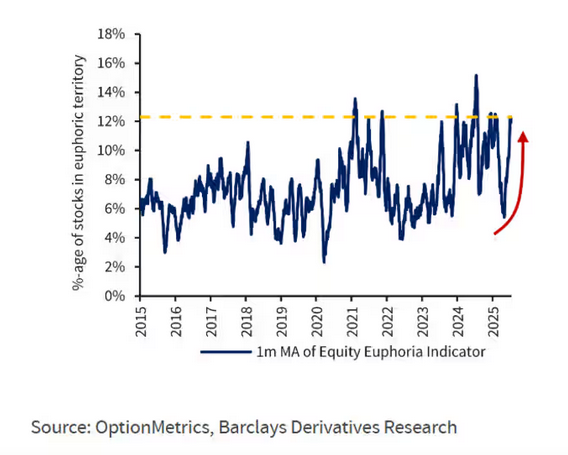

Retail Traders Are Driving Euphoria

Recent surges in speculative stocks are among several indicators that retail traders are introducing a bit of euphoria to the stock market. In an interesting article, MarketWatch notes that Wall Street is paying close attention to speculative trading behavior among retail traders. The following is from the article: Barclays strategists led by Venu Krishna have …

Read More »

Read More »

7-24-25 The Impact of AI on Market Volatility

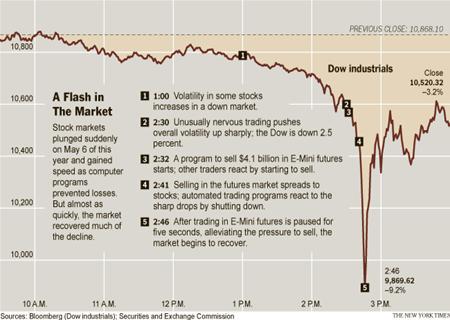

The use of artificial intelligence in stock market trading could be a double-edged sword: While exponentially increasing the velocity of trading, and the heightened possibility of another Flash Crash, AI might also recognize the signs of such before they could occur.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live...

Read More »

Read More »

7-24-25 How AI is Driving the Market

Artificial intelligence is no longer the future—it’s the engine behind today’s market moves. Lance Roberts & Michael Lebowitz break down how AI and machine learning are reshaping investing strategies, influencing algorithmic trading, and transforming financial analysis. Lance looks at earnings season and esla's results; there's nothing wrong with the markets, but all the ingredients are in place for a market reversion; what will be the...

Read More »

Read More »

Japan Financing Seals The Deal And Toyota Jumps

Japan and the US appear to have finalized a trade agreement that reduces the threatened 25% tariffs on Japan to 15%. Beyond the tariff rate, the deal has several important facets, including opening Japanese markets to US goods. However, most intriguing is that Japan will be financing the US with a $550 billion investment fund. …

Read More »

Read More »

7-23-25 Major Market Moves are Always Related to Credit or Forward Earnings Expectations

The major market collapses of 1974, 1999, and 2008 were all similar in that they were caused by issues of credit or forward earnings expectations. If someone says markets are going to crash 50%, and it's not because of credit or forward earnings expectations, it's not a valid reason.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on...

Read More »

Read More »

7-23-25 Why Are Stocks Up? Nobody Knows…

Stocks are rallying despite weak fundamentals. Lance Roberts & Danny Ratliff examine the real reasons behind the 2025 market surge. Malcom Jamal-Warner and Ozzy Osborne pass; they always come in three's: Who's next? Trumps tariff deal with Japan moves markets momentarily; Meme stocks are back. Negative divergences while markets on the rise signal more potential for market correction (not crash!) Lance & Danny discuss why stocks are up and...

Read More »

Read More »

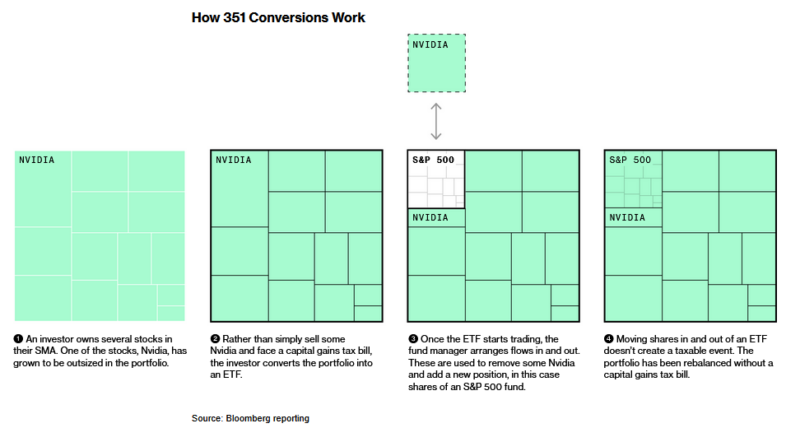

351 ETFs: A New Yet Old Way To Avoid Taxes

Imagine the dilemma of holding a large number of shares of NVDA with a massive unrealized profit. While, on the one hand, you have produced incredible returns, you also have an enormous tax bill once you sell. It appears that very wealthy individuals and some institutions are using a 100-year-old tax code to avoid paying … Continue reading...

Read More »

Read More »

AI Is Powering Markets

On May 6, 2010, the US stock markets dropped nearly 10% within minutes. What would be called a “flash crash” wasn’t caused by news, economic data, or a Fed policy decision. According to the U.S. Commodity Futures Trading Commission (CFTC), a large sell order on E-Mini S&P 500 futures, executed by a mutual fund and … Continue reading...

Read More »

Read More »

8-23-25 Savvy Social Security Planning

Will Social Security be there for you when you’re ready to retire?

Richard Rosso and Jonathan Penn host our next Candid Coffee on Savvy Social Security Planning, Saturday, August 23rd…

When should you apply for Social Security—and how much should you expect to receive?

Register today for Savvy Social Security Planning, Saturday August 23, 2025 at this link:

https://streamyard.com/watch/pbx9RwqV8cjF

#SocialSecurity #SavvySocialSecurityPlanning...

Read More »

Read More »

7-22-25 ‘You Have to Buy a House’ is a Myth

The National Association of Realtors has promoted the idea that home ownership was a 'must-have" ever since Alan Greenspan was promoting Adjustable Rate Mortgages. Their job is to sell houses.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

7-19-25 Candid Coffee – Retirement Blueprint

If you fail to plan, you plan to fail in retirement. Richard Rosso and Jonathan Penn address the thorny questions around preparing for retirement.

INTRO

3:55 Retirement is Qualitative: New Retirement Mentality

8:00 The Pre-Retirement Blueprint Agenda

9:15 What to Do for a Living in Retirement

11:00 Our Right Lane Strategy: Variable assets

13:15 The Impact of Large Losses in Retirement

16:45 The Blueprint Strategy

18:20 Begin a Formal...

Read More »

Read More »

7-22-25 Two Dads on Money: Rent or Buy?

Renting vs Buying a Home – Which Makes More Sense in 2025?

Lance Roberts & Jonathan Penn, Two Dads on Money, ponder whether, with rising mortgage rates and stubbornly high rents, is it better to rent or buy right now?

* What are the true costs of homeownership vs renting?

* What are the hidden fees most people overlook?

* What are the financial pros and cons of both options?

Home ownership is often styled as the "American Dream,"...

Read More »

Read More »

Will The Healthcare Sector Be The Next Rotation?

Investors aware of which types of stocks are rotating in and out favor have a distinct advantage. On Tuesdays, we summarize key points from our SimpleVisor absolute and relative analysis. The DIY tool uses technical analysis to assess how sectors, factors, and individual stocks are performing relative to the market and on an absolute basis. …

Read More »

Read More »

Why Retirement Planning for High Income Earners Requires a Different Approach

For most Americans, retirement planning advice follows a familiar script: save early, contribute to a 401(k), diversify investments, and aim to reduce expenses in retirement. While this guidance is foundational, it often falls short for high-income earners. Individuals earning well above the national average face a more complex set of financial challenges and opportunities that …

Read More »

Read More »

7-21-25 Big Questions for Big Tech

Can the AI boom sustain current valuations, or is a reckoning coming? Lance Roberts examines how AI and Big Tech investing trends are shaping portfolios, whether rising interest rates will derail Tech stock market outlook, and the growing risks of regulation impact on Big Tech from Washington to Brussels. Markets are still flirting with all-time highs. Lance shares the latest Roberts Family Saga, and his Coldplay strategy. Is investor exuberance...

Read More »

Read More »