Category Archive: 9a.) Real Investment Advice

Does Trump Have A Valid Point About Rate Cuts?

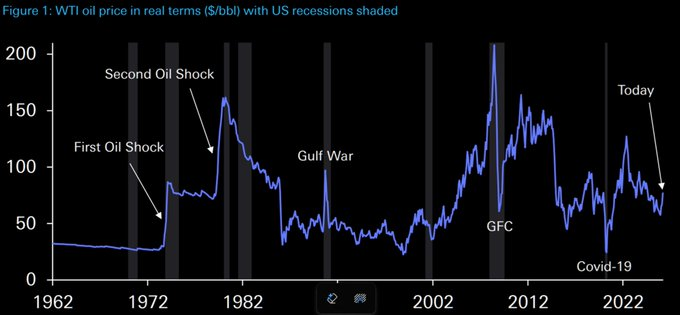

President Trump has been incessantly pressuring Jerome Powell to cut rates ever since he took office. To wit, check out Trump's latest post on Truth Social below. The Fed cut rates in late 2024 but stopped when Trump took office. Some claim the pause is political. Conversely, the Fed primarily supports its case with fears …

Read More »

Read More »

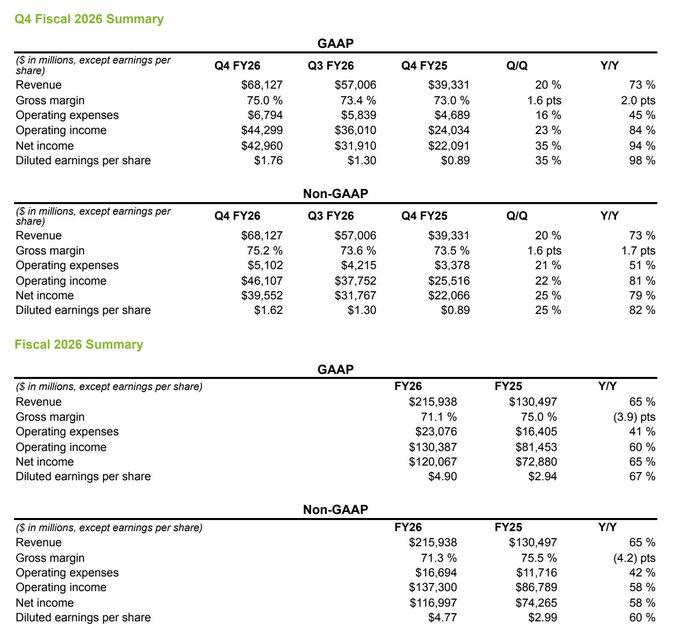

Analysts Grow Bullish With Earnings Forecasts

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

8-1-25 Don’t Let the Point Spread Fool You

The financial media started in early with headlines about "sweeping" new tariffs and markets tumbling 485-points...only, consider, with the Dow at 43,832, that's only about 1%. So don't let yourself be swayed by sensationalistic headlines.

Hosted by RIA Advisors Senior Financial Advisor, Jonathan Penn, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

8-1-25 Herd Mentality Could Be Costing You Big

Why do investors so often buy high and sell low? Jonathan Penn & Matt Doyle expose the dangers of herd mentality in the stock market, how FOMO (fear of missing out) drives bad decisions, and what behavioral finance teaches us about avoiding costly investing mistakes. Learn how to recognize crowd behavior—and how to protect your portfolio from emotional traps. Jon & Matt also cover market response to new tariffs, and whether markets will...

Read More »

Read More »

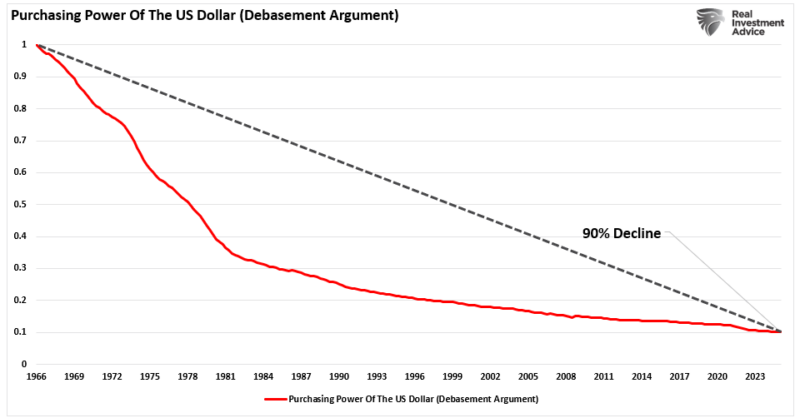

Debasement: What It Is And Isn’t.

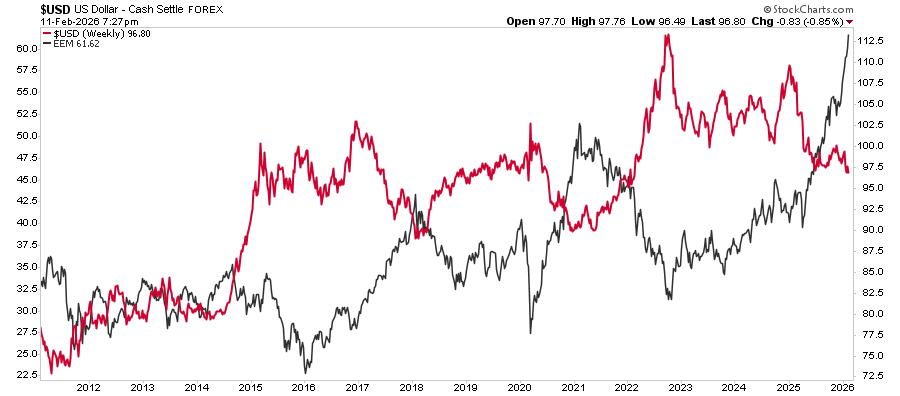

Over the past year, financial headlines continue to flood investors with doomsday predictions about the U.S. dollar. Whether it's social media influencers waving "dollar collapse" charts or YouTube personalities warning about debasement, the noise has become deafening. The narrative is seductive: inflation is out of control, the government is printing money, and the dollar is on its last legs.

Read More »

Read More »

GDP Is Meh: The Bullish And Bearish Headlines Are Misleading

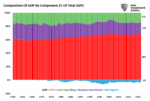

The BEA reported that real GDP grew by 3.0% in the second quarter. Such is almost a percent better than the longer run trend growth rate, and is a cause for optimism for some. However, first quarter GDP was -0.5%, well below trend growth, and worthy of pessimism. The problem with being optimistic about the second quarter or pessimistic about the first quarter is that the threat of tariffs and actual tariffs abnormally impacted the data.

Read More »

Read More »

7-31-25 How High Interest Rates Impact the Housing Market

He housing market is like a pyramid: Younger buyers purchase homes from the generation ahead of them so those buyers can move up. Higher rates are making those houses unaffordable and the pyramid ceases to work.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA.

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's...

Read More »

Read More »

7-31-25 The Fed Holds Firm

The Federal Reserve holds interest rates steady in its latest policy meeting, signaling a firm stance amid inflation concerns, and despite unchecked market bullishness. Lance Roberts & Michael Lebowitz break down what the Fed's decision means for investors, the economy, and your portfolio. AI datacenter buildouts are showing up in economic data...but, the 3% GDP print has a more dire undertone: Strip out the build outs, and the economy is...

Read More »

Read More »

Dissent In The Fed Ranks

December 2024 marked the second-to-last time there was a dissent by an FOMC voting member. The dissent, at the time, was a sole vote by Jefferey Schmid against cutting rates. The last dissent was yesterday. While the Fed voted to maintain the Fed Funds rate at 4.25-4.50%, Michelle Bowman and Christopher Wallace cast dissenting votes in favor of reducing rates.

Read More »

Read More »

7-30-25 How to Effectively Hedge Against Inflation

IIt's a mega-earnings report day, and a Fed Meeting day, to boot; the notion among some investors that 20% returns are normal is scary. The Fed is expected to hold steady on interest rates, but there is dissention in the ranks of Fed Governors. Inflation erodes your purchasing power—are you prepared? Lance Roberts & Danny Ratliff break down smart strategies to hedge against inflation and protect your wealth. Lance and Danny commiserate on kids...

Read More »

Read More »

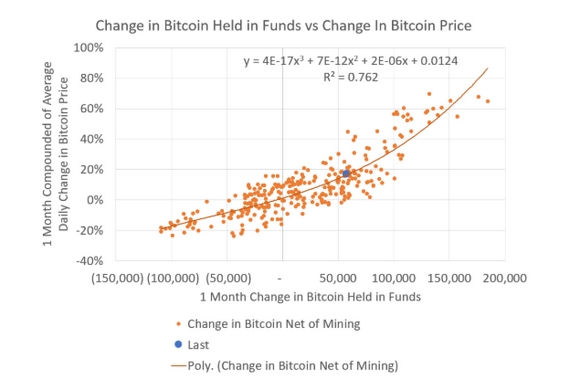

A Ponzi Scheme: The Graph Driving MicroStrategy And Others

The graph below, from Michael Green (@profplum99), is the best way to show the logic that drives a Ponzi scheme in Bitcoin. The Ponzi scheme graph illustrates that there is a robust correlation between changes in the amount of Bitcoin held in funds (ETFs) and the price change. Simply, as new capital is used to …

Read More »

Read More »

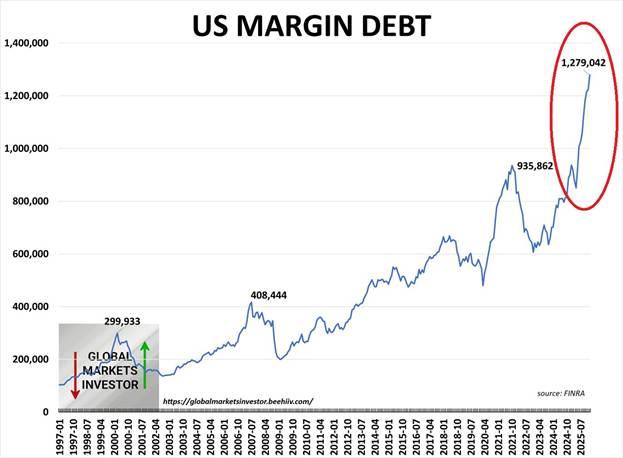

The High Beta Melt Up: Echoes Of 1999

In our recent article, "The Magnificent Seven Are Mediocre," we pondered whether the stock market is entering a melt-up phase, where investors driven by extreme speculative behavior and hopes for exponential returns favor volatile stocks with high betas. To be clear, we do not know whether we are in a melt-up phase. The market could …

Read More »

Read More »

There Will Always Be a Need for Human Connection Even With AI

While AI may replace some jobs, it’s important to remember that certain roles will always require the human touch—no matter how advanced technology becomes.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

7-29-25 Two Dads on Money: Grit, Grind, & Glam

Markets continue their bullish trend; Infrastructure build-out for AI is beginning to show up in data. Money flows return to US markets. Lance shares the bet he has with his dog; Lance & Jon share their "Two Dads" wisdom for fresh college grads' job searched & career choices, and offer three pillars for success:

○ Grit: Passion + perseverance. Stick through setbacks, stay committed, believe effort matters more than innate...

Read More »

Read More »

Tax-Efficient Wealth Transfer Strategies for Business Owners

As a business owner, you've worked hard to build wealth for yourself, your family, and future generations. Yet without the right plan, a significant portion of your estate could be lost to taxes. That’s where tax-efficient wealth transfer strategies come into play. These strategies help you reduce estate tax exposure, preserve your legacy, and support …

Read More »

Read More »

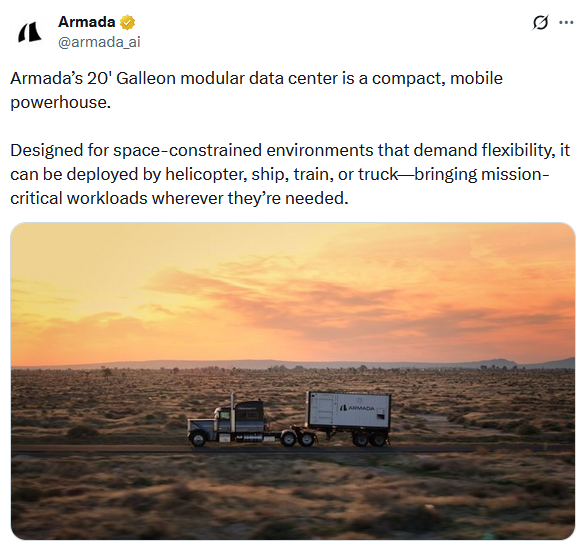

Portable Data Centers

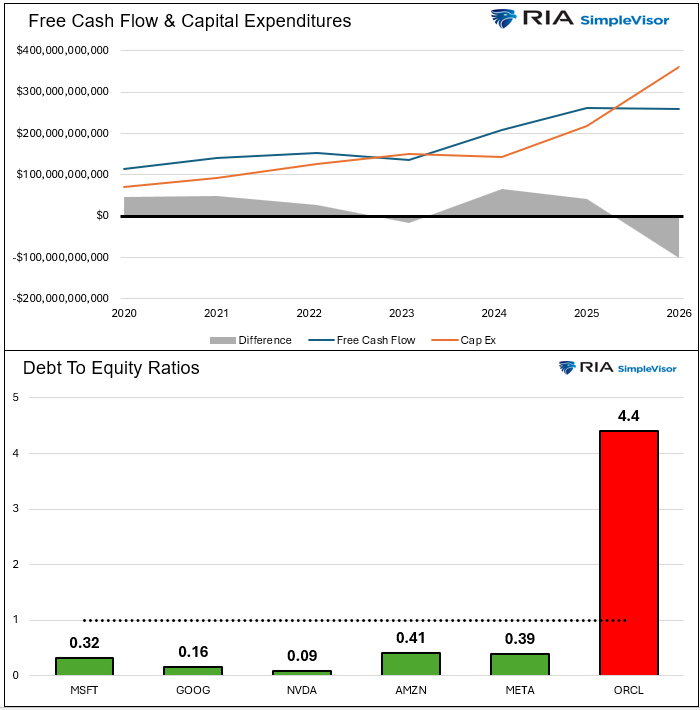

Construction of AI data centers can take anywhere from six months to multiple years to complete. Accordingly, they can't build data centers quickly enough to keep up with the demand. Accordingly, we will need new, innovative solutions to meet the demand. For example, a startup private company named Armada makes portable AI data centers for …

Read More »

Read More »

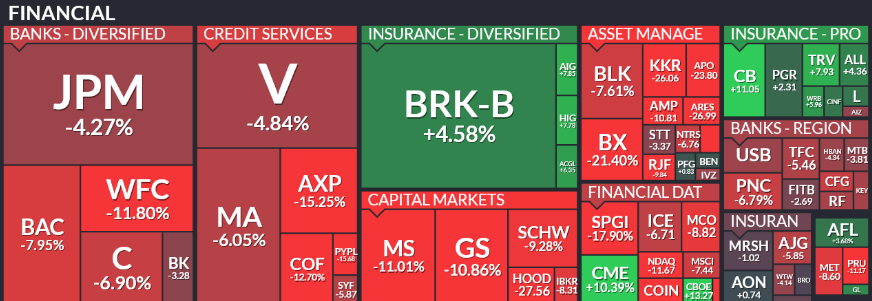

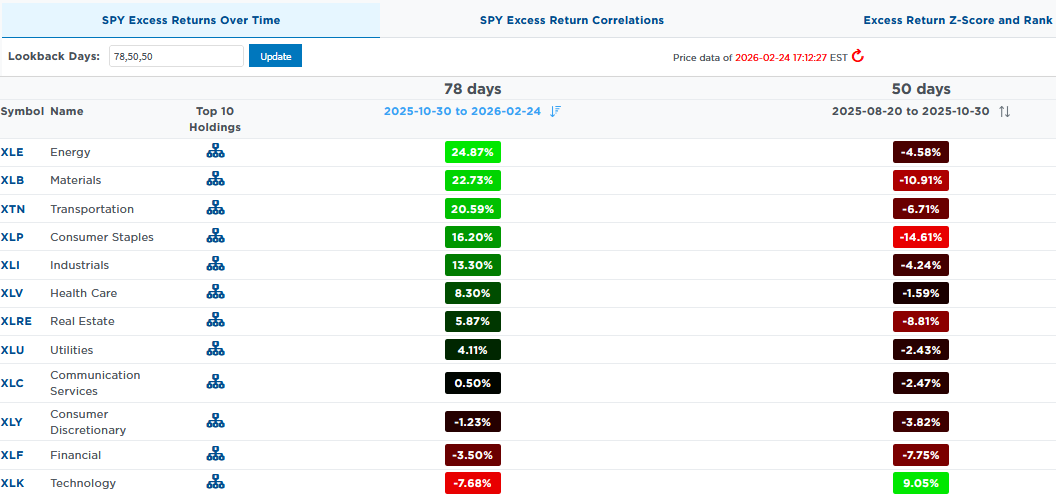

Not Everything Goes Down During a Correction

Money doesn't leave the market during a correction; not everything goes down during a corrective action in the markets. So where do you look to place extra cash?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

7-28-25 Big Tech Earnings

Big Tech Earnings: Lance Roberts reviews what Apple, Google, and Microsoft Just Revealed, plus Market Reaction & Forecast on #TheRealInvestmentShow.

#BigTechEarnings #TechStocks2025 #EarningsSeason

#StockMarketNews #FAANG

Read More »

Read More »

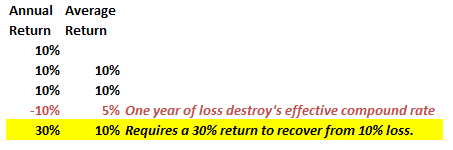

Portfolio Benchmarking: 5-Reasons Underperformance Occurs

When markets decline—especially after long periods of sustained growth—the familiar advice resurfaces: "Be patient. Stay invested. Ride it out." The rationale? The market always goes up over time. But there's a critical flaw in this narrative. Your portfolio and a portfolio benchmark are entirely different things. And portfolio benchmarking, or the constant comparison of your …

Read More »

Read More »