Category Archive: 9a.) Real Investment Advice

TITLE: 8-8-25 Breaking Even with Social Security is a Myth

Thinking you're going to "break even" with Social Security is a myth; using that premise to take SS early is a mistake.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:...

Read More »

Read More »

8/8/25 What Would a 20% Social Security Reduction Mean for Your Retirement?

Could your Social Security check be slashed by 20%?

With trust fund depletion looming, many retirees could face harsh income cuts sooner than expected. Richard Rosso & Jonathan McCarty break down what a 20% Social Security reduction would mean for your retirement lifestyle, how to prepare now, and smart income strategies to fill the gap. Whether you're already retired or nearing retirement, this is a must-watch.

0:18 - Social Security should...

Read More »

Read More »

Data Myopia Foils The Fed

For months, we have been warning that the labor markets are not as strong as the BLS data attests. Six months ago, we wrote: While labor market data is generally good, there are signs the labor market is at a standstill. Continuing jobless claims are steadily rising and at their highest level in over three … Continue reading »

Read More »

Read More »

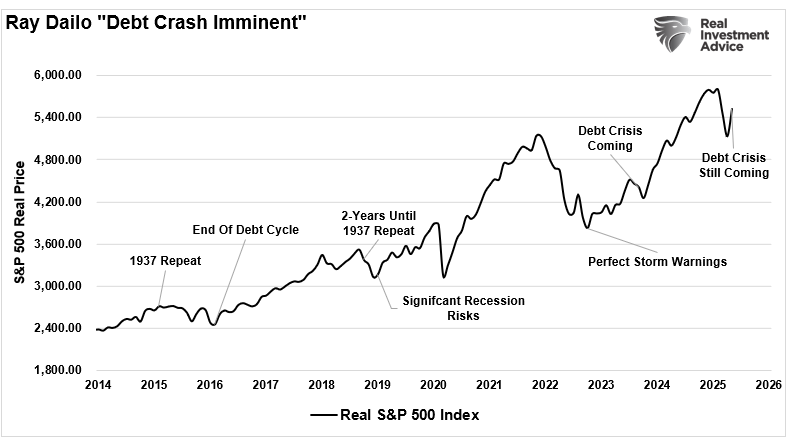

The Debt And Deficit Problem Isn’t What You Think

In recent months, much debate has been about rising debt and increasing deficit levels in the U.S. For example, here is a recent headline from CNBC: The article's author suggests that U.S. federal deficits are ballooning, with spending surging due to the combined impact of tax cuts, expansive stimulus, and entitlement expenditures. Of course, with …

Read More »

Read More »

8-7-25 The Risks of Investing in AI Stocks vs the Dot-com Bubble

Investing in companies just because they're "in AI" is reminiscent of investors who plowed money into anything that had a .com behind their names at the turn of the century. That did not end well for most.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

8-7-25 The Low Beta Boom: Sidestepping The Dot-Com Bust

How can low beta stocks help savvy investors sidestep the pain of the Dot-Com Bust? Lance Roberts & Michael Lebowitz reveal why that lesson matters today...what low beta investing means, how it works in bear markets, and how it can protect your portfolio from bubbles and volatility. Lance reviews market reaction to tariffs coming completely online, and Apple's commitment to re-shore manufacturing to the US; the multiplier effect of domestic...

Read More »

Read More »

The Inheritance Conversation – Love or Turmoil?

I understand how much we all disdain planning for our inevitable demise. As a Certified Financial Planning professional for over 25 years, I truly get it—I, too, find estate planning a necessary but unpleasant endeavor. However, only you can decide whether the inheritance conversation is love or turmoil. My father decided, upon finding out about …

Read More »

Read More »

Navigating a Business Sale: Financial Planning Tips Before and After

Selling a business is often the biggest financial event of an entrepreneur’s life. Whether it’s a decades-long family company or a fast-growing startup, the decision to sell brings both opportunity and complexity. Amid the excitement of closing the deal, it’s crucial not to overlook the planning that must take place before and after the transaction. …

Read More »

Read More »

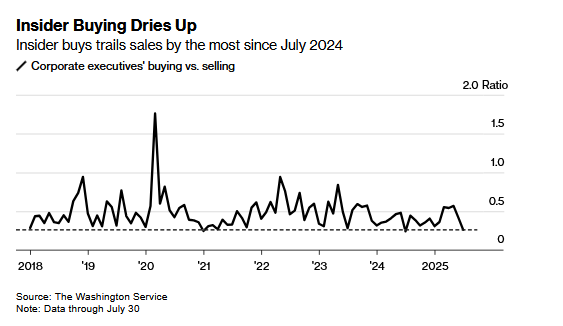

Insiders Sell The July Rally

While the market steadily rose throughout June and July, corporate insiders were growing less enthusiastic about the stock market. Less than a third of S&P 500 companies saw insiders purchase stock in their own company in July. That is the lowest figure since 2018. Moreover, the ratio of buys to sells for insiders fell to … Continue...

Read More »

Read More »

8-6-25 The Risks of Over-reliance on Index Funds

"Just buy the VOO (S&P 500) and chill..." is NOT good advice. Investors made NO money on VOO between 1999 and 2013. Outcomes from buying when valuations are low is very different from buying when valuations are at record highs.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

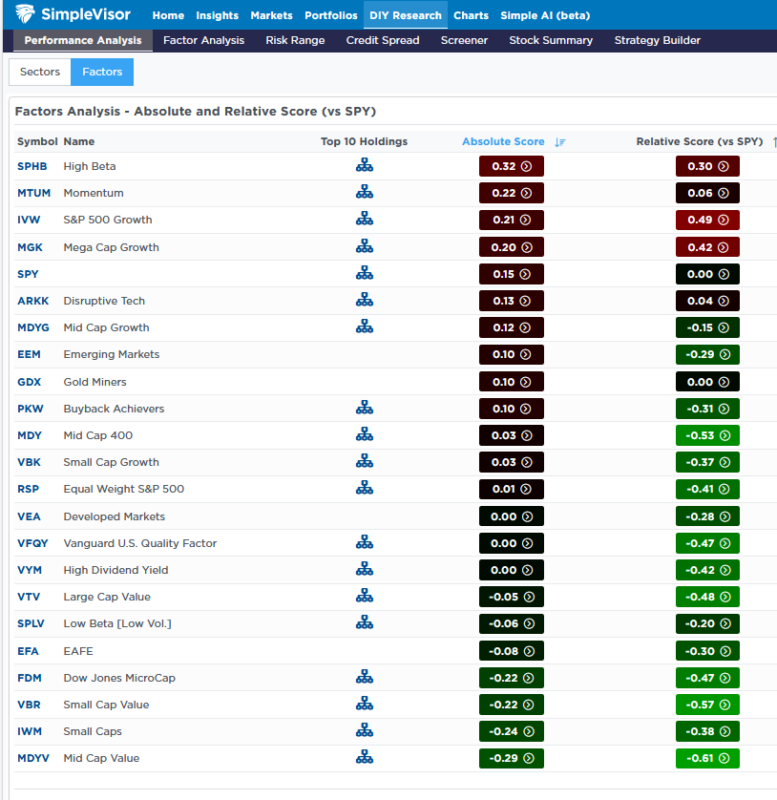

8-6-25 How to Build a Winning Investment Portfolio | What to Buy & What to Avoid in 2025

Are you building an investment portfolio but unsure what assets belong—and which ones to avoid? Lance Roberts & Danny Ratliff demonstrate how to build a diversified portfolio, the critical assets every investor should consider (stocks, bonds, ETFs), and the common portfolio mistakes that could hurt your long-term returns. Whether you're a beginner investor or refining your financial strategy, these portfolio construction tips will help you...

Read More »

Read More »

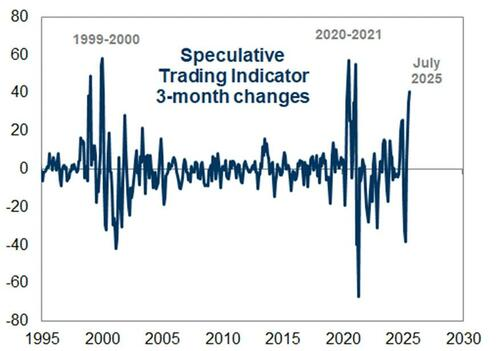

The Low Beta Boom: Sidestepping The Dotcom Bust

Following the release of our article The High Beta Melt Up- Echoes of 1999, we received a few emails complaining that we left our readers hanging. They wanted to know how investors could have shifted their holdings from high beta and momentum stocks to sidestep massive losses when the dot-com bubble burst. In the first …

Read More »

Read More »

Utilities And Industrials Carry The Market

The race to build and power AI data centers is creating an interesting anomaly in the stock market. Despite the S&P 500 being up over 7% on the year, and the higher-beta stocks seemingly leading the way, utilities and industrials are the best-performing sectors. The surging demand for power drives utilities, while industrials benefit from …

Read More »

Read More »

8-5-25 Retirement is Boring

Humans need to DO something. The notion of retirement as sleeping-in, playing video games, doing what ever you want when...it's not healthy, and the guy that created the Financial Independence, Retire Early movement...went back to work.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

8-5-25 Where Do Millennials Get Financial Advice? | Two Dads on Money Talk Smart Money Moves

IIn this episode of Two Dads on Money, Lance Roberts & Jonathan Penn dive into how Millennials find financial advice in today’s digital world. From TikTok influencers to YouTube financial experts, and from Reddit forums to traditional financial planners, where should Millennials really turn for smart money guidance?

Lance reviews Monday's Market action, Eurozone vs U.S. economic growth expectations, and Palantir's earnings report. Millennials...

Read More »

Read More »

How to Use Charitable Giving to Reduce Taxes and Maximize Impact

Charitable giving can be a powerful component of your long-term financial plan. With the right strategy, giving can help you support the causes you care about while simultaneously reducing your tax burden and enhancing your legacy. Whether you’re considering a donor-advised fund, establishing a charitable trust, or exploring private foundations, integrating philanthropy into your broader …

Read More »

Read More »

Palantir Thrives On Trump Presidency

Shares of Palantir rose about 20% the day President Trump was elected president. The stock hasn't looked back, more than tripling since election day. Palantir has been a big winner under the Trump administration. This past weekend, the Washington Post highlighted some of the big government contract wins for Palantir as shown below: Palantir's sales …

Read More »

Read More »

8-4-25 Corrections are Better Opportunities for a Better Price

Market weakness is not a bad thing. We don't like corrections, but corrections are an opportunity to put capital to work at a better price.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube...

Read More »

Read More »

8-4-25 Bull Streak Ends As August Begins

The historic stock market bull streak has finally come to an end as August kicks off, raising concerns about seasonal weakness, rising volatility, and technical breakdowns. Lance Roberts breaks down what triggered the reversal, how meme stock speculation is adding risk, and what the August-September period historically means for investors.

We’ll analyze key technical indicators on the S&P 500, NASDAQ, and Dow Jones, discuss the latest earnings...

Read More »

Read More »

Bull Streak Ends As August Begins

As the turn of the calendar occurred on Friday, the bull streak for the market since the April lows ended. Such was not unexpected, and the correction has been a topic of discussion in our #DailyMarketCommentary over the last two weeks. To wit: "While the overall backdrop remains bullish, including stable economic growth and earnings, …

Read More »

Read More »