Category Archive: 9a.) Real Investment Advice

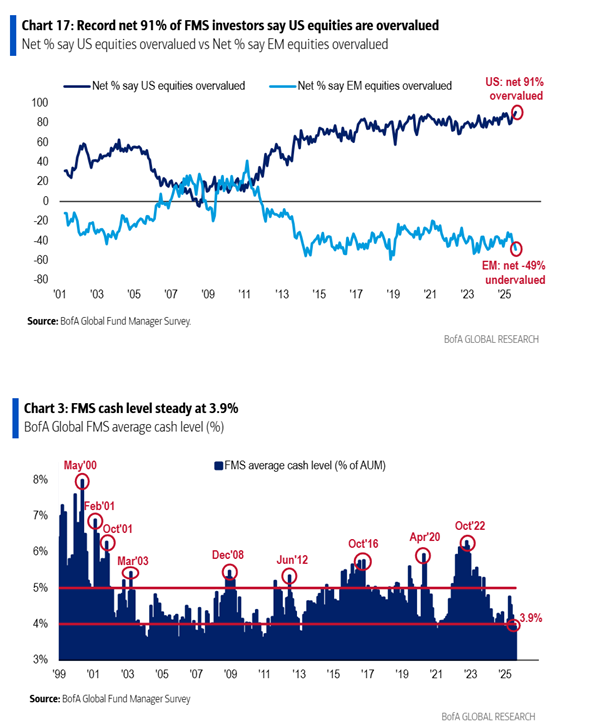

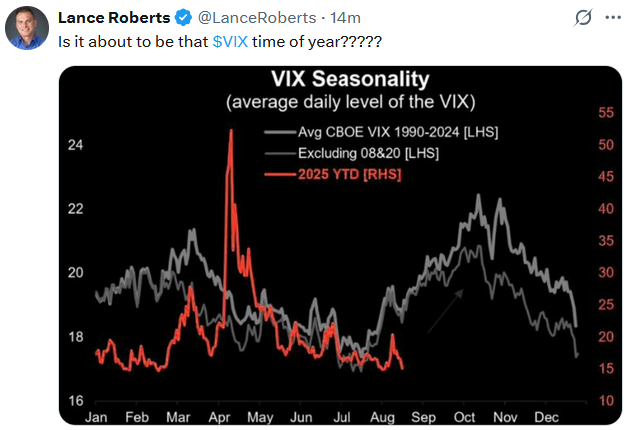

Is Conviction The Biggest Risk To The Stock Market?

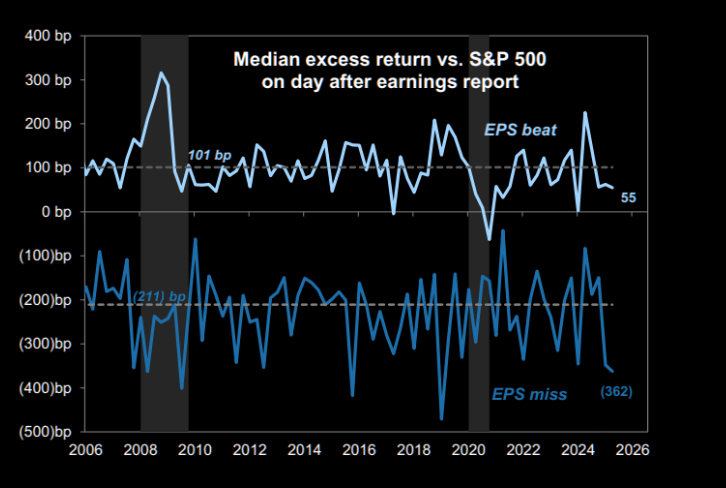

Edward Harrison of Bloomberg recently made the following important market observation: “buying stuff you don’t believe in creates downside risk.” Conviction is a measure of how much investors believe in their holdings. When conviction runs high, investors are often more willing to tolerate lower prices. In fact, some may add to their positions at lower prices. …

Read More »

Read More »

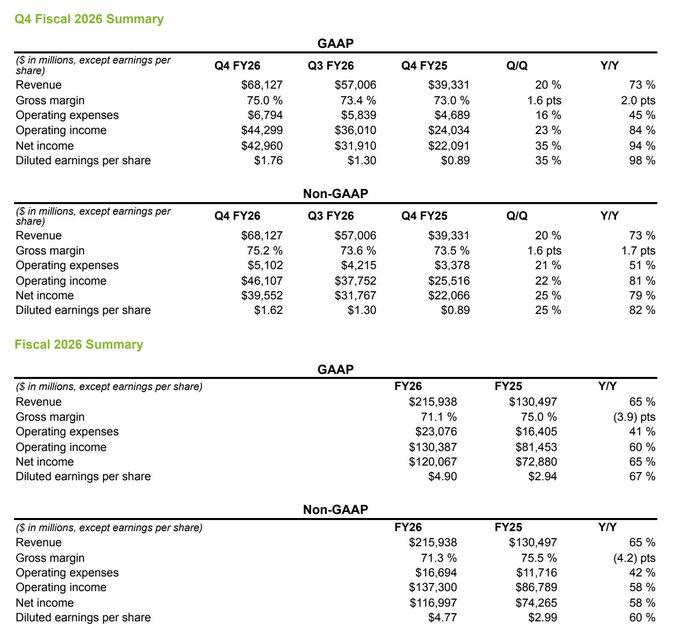

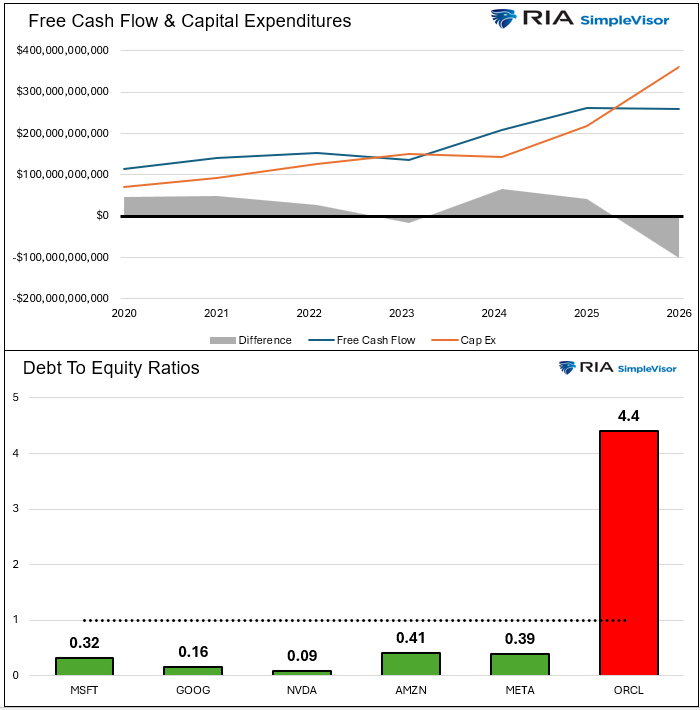

8-14-25 The Risks of Over-Valued AI Stocks

What happens if Nvidia reports slowing earnings or lowered guidance in their next quarterly report? Anything that might change the narrative of the AI cap-ex cycle will have consequences.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:...

Read More »

Read More »

8/14/25 Will the Fed Cut Rates NOW??

Will the Federal Reserve blink and cut rates now? Lance Roberts & Michael Lebowitz break down the latest inflation data, economic trends, and market signals that could force the Fed’s hand and what it means for your portfolio on

#TheRealInvestment Show streaming-live starting at 6:00a CDT on YouTube, Meta, & X!

#FederalReserve #RateCut #InterestRates #USEconomy #StockMarketNews

Read More »

Read More »

The Hidden Cost of Not Having an Investment Policy Statement

When it comes to managing wealth, especially for high-net-worth families and business owners, investment decisions can feel overwhelming. Market volatility, emotional reactions, and competing priorities can quickly lead to inconsistent choices that erode long-term success. That’s where an Investment Policy Statement (IPS) comes in. Yet despite its value, many investors skip this crucial document, unknowingly …

Read More »

Read More »

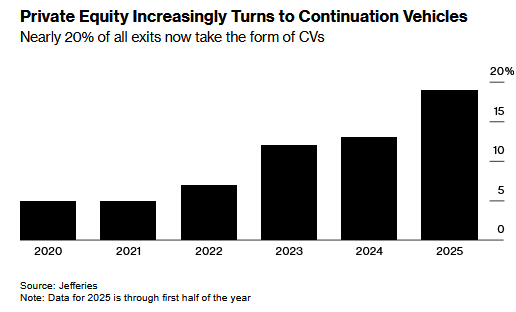

CVs Signal Maturity In Private Equity

Private equity funds often buy assets intending to sell them and realize a profit over a specific period. However, recently it's become more common that their assets are not ready to be sold when they had initially forecasted. While the fund can hold the assets longer than expected, fundholders may demand liquidity. Instead of selling …

Read More »

Read More »

8-13-25 Investing Without a Target is Like Throwing Darts in the Dark

It's often been said, "if you fail to plan, you plan to fail," and the same holds true for investing without a strategy in mind.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube...

Read More »

Read More »

8/13/25 Portfolio Concentration: Hidden Risks That Can Sink Your Returns

Many investors unknowingly take on portfolio concentration risk—placing too much money in one stock or sector. Lance Roberts & Danny Ratliff break down why concentrated stock portfolios can be dangerous, how lack of investment diversification can magnify losses, and what smart risk management investing looks like.

Whether you’re building long-term wealth or protecting what you’ve earned, understanding the hidden dangers of over-concentration...

Read More »

Read More »

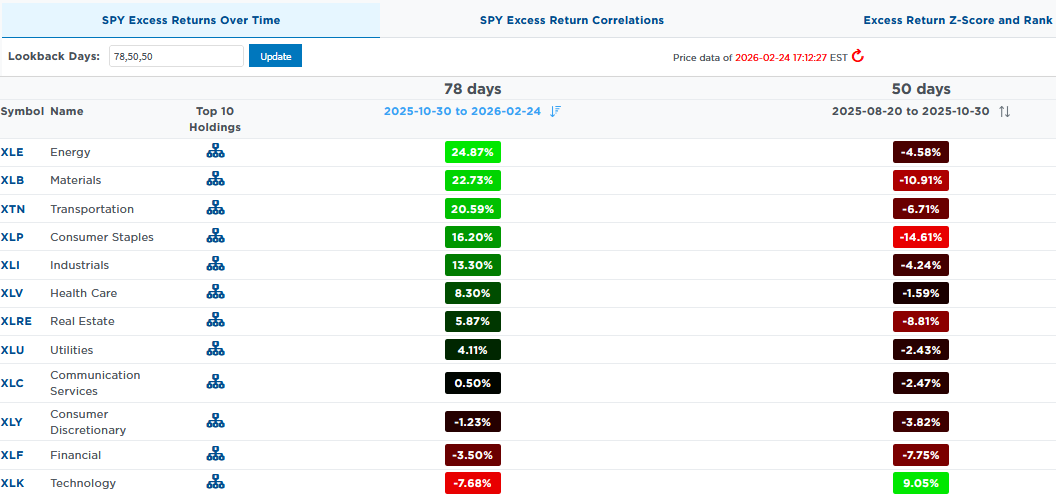

The Index Isn’t Always Accurate: Factors Influencing Yields

How was the weather yesterday in the United States? You could answer by citing an average temperature or precipitation level. However, doing so would severely misrepresent the weather in many parts of the country. Similarly, the typical response to “What did the market do today?” is often to quote the change in the S&P 500 …

Read More »

Read More »

Is Bad Breadth The Norm, Not The Exception?

Since the Pandemic, markets have been behaving abnormally. One such instance is a somewhat regular occurrence of bad market breadth. In other words, the market-cap weighted S&P 500 drives higher, yet fewer and fewer stocks are participating in the rally. For instance, in Monday's Commentary, we discussed the current instance of bad breadth. To wit: …

Read More »

Read More »

8-12-25 Let Your Winners Run, Cut Your Losers Short

Advice from one of the most-revered investors, Jesse Livermore, in 1916 still rings true today: Let the winners in your portfolio run, and cut the losers short; they're not coming back.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢...

Read More »

Read More »

8-12-25 Two Dads on Money – Meme Stock Trading & Jesse Livermore’s Timeless Rules for Speculation

Meme stocks meet Jesse Livermore’s timeless trading rules —

Lance Roberts & Jonathan Penn discover how classic speculation strategies apply to today’s market frenzy. Lance preview's today's CPI print and a Goldman Sachs report on who exactly is shouldering the increased costs of tariffs; a look at markets' up/down pattern, and weakness within; Lance and Jonathan discuss meme stocks, speculative risk, and what the Old Masters of investing had...

Read More »

Read More »

The Benefits of Working With an Independent RIA vs a Big Bank Advisor

When it comes to your financial future, choosing the right advisor matters. But not all financial advisors operate the same way. One of the most important distinctions you can make is between a Registered Investment Advisor (RIA) and an advisor at a big bank or brokerage firm. At first glance, both may offer similar services …

Read More »

Read More »

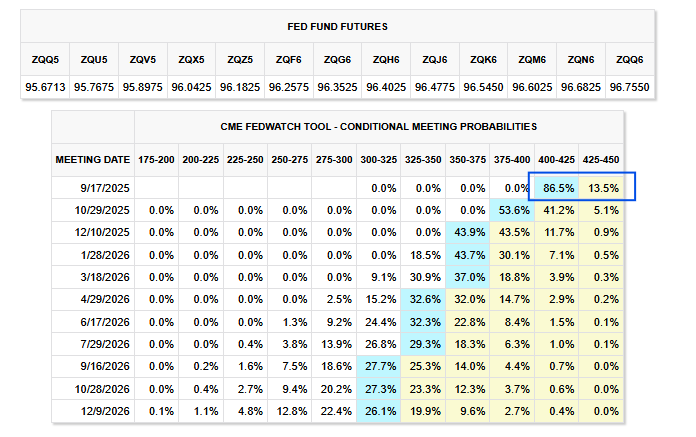

A 50 BPS Rate Cut Is Not Out Of The Question

As we share below, the Fed Funds futures market is 86.5% confident the Fed will cut rates by 25 bps in September. However, they assign a zero percent chance that the Fed cuts by 50 bps. Powell's trepidation to cut rates leaves traders unwilling to consider that anything more than 25bps is possible. We argue … Continue reading »

Read More »

Read More »

8-11-25 The Impact of Adult Pacifiers on Workplace Productivity

During this morning's live-stream, Lance Roberts was distracted by a story on FOX about a new trend of using adult pacifiers to quell workplace stresses. That's not going to fly around here...

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/...

Read More »

Read More »

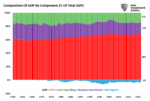

8-11-25 Want an Economic Crisis? Slash Government Spending 50%

Cutting government waste and excess spending sounds like a noble cause, but careful what you ask for.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

Read the article Lance mentions on our website, sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:...

Read More »

Read More »

8/11/25 U.S. GDP Shows Cracks – Why Investors Should Pay Attention

July’s employment report confirmed that the slowdown in US economic growth is taking root.

The unemployment rate increased to 4.2 percent, while labor force participation remained at 62.2 percent.

If wage growth continues to moderate and hiring slows, the consumption-driven economy will lose its primary growth engine.

Lance Roberts examines the data and suggests strategies for investors on today's episode of #TheRealInvestment Show.

#USEconomy...

Read More »

Read More »

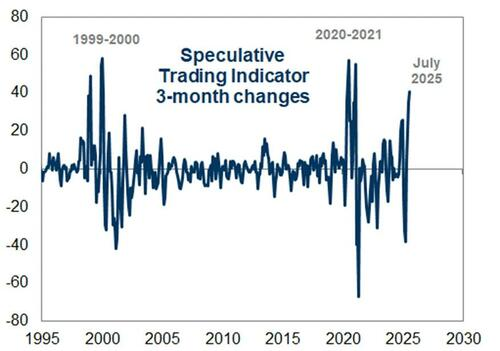

Meme Stock Trading & Livermore’s Approach To Speculation

Meme stock trading has returned in force. As discussed last week, the fear of missing out (FOMO) continues to dominate investor sentiment. The meme stock movement is again dominated by speculative retail trading driven by online forums, social media hype, and short-term momentum. Unlike GameStop and AMC in 2021, the current cycle revolves around names …

Read More »

Read More »

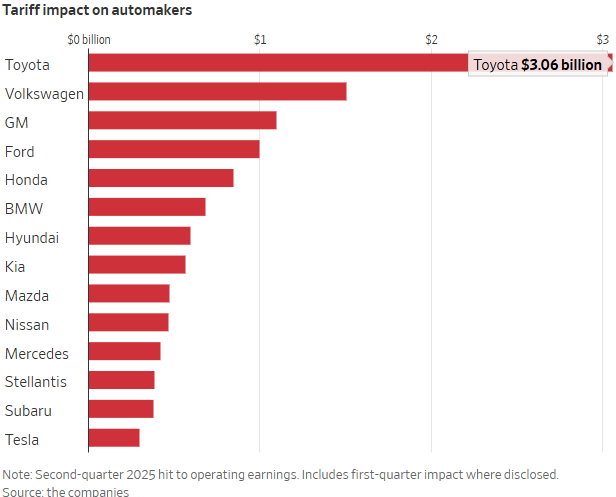

Auto Manufacturing Shift Puts Pressure on Profits

While tariff threats dominate headlines, automakers face a structural shift that could reshape the global auto industry. In response to steep auto import duties, manufacturers are being nudged toward “local for local” production models- an expensive and time-consuming pivot. Per the Wall Street Journal article “Auto Industry Takes $12 Billion Hit From Trade War”: Beyond …

Read More »

Read More »

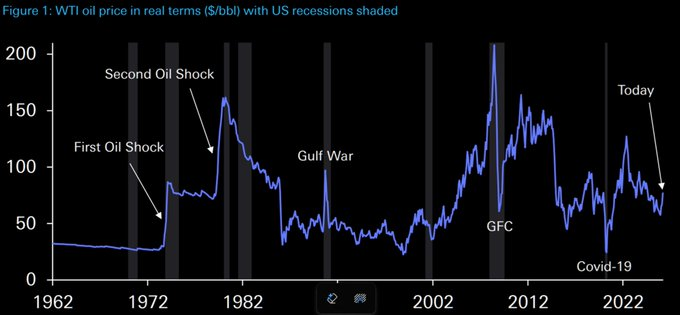

US Economic Growth Shows Cracks

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »