Category Archive: 9a.) Real Investment Advice

SaaS: Is There Opportunity In The Destruction?

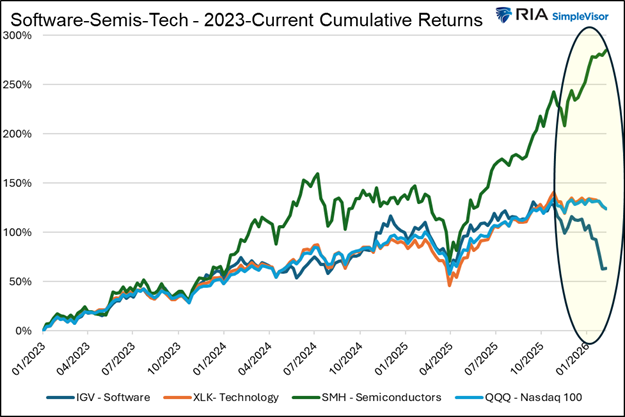

A specter is haunting Wall Street—the specter of the “SaaSpocalypse.” Since the iShares Expanded Tech-Software Sector ETF (IGV) peaked on September 19, 2025, it has fallen roughly 30%. For context, the broad technology indexes like XLK and QQQ are essentially flat over the same period, and the semiconductor ETF (SMH) is up 30%. Between mid-January …

Read More »

Read More »

MFS Collapses Adding To Private Credit Woes

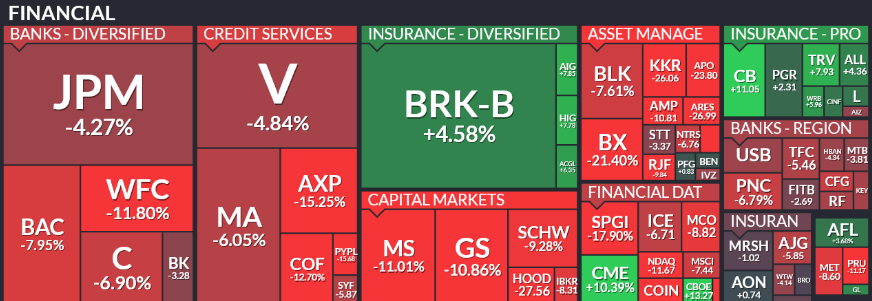

In our February 3rd Commentary, we discussed the recent woes negatively impacting private credit funds. The concerns began last year with the bankruptcies of Tricolor and First Brands and continue to mount, as evidenced by the share prices of some private credit managers shown below. Adding to market worries is fresh news of a $1.3 …

Read More »

Read More »

Market Topping Process?

🔎 At a Glance Give Us A Review ***** If you enjoy our work each week, could you be so kind as to leave us a review? It would be most appreciated. 🏛️ Market Brief - Turmoil In AI Stocks As we will discuss further in today's commentary, the market remains stuck in a fairly narrow … Continue reading »

Read More »

Read More »

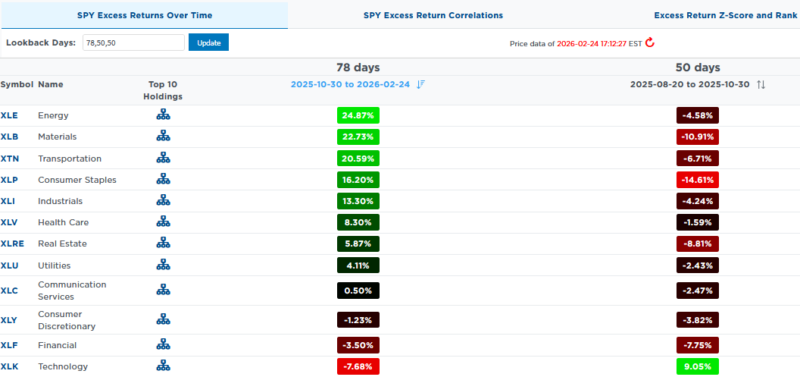

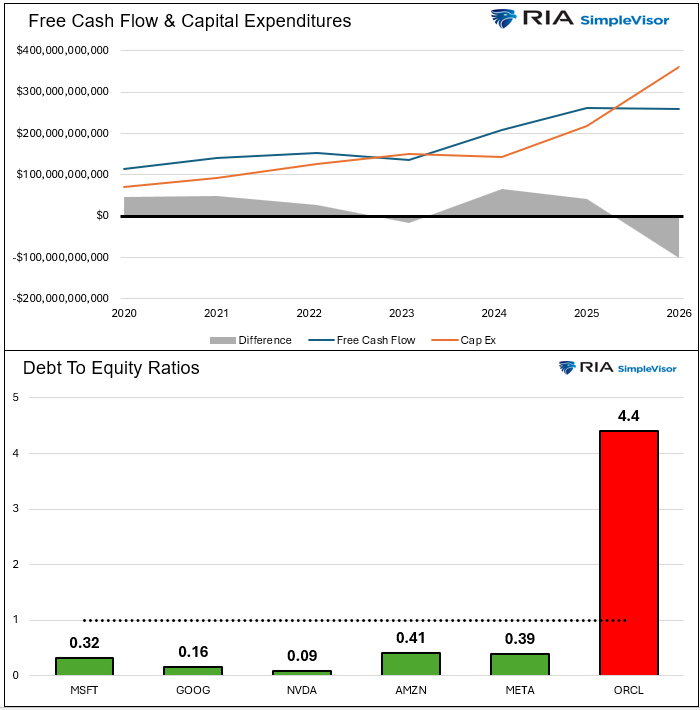

2-27-26 When AI CapEx Growth Will Slow, Leadership Will Change

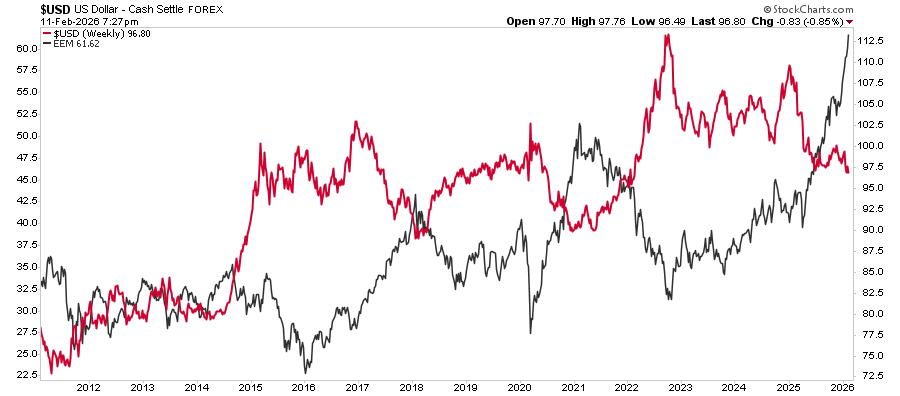

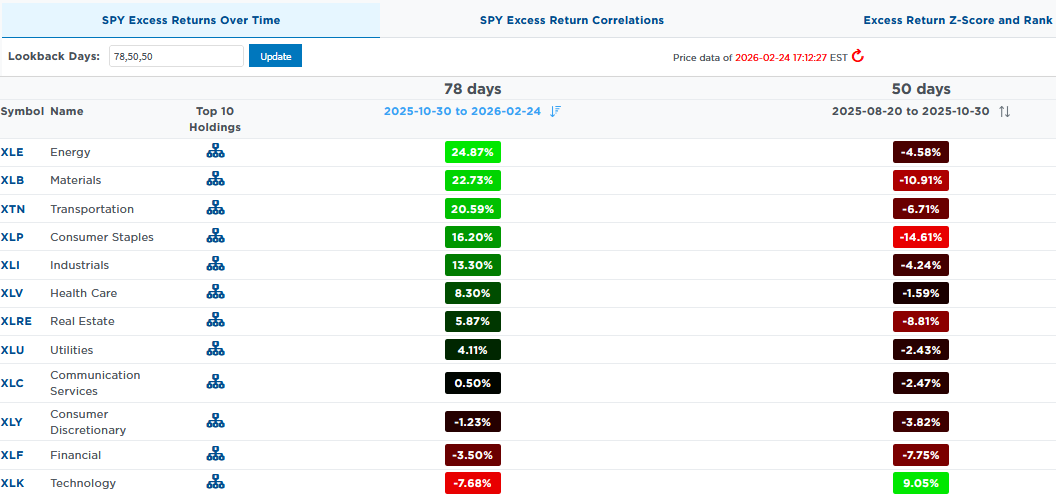

Money is pouring into the AI infrastructure boom, driving energy $XLE, materials $XLB, and industrials $XLI to stretched valuations as investors chase the CapEx buildout story.

Yet at the same time, the market has been selling $NVDA even after a blowout quarter.

Capital is crowding into sectors trading at record relative premiums, while one of the core AI beneficiaries and enablers now looks significantly cheaper on a growth-adjusted basis....

Read More »

Read More »

2-27-26 Cut Your Medicare Bill in 2026 | IRMAA Appeal Secrets

Are you paying MORE than necessary for Medicare in 2026?

The IRMAA (Income-Related Monthly Adjustment Amount) could be adding hundreds of dollars a year to your Medicare premiums — but there's a legal way to fight back.

Richard Rosso breaks down everything you need to know about the 2026 IRMAA thresholds, how to appeal, and the income strategies that could save you thousands in retirement.

Hosted by RIA Advisors Director of Financial Planning,...

Read More »

Read More »

Economic Sentiment Belies Strong Economic Estimates

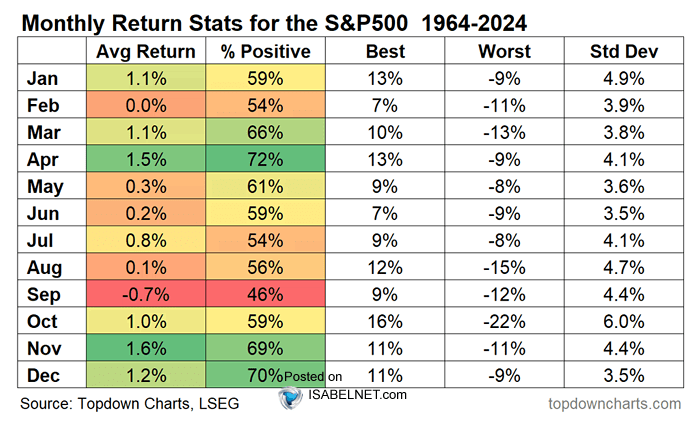

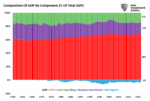

Economic growth metrics for the United States have recently shown surprising resilience; however, consumers' economic sentiment has not. According to the Bureau of Economic Analysis's advance estimate, real Gross Domestic Product expanded at an annualized rate of just 1.4%, well below expectations and a steep drop from the 4.4% pace in the third quarter. However, …

Read More »

Read More »

Nvidia Delivers Perfection But Market Has Concerns

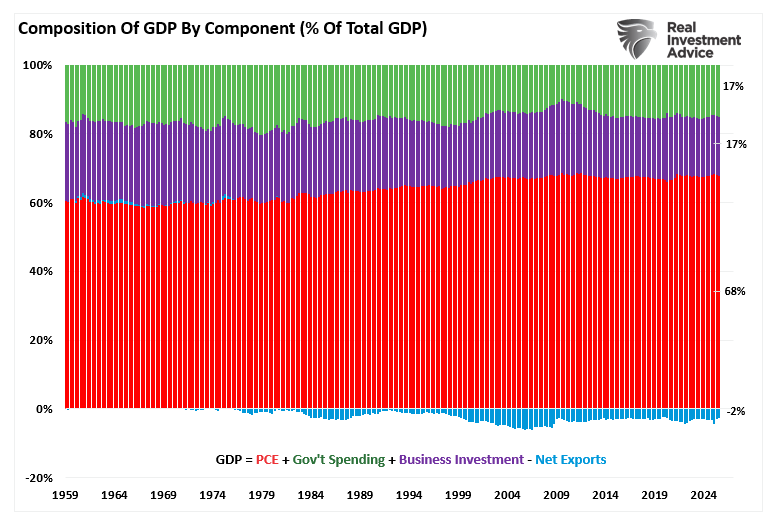

Yet again, Nvidia delivers another incredible earnings report, reinforcing that the AI investment boom continues. As we show below, they posted annual revenue growth of of 73%, handily beating Wall Street forecasts. Most importantly, strong earnings and robust forward guidance confirm that their customers continue to aggressively expand AI infrastructure. Nvidia delivers the critical computing …

Read More »

Read More »

$NVDA Just Posted Historic Numbers… So Why Isn’t It Soaring?

#Nvidia delivered one of the most impressive quarters in market history: $1.62 EPS vs $1.53 expected, $68.1B in revenue up 73% year over year, and data center revenue up 75%. Free cash flow is running at roughly $30–35B per quarter.

By any fundamental measure, this was a blowout. Yet the stock is down big today and has been stagnant for months.

The real issue isn’t earnings strength — it’s capital. The market is questioning whether the AI boom...

Read More »

Read More »

2-26-26 Software Stocks: Steal or Zero

Is AI killing software stocks — or creating the buying opportunity of the decade?

Lance Roberts & Michael Lebowitz review: Since peaking in September 2025, the software ETF (IGV) has crashed 30% while semiconductors (SMH) surged 30% and broad tech stayed flat. The market is pricing in a "SaaSpocalypse" — the idea that generative AI will make traditional SaaS companies obsolete. But is that narrative right?

Hosted by RIA Advisors...

Read More »

Read More »

Hindenburg Alarm: Another Rotation Or Worse?

In early November, we sounded the alarm about a recent Hindenburg Omen. Per the Commentary's summary: Bottom line: market breadth is horrendous and will likely lead to a rotation favoring out-of-favor sectors and stocks. Thus, it’s not surprising that the Hindenburg Omen was triggered. If we continue to see more of these Omens, the threat …

Read More »

Read More »

2-25-26 The Truth Behind Brazil’s 12% Yield

A 12% yield is not a gift — it’s a warning sign.

This is the classic mistake of chasing yield. If something pays dramatically more than the risk-free rate (the U.S. Treasury), it’s compensating you for meaningful uncertainty: credit risk, default risk, currency volatility, and geopolitical instability.

In this short video, Lance Roberts & Danny Ratliff break down whether Brazilian treasuries yielding over 12% are actually worth buying, the...

Read More »

Read More »

2-25-26 Q & A Wednesday: Straight Talk About Your Money

Welcome to Q & A Wednesday: Straight Talk on Your Money — a live, unscripted Q&A show pulled directly from our YouTube chatroom. No canned slides. No rehearsed talking points. Just practical, plain-English answers to real-world money questions with Lance Roberts and Danny Ratliff.

Lance & Danny tackle topics like retirement planning, Roth vs. traditional decisions, tax-smart withdrawal strategies, Social Security timing, portfolio risk...

Read More »

Read More »

Software Stocks: Navigating The SaaSpocalypse

The recent rotation from growth to value is well documented. While the return divergences between, for instance, technology stocks and materials or industrials stocks are significant, they do not tell the whole story. There are also extreme return differentials between broad industries and their sub-industries. In this article, we address one such divergence between the …

Read More »

Read More »

Homesellers Dwarf Homebuyers: Home Prices At Risk

The housing market is experiencing a widening imbalance between homesellers and homebuyers, with listings rising faster than demand. This is contrary to the post-pandemic period of extremely tight inventory and strong demand. Homeowners with ultra-low mortgage rates who were initially hesitant to sell are now increasingly selling. As shown below, the housing market is shifting …

Read More »

Read More »

2-24-26 Why You’ll Never Beat The Index (And That’s Okay)

Most investors chase returns and compare themselves to an index that isn’t a real portfolio.

Indexes don’t pay taxes, trading costs, management fees, or deal with withdrawals.

They also replace failed companies without absorbing permanent capital losses — something individual investors can’t do.

That structural advantage makes consistent outperformance extremely difficult.

Because of these differences, obsessing over beating or matching an...

Read More »

Read More »

2-24-26 Stop Chasing 2026 Returns

Most investors don’t realize how quickly a good plan can get derailed by one bad question: “What will your investments return this year?”

Lance Roberts and Jonathan Penn break down why asking an advisor for short-term performance predictions is usually the wrong framework—especially when comparisons start with “Can you beat Treasuries this year?”

#FinancialPlanning #InvestingEducation #BehavioralFinance #RiskManagement #WealthProtection

Read More »

Read More »

Our Take On Tariffs

To address the many emails we received, we present our take on the Supreme Court's tariff ruling. First, President Trump has multiple ways he can implement trade restrictions beyond what the Supreme Court ruled against. In fact, he implemented a 150-day 15% global tariff after the court's ruling. As we share below, the effective tariff … Continue reading...

Read More »

Read More »

2-21-26 What You’re Being Told About Annuities is Wrong

Richard Rosso & Danny Ratliff tackle one of the most misunderstood retirement tools: annuities—what they are, who they’re actually for, and where investors frequently get trapped by slick marketing and incomplete comparisons. We start with why annuities aren’t for everyone, then walk through three clear use-cases where an annuity can make sense—especially for households prioritizing guaranteed lifetime income and a more stable retirement...

Read More »

Read More »

2-23-26 The Tariff Saga Continues — What It Means for Markets

The Supreme Court struck down the structure used to impose prior tariffs, ruling they must go through Congress.

The administration quickly shifted strategy: Trump imposed a temporary blanket tariff — initially 10%, later raised to 15% — set to last 150 days. This effectively resets the framework while keeping tariffs in place, just under a different legal justification.

Even with Monday’s sharp selloff, from a market perspective, this changes...

Read More »

Read More »

2-23-26 Is China Really Dumping U.S. Treasuries?

Is China really “dumping” U.S. Treasury bonds—or is that headline missing key context?

Lance Roberts examines what Treasury International Capital (TIC) data does (and doesn’t) show, why China’s reported holdings can shift for reasons that have nothing to do with panic selling, and how custody chains and financial centers can complicate the narrative.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton,...

Read More »

Read More »