Category Archive: 9a.) Real Investment Advice

11-19-25 Pension or Lump Sum – What’s the Smarter Move?

Choosing between a company pension and a lump-sum payout is one of the biggest financial decisions many pre-retirees will ever face—especially for workers in industries facing layoffs or restructuring, like the major oil companies in Houston right now.

Lance Roberts & Danny Ratliff break down the key factors to consider when comparing a lifetime pension annuity versus taking a lump-sum distribution you can invest or convert into a private...

Read More »

Read More »

How The Fed Deals Liquidity: The Monetary Toolbox

In our last article, QE Is Coming, we focused on why the capital and financial markets have become so dependent on the Fed for liquidity. The article explains that, in the aftermath of the crisis, a slew of regulations drastically changed the liquidity landscape. As a result, the Fed—not the private market—is now the primary …

Read More »

Read More »

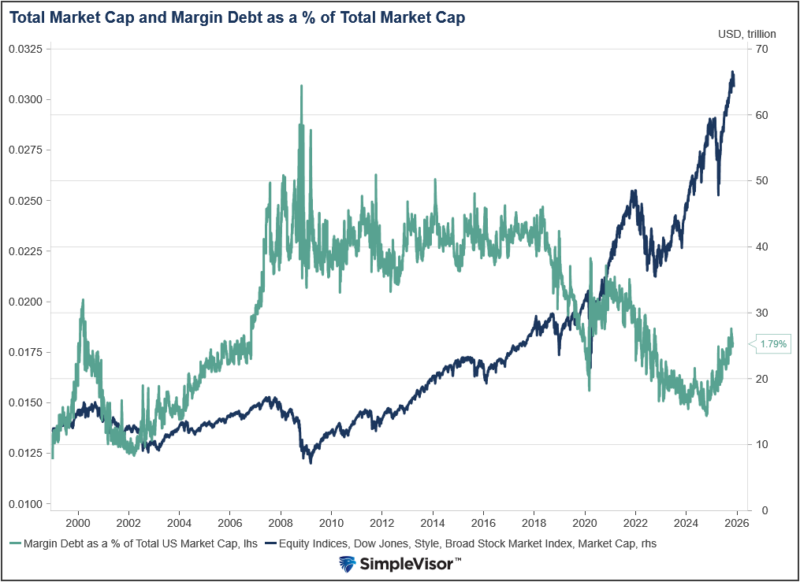

Margin Debt Sets Records: Should We Be Concnered?

There is a strong historical relationship between margin debt and the stock market. Given that margin debt just set a record at $1.18 trillion, it's worth appreciating the mechanics that support this relationship and what it may tell us about how much longer the bull market may run. When stocks rise, the wealth effect kicks …

Read More »

Read More »

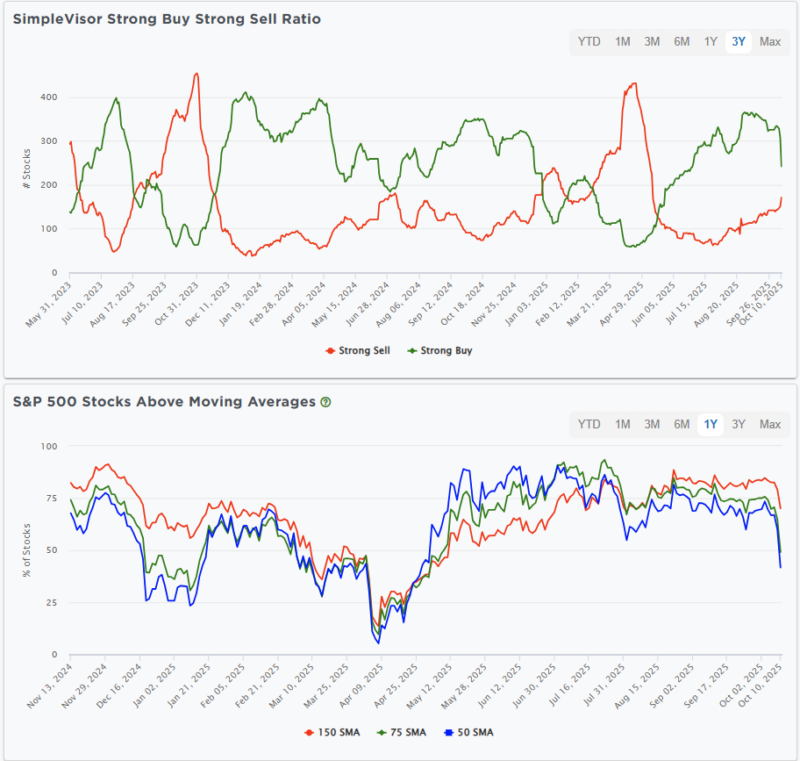

11-18-24 The Simple Rule That Keeps You On The Right Side Of The Market

$SPX / $SPY just broke below its 50-day moving average, making the next support levels crucial.

In this short video, I show how to read these trend shifts so you know when to stay invested and when the weakening momentum may call for trimming exposure.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

11-18-25 Indicators & Income: What Retirees Must Know (Who Can You Trust)?

Lance Roberts & Jonathan Penn tackle two of the biggest gaps in financial education:

How to actually use RSI, MACD, Money Flow, and MACD Histogram together, and why post-retirement planning (the “decumulation” phase) is so overlooked—yet absolutely critical.

If you’re an “Ole Coot” looking to better understand technical indicators… or a younger “You’t” trying to build financial literacy early… Lance and Jon break down the mysteries of...

Read More »

Read More »

Apple Out Google In: Warren Buffett’s Latest Moves

Warren Buffett's Berkshire Hathaway has long viewed Apple as its crown jewel. In early 2024, Apple shares accounted for nearly 25% of the Berkshire Hathaway portfolio. However, Buffett has been selling out of Apple since then, trimming its stake by over 40%. Based on Buffett's comments, they are reducing their holdings due to concerns about …

Read More »

Read More »

11-27-25 Market Cycles, Tariff Checks, & 50-Year Mortgages

Out Thanksgiving Day special, featuring Lance Roberts, Danny Ratliff, and Michael Lebowitz opining what he would do, were he to run the Federal Reserve, and why you shouldn't spend that $2k tariff refund just yet.

Read More »

Read More »

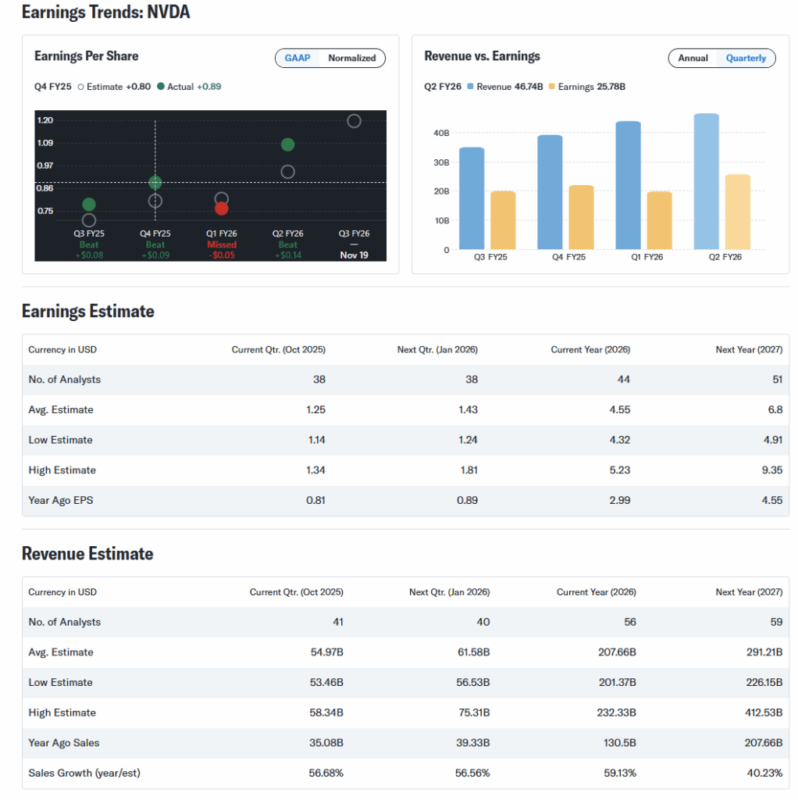

11-17-25 Wall Street’s 2026 Earnings Expectations: Real Growth or Just a Dream?

The market is betting on big earnings growth in 2026, but the economy may not deliver.

In this short video, I break down why strong forecasts clash with weak labor data and what that tension means for the outlook ahead.

📺Full episode: -K-dbfV_o

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

$SPX / $SPY $NDX / $QQQ

Read More »

Read More »

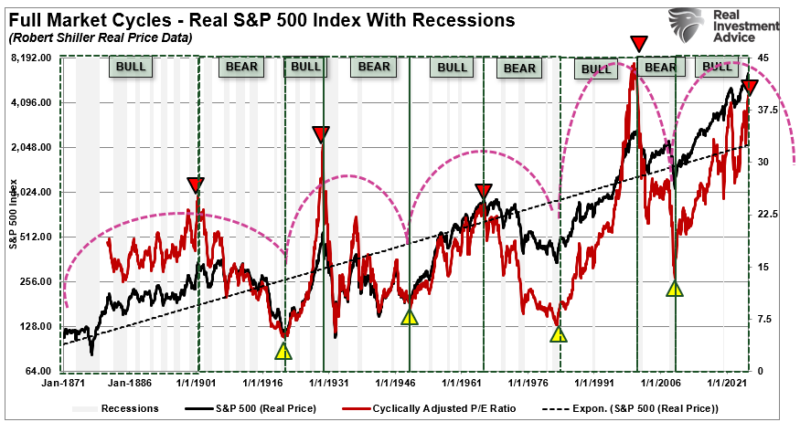

11-17-25 Full Market Cycles: Why Bull Runs Always Meet Their Match

Full market cycles matter more today than at any point in the last 15 years. Lance Roberts breaks down why valuations, history, and market structure all point to a simple truth:

Every bull market is only half the story. The other half is the bear. Lance's approach isn’t bullish or bearish. It’s risk-focused. Your job as an investor isn’t to predict the next crash—it’s to avoid catastrophic losses that erase years of gains during the completion of...

Read More »

Read More »

Full Market Cycles: Half Bull and Half Bear

Last week, we discussed the importance of "math" as it relates to valuations and noted the importance of understanding "full market cycles." To wit: "The math on forward return expectations, given current valuation levels, does not hold up. The assumption that valuations can fall without the price of the markets being negatively impacted is also grossly flawed. …

Read More »

Read More »

Is Strategy Dragging Bitcoin Down?

Bitcoin is up 2% year to date, but the share price of the world's largest holder of Bitcoin, Strategy (MSTR - formerly MicroStrategy), is down about 30% year to date. As we have noted in the past, Strategy is a Bitcoin holding company, a leveraged alternative to holding Bitcoin. Its original business, enterprise analytics software, …

Read More »

Read More »

11-15-25 Why The Fed Is Easing Into Strength — And What It Means For Markets

The Fed is preparing to cut rates just as an AI-driven boom accelerates.

In this short video, MIchael Lebowitz and I discuss why easing into strength is unusual, how it could stoke inflation, and what it means for the next phase of market growth.

📺Full episode: https://www.youtube.com/watch?v=-YZaHtreohI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

EBITDA And The Warnings Of Charlie Munger

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ …

Read More »

Read More »

12-2-25 Dollar Power, AI, & The New Financial Order

In this episode, Lance Roberts sits down with Brent Johnson, CEO of Santiago Capital, to break down what’s really happening with the U.S. dollar, the global monetary system, and why AI is accelerating a geopolitical and economic power shift.

If you're looking for big-picture insights on the future of the dollar, geopolitics, AI-driven capital flows, and where long-term investing tailwinds are forming—this is a must-watch.

#BrentJohnson #USDollar...

Read More »

Read More »

11-14-25 Open Enrollment Traps to Avoid This Year

11-14-25 Open Enrollment Traps to Avoid This Year

Open Enrollment season is here—and it’s one of the most overlooked financial opportunities employees have all year. In this episode, we break down the biggest mistakes people make when reviewing their employer benefits and how to approach your plan as if you were a brand-new hire.

Richard Rosso & Jonathan McCarty tackle the smart way to choose health insurance, whether young workers really...

Read More »

Read More »

11-13-25 Everyone Thinks AI Is the Bubble — But the Real One Is the Fed

For over a decade, the Fed’s endless liquidity has fueled moral hazard—pushing investors to buy every dip and keeping valuations inflated.

In this short video, @michaellebowitz and I discuss why the real bubble isn’t AI—it’s the Fed’s never-ending backstop.

📺Full episode: https://www.youtube.com/watch?v=-YZaHtreohI

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

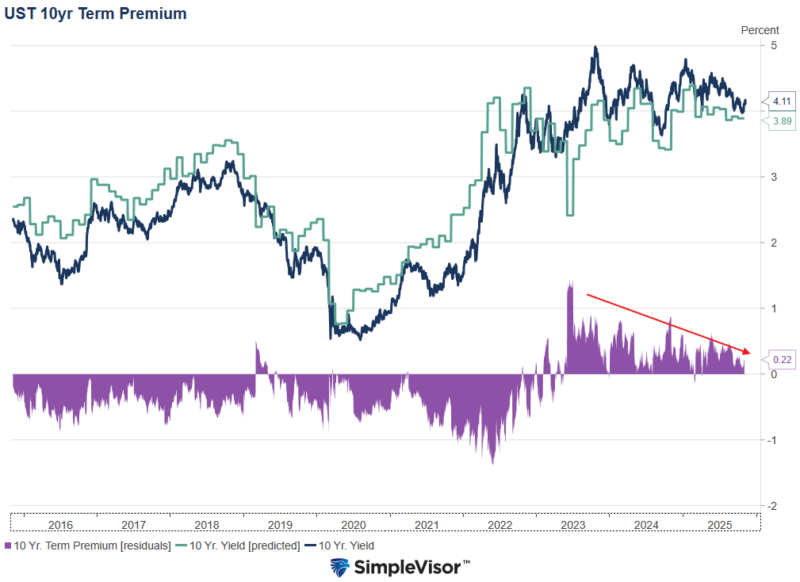

The Bearish Bond Narrative Fades

Not that long ago, bond yields were rising as concerns over deficits, inflation, and a series of bad Treasury auctions were paraded through the media. We bring this to your attention as the Ten-year Treasury auction on Wednesday was on the weaker side, yet the bond market reaction was minimal. Additionally, government deficits are just …

Read More »

Read More »

Economic Reacceleration: A Contrarian View

Over the past two weeks, we’ve addressed a persistent question: if the data signals weakness, why hasn’t the recession arrived? In "Slowdown Signals: Are Leading Indicators Flashing Red?" we examined the cracks forming beneath the economy's surface. From deteriorating leading indicators to credit stress and cooling employment metrics, the evidence supported a cautious stance. In …

Read More »

Read More »

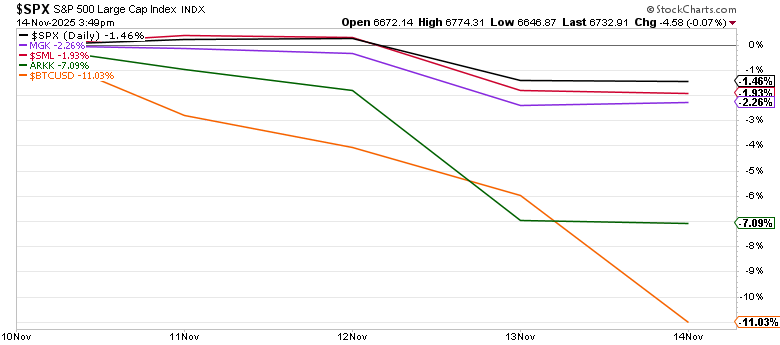

11-13-25 A Daily Dose Of Charts & Graphs

In this short video, I cover the end of the 43-day US government shutdown, renewed dip-buying from both retail and institutions, and #Bitcoin drawdown closely mirroring its February correction.

I also touch on widening performance gaps among the top tech stocks — with rotation opportunities emerging from $AAPL and $AMZN into $META — all in one visual market update.

🐦Follow me on X: https://x.com/LanceRoberts

Catch me daily on The Real...

Read More »

Read More »

11-13-25 QE Is Coming: Why Fed Liquidity Now Runs the Entire Market

The scent of QE is back.

With overnight funding markets flashing early stress and NY Fed President John Williams hinting at “gradual asset purchases,” it’s clear: the liquidity cycle is turning again.

But the real question is why markets have become so dependent on the Fed in the first place.

Lance Roberts & Michael Lebowitz break down how the 2008 financial crisis fundamentally rewired market plumbing, sidelined private liquidity providers,...

Read More »

Read More »