Category Archive: 9a.) Real Investment Advice

Oppenheimer: The Risk Calculus Has Changed

🔎 At a Glance Give Us A Review ***** If you enjoy our work each week, could you be so kind as to leave us a review? It would be most appreciated. 🏛️ Market Brief - Markets Navigate Military Conflict It was a brutal week on Wall Street. The S&P 500 finished at its lowest close … Continue reading »

Read More »

Read More »

3-6-26 The Market’s Biggest Blind Spot Right Now

Markets often become complacent during strong rallies, with investors focusing on bullish narratives while ignoring potential risks.

Last year, the dominant story was AI, while this year the debate has shifted to whether massive CapEx spending will actually translate into real revenue growth.

However, unexpected events—such as geopolitical tensions with Iran and rising oil prices—can quickly challenge those narratives and force markets to...

Read More »

Read More »

3-6-26 Diversification Is Not Risk Management

Most investors believe diversification protects them from risk. It does not.

Richard Rosso breaks down what diversification actually does, what it does not do, and why confusing it with risk management can quietly damage your portfolio over time.

We also tackle one of the most overlooked questions in retirement planning: do you actually need long-term care insurance?

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP...

Read More »

Read More »

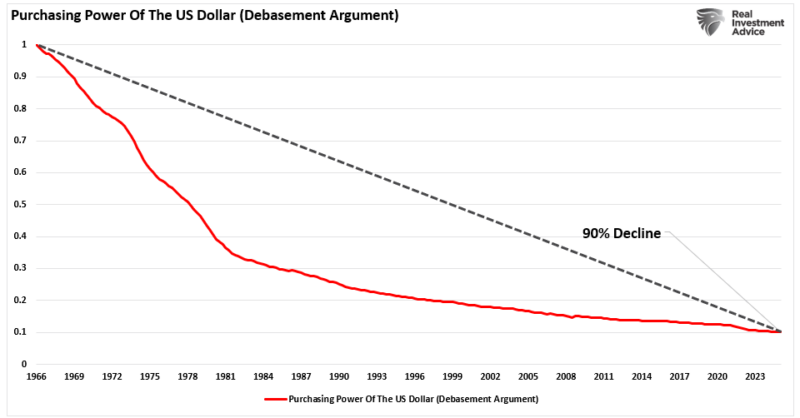

USD Stablecoins And The Rebasement Of The US Dollar

The “fiat is dying” argument has become a catchphrase narrative among digital asset bulls, gold bugs, and cryptocurrency advocates. That narrative's core is that central banks have printed vast amounts of money. The "money printing" has led to currency debasement and rendered the U.S. dollar obsolete. We discussed this "debasement" narrative previously. The narrative is …

Read More »

Read More »

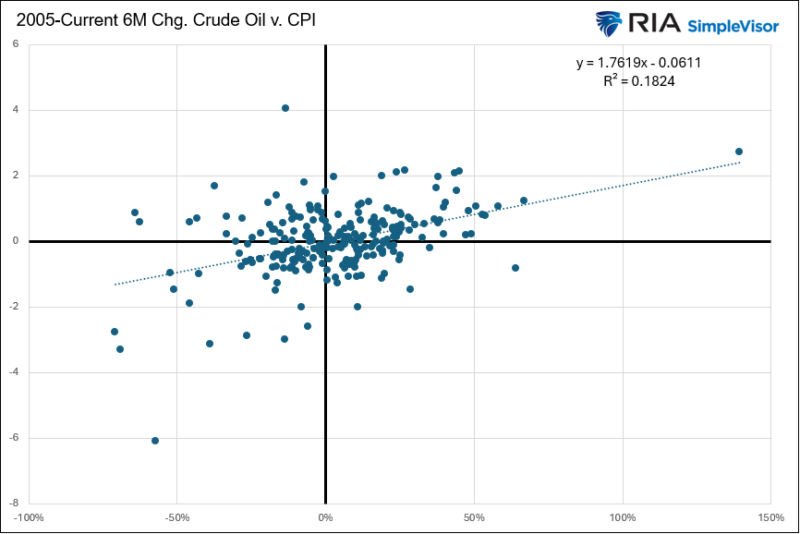

Will Oil Prices Unleash A Wave Of Inflation?

Bloomberg writes: "Iran War Oil ShockThreatens to Unleash Wave of Global Inflation." To be fair, the article is not as pessimistic as the title suggests. However, the fear that significantly higher, sustained oil prices will unleash a wave of inflation is gaining popularity and merits discussion. We start with math to address the historical relationship …

Read More »

Read More »

3-5-26 Stronger Economic Data Beneath Iran Headlines & Implications For Fed Policy

While headlines are dominated by the Iran operation, important economic data beneath the surface is showing improvement.

Manufacturing has moved back into expansion territory, the services sector is seeing a sharp increase in activity, and recent employment data came in stronger than expected. These signals suggest economic momentum may be strengthening after a softer period at the end of 2025.

At the same time, prices paid in the services...

Read More »

Read More »

3-5-26 Passive Aggressive Market: Bogle’s Warning Came True

Are passive investors really passive? Not anymore.

Lance Roberts & Michael Lebowitz break down how index funds and ETFs — the tools designed for patient, long-term investing — have quietly become weapons of short-term speculation.

#PassiveInvesting #ETFStrategy #IndexFunds #SectorRotation #JohnBogle

Read More »

Read More »

Credit Spreads Are Widening: Omen Or No Bother?

Increasing corporate credit spreads, or a growing divergence between corporate bond yields and similar-maturity Treasury yields, can be an omen of stock market weakness. Recent troublesome defaults in the private credit markets are showing signs of spreading concern to the more liquid corporate debt markets. Thus, it's appropriate to review corporate credit spreads. in the …

Read More »

Read More »

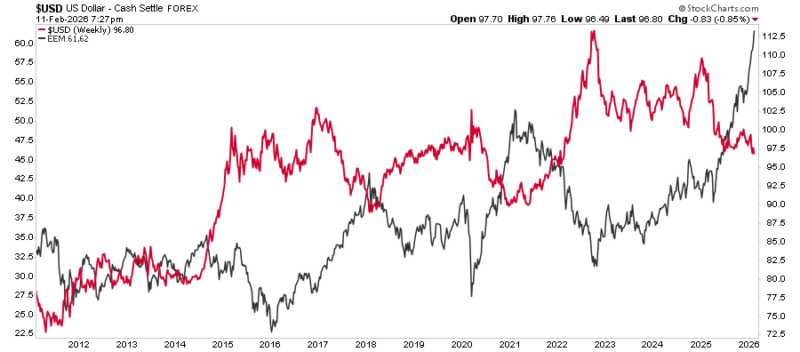

3-4-26 Iran Conflict: What It Means for Oil, Inflation, & The Dollar

Geopolitical tensions with Iran sparked fears that a shutdown of the Strait of Hormuz could send oil prices sharply higher. But markets have been calmer than expected. After briefly spiking above $80, oil pulled back to around $74 as Trump’s response helped stabilize shipping risks.

While higher oil prices could temporarily push up gasoline prices and create short-term inflationary pressure, energy is not the primary driver of the CPI, which...

Read More »

Read More »

3-4-26 Q & A Wednesday: Ask Us Anything

Are you watching the market and wondering what's really going on?

Lance Roberts & Danny Ratliff dive straight into YOUR questions — pulled live from the chat — covering the stock market outlook, what sectors to watch, and how investors should be positioning right now.

No fluff, no filler — just real talk about where the market's heading and what it means for YOUR portfolio.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts,...

Read More »

Read More »

The Passive Aggressive Market: Bogle’s Warning Came True

Since the pandemic, the line between passive investing and aggressive speculation has blurred. The current bout of speculative fervor extends beyond financial markets. For instance, we see the same impulse in the explosion of sports betting and the surge in event-betting sites like Kalshi and Polymarket. In the investment arena, margin debt is at record …

Read More »

Read More »

Middle East Military Conflicts And Stocks

The question for investors is how the Iranian conflict will affect the stock market. The markets' initial reaction on Sunday was concern as the S&P 500 fell by over 1%, crude oil rose nearly 10%, and precious metals rallied. Within 12 hours, many of the substantial gains or losses, except oil, were reversed. However, stocks, …

Read More »

Read More »

3-3-36 It’s Not Iran — We Have Private Credit Cracking

Markets aren’t under pressure just because of Iran. The bigger issue is stress building in private credit.

Blackstone’s large private credit fund is facing record redemptions above its limits, following earlier cracks in the sector.

That raises liquidity concerns and is weighing on technology stocks.

Geopolitical headlines grab attention, but tightening credit and redemption pressure are the real risks investors should be watching right now....

Read More »

Read More »

3-3-26 Ten Immutable Laws of Money

Most people will never build wealth — not because of the economy, but because no one taught them the rules.

Lance Roberts & Jonathan Penn break down the 10 Immutable Laws of Money — time-tested principles that have worked for generations, regardless of your income, age, or background. From budgeting basics and crushing debt to understanding why millionaires live more modestly than you think, these laws are the foundation of lasting financial...

Read More »

Read More »

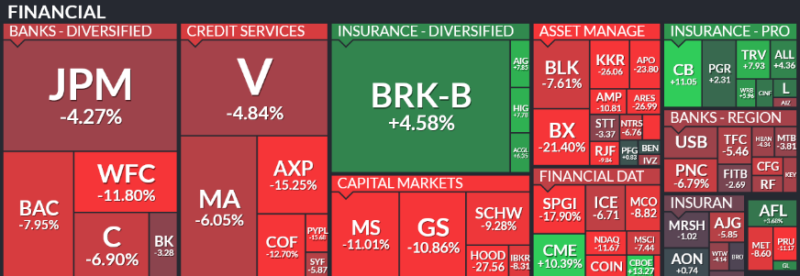

The Financial Sector Is Under Pressure

The heatmap below, courtesy of FinViz, shows the one-month performance of the S&P 500 financial sector stocks. As shown, Berkshire Hathaway and the insurance companies are higher over the period, while the large majority of the remaining financial sector stocks struggle. For context, the S&P 500 was down 2.80% over the same period. There appear …

Read More »

Read More »

3-2-26 War Headlines Don’t Move Markets – Long-Term Earnings Do

War headlines spark sharp reactions—oil jumps, stocks dip, the dollar firms—but history shows these moves are usually temporary. Markets price uncertainty fast, then refocus on what truly drives long-term returns: earnings, cash flow, and forward guidance.

The key question isn’t how dramatic the news sounds. It’s whether it permanently changes corporate profitability. Some sectors may benefit short term, others may sell off, but once fear fades,...

Read More »

Read More »

3-2-26 Is the Market Topping? Iran, AI Chaos & the Signals You Can’t Ignore

Is the stock market topping — or just catching its breath?

This week, equity markets face a triple threat: an Iranian strike rattling geopolitical risk assets, an Anthropic AI capability announcement that hammered IBM, CrowdStrike, financials, and SaaS stocks, and a technical picture showing the S&P 500 slipping below both its 20- and 50-day moving averages.

Lance Roberts breaks down the bull and bear cases in full.

Hosted by RIA Advisors...

Read More »

Read More »

SaaS: Is There Opportunity In The Destruction?

A specter is haunting Wall Street—the specter of the “SaaSpocalypse.” Since the iShares Expanded Tech-Software Sector ETF (IGV) peaked on September 19, 2025, it has fallen roughly 30%. For context, the broad technology indexes like XLK and QQQ are essentially flat over the same period, and the semiconductor ETF (SMH) is up 30%. Between mid-January …

Read More »

Read More »

MFS Collapses Adding To Private Credit Woes

In our February 3rd Commentary, we discussed the recent woes negatively impacting private credit funds. The concerns began last year with the bankruptcies of Tricolor and First Brands and continue to mount, as evidenced by the share prices of some private credit managers shown below. Adding to market worries is fresh news of a $1.3 …

Read More »

Read More »

Market Topping Process?

🔎 At a Glance Give Us A Review ***** If you enjoy our work each week, could you be so kind as to leave us a review? It would be most appreciated. 🏛️ Market Brief - Turmoil In AI Stocks As we will discuss further in today's commentary, the market remains stuck in a fairly narrow … Continue reading »

Read More »

Read More »