Category Archive: 6a) Gold & Monetary Metals

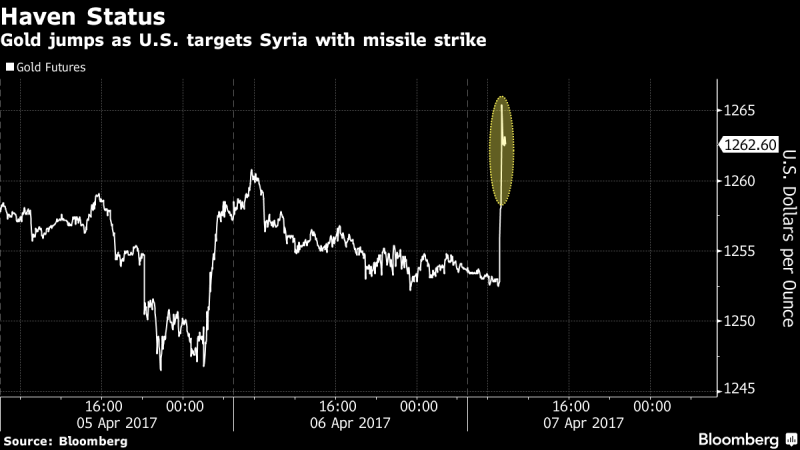

Gold Silver Oil Spike After U.S. Bombs Syria

Gold silver oil spike after U.S. bombs Syria. Gold and silver spike 1% as oil rises 1.4%. Gold breaks 200 day moving average, 4th week of gains. Stocks fall after U.S. strikes in Syria rattle markets. U.S. missiles hit airbase; Lavrov says no Russian casualties; Russia deploys cruise missile frigate to Syria.

Read More »

Read More »

Dr Marc Faber: Coordinating Central Bankers Desperate to Keep Colossal Global Debt Bubble Inflated

Jason Burack of Wall St for Main St interviewed returning guest, Editor & Publisher of the Gloom Boom & Doom Report https://www.gloomboomdoom.com/, Dr. Marc Faber. During this 25+ minute interview, Jason asks Marc if he thinks the Federal Reserve will increase interest rates 2-3 times more in 2017? Marc thinks the Fed will only raise …

Read More »

Read More »

Marc Faber Warns of A Looming Deflationary Collapse in 2017

Marc Faber Warns of A Looming Deflationary Collapse I created this video with the YouTube Video Editor (http://www.youtube.com/editor)

Read More »

Read More »

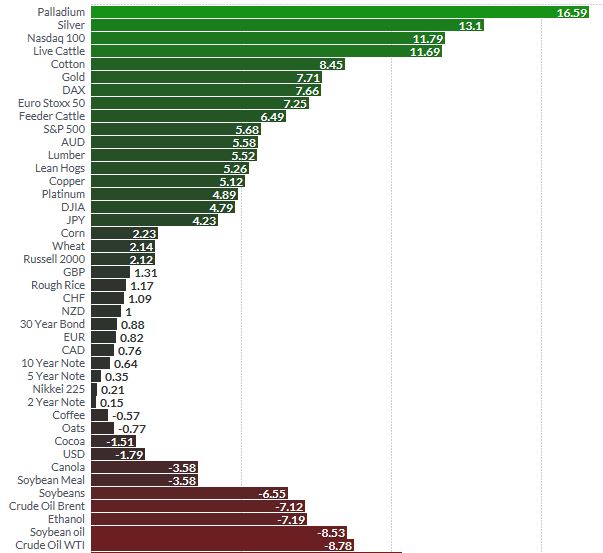

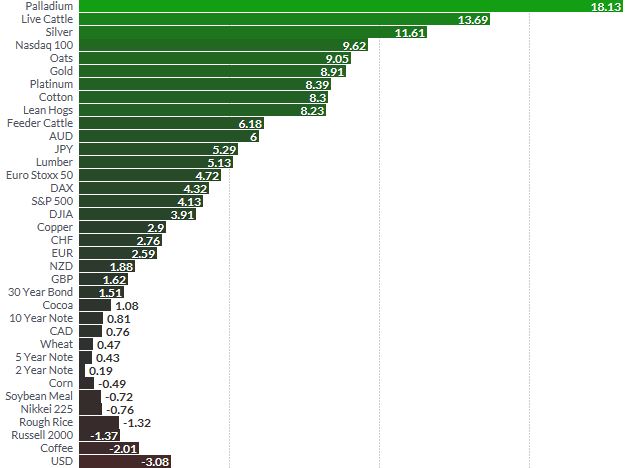

Gold, Silver Best Performing Assets In Q1, 2017

Gold, silver two of the best performing assets in the first quarter of 2017 with gains of 8% and 14% respectively. Gold outperforms benchmarks – S&P 500 up 6%, MSCI (All Country World Index) up 6.4% (see tables). Nasdaq and German DAX rise 11.8% and 7.6%. Silver best performing currency in quarter. Five best performing currencies in Q1 are in order – silver, bitcoin, Mexican peso, Russian ruble and gold.

Read More »

Read More »

Brexit Gold Buying – UK Demand for Gold Bars Surges 39 percent

As the UK triggered its formal departure from the European Union yesterday, gold demand from UK investors remained ongoing and robust with increased numbers of British investors diversifying into physical gold in order to hedge the considerable uncertainty and volatility that the coming months and years will bring.

Read More »

Read More »

Safe Haven Gold Rises 2.5 percent As Stocks Fall and ‘Trump Trade’ Fades

Gold and silver jumped another 1% overnight in Asia, building on the respective 1.5% and 2.2% gains seen last week. The ‘Trump trade’ is fading, impacting stock markets and risk off has returned to global markets with the Nikkei, S&P 500 futures and European stocks weakening.

Read More »

Read More »

Gold ETFs or Physical Gold? Dangers In Exchange Traded Funds

Considering the public’s waning trust in the banking system, many investors find themselves wondering how GLD stacks up to owning the real thing. When you look at both assets more closely, it’s clear that gold ETFs and gold bullion are very different investments.

Read More »

Read More »

Peak Gold – Biggest Gold Story Not Being Reported

Peak gold – Biggest gold story not being reported. Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets. Decline in gold production at world’s top 10 gold mining companies - Byron King. “No new big mines being built in the world today” – Glencore CEO Glasenberg. Primary global gold output declined in 2016 – Thomson Reuters via Mining.com.

Read More »

Read More »

The Best Ways to Invest in Gold Today

The cost of buying and selling gold. How to buy gold on the cheap. How to avoid paying capital gains tax (CGT) on your gold. Open an account with one of the online bullion dealers – the likes of GoldMoney, GoldCore or Bullion Vault. Gold Sovereigns and Gold Britannias make for a considerable saving on cost because of the CGT exemption.

Read More »

Read More »

Physical Metals Demand Plus Manipulation Suits Will Break Paper Market

Read the full transcript here: https://goo.gl/R659Nt Craig Hemke of the TF Metals Report speaks out on the technical situation for the metals, whether or not the economy his headed towards a recession and reveals something that could ultimately break the paper markets for gold and silver and get us back to free and fair pricing …

Read More »

Read More »

Sprott Money News Ask The Expert March 2017 – Jim Rogers

Legendary investor Jim Rogers joins us this month to discuss Fed policy, the dollar and gold.

Read More »

Read More »

Mr Marc Faber Warning The Risk of Global Collapse

Thanks for ing !!! Please Subscribe & Share video We are pleased that Mr. Marc Faber has agreed to be our guest to discuss the stability of the world’s . Thanks for ing !!! Please Subscribe & Share video We are pleased that Mr. Marc Faber has agreed to be our guest to discuss the … Continue reading...

Read More »

Read More »